-

Kenya's economy faces climate change risks: World Bank

Kenya's economy faces climate change risks: World Bank

-

Volatile Oracle shares a proxy for Wall Street's AI jitters

-

Japan hikes interest rates to 30-year-high

Japan hikes interest rates to 30-year-high

-

Brazil's top court strikes down law blocking Indigenous land claims

-

'We are ghosts': Britain's migrant night workers

'We are ghosts': Britain's migrant night workers

-

Asian markets rise as US inflation eases, Micron soothes tech fears

-

Trump signs $900 bn defense policy bill into law

Trump signs $900 bn defense policy bill into law

-

EU-Mercosur deal delayed as farmers stage Brussels show of force

-

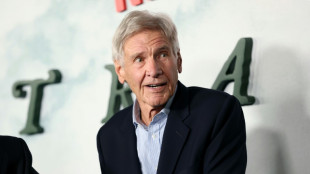

Harrison Ford to get lifetime acting award

Harrison Ford to get lifetime acting award

-

Trump health chief seeks to bar trans youth from gender-affirming care

-

Argentine unions in the street over Milei labor reforms

Argentine unions in the street over Milei labor reforms

-

Brazil open to EU-Mercosur deal delay as farmers protest in Brussels

-

Brussels farmer protest turns ugly as EU-Mercosur deal teeters

Brussels farmer protest turns ugly as EU-Mercosur deal teeters

-

US accuses S. Africa of harassing US officials working with Afrikaners

-

ECB holds rates as Lagarde stresses heightened uncertainty

ECB holds rates as Lagarde stresses heightened uncertainty

-

Trump Media announces merger with fusion power company

-

Stocks rise as US inflation cools, tech stocks bounce

Stocks rise as US inflation cools, tech stocks bounce

-

Zelensky presses EU to tap Russian assets at crunch summit

-

Danish 'ghetto' residents upbeat after EU court ruling

Danish 'ghetto' residents upbeat after EU court ruling

-

ECB holds rates but debate swirls over future

-

Bank of England cuts interest rate after UK inflation slides

Bank of England cuts interest rate after UK inflation slides

-

Have Iran's authorities given up on the mandatory hijab?

