-

Kenya's economy faces climate change risks: World Bank

Kenya's economy faces climate change risks: World Bank

-

Why bitcoin is losing its luster after stratospheric rise

-

Stocks rebound though tech stocks still suffer

Stocks rebound though tech stocks still suffer

-

Digital euro delay could leave Europe vulnerable, ECB warns

-

German exports to US plunge as tariffs exact heavy cost

German exports to US plunge as tariffs exact heavy cost

-

Stellantis takes massive hit for 'overestimation' of EV shift

-

'Mona's Eyes': how an obscure French art historian swept the globe

'Mona's Eyes': how an obscure French art historian swept the globe

-

In Dakar fishing village, surfing entices girls back to school

-

Russian pensioners turn to soup kitchen as war economy stutters

Russian pensioners turn to soup kitchen as war economy stutters

-

As Estonia schools phase out Russian, many families struggle

-

Toyota names new CEO, hikes profit forecasts

Toyota names new CEO, hikes profit forecasts

-

Bangladesh Islamist leader seeks power in post-uprising vote

-

Japan to restart world's biggest nuclear plant

Japan to restart world's biggest nuclear plant

-

UK royal finances in spotlight after Andrew's downfall

-

Undercover probe finds Australian pubs short-pouring beer

Undercover probe finds Australian pubs short-pouring beer

-

New Zealand deputy PM defends claims colonisation good for Maori

-

Amazon shares plunge as AI costs climb

Amazon shares plunge as AI costs climb

-

Deadly storm sparks floods in Spain, raises calls to postpone Portugal vote

-

Carney scraps Canada EV sales mandate, affirms auto sector's future is electric

Carney scraps Canada EV sales mandate, affirms auto sector's future is electric

-

Lower pollution during Covid boosted methane: study

-

Carney scraps Canada EV sales mandate

Carney scraps Canada EV sales mandate

-

Record January window for transfers despite drop in spending

-

Mining giant Rio Tinto abandons Glencore merger bid

Mining giant Rio Tinto abandons Glencore merger bid

-

Davos forum opens probe into CEO Brende's Epstein links

-

ECB warns of stronger euro impact, holds rates

ECB warns of stronger euro impact, holds rates

-

Greece aims to cut queues at ancient sites with new portal

-

ECB holds interest rates as strong euro causes jitters

ECB holds interest rates as strong euro causes jitters

-

What does Iran want from talks with the US?

