-

Kenya's economy faces climate change risks: World Bank

Kenya's economy faces climate change risks: World Bank

-

Rome to charge visitors for access to Trevi Fountain

-

Stocks advance with focus on central banks, tech

Stocks advance with focus on central banks, tech

-

Norway crown princess likely to undergo lung transplant

-

France's budget hits snag in setback for embattled PM

France's budget hits snag in setback for embattled PM

-

Volatile Oracle shares a proxy for Wall Street's AI jitters

-

Japan hikes interest rates to 30-year-high

Japan hikes interest rates to 30-year-high

-

Brazil's top court strikes down law blocking Indigenous land claims

-

'We are ghosts': Britain's migrant night workers

'We are ghosts': Britain's migrant night workers

-

Asian markets rise as US inflation eases, Micron soothes tech fears

-

Trump signs $900 bn defense policy bill into law

Trump signs $900 bn defense policy bill into law

-

EU-Mercosur deal delayed as farmers stage Brussels show of force

-

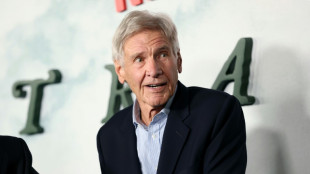

Harrison Ford to get lifetime acting award

Harrison Ford to get lifetime acting award

-

Trump health chief seeks to bar trans youth from gender-affirming care

-

Argentine unions in the street over Milei labor reforms

Argentine unions in the street over Milei labor reforms

-

Brazil open to EU-Mercosur deal delay as farmers protest in Brussels

-

Brussels farmer protest turns ugly as EU-Mercosur deal teeters

Brussels farmer protest turns ugly as EU-Mercosur deal teeters

-

US accuses S. Africa of harassing US officials working with Afrikaners

-

ECB holds rates as Lagarde stresses heightened uncertainty

ECB holds rates as Lagarde stresses heightened uncertainty

-

Trump Media announces merger with fusion power company

-

Stocks rise as US inflation cools, tech stocks bounce

Stocks rise as US inflation cools, tech stocks bounce

-

Zelensky presses EU to tap Russian assets at crunch summit

-

Danish 'ghetto' residents upbeat after EU court ruling

Danish 'ghetto' residents upbeat after EU court ruling

-

ECB holds rates but debate swirls over future

-

Bank of England cuts interest rate after UK inflation slides

Bank of England cuts interest rate after UK inflation slides

-

Have Iran's authorities given up on the mandatory hijab?

-

British energy giant BP extends shakeup with new CEO pick

British energy giant BP extends shakeup with new CEO pick

-

EU kicks off crunch summit on Russian asset plan for Ukraine

-

Sri Lanka plans $1.6 bn in cyclone recovery spending in 2026

Sri Lanka plans $1.6 bn in cyclone recovery spending in 2026

-

Most Asian markets track Wall St lower as AI fears mount

-

Danish 'ghetto' tenants hope for EU discrimination win

Danish 'ghetto' tenants hope for EU discrimination win

-

What to know about the EU-Mercosur deal

-

Trump vows economic boom, blames Biden in address to nation

Trump vows economic boom, blames Biden in address to nation

-

ECB set to hold rates but debate swirls over future

-

EU holds crunch summit on Russian asset plan for Ukraine

EU holds crunch summit on Russian asset plan for Ukraine

-

Nasdaq tumbles on renewed angst over AI building boom

-

Billionaire Trump nominee confirmed to lead NASA amid Moon race

Billionaire Trump nominee confirmed to lead NASA amid Moon race

-

CNN's future unclear as Trump applies pressure

-

German MPs approve 50 bn euros in military purchases

German MPs approve 50 bn euros in military purchases

-

EU's Mercosur trade deal hits French, Italian roadblock

-

Warner Bros rejects Paramount bid, sticks with Netflix

Warner Bros rejects Paramount bid, sticks with Netflix

-

Crude prices surge after Trump orders Venezuela oil blockade

-

Warner Bros. Discovery rejects Paramount bid

Warner Bros. Discovery rejects Paramount bid

-

Doctors in England go on strike for 14th time

-

Ghana's Highlife finds its rhythm on UNESCO world stage

Ghana's Highlife finds its rhythm on UNESCO world stage

-

Stocks gain as traders bet on interest rate moves

-

France probes 'foreign interference' after malware found on ferry

France probes 'foreign interference' after malware found on ferry

-

Europe's Ariane 6 rocket puts EU navigation satellites in orbit

-

Bleak end to the year as German business morale drops

Bleak end to the year as German business morale drops

-

Hundreds queue at Louvre museum as strike vote delays opening

HSBC bank says to stop funding new oil and gas fields

Banking giant HSBC on Wednesday said it would end financing for new oil and gas fields, a decision welcomed by environmentalists who nevertheless urged greater action from banks and government.

In an annual update of its climate transition plans, the London-headquartered bank said it "will no longer provide new lending or capital markets finance for the specific purpose of projects pertaining to new oil and gas fields and related infrastructure".

HSBC added in a statement that it was "committed to supporting and financing the transition to a secure net zero future".

Responding, Greenpeace UK's senior climate campaigner Charlie Kronick called the announcement "long overdue".

He added in a statement: "Banks have been funding climate chaos to the tune of billions of pounds. Now one of the UK's biggest banks has realised that there's no place for new oil and gas in a world that is trying to tackle the climate crisis."

Kronick called the announcement "an embarrassment for the UK government", which is "pressing on with new oil and gas licences" as it looks to beef up energy security following the invasion of Ukraine by major fossil fuel producer Russia.

HSBC meanwhile said it would continue to provide finance and advisory services to energy sector clients at the corporate level, as long as their plans were in line with the bank's targets to cut emissions.

- 'Strong signal' -

"HSBC's announcement sends a strong signal to fossil fuel giants and governments that banks' appetite for financing new oil and gas fields is diminishing," said Jeanne Martin, head of banking programme at ShareAction.

"It sets a new minimum level of ambition for all banks committed to net zero. We urge major banks like Barclays and BNP Paribas to follow suit."

Martin meanwhile stressed that "HSBC's announcement only applies to asset financing, and doesn't deal with the much larger proportion of finance it still provides to companies that have oil and gas expansion plans".

Citing the International Energy Agency, the bank said "an orderly transition requires continued financing and investment in existing oil and gas fields to maintain the necessary output".

HSBC "will therefore continue to provide finance to maintain supplies of oil and gas in line with current and future declining global oil and gas demand".

The bank on Wednesday added it would "accelerate" activities in renewable energy and clean infrastructure following a previous announcement to provide between $750 billion and $1 trillion in sustainable finance and investment by 2030.

A year ago, the lender published a plan to stop financing thermal coal activities.

St.Ch.Baker--CPN