-

Kenya's economy faces climate change risks: World Bank

Kenya's economy faces climate change risks: World Bank

-

Ghana's Highlife finds its rhythm on UNESCO world stage

-

Stocks gain as traders bet on interest rate moves

Stocks gain as traders bet on interest rate moves

-

France probes 'foreign interference' after malware found on ferry

-

Europe's Ariane 6 rocket puts EU navigation satellites in orbit

Europe's Ariane 6 rocket puts EU navigation satellites in orbit

-

Bleak end to the year as German business morale drops

-

Hundreds queue at Louvre museum as strike vote delays opening

Hundreds queue at Louvre museum as strike vote delays opening

-

Markets rise even as US jobs data fail to boost rate cut bets

-

Asian markets mixed as US jobs data fails to boost rate cut hopes

Asian markets mixed as US jobs data fails to boost rate cut hopes

-

Bondi shooting shocks, angers Australia Jewish community

-

UK experiences sunniest year on record

UK experiences sunniest year on record

-

Australia holds first funerals for Bondi Beach attack victims

-

Netflix boss promises Warner Bros films would still be seen in cinemas

Netflix boss promises Warner Bros films would still be seen in cinemas

-

Tepid 2026 outlook dents Pfizer shares

-

EU weakens 2035 combustion-engine ban to boost car industry

EU weakens 2035 combustion-engine ban to boost car industry

-

Arctic sees unprecedented heat as climate impacts cascade

-

VW stops production at German site for first time

VW stops production at German site for first time

-

Rome's new Colosseum station reveals ancient treasures

-

EU eases 2035 combustion-engine ban to boost car industry

EU eases 2035 combustion-engine ban to boost car industry

-

US unemployment rises further, hovering at highest since 2021

-

Shift in battle to tackle teens trapped in Marseille drug 'slavery'

Shift in battle to tackle teens trapped in Marseille drug 'slavery'

-

Stocks retreat on US jobs, oil drops on Ukraine hopes

-

Stocks retreat ahead of US jobs, oil drops on Ukraine hopes

Stocks retreat ahead of US jobs, oil drops on Ukraine hopes

-

EU set to drop 2035 combustion-engine ban to boost car industry

-

Elusive December sun leaves Stockholm in the dark

Elusive December sun leaves Stockholm in the dark

-

Thousands of glaciers to melt each year by mid-century: study

-

China to impose anti-dumping duties on EU pork for five years

China to impose anti-dumping duties on EU pork for five years

-

Nepal starts tiger census to track recovery

-

Economic losses from natural disasters down by a third in 2025: Swiss Re

Economic losses from natural disasters down by a third in 2025: Swiss Re

-

Kenyan girls still afflicted by genital mutilation years after ban

-

Men's ATP tennis to apply extreme heat rule from 2026

Men's ATP tennis to apply extreme heat rule from 2026

-

Bank of Japan expected to hike rates to 30-year high

-

EU to unveil plan to tackle housing crisis

EU to unveil plan to tackle housing crisis

-

EU set to scrap 2035 combustion-engine ban in car industry boost

-

Asian markets retreat ahead of US jobs as tech worries weigh

Asian markets retreat ahead of US jobs as tech worries weigh

-

Famed Jerusalem stone still sells despite West Bank economic woes

-

Will OpenAI be the next tech giant or next Netscape?

Will OpenAI be the next tech giant or next Netscape?

-

Eastman, AstraZeneca, Kraft Heinz, and P&G Recognized with OMP Supply Chain Awards

-

French minister urges angry farmers to trust cow culls, vaccines

French minister urges angry farmers to trust cow culls, vaccines

-

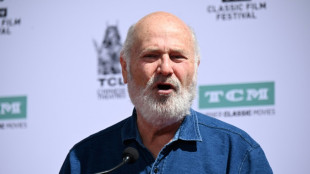

Rob Reiner's death: what we know

-

Stock market optimism returns after tech selloff but Wall Street wobbles

Stock market optimism returns after tech selloff but Wall Street wobbles

-

Nobel winner Machado suffered vertebra fracture leaving Venezuela

-

Stock market optimism returns after tech sell-off

Stock market optimism returns after tech sell-off

-

'Angry' Louvre workers' strike shuts out thousands of tourists

-

Showdown looms as EU-Mercosur deal nears finish line

Showdown looms as EU-Mercosur deal nears finish line

-

Eurovision 2026 will feature 35 countries: organisers

-

German shipyard, rescued by the state, gets mega deal

German shipyard, rescued by the state, gets mega deal

-

'We are angry': Louvre Museum closed as workers strike

-

Stocks diverge ahead of central bank calls, US data

Stocks diverge ahead of central bank calls, US data

-

Louvre Museum closed as workers strike

Markets rise even as US jobs data fail to boost rate cut bets

Equities mostly rose Wednesday even as US jobs data did little to boost expectations for another interest rate cut next month, while oil rallied after President Donald Trump ordered the blockade of "sanctioned" Venezuelan tankers.

