-

Kenya's economy faces climate change risks: World Bank

Kenya's economy faces climate change risks: World Bank

-

Jury told that Meta, Google 'engineered addiction' at landmark US trial

-

Three missing employees of Canadian miner found dead in Mexico

Three missing employees of Canadian miner found dead in Mexico

-

Meta, Google face jury in landmark US addiction trial

-

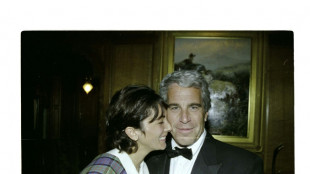

Epstein accomplice Maxwell seeks Trump clemency before testimony

Epstein accomplice Maxwell seeks Trump clemency before testimony

-

Some striking NY nurses reach deal with employers

-

Emergency measures kick in as Cuban fuel supplies dwindle under US pressure

Emergency measures kick in as Cuban fuel supplies dwindle under US pressure

-

EU chief backs Made-in-Europe push for 'strategic' sectors

-

AI chatbots give bad health advice, research finds

AI chatbots give bad health advice, research finds

-

Iran steps up arrests while remaining positive on US talks

-

Bank of France governor Francois Villeroy de Galhau to step down in June

Bank of France governor Francois Villeroy de Galhau to step down in June

-

EU warns Meta it must open up WhatsApp to rival AI chatbots

-

Japan restarts world's biggest nuclear plant again

Japan restarts world's biggest nuclear plant again

-

Japan's Takaichi may struggle to soothe voters and markets

-

'Want to go home': Indonesian crew abandoned off Africa demand wages

'Want to go home': Indonesian crew abandoned off Africa demand wages

-

Arguments to begin in key US social media addiction trial

-

Trump says China's Xi to visit US 'toward the end of the year'

Trump says China's Xi to visit US 'toward the end of the year'

-

'Send Help' repeats as N.America box office champ

-

US astronaut to take her 3-year-old's cuddly rabbit into space

US astronaut to take her 3-year-old's cuddly rabbit into space

-

UK foreign office to review pay-off to Epstein-linked US envoy

-

Storm-battered Portugal votes in presidential election run-off

Storm-battered Portugal votes in presidential election run-off

-

French police arrest five over crypto-linked magistrate kidnapping

-

De Beers sale drags in diamond doldrums

De Beers sale drags in diamond doldrums

-

What's at stake for Indian agriculture in Trump's trade deal?

-

Pakistan's capital picks concrete over trees, angering residents

Pakistan's capital picks concrete over trees, angering residents

-

Neglected killer: kala-azar disease surges in Kenya

-

Chile's climate summit chief to lead plastic pollution treaty talks

Chile's climate summit chief to lead plastic pollution treaty talks

-

Spain, Portugal face fresh storms, torrential rain

-

Opinions of Zuckerberg hang over social media addiction trial jury selection

Opinions of Zuckerberg hang over social media addiction trial jury selection

-

Crypto firm accidentally sends $40 bn in bitcoin to users

-

Dow surges above 50,000 for first time as US stocks regain mojo

Dow surges above 50,000 for first time as US stocks regain mojo

-

Danone expands recall of infant formula batches in Europe

-

EU nations back chemical recycling for plastic bottles

EU nations back chemical recycling for plastic bottles

-

Why bitcoin is losing its luster after stratospheric rise

-

Stocks rebound though tech stocks still suffer

Stocks rebound though tech stocks still suffer

-

Digital euro delay could leave Europe vulnerable, ECB warns

-

German exports to US plunge as tariffs exact heavy cost

German exports to US plunge as tariffs exact heavy cost

-

Stellantis takes massive hit for 'overestimation' of EV shift

-

'Mona's Eyes': how an obscure French art historian swept the globe

'Mona's Eyes': how an obscure French art historian swept the globe

-

In Dakar fishing village, surfing entices girls back to school

-

Russian pensioners turn to soup kitchen as war economy stutters

Russian pensioners turn to soup kitchen as war economy stutters

-

As Estonia schools phase out Russian, many families struggle

-

Toyota names new CEO, hikes profit forecasts

Toyota names new CEO, hikes profit forecasts

-

Bangladesh Islamist leader seeks power in post-uprising vote

-

Japan to restart world's biggest nuclear plant

Japan to restart world's biggest nuclear plant

-

UK royal finances in spotlight after Andrew's downfall

-

Undercover probe finds Australian pubs short-pouring beer

Undercover probe finds Australian pubs short-pouring beer

-

New Zealand deputy PM defends claims colonisation good for Maori

-

Amazon shares plunge as AI costs climb

Amazon shares plunge as AI costs climb

-

Deadly storm sparks floods in Spain, raises calls to postpone Portugal vote

Dollar plunges, stocks wobble over trade war turmoil

Investors dumped US government bonds, the dollar tumbled and stocks seesawed Friday, capping a volatile week as President Donald Trump's unpredictable tariff policy rattled market confidence.

