-

Kenya's economy faces climate change risks: World Bank

Kenya's economy faces climate change risks: World Bank

-

Volatile Oracle shares a proxy for Wall Street's AI jitters

-

Japan hikes interest rates to 30-year-high

Japan hikes interest rates to 30-year-high

-

Brazil's top court strikes down law blocking Indigenous land claims

-

'We are ghosts': Britain's migrant night workers

'We are ghosts': Britain's migrant night workers

-

Asian markets rise as US inflation eases, Micron soothes tech fears

-

Trump signs $900 bn defense policy bill into law

Trump signs $900 bn defense policy bill into law

-

EU-Mercosur deal delayed as farmers stage Brussels show of force

-

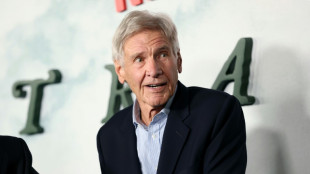

Harrison Ford to get lifetime acting award

Harrison Ford to get lifetime acting award

-

Trump health chief seeks to bar trans youth from gender-affirming care

-

Argentine unions in the street over Milei labor reforms

Argentine unions in the street over Milei labor reforms

-

Brazil open to EU-Mercosur deal delay as farmers protest in Brussels

-

Brussels farmer protest turns ugly as EU-Mercosur deal teeters

Brussels farmer protest turns ugly as EU-Mercosur deal teeters

-

US accuses S. Africa of harassing US officials working with Afrikaners

-

ECB holds rates as Lagarde stresses heightened uncertainty

ECB holds rates as Lagarde stresses heightened uncertainty

-

Trump Media announces merger with fusion power company

-

Stocks rise as US inflation cools, tech stocks bounce

Stocks rise as US inflation cools, tech stocks bounce

-

Zelensky presses EU to tap Russian assets at crunch summit

-

Danish 'ghetto' residents upbeat after EU court ruling

Danish 'ghetto' residents upbeat after EU court ruling

-

ECB holds rates but debate swirls over future

-

Bank of England cuts interest rate after UK inflation slides

Bank of England cuts interest rate after UK inflation slides

-

Have Iran's authorities given up on the mandatory hijab?

