-

Kenya's economy faces climate change risks: World Bank

Kenya's economy faces climate change risks: World Bank

-

EU weakens 2035 combustion-engine ban to boost car industry

-

Arctic sees unprecedented heat as climate impacts cascade

Arctic sees unprecedented heat as climate impacts cascade

-

VW stops production at German site for first time

-

Rome's new Colosseum station reveals ancient treasures

Rome's new Colosseum station reveals ancient treasures

-

EU eases 2035 combustion-engine ban to boost car industry

-

US unemployment rises further, hovering at highest since 2021

US unemployment rises further, hovering at highest since 2021

-

Shift in battle to tackle teens trapped in Marseille drug 'slavery'

-

Stocks retreat on US jobs, oil drops on Ukraine hopes

Stocks retreat on US jobs, oil drops on Ukraine hopes

-

Stocks retreat ahead of US jobs, oil drops on Ukraine hopes

-

EU set to drop 2035 combustion-engine ban to boost car industry

EU set to drop 2035 combustion-engine ban to boost car industry

-

Elusive December sun leaves Stockholm in the dark

-

Thousands of glaciers to melt each year by mid-century: study

Thousands of glaciers to melt each year by mid-century: study

-

China to impose anti-dumping duties on EU pork for five years

-

Nepal starts tiger census to track recovery

Nepal starts tiger census to track recovery

-

Economic losses from natural disasters down by a third in 2025: Swiss Re

-

Kenyan girls still afflicted by genital mutilation years after ban

Kenyan girls still afflicted by genital mutilation years after ban

-

Men's ATP tennis to apply extreme heat rule from 2026

-

Bank of Japan expected to hike rates to 30-year high

Bank of Japan expected to hike rates to 30-year high

-

EU to unveil plan to tackle housing crisis

-

EU set to scrap 2035 combustion-engine ban in car industry boost

EU set to scrap 2035 combustion-engine ban in car industry boost

-

Asian markets retreat ahead of US jobs as tech worries weigh

-

Famed Jerusalem stone still sells despite West Bank economic woes

Famed Jerusalem stone still sells despite West Bank economic woes

-

Will OpenAI be the next tech giant or next Netscape?

-

Eastman, AstraZeneca, Kraft Heinz, and P&G Recognized with OMP Supply Chain Awards

Eastman, AstraZeneca, Kraft Heinz, and P&G Recognized with OMP Supply Chain Awards

