-

Kenya's economy faces climate change risks: World Bank

Kenya's economy faces climate change risks: World Bank

-

US Afghans in limbo after Washington soldier attack

-

Nasdaq rallies again while yen falls despite BOJ rate hike

Nasdaq rallies again while yen falls despite BOJ rate hike

-

US university killer's mystery motive sought after suicide

-

IMF approves $206 mn aid to Sri Lanka after Cyclone Ditwah

IMF approves $206 mn aid to Sri Lanka after Cyclone Ditwah

-

Rome to charge visitors for access to Trevi Fountain

-

Stocks advance with focus on central banks, tech

Stocks advance with focus on central banks, tech

-

Norway crown princess likely to undergo lung transplant

-

France's budget hits snag in setback for embattled PM

France's budget hits snag in setback for embattled PM

-

Volatile Oracle shares a proxy for Wall Street's AI jitters

-

Japan hikes interest rates to 30-year-high

Japan hikes interest rates to 30-year-high

-

Brazil's top court strikes down law blocking Indigenous land claims

-

'We are ghosts': Britain's migrant night workers

'We are ghosts': Britain's migrant night workers

-

Asian markets rise as US inflation eases, Micron soothes tech fears

-

Trump signs $900 bn defense policy bill into law

Trump signs $900 bn defense policy bill into law

-

EU-Mercosur deal delayed as farmers stage Brussels show of force

-

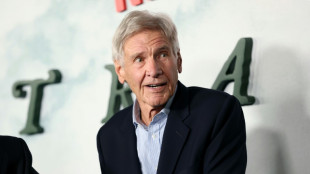

Harrison Ford to get lifetime acting award

Harrison Ford to get lifetime acting award

-

Trump health chief seeks to bar trans youth from gender-affirming care

-

Argentine unions in the street over Milei labor reforms

Argentine unions in the street over Milei labor reforms

-

Brazil open to EU-Mercosur deal delay as farmers protest in Brussels

-

Brussels farmer protest turns ugly as EU-Mercosur deal teeters

Brussels farmer protest turns ugly as EU-Mercosur deal teeters

-

US accuses S. Africa of harassing US officials working with Afrikaners

-

ECB holds rates as Lagarde stresses heightened uncertainty

ECB holds rates as Lagarde stresses heightened uncertainty

-

Trump Media announces merger with fusion power company

-

Stocks rise as US inflation cools, tech stocks bounce

Stocks rise as US inflation cools, tech stocks bounce

-

Zelensky presses EU to tap Russian assets at crunch summit

-

Danish 'ghetto' residents upbeat after EU court ruling

Danish 'ghetto' residents upbeat after EU court ruling

-

ECB holds rates but debate swirls over future

-

Bank of England cuts interest rate after UK inflation slides

Bank of England cuts interest rate after UK inflation slides

-

Have Iran's authorities given up on the mandatory hijab?

