-

Kenya's economy faces climate change risks: World Bank

Kenya's economy faces climate change risks: World Bank

-

German MPs approve 50 bn euros in military purchases

-

EU's Mercosur trade deal hits French, Italian roadblock

EU's Mercosur trade deal hits French, Italian roadblock

-

Warner Bros rejects Paramount bid, sticks with Netflix

-

Crude prices surge after Trump orders Venezuela oil blockade

Crude prices surge after Trump orders Venezuela oil blockade

-

Warner Bros. Discovery rejects Paramount bid

-

Doctors in England go on strike for 14th time

Doctors in England go on strike for 14th time

-

Ghana's Highlife finds its rhythm on UNESCO world stage

-

Stocks gain as traders bet on interest rate moves

Stocks gain as traders bet on interest rate moves

-

France probes 'foreign interference' after malware found on ferry

-

Europe's Ariane 6 rocket puts EU navigation satellites in orbit

Europe's Ariane 6 rocket puts EU navigation satellites in orbit

-

Bleak end to the year as German business morale drops

-

Hundreds queue at Louvre museum as strike vote delays opening

Hundreds queue at Louvre museum as strike vote delays opening

-

Markets rise even as US jobs data fail to boost rate cut bets

-

Asian markets mixed as US jobs data fails to boost rate cut hopes

Asian markets mixed as US jobs data fails to boost rate cut hopes

-

Bondi shooting shocks, angers Australia Jewish community

-

UK experiences sunniest year on record

UK experiences sunniest year on record

-

Australia holds first funerals for Bondi Beach attack victims

-

Netflix boss promises Warner Bros films would still be seen in cinemas

Netflix boss promises Warner Bros films would still be seen in cinemas

-

Tepid 2026 outlook dents Pfizer shares

-

EU weakens 2035 combustion-engine ban to boost car industry

EU weakens 2035 combustion-engine ban to boost car industry

-

Arctic sees unprecedented heat as climate impacts cascade

-

VW stops production at German site for first time

VW stops production at German site for first time

-

Rome's new Colosseum station reveals ancient treasures

-

EU eases 2035 combustion-engine ban to boost car industry

EU eases 2035 combustion-engine ban to boost car industry

-

US unemployment rises further, hovering at highest since 2021

-

Shift in battle to tackle teens trapped in Marseille drug 'slavery'

Shift in battle to tackle teens trapped in Marseille drug 'slavery'

-

Stocks retreat on US jobs, oil drops on Ukraine hopes

-

Stocks retreat ahead of US jobs, oil drops on Ukraine hopes

Stocks retreat ahead of US jobs, oil drops on Ukraine hopes

-

EU set to drop 2035 combustion-engine ban to boost car industry

-

Elusive December sun leaves Stockholm in the dark

Elusive December sun leaves Stockholm in the dark

-

Thousands of glaciers to melt each year by mid-century: study

-

China to impose anti-dumping duties on EU pork for five years

China to impose anti-dumping duties on EU pork for five years

-

Nepal starts tiger census to track recovery

-

Economic losses from natural disasters down by a third in 2025: Swiss Re

Economic losses from natural disasters down by a third in 2025: Swiss Re

-

Kenyan girls still afflicted by genital mutilation years after ban

-

Men's ATP tennis to apply extreme heat rule from 2026

Men's ATP tennis to apply extreme heat rule from 2026

-

Bank of Japan expected to hike rates to 30-year high

-

EU to unveil plan to tackle housing crisis

EU to unveil plan to tackle housing crisis

-

EU set to scrap 2035 combustion-engine ban in car industry boost

-

Asian markets retreat ahead of US jobs as tech worries weigh

Asian markets retreat ahead of US jobs as tech worries weigh

-

Famed Jerusalem stone still sells despite West Bank economic woes

-

Will OpenAI be the next tech giant or next Netscape?

Will OpenAI be the next tech giant or next Netscape?

