-

Kenya's economy faces climate change risks: World Bank

Kenya's economy faces climate change risks: World Bank

-

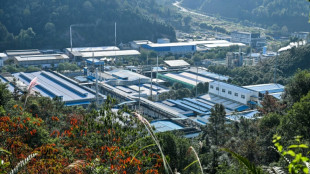

China's rare earths El Dorado gives strategic edge

-

Wheelchair user flies into space, a first

Wheelchair user flies into space, a first

-

French culture boss accused of mass drinks spiking to humiliate women

-

US Afghans in limbo after Washington soldier attack

US Afghans in limbo after Washington soldier attack

-

Nasdaq rallies again while yen falls despite BOJ rate hike

-

US university killer's mystery motive sought after suicide

US university killer's mystery motive sought after suicide

-

IMF approves $206 mn aid to Sri Lanka after Cyclone Ditwah

-

Rome to charge visitors for access to Trevi Fountain

Rome to charge visitors for access to Trevi Fountain

-

Stocks advance with focus on central banks, tech

-

Norway crown princess likely to undergo lung transplant

Norway crown princess likely to undergo lung transplant

-

France's budget hits snag in setback for embattled PM

-

Volatile Oracle shares a proxy for Wall Street's AI jitters

Volatile Oracle shares a proxy for Wall Street's AI jitters

-

Japan hikes interest rates to 30-year-high

-

Brazil's top court strikes down law blocking Indigenous land claims

Brazil's top court strikes down law blocking Indigenous land claims

-

'We are ghosts': Britain's migrant night workers

-

Asian markets rise as US inflation eases, Micron soothes tech fears

Asian markets rise as US inflation eases, Micron soothes tech fears

-

Trump signs $900 bn defense policy bill into law

-

EU-Mercosur deal delayed as farmers stage Brussels show of force

EU-Mercosur deal delayed as farmers stage Brussels show of force

-

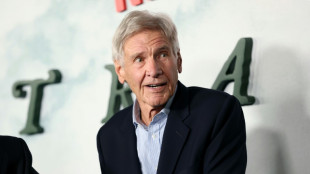

Harrison Ford to get lifetime acting award

-

Trump health chief seeks to bar trans youth from gender-affirming care

Trump health chief seeks to bar trans youth from gender-affirming care

-

Argentine unions in the street over Milei labor reforms

-

Brazil open to EU-Mercosur deal delay as farmers protest in Brussels

Brazil open to EU-Mercosur deal delay as farmers protest in Brussels

-

Brussels farmer protest turns ugly as EU-Mercosur deal teeters

-

US accuses S. Africa of harassing US officials working with Afrikaners

US accuses S. Africa of harassing US officials working with Afrikaners

-

ECB holds rates as Lagarde stresses heightened uncertainty

-

Trump Media announces merger with fusion power company

Trump Media announces merger with fusion power company

-

Stocks rise as US inflation cools, tech stocks bounce

-

Zelensky presses EU to tap Russian assets at crunch summit

Zelensky presses EU to tap Russian assets at crunch summit

-

Danish 'ghetto' residents upbeat after EU court ruling

-

ECB holds rates but debate swirls over future

ECB holds rates but debate swirls over future

-

Bank of England cuts interest rate after UK inflation slides

-

Have Iran's authorities given up on the mandatory hijab?

Have Iran's authorities given up on the mandatory hijab?

-

British energy giant BP extends shakeup with new CEO pick

-

EU kicks off crunch summit on Russian asset plan for Ukraine

EU kicks off crunch summit on Russian asset plan for Ukraine

-

Sri Lanka plans $1.6 bn in cyclone recovery spending in 2026

-

Most Asian markets track Wall St lower as AI fears mount

Most Asian markets track Wall St lower as AI fears mount

-

Danish 'ghetto' tenants hope for EU discrimination win

-

What to know about the EU-Mercosur deal

What to know about the EU-Mercosur deal

-

Trump vows economic boom, blames Biden in address to nation

-

ECB set to hold rates but debate swirls over future

ECB set to hold rates but debate swirls over future

-

EU holds crunch summit on Russian asset plan for Ukraine

-

Nasdaq tumbles on renewed angst over AI building boom

Nasdaq tumbles on renewed angst over AI building boom

-

Billionaire Trump nominee confirmed to lead NASA amid Moon race

-

CNN's future unclear as Trump applies pressure

CNN's future unclear as Trump applies pressure

-

German MPs approve 50 bn euros in military purchases

-

EU's Mercosur trade deal hits French, Italian roadblock

EU's Mercosur trade deal hits French, Italian roadblock

-

Warner Bros rejects Paramount bid, sticks with Netflix

-

Crude prices surge after Trump orders Venezuela oil blockade

Crude prices surge after Trump orders Venezuela oil blockade

-

Warner Bros. Discovery rejects Paramount bid

Meta shows strong growth as AI spending surges

Facebook owner Meta saw net income and revenues top expectations on Wednesday as the company said it would expand investments into artificial intelligence, drawing nervousness from investors.

The social media behemoth, which is also the parent company of Instagram and WhatsApp, said net profit in the third quarter was $15.7 billion -- up 35 percent on the same period last year.

Revenues rose 19 percent to $40.6 billion, slightly higher than analyst estimates.

But investors sent Meta shares lower in after hours trading over the outlook for AI spending in the months ahead and another big loss at its virtual and augmented reality arm, Reality Labs.

"Our AI investments continue to require serious infrastructure, and I expect to continue investing significantly there, too," Meta's founder and chief executive Mark Zuckerberg told analysts.

"We haven't decided on a final budget yet, but those are some of the directional trends," he added.

Meta's share price slipped nearly three percent after its earnings results were published.

Like its Big Tech peers, Meta is rushing into artificial intelligence as it tries to build revenue streams away from its social media core business.

In recent months Zuckerberg has put most of his attention and spending on the company's AI innovations that have been rolled out as chatbots across its platforms or used to upgrade its ad tech.

On Wednesday, Meta once again raised its capital investment outlook: for 2024 alone, it is forecasting a range of $38-40 billion, compared with $37-40 billion previously, much of it for AI.

- 'Rising costs' -

Investors "were a little disappointed by the rising costs" said Jasmine Enberg of Emarketer.

"It's going to take longer time to pay off" than some had hoped, she added.

In the first quarter this year, the spending had already caused concern among investors, despite a doubling of earnings.

But a quarter later, Meta's results impressed investors with a further surge in profits, showing that its core ad business could support the investments.

"Meta's solid revenue growth in the quarter will help stave off investor concern about its AI investments," said Debra Aho Williamson of Sonata Insights, who added that these investments were making it easier to post ads on the platforms.

However, she warned, that the full impact of consumer facing AI "won't be felt until 2025 or beyond."

Reactions were positive last month when the company unveiled its Orion augmented reality glasses, which remain experimental but bolstered confidence that Meta will be a leader in the AI wearable space.

Meta also hopes to ride on the excitement of its Ray-Ban Meta smart glasses, which it developed with EssilorLuxottica, the European eyewear giant.

Analysts believe that the glasses could be a hot item during the end-of-year holiday season.

But the recurring losses at Reality Labs, the VR division, continued to weigh on investors minds. The division posted $270 million in revenues in the third quarter -- and $4.4 billion in operating losses.

O.Ignatyev--CPN