Trump triggered a massive market sell-off last week by announcing universal tariffs, and this week he sparked a huge but short-lived rally by pausing higher duties against scores of countries.

But he kept China in his crosshairs, hitting Chinese goods with a 145 percent tariff.

Beijing said Friday that it would hit back with 125 percent duties on American products, but suggested it would not retaliate further in the future.

Wall Street indexes opened in the red Friday but rose shortly thereafter as investors sought to make sense of the latest trade war news, with the broad-based S&P 500 edging up 0.3 percent around midday.

European markets also had a roller-coaster trading day, with Frankfurt closing 0.9 percent lower and Paris down 0.3 percent. London rose 0.6 as data showed the UK economy grew far more than expected in February.

"The main driver of the renewed market pressure was an increased focus on the US-China escalation," said Jim Reid, managing director at Deutsche Bank.

"Neither the US nor China are showing signs of backing down, with President Trump expressing confidence in his tariff plans," Reid said.

The dollar plunged to its lowest level against the euro in more than three years as investors fled what is typically considered a key haven currency, though it later pared some of its losses.

In a more worrying sign of cracking investor confidence in the US economy, the yield on the 10-year US Treasury bill rose sharply to 4.5 percent as its price tumbled.

John Higgins, chief markets economist at Capital Economics, said it was a sign of "concern that China might dump its vast holdings of Treasuries" even if that risked losses for Beijing and driving the yuan higher against the dollar.

With Treasuries being sold off, sending their yields higher and making US debt more expensive, there is a fear of a bigger exodus from American assets down the line.

JPMorgan Chase CEO Jamie Dimon on Friday rejected the notion that US Treasuries were no longer a haven.

"If you're going to invest your money in something, America is still a pretty, pretty good place in this turbulent world," Dimon said in a conference call after his bank reported hefty first-quarter profits and revenue.

- Gold record -

The weaker dollar and the rush for safety sent gold to a record high above $3,220 an ounce.

Oil prices rose slightly after huge falls on Thursday.

"There remains considerable uncertainty around the impact of tariffs on economies and company earnings, and that could keep markets volatile for some time," said Russ Mould, investment director at AJ Bell.

Investors were also turning to more routine economic and business data, with the release of inflation data and corporate earnings.

Official figures showed US producer inflation fell sharply last month before the tariffs took effect.

JPMorgan Chase reported first-quarter profits of $14.6 billion, up nine percent from the period last year.

In Asia, the Tokyo stock market shed three percent -- a day after surging more than nine percent -- while Sydney and Seoul were also in the red.

Hong Kong and Shanghai rose as traders focused on possible Chinese stimulus measures.

There were gains in Taipei and Ho Chi Minh City stocks as the leaders of Taiwan and Vietnam said they would hold talks with Trump.

- Key figures around 1600 GMT -

New York - Dow: UP 0.2 percent at 39,665.48 points

New York - S&P 500: UP 0.3 percent at 5,284.24

New York - Nasdaq: UP 0.5 percent at 16,465.20

London - FTSE 100: UP 0.6 percent at 7,964.18 (close)

Paris - CAC 40: DOWN 0.3 percent at 7,104.80 (close)

Frankfurt - DAX: DOWN 0.9 percent at 20,374.10 (close)

Tokyo - Nikkei 225: DOWN 3.0 percent at 33,585.58 (close)

Hong Kong - Hang Seng Index: UP 1.1 percent at 20,914.69 (close)

Shanghai - Composite: UP 0.5 percent at 3,238.23 (close)

Euro/dollar: UP at $1.1349 from $1.1183 on Thursday

Pound/dollar: UP at $1.3041 from $1.2954

Dollar/yen: DOWN at 143.63 yen from 144.79 yen

Euro/pound: UP at 86.94 pence from 86.33 pence

Brent North Sea Crude: UP 0.7 percent at $63.75 per barrel

West Texas Intermediate: UP 0.7 percent at $60.48 per barrel

burs-lth/js

Y.Ponomarenko--CPN