-

Kenya's economy faces climate change risks: World Bank

Kenya's economy faces climate change risks: World Bank

-

Stocks retreat ahead of US jobs, oil drops on Ukraine hopes

-

EU set to drop 2035 combustion-engine ban to boost car industry

EU set to drop 2035 combustion-engine ban to boost car industry

-

Elusive December sun leaves Stockholm in the dark

-

Thousands of glaciers to melt each year by mid-century: study

Thousands of glaciers to melt each year by mid-century: study

-

China to impose anti-dumping duties on EU pork for five years

-

Nepal starts tiger census to track recovery

Nepal starts tiger census to track recovery

-

Economic losses from natural disasters down by a third in 2025: Swiss Re

-

Kenyan girls still afflicted by genital mutilation years after ban

Kenyan girls still afflicted by genital mutilation years after ban

-

Men's ATP tennis to apply extreme heat rule from 2026

-

Bank of Japan expected to hike rates to 30-year high

Bank of Japan expected to hike rates to 30-year high

-

EU to unveil plan to tackle housing crisis

-

EU set to scrap 2035 combustion-engine ban in car industry boost

EU set to scrap 2035 combustion-engine ban in car industry boost

-

Asian markets retreat ahead of US jobs as tech worries weigh

-

Famed Jerusalem stone still sells despite West Bank economic woes

Famed Jerusalem stone still sells despite West Bank economic woes

-

Will OpenAI be the next tech giant or next Netscape?

-

French minister urges angry farmers to trust cow culls, vaccines

French minister urges angry farmers to trust cow culls, vaccines

-

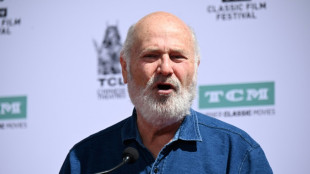

Rob Reiner's death: what we know

-

Stock market optimism returns after tech selloff but Wall Street wobbles

Stock market optimism returns after tech selloff but Wall Street wobbles

-

Nobel winner Machado suffered vertebra fracture leaving Venezuela

-

Stock market optimism returns after tech sell-off

Stock market optimism returns after tech sell-off

-

'Angry' Louvre workers' strike shuts out thousands of tourists

-

Showdown looms as EU-Mercosur deal nears finish line

Showdown looms as EU-Mercosur deal nears finish line

-

Eurovision 2026 will feature 35 countries: organisers

-

German shipyard, rescued by the state, gets mega deal

German shipyard, rescued by the state, gets mega deal

-

'We are angry': Louvre Museum closed as workers strike

-

Stocks diverge ahead of central bank calls, US data

Stocks diverge ahead of central bank calls, US data

-

Louvre Museum closed as workers strike

-

Australia defends record on antisemitism after Bondi Beach attack

Australia defends record on antisemitism after Bondi Beach attack

-

EU-Mercosur trade deal faces bumpy ride to finish line

-

Asian markets drop with Wall St as tech fears revive

Asian markets drop with Wall St as tech fears revive

-

France's Bardella slams 'hypocrisy' over return of brothels

-

Tokyo-bound United plane returns to Washington after engine fails

Tokyo-bound United plane returns to Washington after engine fails

-

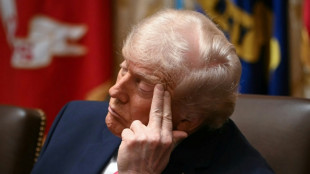

Deja vu? Trump accused of economic denial and physical decline

-

China's smaller manufacturers look to catch the automation wave

China's smaller manufacturers look to catch the automation wave

-

Hungary winemakers fear disease may 'wipe out' industry

-

Campaigning starts in Central African Republic quadruple election

Campaigning starts in Central African Republic quadruple election

-

'Stop the slaughter': French farmers block roads over cow disease cull

-

First urban cable car unveiled outside Paris

First urban cable car unveiled outside Paris

-

Why SpaceX IPO plan is generating so much buzz

-

US unseals warrant for tanker seized off Venezuelan coast

US unseals warrant for tanker seized off Venezuelan coast

-

World stocks mostly slide, consolidating Fed-fuelled gains

-

Crypto firm Tether bids for Juventus, is quickly rebuffed

Crypto firm Tether bids for Juventus, is quickly rebuffed

-

UK's king shares 'good news' that cancer treatment will be reduced in 2026

-

Can Venezuela survive US targeting its oil tankers?

