-

Kenya's economy faces climate change risks: World Bank

Kenya's economy faces climate change risks: World Bank

-

Crypto firm accidentally sends $40 bn in bitcoin to users

-

Dow surges above 50,000 for first time as US stocks regain mojo

Dow surges above 50,000 for first time as US stocks regain mojo

-

Danone expands recall of infant formula batches in Europe

-

EU nations back chemical recycling for plastic bottles

EU nations back chemical recycling for plastic bottles

-

Why bitcoin is losing its luster after stratospheric rise

-

Stocks rebound though tech stocks still suffer

Stocks rebound though tech stocks still suffer

-

Digital euro delay could leave Europe vulnerable, ECB warns

-

German exports to US plunge as tariffs exact heavy cost

German exports to US plunge as tariffs exact heavy cost

-

Stellantis takes massive hit for 'overestimation' of EV shift

-

'Mona's Eyes': how an obscure French art historian swept the globe

'Mona's Eyes': how an obscure French art historian swept the globe

-

In Dakar fishing village, surfing entices girls back to school

-

Russian pensioners turn to soup kitchen as war economy stutters

Russian pensioners turn to soup kitchen as war economy stutters

-

As Estonia schools phase out Russian, many families struggle

-

Toyota names new CEO, hikes profit forecasts

Toyota names new CEO, hikes profit forecasts

-

Bangladesh Islamist leader seeks power in post-uprising vote

-

Japan to restart world's biggest nuclear plant

Japan to restart world's biggest nuclear plant

-

UK royal finances in spotlight after Andrew's downfall

-

Undercover probe finds Australian pubs short-pouring beer

Undercover probe finds Australian pubs short-pouring beer

-

New Zealand deputy PM defends claims colonisation good for Maori

-

Amazon shares plunge as AI costs climb

Amazon shares plunge as AI costs climb

-

Deadly storm sparks floods in Spain, raises calls to postpone Portugal vote

-

Carney scraps Canada EV sales mandate, affirms auto sector's future is electric

Carney scraps Canada EV sales mandate, affirms auto sector's future is electric

-

Lower pollution during Covid boosted methane: study

-

Carney scraps Canada EV sales mandate

Carney scraps Canada EV sales mandate

-

Record January window for transfers despite drop in spending

-

Mining giant Rio Tinto abandons Glencore merger bid

Mining giant Rio Tinto abandons Glencore merger bid

-

Davos forum opens probe into CEO Brende's Epstein links

-

ECB warns of stronger euro impact, holds rates

ECB warns of stronger euro impact, holds rates

-

Greece aims to cut queues at ancient sites with new portal

-

ECB holds interest rates as strong euro causes jitters

ECB holds interest rates as strong euro causes jitters

-

What does Iran want from talks with the US?

-

Wind turbine maker Vestas sees record revenue in 2025

Wind turbine maker Vestas sees record revenue in 2025

-

Bitcoin under $70,000 for first time since Trump's election

-

Germany claws back 59 mn euros from Amazon over price controls

Germany claws back 59 mn euros from Amazon over price controls

-

Germany claws back 70 mn euros from Amazon over price controls

-

Stock markets drop amid tech concerns before rate calls

Stock markets drop amid tech concerns before rate calls

-

BBVA posts record profit after failed Sabadell takeover

-

UN human rights agency in 'survival mode': chief

UN human rights agency in 'survival mode': chief

-

Greenpeace slams fossel fuel sponsors for Winter Olympics

-

Russia says thwarted smuggling of giant meteorite to UK

Russia says thwarted smuggling of giant meteorite to UK

-

Heathrow still Europe's busiest airport, but Istanbul gaining fast

-

Shell profits climb despite falling oil prices

Shell profits climb despite falling oil prices

-

German factory orders rise at fastest rate in 2 years in December

-

Trump fuels EU push to cut cord with US tech

Trump fuels EU push to cut cord with US tech

-

Top US news anchor pleads with kidnappers for mom's life

-

The coming end of ISS, symbol of an era of global cooperation

The coming end of ISS, symbol of an era of global cooperation

-

New crew set to launch for ISS after medical evacuation

-

Stocks in retreat as traders reconsider tech investment

Stocks in retreat as traders reconsider tech investment

-

Fiji football legend returns home to captain first pro club

Oil surges, stocks fall on Middle East fears as Israel strikes Iran

Oil prices soared and stocks sank Friday after Israel launched "preemptive" strikes on Iran's nuclear and military sites and warned of more to come, stoking fears of a full-blown war.

Investors ran for the hills on news of the attacks and a warning that retaliatory action from Tehran was possible, after US President Donald Trump said a "massive conflict" in the region was possible.

While Tel Aviv said it had struck military and nuclear targets Iran said residential buildings had been hit.

