-

Kenya's economy faces climate change risks: World Bank

Kenya's economy faces climate change risks: World Bank

-

Crypto firm accidentally sends $40 bn in bitcoin to users

-

Dow surges above 50,000 for first time as US stocks regain mojo

Dow surges above 50,000 for first time as US stocks regain mojo

-

Danone expands recall of infant formula batches in Europe

-

EU nations back chemical recycling for plastic bottles

EU nations back chemical recycling for plastic bottles

-

Why bitcoin is losing its luster after stratospheric rise

-

Stocks rebound though tech stocks still suffer

Stocks rebound though tech stocks still suffer

-

Digital euro delay could leave Europe vulnerable, ECB warns

-

German exports to US plunge as tariffs exact heavy cost

German exports to US plunge as tariffs exact heavy cost

-

Stellantis takes massive hit for 'overestimation' of EV shift

-

'Mona's Eyes': how an obscure French art historian swept the globe

'Mona's Eyes': how an obscure French art historian swept the globe

-

In Dakar fishing village, surfing entices girls back to school

-

Russian pensioners turn to soup kitchen as war economy stutters

Russian pensioners turn to soup kitchen as war economy stutters

-

As Estonia schools phase out Russian, many families struggle

-

Toyota names new CEO, hikes profit forecasts

Toyota names new CEO, hikes profit forecasts

-

Bangladesh Islamist leader seeks power in post-uprising vote

-

Japan to restart world's biggest nuclear plant

Japan to restart world's biggest nuclear plant

-

UK royal finances in spotlight after Andrew's downfall

-

Undercover probe finds Australian pubs short-pouring beer

Undercover probe finds Australian pubs short-pouring beer

-

New Zealand deputy PM defends claims colonisation good for Maori

-

Amazon shares plunge as AI costs climb

Amazon shares plunge as AI costs climb

-

Deadly storm sparks floods in Spain, raises calls to postpone Portugal vote

-

Carney scraps Canada EV sales mandate, affirms auto sector's future is electric

Carney scraps Canada EV sales mandate, affirms auto sector's future is electric

-

Lower pollution during Covid boosted methane: study

-

Carney scraps Canada EV sales mandate

Carney scraps Canada EV sales mandate

-

Record January window for transfers despite drop in spending

-

Mining giant Rio Tinto abandons Glencore merger bid

Mining giant Rio Tinto abandons Glencore merger bid

-

Davos forum opens probe into CEO Brende's Epstein links

-

ECB warns of stronger euro impact, holds rates

ECB warns of stronger euro impact, holds rates

-

Greece aims to cut queues at ancient sites with new portal

-

ECB holds interest rates as strong euro causes jitters

ECB holds interest rates as strong euro causes jitters

-

What does Iran want from talks with the US?

