-

Kenya's economy faces climate change risks: World Bank

Kenya's economy faces climate change risks: World Bank

-

US university killer's mystery motive sought after suicide

-

IMF approves $206 mn aid to Sri Lanka after Cyclone Ditwah

IMF approves $206 mn aid to Sri Lanka after Cyclone Ditwah

-

Rome to charge visitors for access to Trevi Fountain

-

Stocks advance with focus on central banks, tech

Stocks advance with focus on central banks, tech

-

Norway crown princess likely to undergo lung transplant

-

France's budget hits snag in setback for embattled PM

France's budget hits snag in setback for embattled PM

-

Volatile Oracle shares a proxy for Wall Street's AI jitters

-

Japan hikes interest rates to 30-year-high

Japan hikes interest rates to 30-year-high

-

Brazil's top court strikes down law blocking Indigenous land claims

-

'We are ghosts': Britain's migrant night workers

'We are ghosts': Britain's migrant night workers

-

Asian markets rise as US inflation eases, Micron soothes tech fears

-

Trump signs $900 bn defense policy bill into law

Trump signs $900 bn defense policy bill into law

-

EU-Mercosur deal delayed as farmers stage Brussels show of force

-

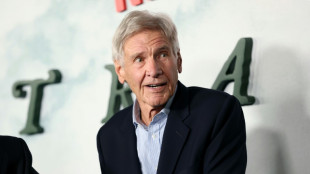

Harrison Ford to get lifetime acting award

Harrison Ford to get lifetime acting award

-

Trump health chief seeks to bar trans youth from gender-affirming care

-

Argentine unions in the street over Milei labor reforms

Argentine unions in the street over Milei labor reforms

-

Brazil open to EU-Mercosur deal delay as farmers protest in Brussels

-

Brussels farmer protest turns ugly as EU-Mercosur deal teeters

Brussels farmer protest turns ugly as EU-Mercosur deal teeters

-

US accuses S. Africa of harassing US officials working with Afrikaners

-

ECB holds rates as Lagarde stresses heightened uncertainty

ECB holds rates as Lagarde stresses heightened uncertainty

-

Trump Media announces merger with fusion power company

-

Stocks rise as US inflation cools, tech stocks bounce

Stocks rise as US inflation cools, tech stocks bounce

-

Zelensky presses EU to tap Russian assets at crunch summit

-

Danish 'ghetto' residents upbeat after EU court ruling

Danish 'ghetto' residents upbeat after EU court ruling

-

ECB holds rates but debate swirls over future

-

Bank of England cuts interest rate after UK inflation slides

Bank of England cuts interest rate after UK inflation slides

-

Have Iran's authorities given up on the mandatory hijab?

