-

Kenya's economy faces climate change risks: World Bank

Kenya's economy faces climate change risks: World Bank

-

Rome to charge visitors for access to Trevi Fountain

-

Stocks advance with focus on central banks, tech

Stocks advance with focus on central banks, tech

-

Norway crown princess likely to undergo lung transplant

-

France's budget hits snag in setback for embattled PM

France's budget hits snag in setback for embattled PM

-

Volatile Oracle shares a proxy for Wall Street's AI jitters

-

Japan hikes interest rates to 30-year-high

Japan hikes interest rates to 30-year-high

-

Brazil's top court strikes down law blocking Indigenous land claims

-

'We are ghosts': Britain's migrant night workers

'We are ghosts': Britain's migrant night workers

-

Asian markets rise as US inflation eases, Micron soothes tech fears

-

Trump signs $900 bn defense policy bill into law

Trump signs $900 bn defense policy bill into law

-

EU-Mercosur deal delayed as farmers stage Brussels show of force

-

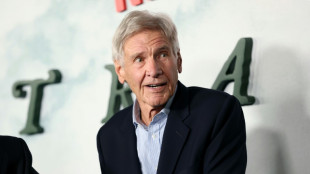

Harrison Ford to get lifetime acting award

Harrison Ford to get lifetime acting award

-

Trump health chief seeks to bar trans youth from gender-affirming care

-

Argentine unions in the street over Milei labor reforms

Argentine unions in the street over Milei labor reforms

-

Brazil open to EU-Mercosur deal delay as farmers protest in Brussels

-

Brussels farmer protest turns ugly as EU-Mercosur deal teeters

Brussels farmer protest turns ugly as EU-Mercosur deal teeters

-

US accuses S. Africa of harassing US officials working with Afrikaners

-

ECB holds rates as Lagarde stresses heightened uncertainty

ECB holds rates as Lagarde stresses heightened uncertainty

-

Trump Media announces merger with fusion power company

-

Stocks rise as US inflation cools, tech stocks bounce

Stocks rise as US inflation cools, tech stocks bounce

-

Zelensky presses EU to tap Russian assets at crunch summit

-

Danish 'ghetto' residents upbeat after EU court ruling

Danish 'ghetto' residents upbeat after EU court ruling

-

ECB holds rates but debate swirls over future

-

Bank of England cuts interest rate after UK inflation slides

Bank of England cuts interest rate after UK inflation slides

-

Have Iran's authorities given up on the mandatory hijab?

