-

Kenya's economy faces climate change risks: World Bank

Kenya's economy faces climate change risks: World Bank

-

Volatile Oracle shares a proxy for Wall Street's AI jitters

-

Japan hikes interest rates to 30-year-high

Japan hikes interest rates to 30-year-high

-

Brazil's top court strikes down law blocking Indigenous land claims

-

'We are ghosts': Britain's migrant night workers

'We are ghosts': Britain's migrant night workers

-

Asian markets rise as US inflation eases, Micron soothes tech fears

-

Trump signs $900 bn defense policy bill into law

Trump signs $900 bn defense policy bill into law

-

EU-Mercosur deal delayed as farmers stage Brussels show of force

-

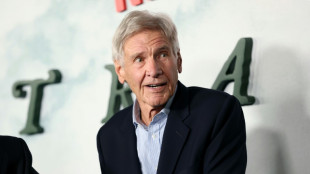

Harrison Ford to get lifetime acting award

Harrison Ford to get lifetime acting award

-

Trump health chief seeks to bar trans youth from gender-affirming care

-

Argentine unions in the street over Milei labor reforms

Argentine unions in the street over Milei labor reforms

-

Brazil open to EU-Mercosur deal delay as farmers protest in Brussels

-

Brussels farmer protest turns ugly as EU-Mercosur deal teeters

Brussels farmer protest turns ugly as EU-Mercosur deal teeters

-

US accuses S. Africa of harassing US officials working with Afrikaners

-

ECB holds rates as Lagarde stresses heightened uncertainty

ECB holds rates as Lagarde stresses heightened uncertainty

-

Trump Media announces merger with fusion power company

-

Stocks rise as US inflation cools, tech stocks bounce

Stocks rise as US inflation cools, tech stocks bounce

-

Zelensky presses EU to tap Russian assets at crunch summit

-

Danish 'ghetto' residents upbeat after EU court ruling

Danish 'ghetto' residents upbeat after EU court ruling

-

ECB holds rates but debate swirls over future

-

Bank of England cuts interest rate after UK inflation slides

Bank of England cuts interest rate after UK inflation slides

-

Have Iran's authorities given up on the mandatory hijab?

-

British energy giant BP extends shakeup with new CEO pick

British energy giant BP extends shakeup with new CEO pick

-

EU kicks off crunch summit on Russian asset plan for Ukraine

-

Sri Lanka plans $1.6 bn in cyclone recovery spending in 2026

Sri Lanka plans $1.6 bn in cyclone recovery spending in 2026

-

Most Asian markets track Wall St lower as AI fears mount

-

Danish 'ghetto' tenants hope for EU discrimination win

Danish 'ghetto' tenants hope for EU discrimination win

-

What to know about the EU-Mercosur deal

-

Trump vows economic boom, blames Biden in address to nation

Trump vows economic boom, blames Biden in address to nation

-

ECB set to hold rates but debate swirls over future

-

EU holds crunch summit on Russian asset plan for Ukraine

EU holds crunch summit on Russian asset plan for Ukraine

-

Nasdaq tumbles on renewed angst over AI building boom

-

Billionaire Trump nominee confirmed to lead NASA amid Moon race

Billionaire Trump nominee confirmed to lead NASA amid Moon race

-

CNN's future unclear as Trump applies pressure

-

German MPs approve 50 bn euros in military purchases

German MPs approve 50 bn euros in military purchases

-

EU's Mercosur trade deal hits French, Italian roadblock

-

Warner Bros rejects Paramount bid, sticks with Netflix

Warner Bros rejects Paramount bid, sticks with Netflix

-

Crude prices surge after Trump orders Venezuela oil blockade

-

Warner Bros. Discovery rejects Paramount bid

Warner Bros. Discovery rejects Paramount bid

-

Doctors in England go on strike for 14th time

-

Ghana's Highlife finds its rhythm on UNESCO world stage

Ghana's Highlife finds its rhythm on UNESCO world stage

-

Stocks gain as traders bet on interest rate moves

-

France probes 'foreign interference' after malware found on ferry

France probes 'foreign interference' after malware found on ferry

-

Europe's Ariane 6 rocket puts EU navigation satellites in orbit

-

Bleak end to the year as German business morale drops

Bleak end to the year as German business morale drops

-

Hundreds queue at Louvre museum as strike vote delays opening

-

Markets rise even as US jobs data fail to boost rate cut bets

Markets rise even as US jobs data fail to boost rate cut bets

-

Asian markets mixed as US jobs data fails to boost rate cut hopes

-

Bondi shooting shocks, angers Australia Jewish community

Bondi shooting shocks, angers Australia Jewish community

-

UK experiences sunniest year on record

EU agrees 90-bn-euro loan for Ukraine, but without Russian assets

EU leaders struck a deal Friday to provide Ukraine a 90-billion-euro loan to plug its looming budget shortfalls -- but failed to agree on using frozen Russian assets to come up with the funds.

The agreement -- which came after more than a day of talks at a summit in Brussels -- offers Kyiv a desperately needed lifeline as US President Donald Trump pushes for a quick deal to end Russia's war.

"We have a deal. Decision to provide 90 billion euros of support to Ukraine for 2026-27 approved," EU chief Antonio Costa wrote on X. "We committed, we delivered."

After scrambling around for a solution, EU leaders settled on coming up with a loan backed by the bloc's common budget.

The number one option on the table had been to tap some 200 billion euros of Russian central bank assets frozen in the EU to generate a loan for Kyiv.

But that scheme fell by the wayside after Belgium, where the vast bulk of the assets are held, demanded guarantees on sharing liability that proved too much for other countries.

German Chancellor Friedrich Merz had pushed hard for the asset plan -- but still said the final decision on the loan "sends a clear signal" to Russian President Vladimir Putin.

- 'It's moral' -

The EU estimates Ukraine needs an extra 135 billion euros ($159 billion) to stay afloat over the next two years, with the cash crunch set to start in April.

Ukraine's President Volodymyr Zelensky had told EU leaders at the start of the summit on Thursday that using Russian assets was the right way to go.

"Russian assets must be used to defend against Russian aggression and rebuild what was destroyed by Russian attacks. It's moral. It's fair. It's legal," Zelensky said.

While Kyiv may be left disappointed that the EU did not take the leap to use the Russian assets -- securing financing another way will still be a relief.

Zelensky told the leaders that Kyiv needed a decision by the end of the year, and that putting his country on a firmer financial footing could give it more leverage in talks to end the war.

- Ukraine, US talks -

Bubbling close to the surface of the EU's discussion are the US efforts to forge a deal to end the war.

He said he wanted Washington to give more details on the guarantees it could offer to protect Ukraine from another invasion.

"What will the United States of America do if Russia comes again with aggression?" he asked. "What will these security guarantees do? How will they work?"

Trump nonetheless kept the pressure on Kyiv, saying again he hopes Ukraine "moves quickly" to agree a deal.

Y.Ibrahim--CPN