-

Kenya's economy faces climate change risks: World Bank

Kenya's economy faces climate change risks: World Bank

-

Stocks retreat ahead of US jobs, oil drops on Ukraine hopes

-

EU set to drop 2035 combustion-engine ban to boost car industry

EU set to drop 2035 combustion-engine ban to boost car industry

-

Elusive December sun leaves Stockholm in the dark

-

Thousands of glaciers to melt each year by mid-century: study

Thousands of glaciers to melt each year by mid-century: study

-

China to impose anti-dumping duties on EU pork for five years

-

Nepal starts tiger census to track recovery

Nepal starts tiger census to track recovery

-

Economic losses from natural disasters down by a third in 2025: Swiss Re

-

Kenyan girls still afflicted by genital mutilation years after ban

Kenyan girls still afflicted by genital mutilation years after ban

-

Men's ATP tennis to apply extreme heat rule from 2026

-

Bank of Japan expected to hike rates to 30-year high

Bank of Japan expected to hike rates to 30-year high

-

EU to unveil plan to tackle housing crisis

-

EU set to scrap 2035 combustion-engine ban in car industry boost

EU set to scrap 2035 combustion-engine ban in car industry boost

-

Asian markets retreat ahead of US jobs as tech worries weigh

-

Famed Jerusalem stone still sells despite West Bank economic woes

Famed Jerusalem stone still sells despite West Bank economic woes

-

Will OpenAI be the next tech giant or next Netscape?

-

French minister urges angry farmers to trust cow culls, vaccines

French minister urges angry farmers to trust cow culls, vaccines

-

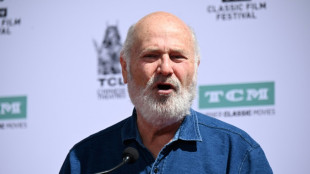

Rob Reiner's death: what we know

-

Stock market optimism returns after tech selloff but Wall Street wobbles

Stock market optimism returns after tech selloff but Wall Street wobbles

-

Nobel winner Machado suffered vertebra fracture leaving Venezuela

-

Stock market optimism returns after tech sell-off

Stock market optimism returns after tech sell-off

-

'Angry' Louvre workers' strike shuts out thousands of tourists

-

Showdown looms as EU-Mercosur deal nears finish line

Showdown looms as EU-Mercosur deal nears finish line

-

Eurovision 2026 will feature 35 countries: organisers

-

German shipyard, rescued by the state, gets mega deal

German shipyard, rescued by the state, gets mega deal

-

'We are angry': Louvre Museum closed as workers strike

-

Stocks diverge ahead of central bank calls, US data

Stocks diverge ahead of central bank calls, US data

-

Louvre Museum closed as workers strike

-

Australia defends record on antisemitism after Bondi Beach attack

Australia defends record on antisemitism after Bondi Beach attack

-

EU-Mercosur trade deal faces bumpy ride to finish line

-

Asian markets drop with Wall St as tech fears revive

Asian markets drop with Wall St as tech fears revive

-

France's Bardella slams 'hypocrisy' over return of brothels

-

Tokyo-bound United plane returns to Washington after engine fails

Tokyo-bound United plane returns to Washington after engine fails

-

Deja vu? Trump accused of economic denial and physical decline

-

China's smaller manufacturers look to catch the automation wave

China's smaller manufacturers look to catch the automation wave

-

Hungary winemakers fear disease may 'wipe out' industry

-

Campaigning starts in Central African Republic quadruple election

Campaigning starts in Central African Republic quadruple election

-

'Stop the slaughter': French farmers block roads over cow disease cull

-

First urban cable car unveiled outside Paris

First urban cable car unveiled outside Paris

-

Why SpaceX IPO plan is generating so much buzz

-

US unseals warrant for tanker seized off Venezuelan coast

US unseals warrant for tanker seized off Venezuelan coast

-

World stocks mostly slide, consolidating Fed-fuelled gains

-

Crypto firm Tether bids for Juventus, is quickly rebuffed

Crypto firm Tether bids for Juventus, is quickly rebuffed

-

UK's king shares 'good news' that cancer treatment will be reduced in 2026

-

Can Venezuela survive US targeting its oil tankers?

Can Venezuela survive US targeting its oil tankers?

-

Salah admired from afar in his Egypt home village as club tensions swirl

-

World stocks retrench, consolidating Fed-fuelled gains

World stocks retrench, consolidating Fed-fuelled gains

-

Iran frees child bride sentenced to death over husband's killing: activists

-

World stocks consolidate Fed-fuelled gains

World stocks consolidate Fed-fuelled gains

-

France updates net-zero plan, with fossil fuel phaseout

India's Adani briefly listed as world's second-richest person

Indian industrialist Gautam Adani briefly became the world's second-richest person on the Forbes real-time billionaire tracker on Friday, weeks after becoming the first Asian to break into the top three.

The self-made billionaire's net worth surged $4 billion overnight to $154 billion, according to Forbes, ranking him ahead of LVMH's Bernard Arnault and Amazon's Jeff Bezos.

Tesla founder Elon Musk remained well out in front with a fortune of more than $270 billion.

Arnault -- who at times held the top spot in May 2021 -- and Adani traded the number two position during the day as the share prices of their companies fluctuated.

Adani, 60, made his fortune in ports and commodities trading and now operates India's second-largest conglomerate with interests ranging from coal mining and edible oils to airports and news media.

His ballooning net worth reflects a stratospheric rise in the market capitalisation of his publicly listed companies, as investors back the Adani Group's aggressive expansion of old and new businesses.

Shares in the flagship Adani Enterprises -- of which the billionaire owns 75 percent -- have soared more than 2,700 percent since March 2020, and doubled in value in the past six months.

Stock price surges in other group companies including Adani Transmission, Adani Power, Adani Ports and Adani Green Energy catapulted Adani past fellow Indian billionaire Mukesh Ambani this year.

Analyst estimates indicated the market capitalisation of Adani's seven listed companies also briefly overtook those of the Tata group on Friday morning, making the Adani Group India's largest conglomerate.

Born in the city of Ahmedabad in the western state of Gujarat to a middle-class family, Adani dropped out of college to work in the diamond industry before starting his export business in 1988.

In 1995, he won a contract to build and operate a commercial shipping port at Mundra in Gujarat, which has since grown to become India's largest port.

At the same time, Adani expanded into thermal power generation and coal mining in India and overseas.

In recent years, the conglomerate has forayed into petrochemicals, cement, data centres and copper refining, in addition to establishing a renewable energy business with ambitious targets.

Recent investments in Indian news media and a bid for 5G airwaves this year have raised speculation that the billionaire's empire could soon impinge on sectors dominated by Ambani's Reliance Industries.

But Adani's rapid expansion into capital-intensive businesses has also raised financial alarms, with Fitch Group's CreditSights last week reiterating that they "remain concerned over the Adani Group's leverage".

D.Goldberg--CPN