-

British energy giant BP extends shakeup with new CEO pick

British energy giant BP extends shakeup with new CEO pick

-

EU kicks off crunch summit on Russian asset plan for Ukraine

-

Sri Lanka plans $1.6 bn in cyclone recovery spending in 2026

Sri Lanka plans $1.6 bn in cyclone recovery spending in 2026

-

Most Asian markets track Wall St lower as AI fears mount

-

Danish 'ghetto' tenants hope for EU discrimination win

Danish 'ghetto' tenants hope for EU discrimination win

-

What to know about the EU-Mercosur deal

-

Trump vows economic boom, blames Biden in address to nation

Trump vows economic boom, blames Biden in address to nation

-

ECB set to hold rates but debate swirls over future

-

EU holds crunch summit on Russian asset plan for Ukraine

EU holds crunch summit on Russian asset plan for Ukraine

-

Nasdaq tumbles on renewed angst over AI building boom

-

Billionaire Trump nominee confirmed to lead NASA amid Moon race

Billionaire Trump nominee confirmed to lead NASA amid Moon race

-

CNN's future unclear as Trump applies pressure

-

German MPs approve 50 bn euros in military purchases

German MPs approve 50 bn euros in military purchases

-

EU's Mercosur trade deal hits French, Italian roadblock

-

Warner Bros rejects Paramount bid, sticks with Netflix

Warner Bros rejects Paramount bid, sticks with Netflix

-

Crude prices surge after Trump orders Venezuela oil blockade

-

Warner Bros. Discovery rejects Paramount bid

Warner Bros. Discovery rejects Paramount bid

-

Doctors in England go on strike for 14th time

-

Ghana's Highlife finds its rhythm on UNESCO world stage

Ghana's Highlife finds its rhythm on UNESCO world stage

-

Stocks gain as traders bet on interest rate moves

-

France probes 'foreign interference' after malware found on ferry

France probes 'foreign interference' after malware found on ferry

-

Europe's Ariane 6 rocket puts EU navigation satellites in orbit

-

Bleak end to the year as German business morale drops

Bleak end to the year as German business morale drops

-

Hundreds queue at Louvre museum as strike vote delays opening

-

Markets rise even as US jobs data fail to boost rate cut bets

Markets rise even as US jobs data fail to boost rate cut bets

-

Asian markets mixed as US jobs data fails to boost rate cut hopes

-

Bondi shooting shocks, angers Australia Jewish community

Bondi shooting shocks, angers Australia Jewish community

-

UK experiences sunniest year on record

Asian markets rise as US inflation eases, Micron soothes tech fears

Asian markets rose Friday as a below-forecast read on US inflation boosted hopes for another interest rate cut next month, while blockbuster earnings from chip firm Micron helped soothe nerves over a tech bubble.

Investors were also keeping tabs on the Bank of Japan as it concludes a policy meeting amid expectations it will hike its own borrowing costs in the face of a weakening yen and rising prices.

A tough week for global equities looked to be heading for a positive end after figures showed US inflation slowed last month to its lowest level since July and was well below forecasts.

The reading provided a sliver of light for rate cuts, after traders pared their bets on a fourth successive reduction in January following the Federal Reserve's policy decision last week.

Markets see a 20 percent chance of a cut next month, though they see two by the end of 2026, according to Bloomberg News.

However, analysts said disruptions to data collection during the longest-ever US government shutdown, which ended in mid-November, had likely distorted the figures.

Economists at Bank of America warned that "we recommend taking (the) report with a large grain of salt", citing "shutdown-related distortions".

Still, the news helped lift all three main indexes on Wall Street, which has come under pressure in recent weeks amid questions about when, if ever, investors will see returns on the colossal amounts of cash that have been pumped into artificial intelligence (AI).

That has led to speculation about a bubble in the tech sector -- which has led the equity surge to record highs this year -- that could pop soon.

Those concerns, though, were tempered Thursday after blowout earnings from chip company Micron Technology, which said quarterly profits nearly tripled to $5.2 billion as it benefits from the AI boom. It also gave an upbeat outlook for the current three months.

The positive lead from Wall Street was picked up by Asia, where Hong Kong, Shanghai, Sydney, Seoul, Singapore, Taipei and Wellington were all up.

Tokyo gained more than one percent as attention turns to the Bank of Japan (BoJ) which is expected to lift rates to a 30-year high later in the day.

The decision comes hours after a report showing inflation held steady at three percent in November.

Yields on Japanese government bonds have risen in recent weeks on worries about Prime Minister Sanae Takaichi's budget discipline, while the yen has weakened. Takaichi, who formally took power in October, has promised to fight inflation as a major priority.

The yen was barely moved against the dollar Friday, though observers see it strengthening as the Fed cuts rates at the same time the BoJ lifts them.

"As the BoJ proceeds with measured rate increases while Fed implements one to two cuts, the yield gap that has long supported dollar strength will continue tightening," wrote IG market analyst Fabien Yip.

"This convergence should exert sustained downward pressure on (the dollar against the yen) throughout the year."

- Key figures at around 0230 GMT -

Tokyo - Nikkei 225: UP 1.2 percent at 49,568.66 (break)

Hong Kong - Hang Seng Index: UP 0.7 percent at 25,676.29

Shanghai - Composite: UP 0.5 percent at 3,896.47

Dollar/yen: UP at 155.74 yen from 155.63 on Thursday

Euro/dollar: UP at $1.1722 from $1.1721

Pound/dollar: UP at $1.3380 from $1.3378

Euro/pound: DOWN at 87.60 pence from 87.62

West Texas Intermediate: DOWN 0.3 percent at $55.99 per barrel

Brent North Sea Crude: DOWN 0.2 percent at $59.69 per barrel

New York - Dow: UP 0.1 percent at 47,951.85 (close)

London - FTSE 100: UP 0.7 percent at 9,837.77 (close)

A.Leibowitz--CPN