-

Wind turbine maker Vestas sees record revenue in 2025

Wind turbine maker Vestas sees record revenue in 2025

-

Bitcoin under $70,000 for first time since Trump's election

-

Germany claws back 59 mn euros from Amazon over price controls

Germany claws back 59 mn euros from Amazon over price controls

-

Germany claws back 70 mn euros from Amazon over price controls

-

Stock markets drop amid tech concerns before rate calls

Stock markets drop amid tech concerns before rate calls

-

BBVA posts record profit after failed Sabadell takeover

-

UN human rights agency in 'survival mode': chief

UN human rights agency in 'survival mode': chief

-

Greenpeace slams fossel fuel sponsors for Winter Olympics

-

Russia says thwarted smuggling of giant meteorite to UK

Russia says thwarted smuggling of giant meteorite to UK

-

Heathrow still Europe's busiest airport, but Istanbul gaining fast

-

Shell profits climb despite falling oil prices

Shell profits climb despite falling oil prices

-

German factory orders rise at fastest rate in 2 years in December

-

Trump fuels EU push to cut cord with US tech

Trump fuels EU push to cut cord with US tech

-

Top US news anchor pleads with kidnappers for mom's life

-

The coming end of ISS, symbol of an era of global cooperation

The coming end of ISS, symbol of an era of global cooperation

-

New crew set to launch for ISS after medical evacuation

-

Stocks in retreat as traders reconsider tech investment

Stocks in retreat as traders reconsider tech investment

-

Fiji football legend returns home to captain first pro club

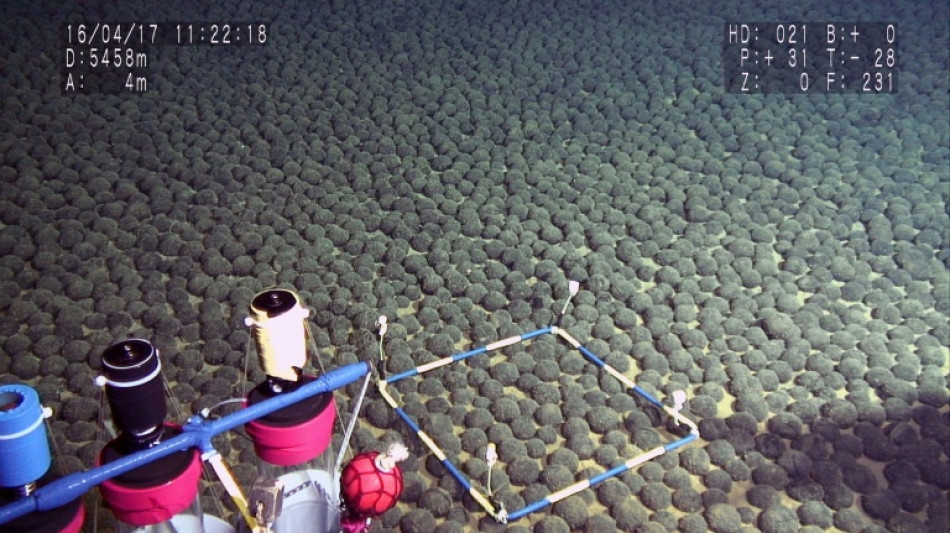

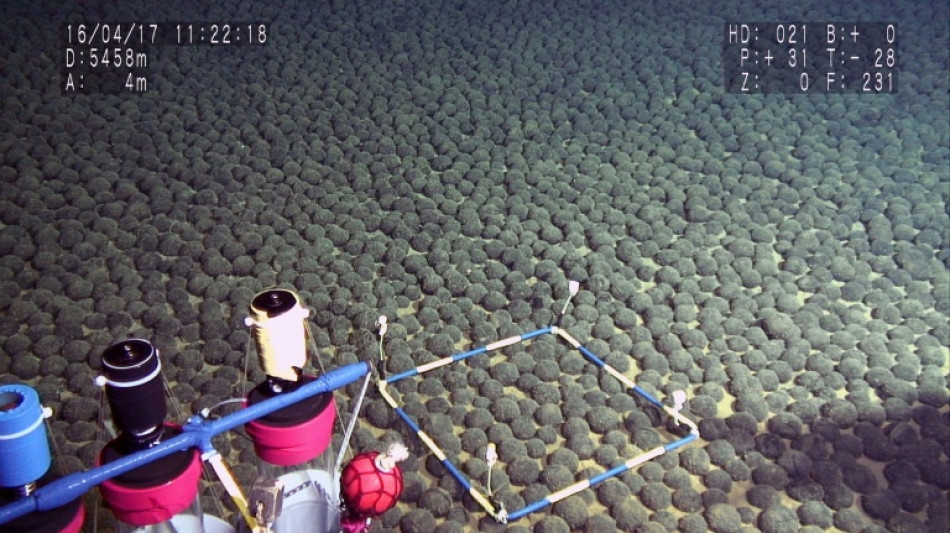

China carefully assembling a deep-sea mining strategy

In a world hungry for crucial resources, China may not be poised to start deep-sea mining but it is planting seeds for such operations in a meticulously planned economic and geopolitical strategy.

The world's oceans, both international waters and those under national jurisdiction, are rich in minerals and metals, like cobalt, nickel and copper.

These are important for building electric car batteries, for instance, and other technologies as countries try to transition away from fossil fuels.

China "is an energy-thirsty country. It will look for resources everywhere," including the deep sea, said Julia Xue of Shanghai Jiao Tong University.

But she said China is not particularly anxious over the issue, although recent developments -- one company is itching to be the first to start mining the sea bed -- may put more pressure on Beijing.

A Canadian firm, The Metals Company, has filed an application with the United States to begin undersea mining in international waters.

Using its American subsidiary, it acted after President Donald Trump, bypassing international negotiations, signed an executive order in April to speed up the permit-issuing process for such mining in US and international waters.

Trump cited an obscure 1980 US law that says American citizens can explore for and recover deep sea minerals in areas beyond the country's jurisdiction.

Environmental groups are outraged by Trump's order, arguing that a wild hunt for the potato-sized, metal-containing nodules could harm fragile undersea ecosystems.

The Canadian company initially said it would submit its request to the International Seabed Authority (ISA), a body which has jurisdiction over the ocean floor in international waters.

The Metals Company says it ignored this authority because of its slow pace in talks on adopting a mining code that establishes rules for exploiting seabed resources. The United States is not an ISA member.

A long-time observer of those talks who spoke on condition of anonymity said China is not particularly worried about who starts mining first.

"For them it's more about dominance, staying competitive in the game, and giving the impression that you can't mess with us," the observer said.

With that goal in mind "they're definitely developing the technology and putting the strategic agreements in place," Alex Gilbert, a researcher at the Payne Institute for Public Policy at Colorado School of Mines, told AFP.

For instance, China has reached an agreement with the Cook Islands to explore for minerals in that Pacific country's waters.

Another tiny Pacific nation, Kiribati, also says it is exploring a deep-sea mining partnership with China.

This approach is "more geopolitical than economic," said Emmanuel Hache of the French Institute for International and Strategic Affairs, noting Beijing is using undersea mining as a lure to cement greater diplomatic support as it exerts power.

China holds five contracts handed out by the ISA to look for resources in the Pacific and Indian Ocean sea beds and these contracts cover all types of undersea mineral resources. China's is the largest number of the 22 contracts the organization has granted.

- Years behind -

"From a research perspective, we have been continuously getting closer. And from a technical perspective, we have been continuously improving," said Chen Xuguang, a researcher at Ocean University of China.

In 2024 a Chinese prototype deep-sea mining vehicle called Pioneer II, developed by Shanghai Jiao Tong University, set a national record by operating at a depth of more than 4,000 meters (13,100 feet).

State-owned Beijing Pioneer Hi-Tech Development Corporation told AFP that later this year it plans a seabed nodule collection test.

Still, China is not as advanced technologically as The Metals Company, experts say.

"I would characterize China as being two to four years behind them in terms of their technology," said Gilbert in Colorado.

Hache, the French expert, put the gap at five years.

But China has an advantage over firms like the Canadian one in recovering and processing nodules: its companies are supported by the state and China has infrastructure for processing metals.

The observer of the international seabed talks said China does not need seabed mining for metal supply, "but maybe geopolitically, in the context of maintaining their control over the commodities market."

China wants to keep its options open, this person said.

And while it supports an international mining code, China does not need one now and "they're not going to put pressure until they've decided strategically that they're ready," said Gilbert.

H.Cho--CPN