-

British energy giant BP extends shakeup with new CEO pick

British energy giant BP extends shakeup with new CEO pick

-

EU kicks off crunch summit on Russian asset plan for Ukraine

-

Sri Lanka plans $1.6 bn in cyclone recovery spending in 2026

Sri Lanka plans $1.6 bn in cyclone recovery spending in 2026

-

Most Asian markets track Wall St lower as AI fears mount

-

Danish 'ghetto' tenants hope for EU discrimination win

Danish 'ghetto' tenants hope for EU discrimination win

-

What to know about the EU-Mercosur deal

-

Trump vows economic boom, blames Biden in address to nation

Trump vows economic boom, blames Biden in address to nation

-

ECB set to hold rates but debate swirls over future

-

EU holds crunch summit on Russian asset plan for Ukraine

EU holds crunch summit on Russian asset plan for Ukraine

-

Nasdaq tumbles on renewed angst over AI building boom

-

Billionaire Trump nominee confirmed to lead NASA amid Moon race

Billionaire Trump nominee confirmed to lead NASA amid Moon race

-

CNN's future unclear as Trump applies pressure

-

German MPs approve 50 bn euros in military purchases

German MPs approve 50 bn euros in military purchases

-

EU's Mercosur trade deal hits French, Italian roadblock

-

Warner Bros rejects Paramount bid, sticks with Netflix

Warner Bros rejects Paramount bid, sticks with Netflix

-

Crude prices surge after Trump orders Venezuela oil blockade

-

Warner Bros. Discovery rejects Paramount bid

Warner Bros. Discovery rejects Paramount bid

-

Doctors in England go on strike for 14th time

-

Ghana's Highlife finds its rhythm on UNESCO world stage

Ghana's Highlife finds its rhythm on UNESCO world stage

-

Stocks gain as traders bet on interest rate moves

-

France probes 'foreign interference' after malware found on ferry

France probes 'foreign interference' after malware found on ferry

-

Europe's Ariane 6 rocket puts EU navigation satellites in orbit

-

Bleak end to the year as German business morale drops

Bleak end to the year as German business morale drops

-

Hundreds queue at Louvre museum as strike vote delays opening

-

Markets rise even as US jobs data fail to boost rate cut bets

Markets rise even as US jobs data fail to boost rate cut bets

-

Asian markets mixed as US jobs data fails to boost rate cut hopes

-

Bondi shooting shocks, angers Australia Jewish community

Bondi shooting shocks, angers Australia Jewish community

-

UK experiences sunniest year on record

Volatile Oracle shares a proxy for Wall Street's AI jitters

For a reading of Wall Street's shifting mood on the artificial intelligence investment boom, take a look at the daily fluctuations of Oracle stock, analysts say.

Shares of the software giant slumped more than five percent Wednesday following a news report of financing troubles with one of the company's giant AI projects.

But they recovered on Thursday and finished up around one percent at $180.03 as tech companies rallied following blowout results from Micron Technology, another big AI player.

"Oracle is probably the poster child" for the AI investment boom, said B. Riley Wealth Management's Art Hogan, who points to questions about "circular financing" arrangements that have made Oracle and OpenAI dependent on each other for billions of dollars in business.

On Thursday, Oracle -- along with Silver Lake and Abu Dhabi-based MGX -- was also named in a new deal with TikTok, according to an internal memo seen by AFP from the social media company's CEO Shou Chew.

"The US joint venture will be responsible for US data protection, algorithm security, content moderation, and software assurance," Chew said in the memo. The deal would allow TikTok to maintain US operations and avoid a ban threat over its Chinese ownership.

Oracle stock rose more than five percent to $190.81 in after-hours trading on Thursday.

The firm's stock peaked at $345.72 in September after it unveiled a massive inventory of AI work, a surge that briefly vaulted co-founder Larry Ellison above Tesla CEO Elon Musk as the world's wealthiest person.

But its shares have since fallen more than 45 percent as investors have begun to question the risk of AI infrastructure overbuilding and scrutinized the financing of individual projects.

Ellison, a close ally of President Donald Trump, is currently fifth on the Forbes real-time billionaire list with $230 billion.

- Michigan project 'limbo' -

This week's gyrations in Oracle shares followed a Financial Times story Wednesday that described a $10 billion AI data center project in Michigan as "in limbo" after a key partner declined to join the project.

The company, Blue Owl Capital, a backer of other major Oracle projects, pulled back after other lenders pushed for stricter terms "amid shifting market sentiment around enormous AI spending," said the FT, which cited people familiar with the matter.

Oracle, which is taking on billions of dollars of debt in the building spree, described the FT story as "incorrect."

"Our development partner, Related Digital, selected the best equity partner from a competitive group of options, which in this instance was not Blue Owl," said Oracle spokesperson Michael Egbert.

"Final negotiations for their equity deal are moving forward on schedule and according to plan."

OpenAI CEO Sam Altman has said the Chat GPT-maker has committed to some $1.4 trillion in investments in AI computing, with some $300 billion reportedly going to Oracle.

But AI stocks have been volatile in recent weeks as the market scrutinizes the profit outlook for the data centers.

"Investors are starting to ask questions about the sustainability of the AI trade and the profitability," said Steve Sosnick of Interactive Brokers.

The enthusiasm for AI "makes sense" when considering that manufacturing and services companies could see profits enhanced by the technology, Sosnick said, before pointing to doubts over lofty AI equity valuations.

Oracle's price drop on Wednesday followed a selloff last week after the firm's quarterly results sparked worry over its massive capital spending.

Analysts bullish on the stock have emphasized its huge growth potential with the AI boom.

On Thursday, Morningstar trimmed its price target on Oracle to $277 from $286, pointing to greater uncertainty around the projects.

Oracle's elevated debt "leaves little room for error, meaning the new data centers have to generate cash flow as soon as possible to service debt and lease obligations," Morningstar said in a note.

"However, we view recent events, including delays in some data centers' completion dates, as minor setbacks that should not alter Oracle's overall capacity ramp-up."

Ch.Lefebvre--CPN