-

Kenya's economy faces climate change risks: World Bank

Kenya's economy faces climate change risks: World Bank

-

French culture boss accused of mass drinks spiking to humiliate women

-

US Afghans in limbo after Washington soldier attack

US Afghans in limbo after Washington soldier attack

-

Nasdaq rallies again while yen falls despite BOJ rate hike

-

US university killer's mystery motive sought after suicide

US university killer's mystery motive sought after suicide

-

IMF approves $206 mn aid to Sri Lanka after Cyclone Ditwah

-

Rome to charge visitors for access to Trevi Fountain

Rome to charge visitors for access to Trevi Fountain

-

Stocks advance with focus on central banks, tech

-

Norway crown princess likely to undergo lung transplant

Norway crown princess likely to undergo lung transplant

-

France's budget hits snag in setback for embattled PM

-

Volatile Oracle shares a proxy for Wall Street's AI jitters

Volatile Oracle shares a proxy for Wall Street's AI jitters

-

Japan hikes interest rates to 30-year-high

-

Brazil's top court strikes down law blocking Indigenous land claims

Brazil's top court strikes down law blocking Indigenous land claims

-

'We are ghosts': Britain's migrant night workers

-

Asian markets rise as US inflation eases, Micron soothes tech fears

Asian markets rise as US inflation eases, Micron soothes tech fears

-

Trump signs $900 bn defense policy bill into law

-

EU-Mercosur deal delayed as farmers stage Brussels show of force

EU-Mercosur deal delayed as farmers stage Brussels show of force

-

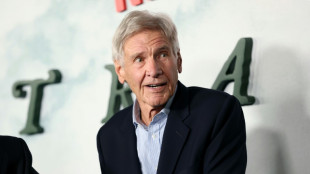

Harrison Ford to get lifetime acting award

-

Trump health chief seeks to bar trans youth from gender-affirming care

Trump health chief seeks to bar trans youth from gender-affirming care

-

Argentine unions in the street over Milei labor reforms

-

Brazil open to EU-Mercosur deal delay as farmers protest in Brussels

Brazil open to EU-Mercosur deal delay as farmers protest in Brussels

-

Brussels farmer protest turns ugly as EU-Mercosur deal teeters

-

US accuses S. Africa of harassing US officials working with Afrikaners

US accuses S. Africa of harassing US officials working with Afrikaners

-

ECB holds rates as Lagarde stresses heightened uncertainty

-

Trump Media announces merger with fusion power company

Trump Media announces merger with fusion power company

-

Stocks rise as US inflation cools, tech stocks bounce

-

Zelensky presses EU to tap Russian assets at crunch summit

Zelensky presses EU to tap Russian assets at crunch summit

-

Danish 'ghetto' residents upbeat after EU court ruling

-

ECB holds rates but debate swirls over future

ECB holds rates but debate swirls over future

-

Bank of England cuts interest rate after UK inflation slides

-

Have Iran's authorities given up on the mandatory hijab?

Have Iran's authorities given up on the mandatory hijab?

-

British energy giant BP extends shakeup with new CEO pick

-

EU kicks off crunch summit on Russian asset plan for Ukraine

EU kicks off crunch summit on Russian asset plan for Ukraine

-

Sri Lanka plans $1.6 bn in cyclone recovery spending in 2026

-

Most Asian markets track Wall St lower as AI fears mount

Most Asian markets track Wall St lower as AI fears mount

-

Danish 'ghetto' tenants hope for EU discrimination win

-

What to know about the EU-Mercosur deal

What to know about the EU-Mercosur deal

-

Trump vows economic boom, blames Biden in address to nation

-

ECB set to hold rates but debate swirls over future

ECB set to hold rates but debate swirls over future

-

EU holds crunch summit on Russian asset plan for Ukraine

-

Nasdaq tumbles on renewed angst over AI building boom

Nasdaq tumbles on renewed angst over AI building boom

-

Billionaire Trump nominee confirmed to lead NASA amid Moon race

-

CNN's future unclear as Trump applies pressure

CNN's future unclear as Trump applies pressure

-

German MPs approve 50 bn euros in military purchases

-

EU's Mercosur trade deal hits French, Italian roadblock

EU's Mercosur trade deal hits French, Italian roadblock

-

Warner Bros rejects Paramount bid, sticks with Netflix

-

Crude prices surge after Trump orders Venezuela oil blockade

Crude prices surge after Trump orders Venezuela oil blockade

-

Warner Bros. Discovery rejects Paramount bid

-

Doctors in England go on strike for 14th time

Doctors in England go on strike for 14th time

-

Ghana's Highlife finds its rhythm on UNESCO world stage

Credit Suisse customers unruffled by stock slump

Credit Suisse customers in Geneva were not spooked by the bank's plunge on the stock exchange Wednesday, believing the Swiss government would ride to the rescue before it could ever collapse.

Emerging from the bank's headquarters branch, in a prime location on the Rhone riverside in the central shopping and business district, customers were largely unruffled by the bank's share price tumbling more than 30 percent during the day to 1.55 Swiss francs.

"It will be covered by the government, under 100,000 Swiss francs" per customer, said a 40-year-old personal trainer, who declined to give his name.

"Someone will buy the bank anyway."

The bank's international activities, rather than its Swiss domestic banking branch, are the greater source of worry, he added.

Share prices nosedived after Ammar Al Khudairy, chairman of Credit Suisse's main shareholder Saudi National Bank, said it would "absolutely not" up its stake.

Another customer stepping outside into the spring sunshine said he thought the bank would stay afloat because it is one of the 30 "global systemically important banks" deemed too big to fail.

"I'm not worried. These are systemically important banks. They can't go bankrupt," said a restaurant manager, who is a professional customer at Credit Suisse and also did not want to be named.

For customers, the 33-year-old added, "there are bigger problems to worry about."

- 'Snowball effect' -

Inside the branch's atrium, there was no air of panic as customers formed queues at various desks.

Footage of Roger Federer played on repeat on bank's electronic screens. The Swiss tennis legend has long been a brand ambassador with Credit Suisse.

Global markets have been rattled by the collapse of tech sector lenders Silicon Valley Bank and Signature.

"It's a snowball effect," said a Geneva-based independent asset manager, who cycled up to the branch and seemed unsurprised that Credit Suisse was in trouble.

"I worked 15 years for them, but nearly 35 years ago," he said, declining to be named. "It was another era. Quite different. There were more people, more counters, a better dynamic."

Credit Suisse wanted to get rid of small customers, he said, including his wealth management portfolio which didn't have enough clients.

"That was fine by us as the service was lamentable," he said

Antolin Coll, 79, who worked for Credit Suisse for 22 years, said he was confident the bank would survive.

"I still have my money there and I always monitor it," the former manager said.

"I'm not afraid about that, because there have been previous cases and it always worked out."

He sold his Credit Suisse shares when they were very high, he said.

"If you have your account in a savings account, leave it alone until things settle down," he said, warning those with stocks however to "watch out".

Credit Suisse shares recovered slightly in afternoon trading Wednesday to close down 24 percent at 1.70 Swiss francs each.

Y.Tengku--CPN