-

British energy giant BP extends shakeup with new CEO pick

British energy giant BP extends shakeup with new CEO pick

-

EU kicks off crunch summit on Russian asset plan for Ukraine

-

Sri Lanka plans $1.6 bn in cyclone recovery spending in 2026

Sri Lanka plans $1.6 bn in cyclone recovery spending in 2026

-

Most Asian markets track Wall St lower as AI fears mount

-

Danish 'ghetto' tenants hope for EU discrimination win

Danish 'ghetto' tenants hope for EU discrimination win

-

What to know about the EU-Mercosur deal

-

Trump vows economic boom, blames Biden in address to nation

Trump vows economic boom, blames Biden in address to nation

-

ECB set to hold rates but debate swirls over future

-

EU holds crunch summit on Russian asset plan for Ukraine

EU holds crunch summit on Russian asset plan for Ukraine

-

Nasdaq tumbles on renewed angst over AI building boom

-

Billionaire Trump nominee confirmed to lead NASA amid Moon race

Billionaire Trump nominee confirmed to lead NASA amid Moon race

-

CNN's future unclear as Trump applies pressure

-

German MPs approve 50 bn euros in military purchases

German MPs approve 50 bn euros in military purchases

-

EU's Mercosur trade deal hits French, Italian roadblock

-

Warner Bros rejects Paramount bid, sticks with Netflix

Warner Bros rejects Paramount bid, sticks with Netflix

-

Crude prices surge after Trump orders Venezuela oil blockade

-

Warner Bros. Discovery rejects Paramount bid

Warner Bros. Discovery rejects Paramount bid

-

Doctors in England go on strike for 14th time

-

Ghana's Highlife finds its rhythm on UNESCO world stage

Ghana's Highlife finds its rhythm on UNESCO world stage

-

Stocks gain as traders bet on interest rate moves

AI startups swap independence for Big Tech's deep pockets

It's the case of the vanishing startup: some of Silicon Valley's most promising names in the fast-developing generative AI space are being gobbled up by or tied to the hip of US tech giants.

Short on funds, in the past few months promising companies like Inflection AI or Adept have seen founders and key executives quietly exit the stage to join the world's dominant tech companies through discrete transactions.

Critics believe these deals are acquisitions in all but name and have been especially designed by Microsoft or Amazon to avoid the attention of competition regulators, which the companies strenuously deny.

Meanwhile, firms like Character AI are reported to be struggling to raise the cash needed to remain independent, and some, like French startup Mistral, are thought to be especially vulnerable to being bought out by a tech giant.

Even ChatGPT's creator OpenAI is locked in a relationship with Microsoft, the world’s biggest company by market capitalization.

Microsoft helps guarantee OpenAI's future with $13 billion in investment in return for exclusive access to the startup's industry-leading models.

Amazon has its own deal with Anthropic, which makes its own high-performing models.

- 'Big money' -

Joining the revolution brought by the era-defining release of ChatGPT requires a supply of cash that only tech behemoths like Microsoft, Amazon or Google can afford.

"The ones with the big money define the rules and design the outcomes that play in their favor," said Sriram Sundararajan, a tech investor and adjunct faculty member at the Leavey School of Business at Santa Clara University.

Breaking from typical Silicon Valley legend, generative AI won't be developed out of some founder's garage.

That type of artificial intelligence, which creates human-like content in just seconds, is a special breed of technology that requires colossal levels of computing from specialized servers.

"Startups have been founded by former research leaders at big tech companies, and they require the resources that only large cloud providers can make available," said Brendan Burke, AI analyst at Pitchbook, which tracks the venture capital world.

"They're not following the traditional entrepreneurial journey of doing more with less, they're really looking to recreate the conditions that they experienced working in a highly funded research lab."

Many of these founders, including those at Inflection or Adept, came from Google or OpenAI.

Mustafa Suleyman, the former boss of Inflection, was a leader at Google DeepMind -- and has now left his startup, with key employees in tow, to head up the consumer AI division at Microsoft.

Inflection still exists on paper but has been stripped of the very assets that gave it value.

Lining up with the big tech companies "makes a lot of sense," said Abdullah Snobar, executive director at DMZ, a startup incubator in Toronto. Their deep pockets help keep "the wheels greased and things moving forward."

- 'Sucking up all the juice' -

But aligning with established tech behemoths also risks "killing competition," potentially creating a situation where "these three big tech companies (are) sucking up all the juice" of creativity and innovation, he added.

The burning question in Silicon Valley is whether government regulators will do anything about it.

Big tech companies are increasingly in the spotlight for their appetite to eat up smaller firms.

Israeli cybersecurity company Wiz this week scrapped plans to sell to Google in what would have been the giant's biggest deal ever -- reportedly because the buyout would not have survived competition regulators.

For Inflection, antitrust regulators in the United States, European Union and Britain said they would look closely at its ties with Microsoft. Amazon's deal with Adept has raised questions with the Federal Trade Commission in Washington.

John Lopatka, professor of law at Penn State University, said "antitrust enforcers would have a difficult time blocking the arrangements" with Inflection and Adept.

However, that "does not mean they won't try."

US, European and UK regulators on Tuesday signed a joint statement insisting that they won't let big tech companies run roughshod over the nascent AI industry.

It's a sign that "regulation is catching up to AI," warned Sundararajan.

P.Gonzales--CPN