-

Kenya's economy faces climate change risks: World Bank

Kenya's economy faces climate change risks: World Bank

-

Australia defends record on antisemitism after Bondi Beach attack

-

EU-Mercosur trade deal faces bumpy ride to finish line

EU-Mercosur trade deal faces bumpy ride to finish line

-

Asian markets drop with Wall St as tech fears revive

-

France's Bardella slams 'hypocrisy' over return of brothels

France's Bardella slams 'hypocrisy' over return of brothels

-

Tokyo-bound United plane returns to Washington after engine fails

-

Deja vu? Trump accused of economic denial and physical decline

Deja vu? Trump accused of economic denial and physical decline

-

China's smaller manufacturers look to catch the automation wave

-

Hungary winemakers fear disease may 'wipe out' industry

Hungary winemakers fear disease may 'wipe out' industry

-

Campaigning starts in Central African Republic quadruple election

-

'Stop the slaughter': French farmers block roads over cow disease cull

'Stop the slaughter': French farmers block roads over cow disease cull

-

First urban cable car unveiled outside Paris

-

Why SpaceX IPO plan is generating so much buzz

Why SpaceX IPO plan is generating so much buzz

-

US unseals warrant for tanker seized off Venezuelan coast

-

World stocks mostly slide, consolidating Fed-fuelled gains

World stocks mostly slide, consolidating Fed-fuelled gains

-

Crypto firm Tether bids for Juventus, is quickly rebuffed

-

UK's king shares 'good news' that cancer treatment will be reduced in 2026

UK's king shares 'good news' that cancer treatment will be reduced in 2026

-

Can Venezuela survive US targeting its oil tankers?

-

Salah admired from afar in his Egypt home village as club tensions swirl

Salah admired from afar in his Egypt home village as club tensions swirl

-

World stocks retrench, consolidating Fed-fuelled gains

-

Iran frees child bride sentenced to death over husband's killing: activists

Iran frees child bride sentenced to death over husband's killing: activists

-

World stocks consolidate Fed-fuelled gains

-

France updates net-zero plan, with fossil fuel phaseout

France updates net-zero plan, with fossil fuel phaseout

-

Stocks rally in wake of Fed rate cut

-

EU agrees recycled plastic targets for cars

EU agrees recycled plastic targets for cars

-

British porn star to be deported from Bali after small fine

-

British porn star fined, faces imminent Bali deportation

British porn star fined, faces imminent Bali deportation

-

Spain opens doors to descendants of Franco-era exiles

-

Indonesia floods were 'extinction level' for rare orangutans

Indonesia floods were 'extinction level' for rare orangutans

-

Thai teacher finds 'peace amidst chaos' painting bunker murals

-

Japan bear victim's watch shows last movements

Japan bear victim's watch shows last movements

-

South Korea exam chief quits over complaints of too-hard tests

-

French indie 'Clair Obscur' dominates Game Awards

French indie 'Clair Obscur' dominates Game Awards

-

South Korea exam chief resigns after tests dubbed too hard

-

Asian markets track Wall St record after Fed cut

Asian markets track Wall St record after Fed cut

-

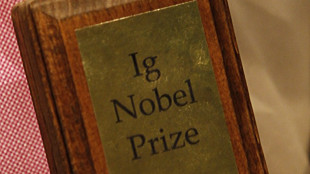

Laughing about science more important than ever: Ig Nobel founder

-

Vaccines do not cause autism: WHO

Vaccines do not cause autism: WHO

-

Crypto mogul Do Kwon sentenced to 15 years for fraud: US media

-

'In her prime': Rare blooming of palm trees in Rio

'In her prime': Rare blooming of palm trees in Rio

-

Make your own Mickey Mouse clip - Disney embraces AI

-

OpenAI beefs up GPT models in AI race with Google

OpenAI beefs up GPT models in AI race with Google

-

Dark, wet, choppy: Machado's secret sea escape from Venezuela

-

Cyclone causes blackout, flight chaos in Brazil's Sao Paulo

Cyclone causes blackout, flight chaos in Brazil's Sao Paulo

-

2024 Eurovision winner Nemo returns trophy over Israel's participation

-

US bringing seized tanker to port, as Venezuela war threats build

US bringing seized tanker to port, as Venezuela war threats build

-

Make your own AI Mickey Mouse - Disney embraces new tech

-

Time magazine names 'Architects of AI' as Person of the Year

Time magazine names 'Architects of AI' as Person of the Year

-

Floodworks on Athens 'oasis' a tough sell among locals

-

OpenAI, Disney to let fans create AI videos in landmark deal

OpenAI, Disney to let fans create AI videos in landmark deal

-

German growth forecasts slashed, Merz under pressure

European stocks diverge before major UK, ECB announcements

European stock markets traded mixed Thursday, ahead of major policy decisions from Britain and the European Central Bank aimed at tackling sky-high inflation.

The pound remained close to a 37-year low against the dollar that was struck Wednesday, as new British Prime Minister Liz Truss prepared to announce that she will freeze domestic fuel bills to help ease the burden of a UK cost-of-living crisis.

The euro steadied versus the greenback, with the ECB forecast to hike eurozone interest rates by a record-high 75 basis points.

Oil prices dropped further on fears of a global recession but losses were far less sharp than on Wednesday.

"There may be fresh storms brewing for the global economy but inflation is the tornado to tame and the drop in crude prices has lifted hopes in the US at least that the price spiral may be easier to control," noted Susannah Streeter, senior investment and markets analyst at Hargreaves Lansdown.

Fears abound that global central bank moves to rein in runaway inflation by ratcheting up borrowing costs will spark recessions in leading economies.

The dollar has moved ever higher against its major peers in recent weeks as investors flood into the currency hoping for better returns and as they seek a haven in the face of economic turmoil.

The US unit is closing in on a 32-year peak against the yen owing to the Bank of Japan's refusal to raise interest rates.

Observers expect the dollar to keep attracting strong interest as long as the Federal Reserve keeps ramping up US interest rates by sizeable amounts.

The Fed holds its next policy meeting on September 21, with a third successive 75-basis-point lift forecast.

"For years, central bank interest rate decisions used to be background noise, with investors confident that rates would stay low," Russ Mould, investment director at AJ Bell, said Thursday.

"This year they've become must-watch events, with every word studied by the market. The current theme is not whether central banks will raise rates, but by how much."

On the corporate front, shares in cyber security company Darktrace crashed around 30 percent after US private equity firm Thoma Bravo ended its takeover interest in the British group.

- Key figures at around 1000 GMT -

London - FTSE 100: UP 0.3 percent at 7,256.23 points

Frankfurt - DAX: DOWN 0.1 percent at 12,901.90

Paris - CAC 40: UP 0.4 percent at 6,130.18

EURO STOXX 50: DOWN 0.2 percent at 3,507.91

Tokyo - Nikkei 225: UP 2.3 percent at 28,065.28 (close)

Hong Kong - Hang Seng Index: DOWN 1.0 percent at 18,854.62 (close)

Shanghai - Composite: DOWN 0.3 percent at 3,235.59 (close)

New York - Dow: UP 1.4 percent at 31,581.28 (close)

Euro/dollar: DOWN at $0.9996 from $1.0012 on Wednesday

Pound/dollar: DOWN at $1.1486 from $1.1535

Euro/pound: UP at 87.01 pence from 86.74 pence

Dollar/yen: UP at 143.87 yen from 143.79 yen

West Texas Intermediate: DOWN 0.6 percent at $81.43 per barrel

Brent North Sea crude: DOWN 0.3 percent at $87.71 per barrel

burs-bcp/rfj/cdw

S.F.Lacroix--CPN