-

Kenya's economy faces climate change risks: World Bank

Kenya's economy faces climate change risks: World Bank

-

US Afghans in limbo after Washington soldier attack

-

Nasdaq rallies again while yen falls despite BOJ rate hike

Nasdaq rallies again while yen falls despite BOJ rate hike

-

US university killer's mystery motive sought after suicide

-

IMF approves $206 mn aid to Sri Lanka after Cyclone Ditwah

IMF approves $206 mn aid to Sri Lanka after Cyclone Ditwah

-

Rome to charge visitors for access to Trevi Fountain

-

Stocks advance with focus on central banks, tech

Stocks advance with focus on central banks, tech

-

Norway crown princess likely to undergo lung transplant

-

France's budget hits snag in setback for embattled PM

France's budget hits snag in setback for embattled PM

-

Volatile Oracle shares a proxy for Wall Street's AI jitters

-

Japan hikes interest rates to 30-year-high

Japan hikes interest rates to 30-year-high

-

Brazil's top court strikes down law blocking Indigenous land claims

-

'We are ghosts': Britain's migrant night workers

'We are ghosts': Britain's migrant night workers

-

Asian markets rise as US inflation eases, Micron soothes tech fears

-

Trump signs $900 bn defense policy bill into law

Trump signs $900 bn defense policy bill into law

-

EU-Mercosur deal delayed as farmers stage Brussels show of force

-

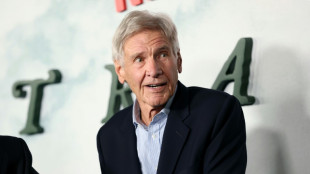

Harrison Ford to get lifetime acting award

Harrison Ford to get lifetime acting award

-

Trump health chief seeks to bar trans youth from gender-affirming care

-

Argentine unions in the street over Milei labor reforms

Argentine unions in the street over Milei labor reforms

-

Brazil open to EU-Mercosur deal delay as farmers protest in Brussels

-

Brussels farmer protest turns ugly as EU-Mercosur deal teeters

Brussels farmer protest turns ugly as EU-Mercosur deal teeters

-

US accuses S. Africa of harassing US officials working with Afrikaners

-

ECB holds rates as Lagarde stresses heightened uncertainty

ECB holds rates as Lagarde stresses heightened uncertainty

-

Trump Media announces merger with fusion power company

-

Stocks rise as US inflation cools, tech stocks bounce

Stocks rise as US inflation cools, tech stocks bounce

-

Zelensky presses EU to tap Russian assets at crunch summit

-

Danish 'ghetto' residents upbeat after EU court ruling

Danish 'ghetto' residents upbeat after EU court ruling

-

ECB holds rates but debate swirls over future

-

Bank of England cuts interest rate after UK inflation slides

Bank of England cuts interest rate after UK inflation slides

-

Have Iran's authorities given up on the mandatory hijab?

-

British energy giant BP extends shakeup with new CEO pick

British energy giant BP extends shakeup with new CEO pick

-

EU kicks off crunch summit on Russian asset plan for Ukraine

-

Sri Lanka plans $1.6 bn in cyclone recovery spending in 2026

Sri Lanka plans $1.6 bn in cyclone recovery spending in 2026

-

Most Asian markets track Wall St lower as AI fears mount

-

Danish 'ghetto' tenants hope for EU discrimination win

Danish 'ghetto' tenants hope for EU discrimination win

-

What to know about the EU-Mercosur deal

-

Trump vows economic boom, blames Biden in address to nation

Trump vows economic boom, blames Biden in address to nation

-

ECB set to hold rates but debate swirls over future

-

EU holds crunch summit on Russian asset plan for Ukraine

EU holds crunch summit on Russian asset plan for Ukraine

-

Nasdaq tumbles on renewed angst over AI building boom

-

Billionaire Trump nominee confirmed to lead NASA amid Moon race

Billionaire Trump nominee confirmed to lead NASA amid Moon race

-

CNN's future unclear as Trump applies pressure

-

German MPs approve 50 bn euros in military purchases

German MPs approve 50 bn euros in military purchases

-

EU's Mercosur trade deal hits French, Italian roadblock

-

Warner Bros rejects Paramount bid, sticks with Netflix

Warner Bros rejects Paramount bid, sticks with Netflix

-

Crude prices surge after Trump orders Venezuela oil blockade

-

Warner Bros. Discovery rejects Paramount bid

Warner Bros. Discovery rejects Paramount bid

-

Doctors in England go on strike for 14th time

-

Ghana's Highlife finds its rhythm on UNESCO world stage

Ghana's Highlife finds its rhythm on UNESCO world stage

-

Stocks gain as traders bet on interest rate moves

Microsoft drops OpenAI board seat as scrunity increases

Microsoft has ditched plans to take up a non-voting position on the board of ChatGPT maker OpenAI, according to a letter seen by AFP on Wednesday, as regulators step up scrutiny of deals involving AI companies.

Microsoft's $13-billion tie-up with OpenAI has raised concerns on both sides of the Atlantic about just how much influence the tech giant has over its smaller partner.

Its early investment in OpenAI has made Microsoft a market leader in AI.

When ChatGPT hit the scene in November 2022, it marked the popular arrival of the AI revolution as the chatbot dazzled users with its ability to churn out eloquent text in seconds.

But regulators began examining the partnership after a failed boardroom coup last year against OpenAI CEO Sam Altman -- whom Microsoft supported and even briefly hired.

After the turmoil in OpenAI, Microsoft got a seat on the board as a non-voting observer that it is now giving up.

Microsoft's withdrawal is "effective immediately", according to a letter sent from the company to OpenAI on Tuesday.

"Over the past eight months we have witnessed significant progress by the newly formed board and are confident in the company's direction," the letter stated.

"We no longer believe our limited role as an observer is necessary."

The EU last month concluded after a preliminary examination that Microsoft's investment did not mean it had taken control of OpenAI.

Brussels is however now seeking more information from Microsoft about the agreement with OpenAI to understand whether "certain exclusivity clauses" could harm competition.

Microsoft is also under examination over its ties to OpenAI by British competition regulators, and faced a potential antitrust probe in the United States.

"It is hard not to conclude that Microsoft's decision has been heavily influenced by the ongoing competition/antitrust scrutiny," said Alex Haffner, a competition lawyer, at Fladgate law firm.

- More scrutiny -

Media reports said Apple had similarly given up the chance to sit on OpenAI's board, but the iPhone maker was not immediately available for comment.

Apple had been due to get a seat after partnering with OpenAI for a suite of new AI features on its popular devices -- rolling out soon in markets outside the EU.

The bloc's competition chief, Margrethe Vestager, has put big tech on alert over investments in the fast-growing AI market and insisted that the EU continues to keep an eye over the sector.

With regulators focused on "the complex web of inter-relationships that big tech has created with AI providers", lawyer Haffner said there was a "need for Microsoft and others to carefully consider how they structure these arrangements going forward".

Another phenomenon in the AI market in the EU's crosshairs is so-called "acqui-hires" -- when a company acquires another firm mainly to grab its key talent -- with Brussels racing to understand if it distorts competition.

Microsoft earlier this year announced a deal to hire senior figures from OpenAI rival Inflection, including its boss, to head up a newly created consumer AI unit.

But unlike a merger, Inflection still operates as an independent company and such a move by Microsoft means it avoids a traditional merger probe.

Regulators have the right to block mergers if there are fears of damage to competition.

L.Peeters--CPN