-

British energy giant BP extends shakeup with new CEO pick

British energy giant BP extends shakeup with new CEO pick

-

EU kicks off crunch summit on Russian asset plan for Ukraine

-

Sri Lanka plans $1.6 bn in cyclone recovery spending in 2026

Sri Lanka plans $1.6 bn in cyclone recovery spending in 2026

-

Most Asian markets track Wall St lower as AI fears mount

-

Danish 'ghetto' tenants hope for EU discrimination win

Danish 'ghetto' tenants hope for EU discrimination win

-

What to know about the EU-Mercosur deal

-

Trump vows economic boom, blames Biden in address to nation

Trump vows economic boom, blames Biden in address to nation

-

ECB set to hold rates but debate swirls over future

-

EU holds crunch summit on Russian asset plan for Ukraine

EU holds crunch summit on Russian asset plan for Ukraine

-

Nasdaq tumbles on renewed angst over AI building boom

-

Billionaire Trump nominee confirmed to lead NASA amid Moon race

Billionaire Trump nominee confirmed to lead NASA amid Moon race

-

CNN's future unclear as Trump applies pressure

-

German MPs approve 50 bn euros in military purchases

German MPs approve 50 bn euros in military purchases

-

EU's Mercosur trade deal hits French, Italian roadblock

-

Warner Bros rejects Paramount bid, sticks with Netflix

Warner Bros rejects Paramount bid, sticks with Netflix

-

Crude prices surge after Trump orders Venezuela oil blockade

-

Warner Bros. Discovery rejects Paramount bid

Warner Bros. Discovery rejects Paramount bid

-

Doctors in England go on strike for 14th time

-

Ghana's Highlife finds its rhythm on UNESCO world stage

Ghana's Highlife finds its rhythm on UNESCO world stage

-

Stocks gain as traders bet on interest rate moves

-

France probes 'foreign interference' after malware found on ferry

France probes 'foreign interference' after malware found on ferry

-

Europe's Ariane 6 rocket puts EU navigation satellites in orbit

| RBGPF | 0% | 80.22 | $ | |

| SCS | 0.12% | 16.14 | $ | |

| RYCEF | -0.98% | 15.25 | $ | |

| AZN | 1.22% | 91.73 | $ | |

| BTI | -0.17% | 56.945 | $ | |

| RIO | 1.08% | 78.48 | $ | |

| CMSD | -0.05% | 23.269 | $ | |

| CMSC | -0.22% | 23.24 | $ | |

| NGG | 0.35% | 76.655 | $ | |

| GSK | 1.07% | 48.81 | $ | |

| RELX | 0.55% | 40.875 | $ | |

| BCE | 0.24% | 22.905 | $ | |

| VOD | 0.64% | 12.883 | $ | |

| BP | 2.07% | 34.015 | $ | |

| BCC | -4.05% | 74.675 | $ | |

| JRI | 0.04% | 13.436 | $ |

Microsoft, Google earnings shine as AI drives revenue

Microsoft and Google on Thursday drubbed quarterly earnings expectations as the tech titans continued investing heavily in artificial intelligence promising to shake up the way people live.

The results were cheered by Wall Street investors who pushed up Alphabet's share price more than 11 percent and Microsoft shares up nearly 4 percent in after-market trades.

Google parent Alphabet reported profit of $23.7 billion on revenue of $80.5 billion, crediting growth in cloud computing, YouTube, and online search advertising.

Artificial intelligence helped drive the Silicon Valley tech giant's business, according to Alphabet and Google chief Sundar Pichai.

"We are well under way with our Gemini era and there's great momentum across the company," Pichai said, referring to the Gemini AI model that powers services across the Google platform.

"Our leadership in AI research and infrastructure, and our global product footprint, position us well for the next wave of AI innovation."

Some $9.5 billion was brought in by Google's cloud computing unit, compared with $7.5 billion in the same quarter a year earlier.

Google also reported its first-ever dividend of 20 cents per share.

"Things are looking good for Google," said Emarketer senior analyst Evelyn Mitchell-Wolf.

However, the future of Google's core search business is not assured, the analyst cautioned.

Google faces an antitrust case in the United States, and the incorporation of AI-generated content into the company's leading search engine "will arguably be the biggest change to the search advertising market since its inception," Mitchell-Wolf said.

The earnings come as Google, Microsoft, Amazon and other rivals competing in the hot field of AI face scrutiny from regulators in the US and Europe.

The US Federal Trade Commission early this year launched a study of AI investments and alliances as part of an effort to make sure regulatory oversight can keep up with developments in the sector and stop major players from shutting out competitors in a field promising upheaval in multiple areas of business.

Amazon -- through its Amazon Web Services arm -- Microsoft and Google are the world's biggest providers of cloud-based data centers, which store and process data on a vast scale, in addition to being some of the world's richest companies.

Microsoft CEO Satya Nadella said sales in the January to March period rose by 17 percent from a year earlier to $61.9 billion, with net profit up by 20 percent to $21.9 billion.

Microsoft has been hugely rewarded by investors since it aggressively pushed into rolling out generative AI, starting with its $13 billion partnership with OpenAI, the creator of ChatGPT, in 2023.

The embrace of AI has boosted sales of its key cloud services, such as Azure, which have become the core of Microsoft's business under Nadella’s leadership.

Cloud giants Amazon and Google are also looking to beef up cloud sales by rolling out AI features to clients and prove that the AI revolution is more than just hype.

In its push, Microsoft has moved beyond OpenAI and signed partnerships with other promising AI startups such as Mistral AI, as well as investing heavily internationally.

In March, Microsoft also announced that it hired DeepMind AI and Inflection AI co-founder Mustafa Suleyman to lead up its AI unit, poaching one of the industry’s key figures from a promising startup.

- Unleashed revolution -

The succession of moves has often taken archrival Google by surprise and seen Microsoft pip Apple as the world's biggest publicly traded company.

"Microsoft's earnings show the company is well-positioned to profit from the AI revolution it helped unleash," said Emarketer senior director of briefings Jeremy Goldman.

"While monetizing AI as effectively as Google remains a challenge, Microsoft has positioned itself in the realm of consideration for ad buys -- something that wasn't necessarily the case even a few years ago."

Meta's results on Wednesday however were a first sign of AI fatigue.

The Facebook parent said its quarterly profits soared last quarter but worries over its spending on artificial intelligence saw its share price take a hit.

A potential dark cloud for AI is government regulators that are taking a closer look at Microsoft's ties with OpenAI and others amid fears that the giant is using its huge financial war chest to thwart the emergence of rivals.

Britain's competition watchdog on Wednesday was the latest to begin examining tie-ups between artificial intelligence firms and their US big tech partners, including Microsoft.

L.K.Baumgartner--CPN