Can Venezuela survive US targeting its oil tankers?

-

Salah admired from afar in his Egypt home village as club tensions swirl

-

World stocks retrench, consolidating Fed-fuelled gains

World stocks retrench, consolidating Fed-fuelled gains

-

Iran frees child bride sentenced to death over husband's killing: activists

-

World stocks consolidate Fed-fuelled gains

World stocks consolidate Fed-fuelled gains

-

France updates net-zero plan, with fossil fuel phaseout

Stocks retreat ahead of US jobs, oil drops on Ukraine hopes

Stock markets mostly fell Tuesday as investors prepared for key US jobs and inflation data, while oil prices slumped on renewed hopes for an end to Russia's war in Ukraine.

A deal to end the war could ease sanctions on Russian oil, adding to oversupply concerns already weighing on the market.

International oil benchmark Brent dropped below $60 per barrel for the first time since May, while the main US crude contract WTI also declined.

US President Donald Trump said Monday that a deal to end the Ukraine war was closer than ever, after Washington said it offered Kyiv NATO-like security guarantees and voiced confidence Moscow would accept.

"I think we're closer now than we have been ever," Trump told reporters, after he spoke to Ukrainian counterpart Volodymyr Zelensky and a host of European leaders.

European defence stocks slid Tuesday following the update on the talks, analysts said.

"A peace deal between Russia and the Ukraine looks to be back on the agenda but there have already been multiple false dawns this year," noted Derren Nathan, head of equity research at Hargreaves Lansdown.

London and Frankfurt stock markets both slid, while Paris ticked up, after Asian markets closed lower.

Weak UK jobs data strengthened expectations that the Bank of England will trim borrowing costs on Thursday.

The European Central Bank is set to hold interest rates steady this week.

Investors' attention turns to the release later in the day of US November jobs data and the delayed reading for October, which will be followed on Thursday by consumer price index figures.

"From a market perspective, the most important question is whether the report opens the door for more rate cuts in the early part of next year," said Jim Reid, managing director at Deutsche Bank.

He added that a softer labour market could support bets for further Federal Reserve rate cuts.

Worries over the tech sector were also weighing on sentiment, with recent warnings about an AI-fuelled bubble compounded by disappointing earnings last week from Oracle and Broadcom.

Speculation that vast sums invested in artificial intelligence will take some time to make returns, if at all, has also acted as a drag.

Seoul lost more than two percent, while Tokyo, Hong Kong and Shanghai were all down more than one percent.

The yen held gains against the dollar ahead of an expected rate hike by the Bank of Japan on Friday.

- Key figures at around 1050 GMT -

London - FTSE 100: DOWN 0.3 percent at 9,720.34 points

Paris - CAC 40: UP 0.1 percent at 8,131.27

Frankfurt - DAX: DOWN 0.3 percent at 24,169.16

Tokyo - Nikkei 225: DOWN 1.6 percent at 49,383.29 (close)

Hong Kong - Hang Seng Index: DOWN 1.5 percent at 25,235.41 (close)

Shanghai - Composite: DOWN 1.1 percent at 3,824.81 (close)

New York - Dow: DOWN 0.1 percent at 48,416.56 points (close)

Euro/dollar: UP at $1.1760 from $1.1750 on Monday

Dollar/yen: DOWN at 154.89 yen from 155.25

Pound/dollar: UP at $1.3422 from $1.3372

Euro/pound: DOWN at 87.61 pence from 87.87

Brent North Sea Crude: DOWN 1.6 percent at $59.62 per barrel

West Texas Intermediate: DOWN 1.7 percent at $55.85 per barrel

Ch.Lefebvre--CPN