-

Kenya's economy faces climate change risks: World Bank

Kenya's economy faces climate change risks: World Bank

-

Volatile Oracle shares a proxy for Wall Street's AI jitters

-

Japan hikes interest rates to 30-year-high

Japan hikes interest rates to 30-year-high

-

Brazil's top court strikes down law blocking Indigenous land claims

-

'We are ghosts': Britain's migrant night workers

'We are ghosts': Britain's migrant night workers

-

Asian markets rise as US inflation eases, Micron soothes tech fears

-

Trump signs $900 bn defense policy bill into law

Trump signs $900 bn defense policy bill into law

-

EU-Mercosur deal delayed as farmers stage Brussels show of force

-

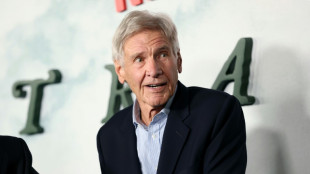

Harrison Ford to get lifetime acting award

Harrison Ford to get lifetime acting award

-

Trump health chief seeks to bar trans youth from gender-affirming care

-

Argentine unions in the street over Milei labor reforms

Argentine unions in the street over Milei labor reforms

-

Brazil open to EU-Mercosur deal delay as farmers protest in Brussels

-

Brussels farmer protest turns ugly as EU-Mercosur deal teeters

Brussels farmer protest turns ugly as EU-Mercosur deal teeters

-

US accuses S. Africa of harassing US officials working with Afrikaners

-

ECB holds rates as Lagarde stresses heightened uncertainty

ECB holds rates as Lagarde stresses heightened uncertainty

-

Trump Media announces merger with fusion power company

-

Stocks rise as US inflation cools, tech stocks bounce

Stocks rise as US inflation cools, tech stocks bounce

-

Zelensky presses EU to tap Russian assets at crunch summit

-

Danish 'ghetto' residents upbeat after EU court ruling

Danish 'ghetto' residents upbeat after EU court ruling

-

ECB holds rates but debate swirls over future

-

Bank of England cuts interest rate after UK inflation slides

Bank of England cuts interest rate after UK inflation slides

-

Have Iran's authorities given up on the mandatory hijab?