-

Wind turbine maker Vestas sees record revenue in 2025

Wind turbine maker Vestas sees record revenue in 2025

-

Bitcoin under $70,000 for first time since Trump's election

-

Germany claws back 59 mn euros from Amazon over price controls

Germany claws back 59 mn euros from Amazon over price controls

-

Germany claws back 70 mn euros from Amazon over price controls

-

Stock markets drop amid tech concerns before rate calls

Stock markets drop amid tech concerns before rate calls

-

BBVA posts record profit after failed Sabadell takeover

-

UN human rights agency in 'survival mode': chief

UN human rights agency in 'survival mode': chief

-

Greenpeace slams fossel fuel sponsors for Winter Olympics

-

Russia says thwarted smuggling of giant meteorite to UK

Russia says thwarted smuggling of giant meteorite to UK

-

Heathrow still Europe's busiest airport, but Istanbul gaining fast

-

Shell profits climb despite falling oil prices

Shell profits climb despite falling oil prices

-

German factory orders rise at fastest rate in 2 years in December

-

Trump fuels EU push to cut cord with US tech

Trump fuels EU push to cut cord with US tech

-

Top US news anchor pleads with kidnappers for mom's life

-

The coming end of ISS, symbol of an era of global cooperation

The coming end of ISS, symbol of an era of global cooperation

-

New crew set to launch for ISS after medical evacuation

-

Stocks in retreat as traders reconsider tech investment

Stocks in retreat as traders reconsider tech investment

-

Fiji football legend returns home to captain first pro club

-

Barry Manilow cancels Las Vegas shows but 'doing great' post-surgery

Barry Manilow cancels Las Vegas shows but 'doing great' post-surgery

-

Rising euro, falling inflation in focus at ECB meeting

-

AI to track icebergs adrift at sea in boon for science

AI to track icebergs adrift at sea in boon for science

-

Google's annual revenue tops $400 bn for first time, AI investments rise

| RYCEF | 0.3% | 16.67 | $ | |

| BCC | 1.23% | 90.27 | $ | |

| VOD | 3.02% | 15.075 | $ | |

| RBGPF | 0.12% | 82.5 | $ | |

| RIO | 2.32% | 93.28 | $ | |

| SCS | 0.12% | 16.14 | $ | |

| RELX | -1.98% | 29.505 | $ | |

| NGG | 0.99% | 87.755 | $ | |

| GSK | 0.74% | 59.61 | $ | |

| CMSC | -0.19% | 23.505 | $ | |

| AZN | 1.22% | 189.48 | $ | |

| CMSD | -0.04% | 23.88 | $ | |

| JRI | 0.81% | 12.985 | $ | |

| BTI | 1.27% | 62.755 | $ | |

| BCE | -0.08% | 25.55 | $ | |

| BP | 2.27% | 39.055 | $ |

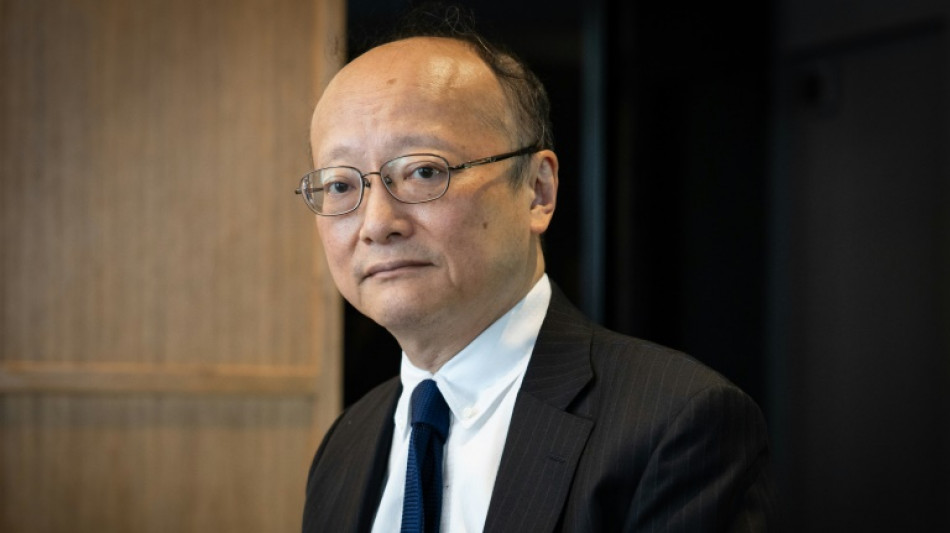

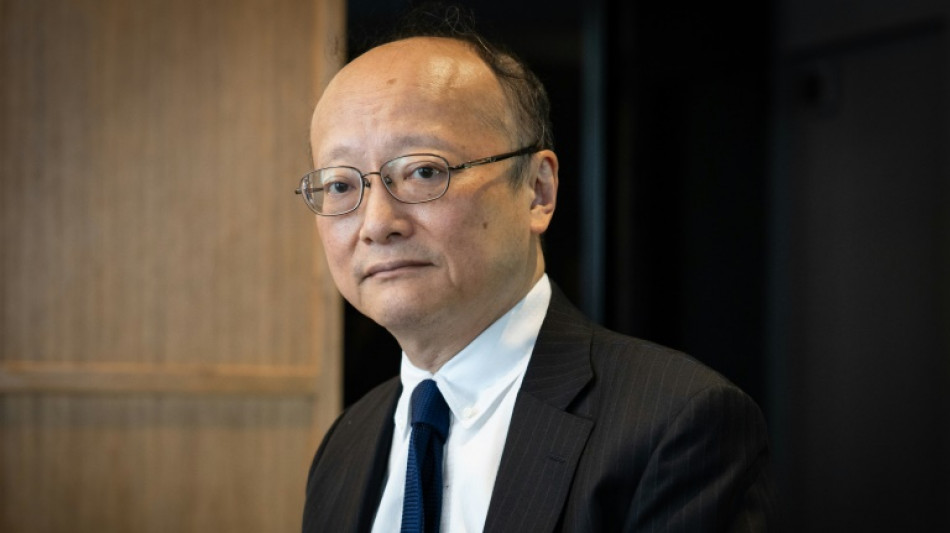

ADB acting on US concerns over China, bank chief tells AFP

The Asian Development Bank was trying "very hard" to accommodate US concerns over lending to China, the bank's president told AFP, including by slashing loans to the world's second-largest economy.

Global development institutions are in Spain this week for a UN summit on financial aid for the world's poorest overshadowed by Washington's gutting of poverty and climate change programs.

The United States is a major donor to multilateral banks like the ABD, but Washington's future commitment to development lenders has been in doubt since the election of President Donald Trump.

In April, US Treasury Secretary Scott Bessent urged ADB President Masato Kanda "to take concrete steps" to end loans to rival China.

Kanda said lending to Beijing was "radically decreasing" and had already halved from $2 billion in 2020 to $1 billion in 2024.

"We are already on... a declining trajectory," the Japanese head of the Manila-based lender told AFP in an interview in Paris on Friday.

"Probably -- I can't promise -- but probably this declining trajectory will be continued, and someday may be zero," he added, stressing that such a decision would ultimately be decided by the bank's shareholders and board of directors.

Kanda said US demands that ADB curtail financing for China were hardly new and probably "one of the very few agendas across the aisle in the US Congress".

"Even under the Biden administration, it was the same request," Kanda said, referring to the last administration under President Joe Biden.

The United States and Japan are the largest shareholders of ADB, which helps bankroll projects in the Asia-Pacific region that lift living standards and promote economic growth.

China, India and Australia are also significant members.

- 'Universal' challenge -

Kanda said ADB's efforts to raise lending without asking more of taxpayers in donor countries "was very much appreciated by the United States and others".

"I try very hard to accommodate the issues of the United States," he said.

Kanda is among thousands this week attending the International Conference on Financing for Development in Seville, the biggest event in a decade on the crisis-hit aid sector.

The United States in snubbing the UN-sponsored conference, underlining the erosion of global cooperation on combating hunger, disease and climate change.

Trump's cuts have come under particular scrutiny but Germany, Britain and France have also slashed foreign aid while boosting spending in areas such as defence.

With budgets in doubt, multilateral development banks have come under particular pressure to step up financing for projects that tackle global warming and prepare poorer countries for climate disaster.

Last year, rich countries committed $300 billion annually by 2035 for climate finance in the developing world -- well short of the $1.3 trillion that experts say is needed.

Last year, the ADB committed to channelling half its annual lending to climate-related projects by 2030 and Kanda said it was likely this would grow in time.

The bank was navigating a level of global uncertainty not seen in many decades but it was critical to consider the most vulnerable on the rocky road ahead, he added.

"This is not just a short-term phenomenon of one country, but it is rather universal," he said.

"This is a really difficult situation. And as long as we don't improve the root cause of this situation -- for instance, a more fair society -- it will not be so easy."

O.Ignatyev--CPN