-

British energy giant BP extends shakeup with new CEO pick

British energy giant BP extends shakeup with new CEO pick

-

EU kicks off crunch summit on Russian asset plan for Ukraine

-

Sri Lanka plans $1.6 bn in cyclone recovery spending in 2026

Sri Lanka plans $1.6 bn in cyclone recovery spending in 2026

-

Most Asian markets track Wall St lower as AI fears mount

-

Danish 'ghetto' tenants hope for EU discrimination win

Danish 'ghetto' tenants hope for EU discrimination win

-

What to know about the EU-Mercosur deal

-

Trump vows economic boom, blames Biden in address to nation

Trump vows economic boom, blames Biden in address to nation

-

ECB set to hold rates but debate swirls over future

-

EU holds crunch summit on Russian asset plan for Ukraine

EU holds crunch summit on Russian asset plan for Ukraine

-

Nasdaq tumbles on renewed angst over AI building boom

-

Billionaire Trump nominee confirmed to lead NASA amid Moon race

Billionaire Trump nominee confirmed to lead NASA amid Moon race

-

CNN's future unclear as Trump applies pressure

-

German MPs approve 50 bn euros in military purchases

German MPs approve 50 bn euros in military purchases

-

EU's Mercosur trade deal hits French, Italian roadblock

-

Warner Bros rejects Paramount bid, sticks with Netflix

Warner Bros rejects Paramount bid, sticks with Netflix

-

Crude prices surge after Trump orders Venezuela oil blockade

-

Warner Bros. Discovery rejects Paramount bid

Warner Bros. Discovery rejects Paramount bid

-

Doctors in England go on strike for 14th time

-

Ghana's Highlife finds its rhythm on UNESCO world stage

Ghana's Highlife finds its rhythm on UNESCO world stage

-

Stocks gain as traders bet on interest rate moves

-

France probes 'foreign interference' after malware found on ferry

France probes 'foreign interference' after malware found on ferry

-

Europe's Ariane 6 rocket puts EU navigation satellites in orbit

-

Bleak end to the year as German business morale drops

Bleak end to the year as German business morale drops

-

Hundreds queue at Louvre museum as strike vote delays opening

| RYCEF | -0.98% | 15.25 | $ | |

| RBGPF | 0% | 80.22 | $ | |

| CMSC | 0.28% | 23.355 | $ | |

| SCS | 0.12% | 16.14 | $ | |

| BCC | -4.13% | 74.62 | $ | |

| VOD | 0.74% | 12.895 | $ | |

| NGG | 0.65% | 76.89 | $ | |

| RIO | 0.97% | 78.39 | $ | |

| JRI | -0.11% | 13.415 | $ | |

| CMSD | -0.06% | 23.265 | $ | |

| GSK | 0.94% | 48.746 | $ | |

| RELX | 0.57% | 40.885 | $ | |

| BCE | 0.54% | 22.975 | $ | |

| BP | 2.16% | 34.045 | $ | |

| AZN | 1.02% | 91.54 | $ | |

| BTI | -0.41% | 56.805 | $ |

Stocks advance with focus on central banks, tech

Global stock markets mostly advanced on Friday as traders reacted to central bank activity and easing concerns over the technology sector.

Equity markets, particularly on Wall Street, have come under pressure in recent weeks amid questions about when, if ever, investors will see returns on the colossal amounts of cash pumped into artificial intelligence.

But blockbuster earnings from chip firm Micron Technology helped soothe nerves over a tech bubble and the tech-heavy Nasdaq close with a gain of 1.4 percent on Thursday.

The Nasdaq added 0.5 percent as trading got underway Friday. Shares in Micron Technology rose by 4.3 percent.

Shares in the so-called Magnificent Seven tech stocks, which includes AI chip maker Nvidia and Google parent company Alphabet, gained 0.3 percent overall.

"Stocks in the tech sector have been boosted by yesterday's bumper earnings from Micron," noted Joshua Mahony, chief market analyst at trading group Scope Markets.

"As we close out a week that has seen a huge amount of data and central bank announcements, there is an expectation that we start to see volumes and volatility ease off from here."

- Russia cuts key interest rate -

However, Briefing.com analyst Patrick O'Hare, said trading volume should be huge today driven by the expiration of options.

"Today is a quadruple witching expiration day, which involves the expiration of stock index futures, single-stock futures, stock index options, and single-stock options," he said.

As traders make purchases or sales to cover options volatility could spike.

"Participants are also waiting to see if yesterday's AI-related bounce following Micron's (MU) stellar report has legs," added O'Hare.

Below-forecast US inflation data Thursday also boosted hopes that the Federal Reserve would cut interest rates next month.

The yen fell against the dollar on profit-taking after the Bank of Japan on Friday hiked, as expected, its own borrowing costs to a three-decade high, hours after data showed prices had held steady.

Russia's central bank said it was cutting its benchmark interest rate to 16 percent as the country's economy sags under the financial burden of the Ukraine offensive and Western sanctions.

The Bank of England cut rates Thursday, when the European Central Bank left eurozone borrowing costs unchanged.

Germany's central bank on Friday predicted a slower recovery for Europe's biggest economy following three years of stagnation.

Shares in Oracle gained more than five percent as trading got underway in New York after TikTok said it has signed a joint venture deal with investors that would allow the company to maintain operations in the United States.

The deal will see Oracle take a 15-percent stake in the joint venture, with private equity fund Silver Lake and Abu Dhabi-based MGX, an Emirati state-owned investment fund for artificial intelligence technologies.

- Key figures at around 1330 GMT -

New York - Dow: UP 0.3 percent at 48,099.15 points

New York - S&P 500: UP 0.4 percent at 6,800.44

New York - Nasdaq Composite: UP 0.5 percent at 23,124.16

London - FTSE 100: UP less than 0.1 percent at 9,844.71

Paris - CAC 40: DOWN less than 0.1 percent at 8,145.04

Frankfurt - DAX: UP percent at 24,239.34

Tokyo - Nikkei 225: UP 1.0 percent at 49,507.21 (close)

Hong Kong - Hang Seng Index: UP 0.8 percent at 25,690.53 (close)

Shanghai - Composite: UP 0.4 percent at 3,890.45 (close)

Dollar/yen: UP at 157.23 yen from 155.63 yen on Thursday

Euro/dollar: UP at $1.1733 from $1.1721

Pound/dollar: UP at $1.3379 from $1.3378

Euro/pound: UP at 87.70 pence from 87.62 pence

Brent North Sea Crude: UP 0.7 percent at $60.21 per barrel

West Texas Intermediate: UP 0.7 percent at $56.39 per barrel

burs-rl/jj

O.Ignatyev--CPN