-

British energy giant BP extends shakeup with new CEO pick

British energy giant BP extends shakeup with new CEO pick

-

EU kicks off crunch summit on Russian asset plan for Ukraine

-

Sri Lanka plans $1.6 bn in cyclone recovery spending in 2026

Sri Lanka plans $1.6 bn in cyclone recovery spending in 2026

-

Most Asian markets track Wall St lower as AI fears mount

-

Danish 'ghetto' tenants hope for EU discrimination win

Danish 'ghetto' tenants hope for EU discrimination win

-

What to know about the EU-Mercosur deal

-

Trump vows economic boom, blames Biden in address to nation

Trump vows economic boom, blames Biden in address to nation

-

ECB set to hold rates but debate swirls over future

-

EU holds crunch summit on Russian asset plan for Ukraine

EU holds crunch summit on Russian asset plan for Ukraine

-

Nasdaq tumbles on renewed angst over AI building boom

-

Billionaire Trump nominee confirmed to lead NASA amid Moon race

Billionaire Trump nominee confirmed to lead NASA amid Moon race

-

CNN's future unclear as Trump applies pressure

-

German MPs approve 50 bn euros in military purchases

German MPs approve 50 bn euros in military purchases

-

EU's Mercosur trade deal hits French, Italian roadblock

-

Warner Bros rejects Paramount bid, sticks with Netflix

Warner Bros rejects Paramount bid, sticks with Netflix

-

Crude prices surge after Trump orders Venezuela oil blockade

-

Warner Bros. Discovery rejects Paramount bid

Warner Bros. Discovery rejects Paramount bid

-

Doctors in England go on strike for 14th time

-

Ghana's Highlife finds its rhythm on UNESCO world stage

Ghana's Highlife finds its rhythm on UNESCO world stage

-

Stocks gain as traders bet on interest rate moves

-

France probes 'foreign interference' after malware found on ferry

France probes 'foreign interference' after malware found on ferry

-

Europe's Ariane 6 rocket puts EU navigation satellites in orbit

-

Bleak end to the year as German business morale drops

Bleak end to the year as German business morale drops

-

Hundreds queue at Louvre museum as strike vote delays opening

-

Markets rise even as US jobs data fail to boost rate cut bets

Markets rise even as US jobs data fail to boost rate cut bets

-

Asian markets mixed as US jobs data fails to boost rate cut hopes

-

Bondi shooting shocks, angers Australia Jewish community

Bondi shooting shocks, angers Australia Jewish community

-

UK experiences sunniest year on record

TSMC to launch chipmaking plant in Japan, but US plant to face delays

Taiwan's TSMC will open its latest chipmaking foundry on Japan's Kyushu island on February 24, but a plant in the United States will face further delays, the company said Thursday.

Taiwan Semiconductor Manufacturing Company -- which counts Apple and Nvidia as clients -- controls more than half the world's output of silicon wafers, used in everything from smartphones to cars and missiles.

In recent years, the company has had to navigate geopolitical tussles between the United States and China as the two face off over technology import restrictions, trade and Taiwan -- the primary manufacturing base for TSMC.

On Thursday, during an investors' call over fourth-quarter earnings, Chairman Mark Liu announced the official date of the long-awaited Japan foundry's opening ceremony would be February 24.

"In Japan, we are building a special technology fab(rication plant) in Kumamoto which will utilise 12- and 16-nanometre and 28- and 22-nanometre process technology," Liu said.

"We will hold an opening ceremony for this fab on February 24 next month and volume production is on track for fourth quarter of 2024."

He added that TSMC's expansion overseas is "based on our customers' needs and a necessary level of government subsidies for support".

"In today's fractured globalisation environment, our strategy is to expand our global manufacturing footprint to increase our customers' trust, expand our future growth potential, and reach for more global talents," Liu said.

Japan's government said last year it plans to spend $13 billion to boost domestic production of strategically important semiconductors and generative AI technology.

Part of that spending would be to support the construction of a second TSMC plant in Kumamoto, a Japanese trade ministry official had said in November.

But Liu said Thursday the second plant is still in the "serious evaluation stage".

"We are still discussing with the Japanese government, they are very cooperative," he said. "Nothing is definitive."

- Delays in US -

Liu also said its fabrication facility in the US state of Arizona is "on track for volume production of N4 -- or 4-nanometre -- technology in the first half of 2025".

However, in a second session with media -- in which TSMC barred audio recording by journalists -- Chief Financial Officer Wendell Huang said the completion of its second foundry in Arizona will be delayed until "2027 or 2028".

This is a setback for the US administration of President Joe Biden, who had wooed TSMC to build its precious chipmaking factories on American soil in a bid to, in theory, lessen US reliance on foreign-located factories.

But the Arizona plants -- one of the largest foreign investments in the United States -- have run into issues, which TSMC attributed to a shortage of skilled workers.

It had also incited the ire of Arizona's unions with those comments.

Liu said TSMC is now working closely to "develop strong relationships with our local union and trade partners in Arizona", signing an agreement on training, hiring local workers, and establishing regular communications.

A planned fabrication facility in Germany -- the first in Europe -- "is scheduled to begin (construction) in Q4 (the fourth quarter) this year", he said.

The company also reported a 19.3 percent drop in net profits in the October-December period to Tw$238.7 billion ($7.6 billion), while its revenues were "essentially flat".

CEO C.C. Wei said that while 2023 was a "challenging year" for the global semiconductor industry, the rising demand for generative AI technology also means "we expect 2024 to be a healthy growth year for TSMC".

The chip industry has seen sluggish performance, which companies attribute to high inflation and slowing global economic growth caused in part by geopolitical tensions.

TSMC had sought to quell investor fears in the past by pointing to the increasing demand for AI-related products, like ChatGPT, which needs high-performing silicon wafers to function.

S.F.Lacroix--CPN