-

French minister urges angry farmers to trust cow culls, vaccines

-

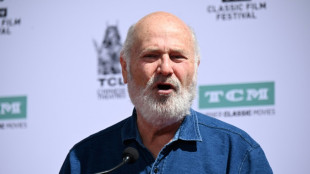

Rob Reiner's death: what we know

Rob Reiner's death: what we know

-

Stock market optimism returns after tech selloff but Wall Street wobbles

-

Nobel winner Machado suffered vertebra fracture leaving Venezuela

Nobel winner Machado suffered vertebra fracture leaving Venezuela

-

Stock market optimism returns after tech sell-off

-

'Angry' Louvre workers' strike shuts out thousands of tourists

'Angry' Louvre workers' strike shuts out thousands of tourists

-

Showdown looms as EU-Mercosur deal nears finish line

-

Eurovision 2026 will feature 35 countries: organisers

Eurovision 2026 will feature 35 countries: organisers

-

German shipyard, rescued by the state, gets mega deal

-

'We are angry': Louvre Museum closed as workers strike

'We are angry': Louvre Museum closed as workers strike

-

Stocks diverge ahead of central bank calls, US data

-

Louvre Museum closed as workers strike

Louvre Museum closed as workers strike

-

Australia defends record on antisemitism after Bondi Beach attack

-

EU-Mercosur trade deal faces bumpy ride to finish line

EU-Mercosur trade deal faces bumpy ride to finish line

-

Asian markets drop with Wall St as tech fears revive

-

France's Bardella slams 'hypocrisy' over return of brothels

France's Bardella slams 'hypocrisy' over return of brothels

-

Tokyo-bound United plane returns to Washington after engine fails

-

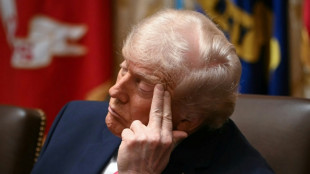

Deja vu? Trump accused of economic denial and physical decline

Deja vu? Trump accused of economic denial and physical decline

-

China's smaller manufacturers look to catch the automation wave

-

Hungary winemakers fear disease may 'wipe out' industry

Hungary winemakers fear disease may 'wipe out' industry

-

Campaigning starts in Central African Republic quadruple election

-

'Stop the slaughter': French farmers block roads over cow disease cull

'Stop the slaughter': French farmers block roads over cow disease cull

-

First urban cable car unveiled outside Paris

-

Why SpaceX IPO plan is generating so much buzz

Why SpaceX IPO plan is generating so much buzz

-

US unseals warrant for tanker seized off Venezuelan coast

| JRI | -0.3% | 13.52 | $ | |

| SCS | 0.12% | 16.14 | $ | |

| BTI | -0.74% | 57.315 | $ | |

| GSK | -1.2% | 48.655 | $ | |

| BCE | -0.55% | 23.48 | $ | |

| BP | -4.12% | 33.855 | $ | |

| NGG | -0.54% | 75.62 | $ | |

| BCC | 0.37% | 75.61 | $ | |

| RIO | 0.45% | 76.16 | $ | |

| RYCEF | -0.68% | 14.8 | $ | |

| CMSD | -0.19% | 23.321 | $ | |

| RBGPF | 4.1% | 81 | $ | |

| VOD | 0.06% | 12.708 | $ | |

| AZN | -1.08% | 90.58 | $ | |

| CMSC | 0.17% | 23.34 | $ | |

| RELX | -0.6% | 40.835 | $ |

Controversial carbon credits flood COP28, yet still no rules

The COP28 climate talks have been flooded with announcements hyping controversial carbon credits before rules for them have been hammered out, with environmental groups fearing "greenwashing" on a massive scale.

The concept behind the credits has taken a major hit recently as scientific research has repeatedly shown claims of reduced emissions under the schemes are often hugely overestimated -- or simply non-existent.

Carbon credits allow corporations -- or countries under certain conditions -- to offset their greenhouse gas emissions.

One credit equals the reduction or removal of one tonne of CO2 from the atmosphere, often in developing countries by projects focusing on things like fighting deforestation.

Scientists stress that any offsetting should not be used as a passport to continue polluting, with emissions needing to fall by almost half this decade to meet global warming goals.

US climate envoy John Kerry declared on Sunday that his country's Energy Transition Accelerator for developing nations -- one of a number being touted -- as a "bold new idea" .

However environmental groups quickly expressed scepticism, pointing to the past failures of similar schemes.

The initiative -- a partnership between the US government, the Rockefeller Foundation and billionaire Jeff Bezos's Earth Fund -- aims to shift developing countries from dirty to clean fuel.

Under the scheme, companies -- and potentially countries -- will be able to buy credits for carbon emissions from projects that do things like boost renewable energy, build electrical transmission lines or "retire" coal plants.

- 'Smoke and mirrors' -

Amazon, Bank of America, Mastercard, McDonald's, Morgan Stanley, PepsiCo and Walmart are some of the US corporate giants lining up to pilot projects in Chile, the Dominican Republic and Nigeria.

Kerry said the initiative could generate tens of billions of dollars, insisting the credits will be "high integrity" and "not the kind of carbon crediting that you read about in some headlines."

He was referring to a series of investigations in recent months that have raised doubts about the effectiveness and integrity of the vast majority of carbon credits already in circulation.

Erika Lennon, a lawyer for the Center for International Environmental Law, said the announcement was "merely smoke and mirrors distracting from the US's paltry contribution to climate finance".

Washington said it was working with the World Bank to ensure the quality of the credits.

Separately on Friday, the World Bank said it had plans to help 15 developing countries in Africa, Southeast Asia and Latin America to earn money from carbon credits by 2028 for forest protection.

Such projects have previously been shown to be the least reliable for reducing emissions, but the World Bank insisted its scheme would be of "high integrity".

AFP has also identified hundreds of events dedicated to carbon credits at COP28, many led by companies seeking a way to compensate -- at least on paper -- for their carbon footprint.

- Vagueness -

Many different players have rushed to set up their own carbon credit rules, slowing down negotiations for a common regulatory framework, according to environmental groups.

This absence of common rules has given companies free rein to engage in widely-criticised offsetting as part of a voluntary carbon credit market.

At COP28, negotiators have been tasked with looking into applying Article Six of the 2015 Paris Agreement.

It allows countries to cooperate on hitting their emissions-reduction targets -- including by swapping carbon credits.

It also envisages a reform of the global carbon credit market that has been dragging on for years.

The Climate Action Network, which brings together hundreds of environmental groups, was scathing about the lack of ambition.

"Just like last year, we feel the draft (agreement) is more likely to remove ambition from climate action than carbon dioxide from the atmosphere," it added.

The network also criticised the vagueness of planned rules for a future UN supervisory body overseeing a global carbon market, which it said could leave the "door too wide open for risky practices" and to protect the rights of the communities involved.

These contentious rules could still be pushed through by countries impatient to start offsetting their emissions, led by wealthy and oil-producing nations -- and possibly developing countries keen to reap vast sums from the market.

On Friday, around 10 countries including the United States, France and the UAE -- as well as Colombia, Kenya and Senegal -- called for carbon markets to be "complementary" to efforts to reduce emissions.

They said that there must be "transparency" and "high-integrity standards" for these markets to reach their potential.

P.Kolisnyk--CPN