-

Kenya's economy faces climate change risks: World Bank

Kenya's economy faces climate change risks: World Bank

-

Third 'Avatar' film soars to top in N. American box office debut

-

China's rare earths El Dorado gives strategic edge

China's rare earths El Dorado gives strategic edge

-

Wheelchair user flies into space, a first

-

French culture boss accused of mass drinks spiking to humiliate women

French culture boss accused of mass drinks spiking to humiliate women

-

US Afghans in limbo after Washington soldier attack

-

Nasdaq rallies again while yen falls despite BOJ rate hike

Nasdaq rallies again while yen falls despite BOJ rate hike

-

US university killer's mystery motive sought after suicide

-

IMF approves $206 mn aid to Sri Lanka after Cyclone Ditwah

IMF approves $206 mn aid to Sri Lanka after Cyclone Ditwah

-

Rome to charge visitors for access to Trevi Fountain

-

Stocks advance with focus on central banks, tech

Stocks advance with focus on central banks, tech

-

Norway crown princess likely to undergo lung transplant

-

France's budget hits snag in setback for embattled PM

France's budget hits snag in setback for embattled PM

-

Volatile Oracle shares a proxy for Wall Street's AI jitters

-

Japan hikes interest rates to 30-year-high

Japan hikes interest rates to 30-year-high

-

Brazil's top court strikes down law blocking Indigenous land claims

-

'We are ghosts': Britain's migrant night workers

'We are ghosts': Britain's migrant night workers

-

Asian markets rise as US inflation eases, Micron soothes tech fears

-

Trump signs $900 bn defense policy bill into law

Trump signs $900 bn defense policy bill into law

-

EU-Mercosur deal delayed as farmers stage Brussels show of force

-

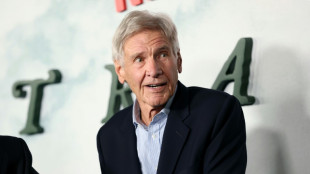

Harrison Ford to get lifetime acting award

Harrison Ford to get lifetime acting award

-

Trump health chief seeks to bar trans youth from gender-affirming care

-

Argentine unions in the street over Milei labor reforms

Argentine unions in the street over Milei labor reforms

-

Brazil open to EU-Mercosur deal delay as farmers protest in Brussels

-

Brussels farmer protest turns ugly as EU-Mercosur deal teeters

Brussels farmer protest turns ugly as EU-Mercosur deal teeters

-

US accuses S. Africa of harassing US officials working with Afrikaners

-

ECB holds rates as Lagarde stresses heightened uncertainty

ECB holds rates as Lagarde stresses heightened uncertainty

-

Trump Media announces merger with fusion power company

-

Stocks rise as US inflation cools, tech stocks bounce

Stocks rise as US inflation cools, tech stocks bounce

-

Zelensky presses EU to tap Russian assets at crunch summit

-

Danish 'ghetto' residents upbeat after EU court ruling

Danish 'ghetto' residents upbeat after EU court ruling

-

ECB holds rates but debate swirls over future

-

Bank of England cuts interest rate after UK inflation slides

Bank of England cuts interest rate after UK inflation slides

-

Have Iran's authorities given up on the mandatory hijab?

