-

Kenya's economy faces climate change risks: World Bank

Kenya's economy faces climate change risks: World Bank

-

Australia defends record on antisemitism after Bondi Beach attack

-

EU-Mercosur trade deal faces bumpy ride to finish line

EU-Mercosur trade deal faces bumpy ride to finish line

-

Asian markets drop with Wall St as tech fears revive

-

France's Bardella slams 'hypocrisy' over return of brothels

France's Bardella slams 'hypocrisy' over return of brothels

-

Tokyo-bound United plane returns to Washington after engine fails

-

Deja vu? Trump accused of economic denial and physical decline

Deja vu? Trump accused of economic denial and physical decline

-

China's smaller manufacturers look to catch the automation wave

-

Hungary winemakers fear disease may 'wipe out' industry

Hungary winemakers fear disease may 'wipe out' industry

-

Campaigning starts in Central African Republic quadruple election

-

'Stop the slaughter': French farmers block roads over cow disease cull

'Stop the slaughter': French farmers block roads over cow disease cull

-

First urban cable car unveiled outside Paris

-

Why SpaceX IPO plan is generating so much buzz

Why SpaceX IPO plan is generating so much buzz

-

US unseals warrant for tanker seized off Venezuelan coast

-

World stocks mostly slide, consolidating Fed-fuelled gains

World stocks mostly slide, consolidating Fed-fuelled gains

-

Crypto firm Tether bids for Juventus, is quickly rebuffed

-

UK's king shares 'good news' that cancer treatment will be reduced in 2026

UK's king shares 'good news' that cancer treatment will be reduced in 2026

-

Can Venezuela survive US targeting its oil tankers?

-

Salah admired from afar in his Egypt home village as club tensions swirl

Salah admired from afar in his Egypt home village as club tensions swirl

-

World stocks retrench, consolidating Fed-fuelled gains

-

Iran frees child bride sentenced to death over husband's killing: activists

Iran frees child bride sentenced to death over husband's killing: activists

-

World stocks consolidate Fed-fuelled gains

-

France updates net-zero plan, with fossil fuel phaseout

France updates net-zero plan, with fossil fuel phaseout

-

Stocks rally in wake of Fed rate cut

-

EU agrees recycled plastic targets for cars

EU agrees recycled plastic targets for cars

-

British porn star to be deported from Bali after small fine

-

British porn star fined, faces imminent Bali deportation

British porn star fined, faces imminent Bali deportation

-

Spain opens doors to descendants of Franco-era exiles

-

Indonesia floods were 'extinction level' for rare orangutans

Indonesia floods were 'extinction level' for rare orangutans

-

Thai teacher finds 'peace amidst chaos' painting bunker murals

-

Japan bear victim's watch shows last movements

Japan bear victim's watch shows last movements

-

South Korea exam chief quits over complaints of too-hard tests

-

French indie 'Clair Obscur' dominates Game Awards

French indie 'Clair Obscur' dominates Game Awards

-

South Korea exam chief resigns after tests dubbed too hard

-

Asian markets track Wall St record after Fed cut

Asian markets track Wall St record after Fed cut

-

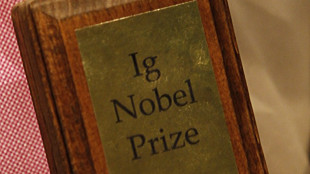

Laughing about science more important than ever: Ig Nobel founder

-

Vaccines do not cause autism: WHO

Vaccines do not cause autism: WHO

-

Crypto mogul Do Kwon sentenced to 15 years for fraud: US media

-

'In her prime': Rare blooming of palm trees in Rio

'In her prime': Rare blooming of palm trees in Rio

-

Make your own Mickey Mouse clip - Disney embraces AI

-

OpenAI beefs up GPT models in AI race with Google

OpenAI beefs up GPT models in AI race with Google

-

Dark, wet, choppy: Machado's secret sea escape from Venezuela

-

Cyclone causes blackout, flight chaos in Brazil's Sao Paulo

Cyclone causes blackout, flight chaos in Brazil's Sao Paulo

-

2024 Eurovision winner Nemo returns trophy over Israel's participation

-

US bringing seized tanker to port, as Venezuela war threats build

US bringing seized tanker to port, as Venezuela war threats build

-

Make your own AI Mickey Mouse - Disney embraces new tech

-

Time magazine names 'Architects of AI' as Person of the Year

Time magazine names 'Architects of AI' as Person of the Year

-

Floodworks on Athens 'oasis' a tough sell among locals

-

OpenAI, Disney to let fans create AI videos in landmark deal

OpenAI, Disney to let fans create AI videos in landmark deal

-

German growth forecasts slashed, Merz under pressure

British cinema chain Cineworld files for US bankruptcy

Britain's Cineworld, the world's second biggest cinema chain, announced Wednesday that it has filed for bankruptcy protection in the United States as it seeks to restructure after facing low audience numbers.

The group, which operates hundreds of movie theatres in the United States, said in a statement that it filed for Chapter 11 at a bankruptcy court in Texas.

Chapter 11 of the US bankruptcy code is a court-supervised restructuring process that provides companies time to negotiate with its creditors to reach a settlement on the reduction of debts.

Cineworld said it "will seek to implement a de-leveraging transaction that will significantly reduce the Group's debt, strengthen its balance sheet and provide the financial strength and flexibility to accelerate, and capitalise on, Cineworld's strategy in the cinema industry."

The statement said it hoped to emerge from bankruptcy proceedings in the first quarter of next year, and had $1.94 billion in financing from existing lenders to help it through that period.

The company also warned existing shareholders that their holdings would likely be considerably diluted as part of the bankruptcy process.

Cineworld's shares had been sliding since the beginning of the year as the company's position deteriorated when people didn't return to cinemas in droves after Covid lockdowns were eased.

They plummeted last month when the company acknowledged it was considering filing for bankruptcy.

Cineworld shares rose 10 percent on Wednesday to 4.29 pence, but were still down 87 percent from the start of the year.

Analysts argue that Cineworld's 2018 takeover of American peer Regal left it saddled with too much debt, putting it in a poor position to weather the pandemic.

A.Agostinelli--CPN