-

Eastman, AstraZeneca, Kraft Heinz, and P&G Recognized with OMP Supply Chain Awards

-

French minister urges angry farmers to trust cow culls, vaccines

French minister urges angry farmers to trust cow culls, vaccines

-

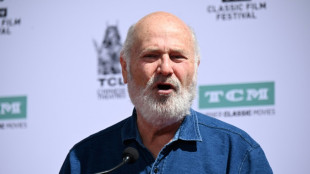

Rob Reiner's death: what we know

-

Stock market optimism returns after tech selloff but Wall Street wobbles

Stock market optimism returns after tech selloff but Wall Street wobbles

-

Nobel winner Machado suffered vertebra fracture leaving Venezuela

-

Stock market optimism returns after tech sell-off

Stock market optimism returns after tech sell-off

-

'Angry' Louvre workers' strike shuts out thousands of tourists

| SCS | 0.12% | 16.14 | $ | |

| RBGPF | 0.5% | 82.01 | $ | |

| CMSD | -0.73% | 23.21 | $ | |

| NGG | 1.64% | 77.035 | $ | |

| BP | 1.64% | 34.323 | $ | |

| GSK | 0.59% | 49.07 | $ | |

| CMSC | -0.34% | 23.26 | $ | |

| RIO | 1.95% | 77.505 | $ | |

| BTI | -0.06% | 57.255 | $ | |

| BCE | -0.41% | 23.235 | $ | |

| RYCEF | -0.2% | 14.77 | $ | |

| RELX | -0.21% | 40.735 | $ | |

| AZN | -0.47% | 90.92 | $ | |

| JRI | -0.52% | 13.44 | $ | |

| BCC | -0.51% | 75.455 | $ | |

| VOD | 0.66% | 12.785 | $ |

Warner Bros rejects Paramount bid, sticks with Netflix

Warner Bros. Discovery on Wednesday rejected a hostile takeover bid by Paramount launched last week to trump plans by streaming giant Netflix to acquire the Hollywood giant and owner of CNN.

In a statement, Warner Bros said the terms of the Netflix merger were better, while the Paramount offer "once again fails to address key concerns that we have consistently communicated... throughout our extensive engagement and review of their six previous proposals."

"We are confident that our merger with Netflix represents superior, more certain value for our shareholders," it said.

Netflix shocked the industry on December 5 by announcing it had sealed an agreement to buy the film and television studio and HBO Max streaming business for nearly $83 billion, the entertainment industry's biggest consolidation deal this decade.

Three days later, Paramount -- whose CEO is David Ellison, the son of Larry Ellison, an ally of President Donald Trump -- launched an all-cash tender offer valuing the entertainment giant at $108.4 billion.

But Warner Bros on Wednesday described the Paramount offer as risky, saying it was backed up by "an unknown and opaque revocable trust" and involved "no Ellison family commitment of any kind," among other factors.

Warner Bros. Discovery also stressed the dependence of the Paramount offer on foreign investors -- $24 billion of the financing is from Middle East sovereign wealth funds -- which will require further regulatory scrutiny.

"Our deal structure is clean and certain, with committed debt financing from leading institutions," Netflix co-CEOs Ted Sarandos and Greg Peters, wrote in a letter to Warner Bros shareholders, according to Business Insider.

"There are no contingencies, no foreign sovereign wealth funds, and no stock collateral or personal loans," they added.

Trump has repeatedly weighed in on the bidding war, saying Netflix's deal "could be a problem" as it would leave Netflix with a huge market share of the film and TV industry.

He later said that he wanted to ensure CNN gets new ownership as part of the Warner Bros. Discovery sale, targeting the outlet he has long blasted for airing critical news coverage that he repeatedly refers to as "fake news."

- 'Strong rationale' -

The president's powerful son-in-law Jared Kushner, was initially a minor investor in the latest Paramount bid through his Middle East-backed private equity company, but backed out of the deal on Tuesday.

"We continue to believe there is a strong strategic rationale for Paramount’s offer," the company, Affinity Partners, said in a statement to AFP.

Unlike Netflix's offer, Paramount's latest bid included the buyout of cable channels such as CNN, TNT, TBS and Discovery -- which would be added to its group of TV assets like CBS, MTV and Comedy Central.

As Netflix emerged as the likely winning bidder for Warner Bros -- the studio behind "Casablanca," the "Harry Potter" movies and "Friends" -- Hollywood's elite launched an aggressive campaign against the acquisition.

The streaming giant is viewed as a pariah in some Hollywood circles, largely due to its reluctance to release content in theaters and its disruption of traditional industry practices.

In an interview Tuesday in Paris, Netflix co-chief executive Sarandos said it would continue to distribute Warner Bros films in cinemas if its takeover bid for the storied studio is successful.

"We're going to continue to operate Warner Bros. studios independently and release the movies traditionally in cinema," he said, while admitting his past comments on theatrical distribution "now confuse people."

M.García--CPN