-

Kenya's economy faces climate change risks: World Bank

Kenya's economy faces climate change risks: World Bank

-

As US battles China on AI, some companies choose Chinese

-

AI resurrections of dead celebrities amuse and rankle

AI resurrections of dead celebrities amuse and rankle

-

Third 'Avatar' film soars to top in N. American box office debut

-

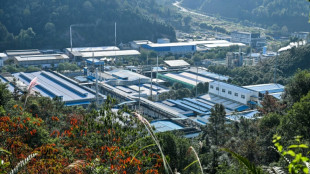

China's rare earths El Dorado gives strategic edge

China's rare earths El Dorado gives strategic edge

-

Wheelchair user flies into space, a first

-

French culture boss accused of mass drinks spiking to humiliate women

French culture boss accused of mass drinks spiking to humiliate women

-

US Afghans in limbo after Washington soldier attack

-

Nasdaq rallies again while yen falls despite BOJ rate hike

Nasdaq rallies again while yen falls despite BOJ rate hike

-

US university killer's mystery motive sought after suicide

-

IMF approves $206 mn aid to Sri Lanka after Cyclone Ditwah

IMF approves $206 mn aid to Sri Lanka after Cyclone Ditwah

-

Rome to charge visitors for access to Trevi Fountain

-

Stocks advance with focus on central banks, tech

Stocks advance with focus on central banks, tech

-

Norway crown princess likely to undergo lung transplant

-

France's budget hits snag in setback for embattled PM

France's budget hits snag in setback for embattled PM

-

Volatile Oracle shares a proxy for Wall Street's AI jitters

-

Japan hikes interest rates to 30-year-high

Japan hikes interest rates to 30-year-high

-

Brazil's top court strikes down law blocking Indigenous land claims

-

'We are ghosts': Britain's migrant night workers

'We are ghosts': Britain's migrant night workers

-

Asian markets rise as US inflation eases, Micron soothes tech fears

-

Trump signs $900 bn defense policy bill into law

Trump signs $900 bn defense policy bill into law

-

EU-Mercosur deal delayed as farmers stage Brussels show of force

-

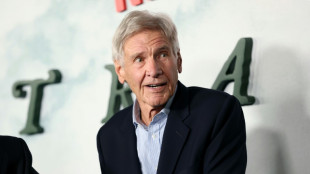

Harrison Ford to get lifetime acting award

Harrison Ford to get lifetime acting award

-

Trump health chief seeks to bar trans youth from gender-affirming care

-

Argentine unions in the street over Milei labor reforms

Argentine unions in the street over Milei labor reforms

-

Brazil open to EU-Mercosur deal delay as farmers protest in Brussels

-

Brussels farmer protest turns ugly as EU-Mercosur deal teeters

Brussels farmer protest turns ugly as EU-Mercosur deal teeters

-

US accuses S. Africa of harassing US officials working with Afrikaners

-

ECB holds rates as Lagarde stresses heightened uncertainty

ECB holds rates as Lagarde stresses heightened uncertainty

-

Trump Media announces merger with fusion power company

-

Stocks rise as US inflation cools, tech stocks bounce

Stocks rise as US inflation cools, tech stocks bounce

-

Zelensky presses EU to tap Russian assets at crunch summit

-

Danish 'ghetto' residents upbeat after EU court ruling

Danish 'ghetto' residents upbeat after EU court ruling

-

ECB holds rates but debate swirls over future

-

Bank of England cuts interest rate after UK inflation slides

Bank of England cuts interest rate after UK inflation slides

-

Have Iran's authorities given up on the mandatory hijab?

