-

Kenya's economy faces climate change risks: World Bank

Kenya's economy faces climate change risks: World Bank

-

Australia defends record on antisemitism after Bondi Beach attack

-

EU-Mercosur trade deal faces bumpy ride to finish line

EU-Mercosur trade deal faces bumpy ride to finish line

-

Asian markets drop with Wall St as tech fears revive

-

France's Bardella slams 'hypocrisy' over return of brothels

France's Bardella slams 'hypocrisy' over return of brothels

-

Tokyo-bound United plane returns to Washington after engine fails

-

Deja vu? Trump accused of economic denial and physical decline

Deja vu? Trump accused of economic denial and physical decline

-

China's smaller manufacturers look to catch the automation wave

-

Hungary winemakers fear disease may 'wipe out' industry

Hungary winemakers fear disease may 'wipe out' industry

-

Campaigning starts in Central African Republic quadruple election

-

'Stop the slaughter': French farmers block roads over cow disease cull

'Stop the slaughter': French farmers block roads over cow disease cull

-

First urban cable car unveiled outside Paris

-

Why SpaceX IPO plan is generating so much buzz

Why SpaceX IPO plan is generating so much buzz

-

US unseals warrant for tanker seized off Venezuelan coast

-

World stocks mostly slide, consolidating Fed-fuelled gains

World stocks mostly slide, consolidating Fed-fuelled gains

-

Crypto firm Tether bids for Juventus, is quickly rebuffed

-

UK's king shares 'good news' that cancer treatment will be reduced in 2026

UK's king shares 'good news' that cancer treatment will be reduced in 2026

-

Can Venezuela survive US targeting its oil tankers?

-

Salah admired from afar in his Egypt home village as club tensions swirl

Salah admired from afar in his Egypt home village as club tensions swirl

-

World stocks retrench, consolidating Fed-fuelled gains

-

Iran frees child bride sentenced to death over husband's killing: activists

Iran frees child bride sentenced to death over husband's killing: activists

-

World stocks consolidate Fed-fuelled gains

-

France updates net-zero plan, with fossil fuel phaseout

France updates net-zero plan, with fossil fuel phaseout

-

Stocks rally in wake of Fed rate cut

-

EU agrees recycled plastic targets for cars

EU agrees recycled plastic targets for cars

-

British porn star to be deported from Bali after small fine

-

British porn star fined, faces imminent Bali deportation

British porn star fined, faces imminent Bali deportation

-

Spain opens doors to descendants of Franco-era exiles

-

Indonesia floods were 'extinction level' for rare orangutans

Indonesia floods were 'extinction level' for rare orangutans

-

Thai teacher finds 'peace amidst chaos' painting bunker murals

-

Japan bear victim's watch shows last movements

Japan bear victim's watch shows last movements

-

South Korea exam chief quits over complaints of too-hard tests

-

French indie 'Clair Obscur' dominates Game Awards

French indie 'Clair Obscur' dominates Game Awards

-

South Korea exam chief resigns after tests dubbed too hard

-

Asian markets track Wall St record after Fed cut

Asian markets track Wall St record after Fed cut

-

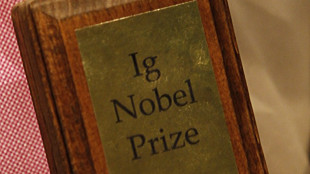

Laughing about science more important than ever: Ig Nobel founder

-

Vaccines do not cause autism: WHO

Vaccines do not cause autism: WHO

-

Crypto mogul Do Kwon sentenced to 15 years for fraud: US media

-

'In her prime': Rare blooming of palm trees in Rio

'In her prime': Rare blooming of palm trees in Rio

-

Make your own Mickey Mouse clip - Disney embraces AI

-

OpenAI beefs up GPT models in AI race with Google

OpenAI beefs up GPT models in AI race with Google

-

Dark, wet, choppy: Machado's secret sea escape from Venezuela

-

Cyclone causes blackout, flight chaos in Brazil's Sao Paulo

Cyclone causes blackout, flight chaos in Brazil's Sao Paulo

-

2024 Eurovision winner Nemo returns trophy over Israel's participation

-

US bringing seized tanker to port, as Venezuela war threats build

US bringing seized tanker to port, as Venezuela war threats build

-

Make your own AI Mickey Mouse - Disney embraces new tech

-

Time magazine names 'Architects of AI' as Person of the Year

Time magazine names 'Architects of AI' as Person of the Year

-

Floodworks on Athens 'oasis' a tough sell among locals

-

OpenAI, Disney to let fans create AI videos in landmark deal

OpenAI, Disney to let fans create AI videos in landmark deal

-

German growth forecasts slashed, Merz under pressure

Fed Must act 'strongly' to avoid repeat of 1980s inflation spike: Powell

The Federal Reserve must continue to act "strongly" to cool demand and contain price pressures to avoid a repeat of the inflation surge the US economy suffered in the 1970s and 1980s, Fed Chair Jerome Powell said Thursday.

With soaring prices in recent months pushing US annual inflation to the fastest in four decades, Powell's Fed has raised the benchmark lending rate four times this year, with a third massive, three-quarter point hike possible later this month.

His predecessor from that era, Paul Volcker, had to take extreme measures because high inflation had become entrenched, resurging and surpassing the peak of the mid-1970s after repeated failed efforts to tame the price increases.

"We need to act now forthrightly, strongly as we have been doing and we need to keep at it until the job is done to avoid ... the kind of very high social costs" of the Volcker era, Powell said.

The comments, which reaffirm his steadfast commitment to bring inflation back down, come as the European Central Bank announced its first ever increase of 75 basis points -- underscoring the pressure on policymakers worldwide to combat the global threat of rising prices.

American families have been struggling with the prices sparked initially by high demand but exacerbated by supply chain woes, Covid lockdowns in China and surging gasoline prices due to Russia's war in Ukraine.

Powell said inflation would not have spiked the way it did without the pandemic effects, which included a shortage of labor. The inflation rate this year hit 9.1 percent in June, before slowing to 8.5 percent in July. Data for August are due to be released next week.

The US jobs market remains tight, with nearly two openings for everyone looking for work, and Powell noted that even with new data last week showing more people joined the labor force last month, it remains well below the pre-pandemic level.

With many people remaining on the sidelines, that has driven up worker pay, which policymakers fear could fuel a dangerous wage-price spiral.

Though the Fed is hoping the world's largest economy will continue growing, Powell has acknowledged that the Fed's aggressive inflation-fighting campaign could cause some pain.

But he has stressed repeatedly that acting now will prevent more damaging consequences down the road.

"The clock is ticking," Powell warned.

US annual inflation spiked to a painful 12.3 percent in December 1974 before trending down, but then resurged. It peaked at 14.8 percent in early 1980 and didn't fall into single digits until late the following year amid Volcker's campaign.

Powell said "history cautions strongly against prematurely loosening policy," once again dousing hopes the central bank might cut interest rates next year as the economy slows.

J.Bondarev--CPN