With Federal Reserve officials indicating they were unlikely to lower borrowing costs for a fourth successive meeting, sentiment on trading floors has been subdued of late, compounded by worries over tech valuations and AI spending.

Focus had been on the delayed release of key non-farm payrolls reports, which showed Tuesday that the unemployment rate had jumped to a four-year high of 4.6 percent in November, reinforcing views that the US labour market was slowing.

However, a forecast-beating 105,000 drop in jobs in October was blamed on the extended government shutdown -- with many expected to return -- while November's rise of 64,000 was more than estimated.

Analysts said the figures did little to move the dial on rate-cut bets, with Bloomberg saying markets had priced in about a 20 percent chance of such a move next month.

"The bleed higher in the unemployment rate plays to the (Fed policy board's) concern about the labour market, which has supported the adjustment over the past three meetings," wrote National Australia Bank senior economist Taylor Nugent.

"But it is unlikely to be enough to push them to further near-term easing," he added. "It would take another jump (in unemployment) next month to shift things much on a January cut."

Wall Street investors largely shrugged at the data, with many concerned that the tech-led rally over the past two years may have gone too far and that the vast sums invested in AI might not see returns as soon as hoped.

Asian markets, having dropped at the start of the week, struggled early on Wednesday, but some managed to dig out gains.

Tokyo, Hong Kong, Shanghai, Seoul, Manila, Bangkok and Jakarta rose, but Sydney, Singapore, Taipei, Mumbai and Wellington fell.

London rose as data showed UK inflation slowed at a faster pace than expected in November, while Paris and Frankfurt also edged up.

Oil prices jumped more than one percent after Trump said on his Truth Social platform that he was "ordering A TOTAL AND COMPLETE BLOCKADE OF ALL SANCTIONED OIL TANKERS going into, and out of, Venezuela".

The announcement sharply escalates his campaign against the country -- while issuing new demands for Venezuelan crude -- after months of building military forces in the Caribbean with the stated goal of combating drug trafficking in Latin America.

Caracas views the operation as a pressure campaign to oust leftist strongman Nicolas Maduro, whom Washington and many nations view as an illegitimate president.

The gains pared some of the 2.7 percent in losses suffered Tuesday after the US president said a deal to end the war in Ukraine was closer than ever.

An end to the war could ease sanctions on Russian oil, adding to oversupply concerns already weighing on the market.

On currency markets, the yen strengthened further against the dollar following the US jobs data and days before the Bank of Japan is expected to hike interest rates to a 30-year high on Friday.

And the Indian rupee surged one percent following the central bank's intervention to provide support a day after the unit hit a new record low against the dollar.

The rupee has been hammered this year -- making it Asia's worst forex performer -- on worries about the delay in striking a trade deal with the United States as well as a current account deficit and foreign outflows.

It strengthened to 89.9662 to the greenback, from more than 91 earlier in the day.

In corporate news, Chinese chipmaker MetaX Integrated Circuits Shanghai soared more than 550 percent on its home city debut Wednesday, having raised $585.8 million in an initial public offering.

The jump comes after semiconductor company Moore Threads also rocketed more than 500 percent on its first day earlier in the month, having taken $1.1 billion in its IPO.

Shares in Hong Kong's biggest licensed cryptocurrency exchange, HashKey, retreated around two percent on their first day of trading, following an IPO that brought in $205 million.

- Key figures at around 0815 GMT -

Tokyo - Nikkei 225: UP 0.3 percent at 49,512.28 (close)

Hong Kong - Hang Seng Index: UP 0.9 percent at 25,468.78 (close)

Shanghai - Composite: UP 1.2 percent at 3,870.28 (close)

London - FTSE 100: UP 0.8 percent at 9,759.85

Dollar/yen: DOWN at 155.50 yen from 154.80 on Tuesday

Euro/dollar: DOWN at $1.1712 from $1.1747

Pound/dollar: DOWN at $1.3324 from $1.3422

Euro/pound: UP at 87.92 pence from 87.52

West Texas Intermediate: UP 1.6 percent at $56.13 per barrel

Brent North Sea Crude: UP 1.5 percent at $59.81 per barrel

New York - Dow: DOWN 0.6 percent at 48,114.26 (close)

A.Mykhailo--CPN