-

Kenya's economy faces climate change risks: World Bank

Kenya's economy faces climate change risks: World Bank

-

Bank of Japan expected to hike rates to 30-year high

-

EU to unveil plan to tackle housing crisis

EU to unveil plan to tackle housing crisis

-

EU set to scrap 2035 combustion-engine ban in car industry boost

-

Asian markets retreat ahead of US jobs as tech worries weigh

Asian markets retreat ahead of US jobs as tech worries weigh

-

Famed Jerusalem stone still sells despite West Bank economic woes

-

Will OpenAI be the next tech giant or next Netscape?

Will OpenAI be the next tech giant or next Netscape?

-

French minister urges angry farmers to trust cow culls, vaccines

-

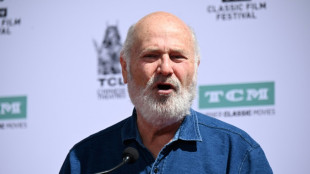

Rob Reiner's death: what we know

Rob Reiner's death: what we know

-

Stock market optimism returns after tech selloff but Wall Street wobbles

-

Nobel winner Machado suffered vertebra fracture leaving Venezuela

Nobel winner Machado suffered vertebra fracture leaving Venezuela

-

Stock market optimism returns after tech sell-off

-

'Angry' Louvre workers' strike shuts out thousands of tourists

'Angry' Louvre workers' strike shuts out thousands of tourists

-

Showdown looms as EU-Mercosur deal nears finish line

-

Eurovision 2026 will feature 35 countries: organisers

Eurovision 2026 will feature 35 countries: organisers

-

German shipyard, rescued by the state, gets mega deal

-

'We are angry': Louvre Museum closed as workers strike

'We are angry': Louvre Museum closed as workers strike

-

Stocks diverge ahead of central bank calls, US data

-

Louvre Museum closed as workers strike

Louvre Museum closed as workers strike

-

Australia defends record on antisemitism after Bondi Beach attack

-

EU-Mercosur trade deal faces bumpy ride to finish line

EU-Mercosur trade deal faces bumpy ride to finish line

-

Asian markets drop with Wall St as tech fears revive

-

France's Bardella slams 'hypocrisy' over return of brothels

France's Bardella slams 'hypocrisy' over return of brothels

-

Tokyo-bound United plane returns to Washington after engine fails

-

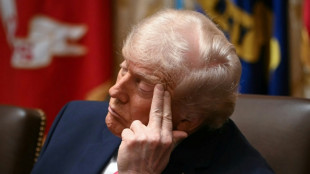

Deja vu? Trump accused of economic denial and physical decline

Deja vu? Trump accused of economic denial and physical decline

-

China's smaller manufacturers look to catch the automation wave

-

Hungary winemakers fear disease may 'wipe out' industry

Hungary winemakers fear disease may 'wipe out' industry

-

Campaigning starts in Central African Republic quadruple election

-

'Stop the slaughter': French farmers block roads over cow disease cull

'Stop the slaughter': French farmers block roads over cow disease cull

-

First urban cable car unveiled outside Paris

-

Why SpaceX IPO plan is generating so much buzz

Why SpaceX IPO plan is generating so much buzz

-

US unseals warrant for tanker seized off Venezuelan coast

-

World stocks mostly slide, consolidating Fed-fuelled gains

World stocks mostly slide, consolidating Fed-fuelled gains

-

Crypto firm Tether bids for Juventus, is quickly rebuffed

-

UK's king shares 'good news' that cancer treatment will be reduced in 2026

UK's king shares 'good news' that cancer treatment will be reduced in 2026

-

Can Venezuela survive US targeting its oil tankers?