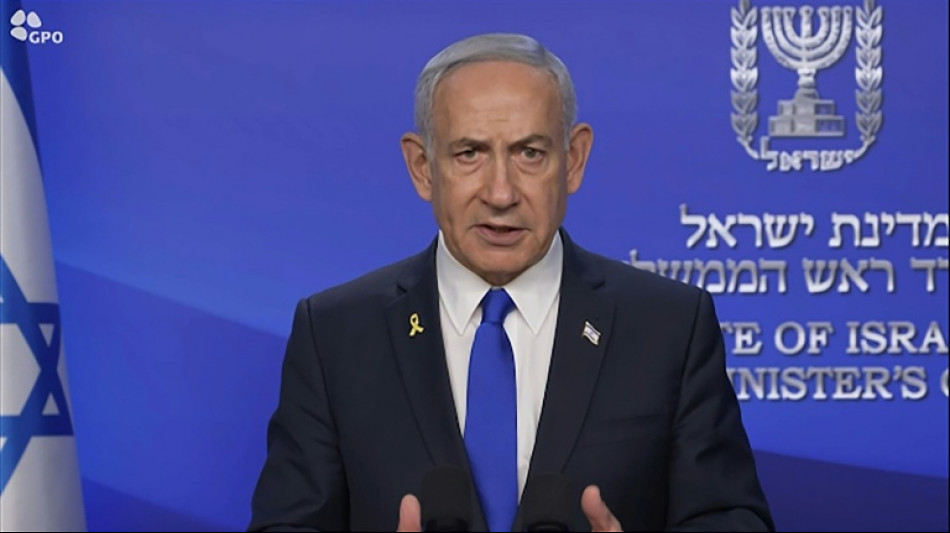

Israeli Prime Minister Benjamin Netanyahu said in a video statement: "This operation will continue for as many days as it takes to remove this threat.

"We struck at the heart of Iran's nuclear enrichment programme. We targeted Iran's main enrichment facility at Natanz. We also struck at the heart of Iran's ballistic missile programme," he added.

Iranian nuclear scientists "working on the Iranian bomb" had also been hit, he said.

Israeli Defence Minister Israel Katz cautioned that "a missile and drone attack against the State of Israel and its civilian population is expected in the immediate future".

Trump had previously warned that an attack could be on the cards, telling reporters at the White House: "I don't want to say imminent, but it looks like it's something that could very well happen."

The US leader said he believed a "pretty good" deal on Iran's nuclear programme was "fairly close", but that an Israeli strike on the country could wreck the chances of an agreement.

A US official said there had been no US involvement in the operation.

Still there are worries the United States could be sucked into the crisis after Iran threatened this week to target US military bases in the region if a regional conflict broke out.

Both main oil contracts, which had rallied earlier in the week on rising tensions, spiked more than eight percent amid fears about supplies of the commodity.

The rush from risk assets to safe havens saw equity markets across Asia tumble and bonds rally with gold. US and European equity futures were deep in the red.

"The Middle East powder keg just blew the lid off global markets," said Stephen Innes at SPI Asset Management.

"Equity futures are plummeting. Bond yields are sinking. Gold and oil are skyrocketing," he added.

"Brent crude futures are racing toward the mid-$70s range -- but if the Strait of Hormuz, which accounts for 20 percent of global oil flows, finds itself in the blast radius, you can add another $15 to the bid.

"If Iran holds back, we get a relief bounce. But if missiles start raining down on Tel Aviv or Tehran retaliates with real teeth, we're staring down a scenario that could redefine the macro narrative for the rest of 2025."

Banking giant JPMorgan Chase had warned just this week that prices could top $130 if the worst-case scenario developed.

Market sentiment had already been low after Trump sounded his trade war klaxon again by saying he would be sending letters within the next two weeks to other countries' governments to announce unilateral levies on their exports to the United States.

The "take it or leave it" deal spurred fears he would reimpose the eye-watering tolls announced on April 2 that tanked markets before he announced a 90-day pause.

- Key figures at around 0200 GMT -

West Texas Intermediate: UP 8.6 percent at $73.86 per barrel

Brent North Sea Crude: UP 8.2 percent $75.03 per barrel

Tokyo - Nikkei 225: DOWN 1.5 percent at 37,606.72

Hong Kong - Hang Seng Index: DOWN 0.3 percent at 23,959.81

Shanghai - Composite: DOWN 0.2 percent at 3,39748

Dollar/yen: DOWN at 143.18 yen from 143.56 yen on Thursday

Euro/dollar: DOWN at $1.1543 from $1.1583

Pound/dollar: DOWN at $1.3557 from $1.3605

Euro/pound: UP at 85.12 pence from 85.11 pence

New York - Dow: UP 0.2 percent at 42,967.62 (close)

London - FTSE 100: UP 0.2 percent at 8,884.92 (close)

D.Avraham--CPN