-

British energy giant BP extends shakeup with new CEO pick

British energy giant BP extends shakeup with new CEO pick

-

EU kicks off crunch summit on Russian asset plan for Ukraine

-

Sri Lanka plans $1.6 bn in cyclone recovery spending in 2026

Sri Lanka plans $1.6 bn in cyclone recovery spending in 2026

-

Most Asian markets track Wall St lower as AI fears mount

-

Danish 'ghetto' tenants hope for EU discrimination win

Danish 'ghetto' tenants hope for EU discrimination win

-

What to know about the EU-Mercosur deal

-

Trump vows economic boom, blames Biden in address to nation

Trump vows economic boom, blames Biden in address to nation

-

ECB set to hold rates but debate swirls over future

-

EU holds crunch summit on Russian asset plan for Ukraine

EU holds crunch summit on Russian asset plan for Ukraine

-

Nasdaq tumbles on renewed angst over AI building boom

-

Billionaire Trump nominee confirmed to lead NASA amid Moon race

Billionaire Trump nominee confirmed to lead NASA amid Moon race

-

CNN's future unclear as Trump applies pressure

-

German MPs approve 50 bn euros in military purchases

German MPs approve 50 bn euros in military purchases

-

EU's Mercosur trade deal hits French, Italian roadblock

-

Warner Bros rejects Paramount bid, sticks with Netflix

Warner Bros rejects Paramount bid, sticks with Netflix

-

Crude prices surge after Trump orders Venezuela oil blockade

Sergio Ermotti: George Clooney of Swiss banking back as UBS boss

Sergio Ermotti, back as chief executive of UBS to oversee the mammoth takeover of Credit Suisse, has gone from local apprentice to the two-time boss of a top global bank.

Nicknamed the "George Clooney of Paradeplatz", after the Hollywood star and the Zurich square at the heart of Switzerland's banking industry, the silver-haired 62-year-old is known for always being immaculately turned out.

The Swiss banker, who returns to the UBS hot seat at its annual general meeting on Wednesday, has a reputation that lives up to such star billing, having turned around the fortunes of UBS after the 2008 global financial crisis.

As a child, he dreamed of a career in football but made his mark instead as one of the most talented bankers of his generation, the Neue Zurcher Zeitung newspaper said after his return to UBS was announced on Tuesday.

At 15, he quit school to become an apprentice at the Corner private bank in Lugano, his home town in the Italian-speaking south of Switzerland.

From there, he started out on a dazzling journey seen as a shining example of the Swiss apprenticeship system.

After a stint at the US bank Citigroup, he rose through the ranks of the US investment bank Merrill Lynch between 1987 and 2004, completing his training along the way via the advanced management programme at Britain's prestigious Oxford University.

In 2005, he joined the Italian bank UniCredit for five years, where he notably headed the markets and investment banking division.

He was then entrusted with the CEO role at UBS, running Switzerland's biggest bank from 2011 to 2020.

In 2021, he became the chairman of the reinsurance giant Swiss Re.

- Call of duty -

Ermotti is "made for the takeover of Credit Suisse" as he "used to playing the fireman role" and coming in to douse down trouble, said the Tribune de Geneve newspaper.

Back in 2020, Ermotti called the UBS chief executive role a dream job, but he will now find it "a much less comfortable chair", the daily said.

Amid fears of a growing banking crisis following the collapse of two banks in the United States, Credit Suisse's share price plummeted on March 15 as investor confidence evaporated.

On March 19, the Swiss government, the central bank and the financial regulators strongarmed UBS into buying Credit Suisse for $3.25 billion to prevent it from collapsing -- something which it was feared could have triggered a global banking meltdown.

The somewhat forced marriage needs stitching together carefully.

This prompted the UBS board to turn once more to Ermotti, thinking him the "better pilot" than current Dutch CEO Ralph Hamers to navigate the new flight path, said UBS chairman Colm Kelleher.

The quickfire merger of the two biggest banks in Switzerland triggered unease in the wealthy Alpine nation, with choice for customers and small businesses now seriously reduced.

While Kelleher admitted that Ermotti's Swiss nationality helped a little, he recalled that most of UBS's business is international, and said the decision to ask him back was dictated by the task ahead.

Ermotti will have to merge two institutions which were both among the 30 banks around the world deemed of global importance to the banking system -- in short, too big to fail.

Ermotti said he felt the "call of duty" to return and carry out the merger -- which Kelleher admitted comes with "huge" execution risks.

- Settling disputes -

UBS came in for fierce criticism after its bailout by the state during the 2008 financial crisis.

But the losses in 2011 of a rogue trader who blew $2.3 billion in shady transactions was the straw that broke the camel's back.

Heads rolled and UBS turned to Ermotti, who was little-known within Switzerland, having made his career mainly in London, New York and Milan.

But he returned home after being overlooked for the CEO role at UniCredit.

He made cuts in the investment bank, refocused UBS on wealth management and settled the disputes accumulated by the bank, including the Libor and exchange rate manipulation scandals.

C.Peyronnet--CPN