-

Salah admired from afar in his Egypt home village as club tensions swirl

Salah admired from afar in his Egypt home village as club tensions swirl

-

World stocks retrench, consolidating Fed-fuelled gains

-

Iran frees child bride sentenced to death over husband's killing: activists

Iran frees child bride sentenced to death over husband's killing: activists

-

World stocks consolidate Fed-fuelled gains

-

France updates net-zero plan, with fossil fuel phaseout

France updates net-zero plan, with fossil fuel phaseout

-

Stocks rally in wake of Fed rate cut

-

EU agrees recycled plastic targets for cars

EU agrees recycled plastic targets for cars

-

British porn star to be deported from Bali after small fine

-

British porn star fined, faces imminent Bali deportation

British porn star fined, faces imminent Bali deportation

-

Spain opens doors to descendants of Franco-era exiles

-

Indonesia floods were 'extinction level' for rare orangutans

Indonesia floods were 'extinction level' for rare orangutans

-

Thai teacher finds 'peace amidst chaos' painting bunker murals

-

Japan bear victim's watch shows last movements

Japan bear victim's watch shows last movements

-

South Korea exam chief quits over complaints of too-hard tests

AI chip crunch: startups vie for Nvidia's vital component

The artificial intelligence revolution is fully underway, but soaring demand for its most crucial component has startups scratching their heads on how they can deliver on AI's promise.

Generative AI's lifeblood is a book-sized semiconductor known as the graphics processing unit (GPU) -- built by one company, Nvidia.

Nvidia's CEO and founder Jensen Huang made a wild bet years ago that the world would soon clamor for a powerful chip usually used for making video games, but that could build AI as well.

No company working with the generative AI models that fuel today's frenzy can get off the ground without Nvidia's singular product: the latest model is the H100 and its accompanying software.

That painful reality is one that Amazon, Intel, AMD and others are scrambling to fix with their own alternatives, but those attempts could take years.

- 'Not a lot of GPUs' -

And with the biggest tech companies throwing all their financial might into generative AI, the smaller fish must go on the hunt to secure Nvidia’s holy grail.

"Around the world, it is becoming very hard to get thousands of GPUs because all these big companies are putting in billions of dollars, stockpiling GPUs," said Fangbo Tao, co-founder of Mindverse.AI, a Singapore-based startup.

"There's not a lot of GPUs around," he said.

Tao spoke to AFP at the TechCrunch Disrupt conference in San Francisco, where AI startups jostled to make their pitches to Silicon Valley's venture capitalists (VC).

ChatGPT took the world by storm just as Silicon Valley was caught in a nasty hangover from the pandemic when investors threw money at startups, convinced that life had gone irreversibly online.

That turned out to be far-fetched, and the US tech scene entered a downturn with rounds of layoffs and VC money dried up.

Thanks to AI, some of the old mojo is back, and anyone with those two letters on their resume will likely see a red carpet rolled out on the legendary Sand Hill Road, home to Silicon Valley’s most storied investors.

But as the startups walk away with their VC cash, the money in their pockets will be quickly forked out to Nvidia for GPUs either directly or through providers to bring their AI dreams to execution.

"We call on a lot of the big cloud providers (Microsoft, AWS and Google) ), and they all tell us even they are having trouble getting supplies," said Laurent Daudet, CEO of AI startup LightOn.

The problem is most acute for companies involved in training generative AI models, which requires that power hungry GPUs work at peak capacity to process troves of data ingested from the internet.

The computing needs are so massive that only a few companies can stump up the cash to build one of these state-of-the-art large language models.

- 'Sucking the oxygen' -

The ten billion dollars investment by Microsoft into OpenAI is widely understood to be paid out as credits to access purpose-built data centers humming with Nvidia GPUs.

Google has built its own models and now Amazon on Monday said it was pumping four billion dollars into Anthropic AI, another company that trains AI.

Training on that mountain of data "is sucking out almost all the oxygen from the GPU market right now," said Said Ouissal, CEO of Zededa, a company that works on making AI less power hungry.

"You're looking at mid-next year, maybe late next year before you're actually going to get delivery on new orders. The shortage doesn't seem to be letting up," added Wes Cummins, CEO Applied Digital, a company that supplies AI infrastructure.

Companies on the AI frontlines also point out that Nvidia’s primordial role makes it the de-facto kingmaker on where the technology is going.

The market is "almost entirely driven by the big players -- Googles, Amazons, Metas" that have the "enormous amounts of data and enormous amounts of capital," former Nvidia engineer Jacopo Pantaleoni told The Information.

"This was not the world I wanted to help build," he said.

Some veterans of Silicon Valley said that the frenzied days of Nvidia GPUs will not last forever and that other options will inevitably emerge.

Or the cost of entry will prove too high, even for the giants, bringing the current boom down to earth.

Ch.Lefebvre--CPN