-

Kenya's economy faces climate change risks: World Bank

Kenya's economy faces climate change risks: World Bank

-

Iran, Ukraine talks spark diplomatic merry-go-round in Geneva

-

Greenland entrepreneur gambles on leafy greens

Greenland entrepreneur gambles on leafy greens

-

Warner Bros. gives Paramount one week to outbid Netflix

-

Warner Bros. says reopening talks with Paramount on its buyout offer

Warner Bros. says reopening talks with Paramount on its buyout offer

-

AI 'arms race' risks human extinction, warns top computing expert

-

Oil prices rise as Trump ramps up Iran threats

Oil prices rise as Trump ramps up Iran threats

-

EU investigates Shein over sale of childlike sex dolls

-

Bangladesh's new PM, political heir Tarique Rahman

Bangladesh's new PM, political heir Tarique Rahman

-

US civil rights leader Jesse Jackson dies at 84: family

-

'Made in Europe' or 'Made with Europe'? Buy European push splits bloc

'Made in Europe' or 'Made with Europe'? Buy European push splits bloc

-

Sydney man jailed for mailing reptiles in popcorn bags

-

'Not just props that eat': Extras seek recognition at their own 'Oscars'

'Not just props that eat': Extras seek recognition at their own 'Oscars'

-

Oil in spotlight as Trump's Iran warning rattles sleepy markets

-

Why are more under-50s getting colorectal cancer? 'We don't know'

Why are more under-50s getting colorectal cancer? 'We don't know'