-

British energy giant BP extends shakeup with new CEO pick

British energy giant BP extends shakeup with new CEO pick

-

EU kicks off crunch summit on Russian asset plan for Ukraine

-

Sri Lanka plans $1.6 bn in cyclone recovery spending in 2026

Sri Lanka plans $1.6 bn in cyclone recovery spending in 2026

-

Most Asian markets track Wall St lower as AI fears mount

-

Danish 'ghetto' tenants hope for EU discrimination win

Danish 'ghetto' tenants hope for EU discrimination win

-

What to know about the EU-Mercosur deal

-

Trump vows economic boom, blames Biden in address to nation

Trump vows economic boom, blames Biden in address to nation

-

ECB set to hold rates but debate swirls over future

-

EU holds crunch summit on Russian asset plan for Ukraine

EU holds crunch summit on Russian asset plan for Ukraine

-

Nasdaq tumbles on renewed angst over AI building boom

-

Billionaire Trump nominee confirmed to lead NASA amid Moon race

Billionaire Trump nominee confirmed to lead NASA amid Moon race

-

CNN's future unclear as Trump applies pressure

-

German MPs approve 50 bn euros in military purchases

German MPs approve 50 bn euros in military purchases

-

EU's Mercosur trade deal hits French, Italian roadblock

Austrian property tycoon's troubles rattle investors

The Austrian property group that co-owns New York's iconic Chrysler building has warned of an imminent "restructuring" that has cast a spotlight on several precarious projects -- and the wealthy tycoon behind the company.

Rene Benko, one of Austria's richest people, with a net worth of $6 billion according to Forbes, has grown his Signa group into a real estate giant since founding it in 2000.

But as the sector is hit by higher borrowing costs and surging material prices, a growing number of developers are filing for bankruptcy.

Several Signa projects, including the construction of a landmark high-rise in Germany, have ground to a halt, making investors jittery about their money.

Confirming its troubles, Signa announced last week that Benko was stepping down from its advisory board as the group prepares a "plan for essential restructuring steps" by the end of November.

"Signa symbolises the real estate boom of recent years, in which cheap money was readily distributed for every project, no matter how daring," the Austrian daily Die Presse wrote in an editorial this month.

"A perfect environment for Benko, who took out dizzying amounts of loans without shame. Sustainability didn't play a role," it said.

- 'Never so boring to get rich' -

Born in 1977 to a middle-class family in Innsbruck, Benko worked with a friend restoring attics as a teenager before dropping out of school and founding Signa.

Among its first purchases was a department store in Innsbruck, which Benko transformed into a modern shopping centre.

Since then, Benko has added the Chrysler building and the Berlin shopping gallery KaDeWe to the company's portfolio, while branching out into media and other sectors.

At one point, the company reportedly tried to attract investors with slogans like "It was never so boring to get rich".

"When you have success, you become interesting. And if you give the impression that you have remained a man of your words, you build trust and expand your circle of friends," Benko told Die Presse in 2008.

With offices in Austria, Germany, Italy, Luxembourg and Switzerland, Signa has holdings worth 27 billion euros ($29 billion) and projects worth 25 billion euros in development, according to its website.

But Signa looks to be in trouble.

Thailand's Central Group said this month that it had taken control of the historic British department store Selfridges, which Signa used to own.

And Signa-led work on the prestigious Elbtower in the heart of Hamburg -- expected to be one of Germany's tallest buildings -- was halted at the end of last month.

Karen Pein, the Hamburg senator in charge of urban development, has threatened to demolish the half-built tower if the group is not able to continue work on schedule.

The future of another Signa project, the renovation of the Alte Akademie in Munich, a former Jesuit college to be transformed into an office and residential complex, is also uncertain.

Fitch, the credit rating agency, has already downgraded the Signa Development subsidiary after it said it was "facing challenges including with respect to its liquidity position".

And the online e-commerce unit Signa Sports United has initiated insolvency proceedings for several of its entities and has decided to drop its stock listing on the New York Stock Exchange to reduce costs.

Signa did not respond to AFP requests for comment.

- Past controversies -

Signa's undertakings have drawn criticism in the past.

The leading German department store chain Galeria Karstadt Kaufhof, which Signa purchased in 2019, filed for bankruptcy in 2020 amid the coronavirus pandemic, and the chain decided to close 52 stores at the start of the year.

In 2020, Benko testified before an Austrian parliamentary committee probing wide-ranging corruption allegations after the so-called Ibizagate scandal shook the country's politics.

He was asked about his links to several high-ranking conservative and far-right political figures, though Benko has not been charged in connection with the case.

The scandal erupted in 2019 when a video showed Austria's former far-right leader offering public contracts to a woman posing as a Russian oligarch's niece in exchange for campaign help.

In a separate matter, Benko received in 2012 a 12-month suspended jail sentence over an Italian tax case, after a court found him guilty of bribing Croatia's former prime minister Ivo Sanader with 150,000 euros to intervene with the Italian tax authorities.

M.Anderson--CPN