-

Doctors, tourism, tobacco: Cuba buckling under US pressure

-

Kraft Heinz, Braskem, and Tenaris to headline OMP Conference São Paulo 2026

Kraft Heinz, Braskem, and Tenaris to headline OMP Conference São Paulo 2026

-

Copper powers profit surge at Australia's BHP

-

France loosens rules on allowing farmers to shoot wolves

France loosens rules on allowing farmers to shoot wolves

-

'Godfather' and 'Apocalypse Now' actor Robert Duvall dead at 95

-

St Peter's Basilica gets terrace cafe, translated mass for 400th birthday

St Peter's Basilica gets terrace cafe, translated mass for 400th birthday

-

Gold rush grips South African township

-

AI chatbots to face UK safety rules after outcry over Grok

AI chatbots to face UK safety rules after outcry over Grok

-

African diaspora's plural identities on screen in Berlin

-

Killing of far-right activist stokes tensions in France

Killing of far-right activist stokes tensions in France

-

Greenland's west coast posts warmest January on record

-

Madagascar cyclone death toll rises to 59

Madagascar cyclone death toll rises to 59

-

ByteDance vows to boost safeguards after AI model infringement claims

-

'Pure extortion': foreign workers face violence and exploitation in Croatia

'Pure extortion': foreign workers face violence and exploitation in Croatia

-

India hosts AI summit as safety concerns grow

-

Tech is thriving in New York. So are the rents

Tech is thriving in New York. So are the rents

-

Historical queer film 'Rose' shown at Berlin with call to action

-

Brignone strikes Olympic gold again as Klaebo becomes first to win nine

Brignone strikes Olympic gold again as Klaebo becomes first to win nine

-

New world for users and brands as ads hit AI chatbots

-

Japan's 'godless' lake warns of creeping climate change

Japan's 'godless' lake warns of creeping climate change

-

World copper rush promises new riches for Zambia

-

Paw patrol: Larry the cat marks 15 years at 10 Downing Street

Paw patrol: Larry the cat marks 15 years at 10 Downing Street

-

Crash course: Vietnam's crypto boom goes bust

-

US cattle farmers caught between high costs and weary consumers

US cattle farmers caught between high costs and weary consumers

-

European debate over nuclear weapons gains pace

-

French prosecutors announce special team for Epstein files

French prosecutors announce special team for Epstein files

-

ECB to extend euro backstop to boost currency's global role

-

Cuba cancels cigar festival amid economic crisis

Cuba cancels cigar festival amid economic crisis

-

International crew set to dock at space station

-

Top entertainment figures back under-fire UN Palestinians expert

Top entertainment figures back under-fire UN Palestinians expert

-

Greenland prepares next generation for mining future

-

China top court says drivers responsible despite autonomous technology

China top court says drivers responsible despite autonomous technology

-

All-in on AI: what TikTok creator ByteDance did next

-

Havana refinery fire under control as Cuba battles fuel shortages

Havana refinery fire under control as Cuba battles fuel shortages

-

Costa Rica digs up mastodon, giant sloth bones in major archaeological find

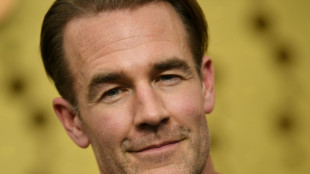

Warner Bros. says reopening talks with Paramount on its buyout offer

Warner Bros. Discovery said Tuesday it has reopened talks with Paramount Skydance on its buyout offer, giving the company a week to beat a rival Netflix bid.

These discussions, scheduled to end February 23, are designed to give Paramount Skydance a chance to make its "best and final offer," Warner Bros. Discovery said in a statement that stressed it prefers the Netflix merger and has scheduled a special shareholders meeting to vote on it on March 20.

Television and film titan Warner Bros. Discovery, which owns CNN, announced in late October that it was open to acquisition offers. Its board subsequently accepted a bid from Netflix to buy only its streaming and studio business.

Paramount Skydance is seeking to buy all of Warner Bros. Discovery for $108 billion. Netflix is offering $83 billion for its more limited merger.

The Netflix offer does not include Warner Bros. Discovery's television properties such as CNN and Discovery. Those would belong to a newly created, publicly traded company called Discovery Global if the deal goes through.

Paramount Skydance accuses the Warner Bros. Discovery board of failing to present shareholders with the details needed to properly compare its offer to the Netflix bid.

During the talks that opened Tuesday, Warner Bros. Discovery said it will discuss "deficiencies that remain unresolved and clarify certain terms of PSKY's proposed merger agreement."

Paramount CEO David Ellison insists that his offer, largely financed by his father, multi-billionaire Larry Ellison, will not face the regulatory scrutiny in the US and Europe that could derail or seriously delay the Netflix deal.

With that in mind, Paramount has offered to pay Warner Bros. Discovery shareholders a "ticking fee" of 25 cents per share — roughly $650 million per quarter — for every quarter the deal is not closed beyond December 31, 2026.

Paramount has also pledged to cover the $2.8 billion termination fee owed if Warner Bros. Discovery walks away from the Netflix agreement.

Paramount's offer is fully financed by $43.6 billion in equity commitments from Larry Ellison and RedBird Capital Partners, alongside $54 billion in debt financing from Bank of America, Citigroup, and Apollo Global Management.

Critics say Netflix's acquisition of Warner Bros. would give the streaming giant too much control over Hollywood production, which is already under pressure from the streaming revolution and Netflix's lack of commitment to theatrical releases for its movies.

To address concerns about theatrical distribution, Netflix has committed to giving Warner Bros. films a 45-day theatrical window if the acquisition goes through.

A successful buyout by Paramount would see a major media property that includes CNN fall under the control of the Ellison family, which has close ties to the Trump administration.

David Ellison's recent takeover of CBS, part of the Paramount empire, has brought major editorial changes to its news coverage that are widely seen as more sympathetic to conservative criticisms of mainstream media in the United States.

Larry Ellison is also a major investor in the US operations of TikTok, at the invitation of President Donald Trump.

At a recent Senate hearing, Netflix co-CEO Ted Sarandos faced questions from Republicans about alleged political bias, telling lawmakers that "Netflix has no political agenda of any kind."

M.Davis--CPN