-

Kenya's economy faces climate change risks: World Bank

Kenya's economy faces climate change risks: World Bank

-

Chloe Kim misses Olympic milestone, Ukrainian disqualfied over helmet

-

Europe's most powerful rocket carries 32 satellites for Amazon Leo network into space

Europe's most powerful rocket carries 32 satellites for Amazon Leo network into space

-

Strange 'inside-out' planetary system baffles astronomers

-

EU vows reforms to confront China, US -- but split on joint debt

EU vows reforms to confront China, US -- but split on joint debt

-

The secret to an elephant's grace? Whiskers

-

Chance glimpse of star collapse offers new insight into black hole formation

Chance glimpse of star collapse offers new insight into black hole formation

-

US lawmaker moves to shield oil companies from climate cases

-

Stocks diverge as all eyes on corporate earnings

Stocks diverge as all eyes on corporate earnings

-

'Virgin' frescoes emerge from Pompeii suburb

-

HK firm CK Hutchison threatens legal action if Maersk takes over Panama ports

HK firm CK Hutchison threatens legal action if Maersk takes over Panama ports

-

UN climate chief says 'new world disorder' hits cooperation

-

Russia is cracking down on WhatsApp and Telegram. Here's what we know

Russia is cracking down on WhatsApp and Telegram. Here's what we know

-

Stocks rise as all eyes on corporate earnings

-

Turkey's central bank lifts 2026 inflation forecasts

Turkey's central bank lifts 2026 inflation forecasts

-

UK economy struggles for growth in fresh blow to government

-

UK nursery worker faces jail for serial child sex abuse

UK nursery worker faces jail for serial child sex abuse

-

Anti-racism body slams Man Utd co-owner for 'disgraceful' immigration comments

-

Mercedes-Benz net profit nearly halves amid China, US woes

Mercedes-Benz net profit nearly halves amid China, US woes

-

Hermes sales rise despite US tariffs, currency headwinds

-

Pro-Kremlin accounts using Epstein files to push conspiracy: AFP research

Pro-Kremlin accounts using Epstein files to push conspiracy: AFP research

-

Sanofi says board has removed CEO Paul Hudson

-

Struggling Nissan forecasts $4.2 bn full-year net loss

Struggling Nissan forecasts $4.2 bn full-year net loss

-

Asia markets mixed as stong US jobs data temper rate expectations

-

Samsung starts mass production of next-gen AI memory chip

Samsung starts mass production of next-gen AI memory chip

-

Greece's Cycladic islands swept up in concrete fever

-

'China shock': Germany struggles as key market turns business rival

'China shock': Germany struggles as key market turns business rival

-

EU leaders push to rescue European economy challenged by China, US

-

Plenty of peaks, but skiing yet to take off in Central Asia

Plenty of peaks, but skiing yet to take off in Central Asia

-

Berlin Film Festival to open with a rallying cry 'to defend artistic freedom'

-

Protesters, police clash at protest over Milei labor reform

Protesters, police clash at protest over Milei labor reform

-

GA-ASI Achieves New Milestone With Semi-Autonomous CCA Flight

-

Trump orders Pentagon to buy coal-fired electricity

Trump orders Pentagon to buy coal-fired electricity

-

US pushes for 'dramatic increase' in Venezuela oil output

-

Milei labor law reforms spark clashes in Buenos Aires

Milei labor law reforms spark clashes in Buenos Aires

-

US stocks move sideways after January job growth tops estimates

-

James Van Der Beek, star of 'Dawson's Creek,' dies at 48

James Van Der Beek, star of 'Dawson's Creek,' dies at 48

-

US top official in Venezuela for oil talks after leader's ouster

-

TotalEnergies can do without Russian gas: CEO

TotalEnergies can do without Russian gas: CEO

-

Instagram CEO denies addiction claims in landmark US trial

-

EU leaders push rival fixes to reverse bloc's 'decline'

EU leaders push rival fixes to reverse bloc's 'decline'

-

BMW recalls hundreds of thousands of cars over fire risk

-

Norway's ex-diplomat seen as key cog in Epstein affair

Norway's ex-diplomat seen as key cog in Epstein affair

-

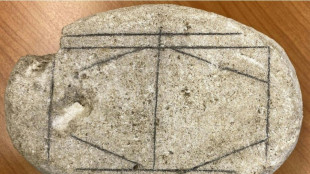

AI cracks Roman-era board game

-

Cyclone batters Madagascar's second city, killing 31

Cyclone batters Madagascar's second city, killing 31

-

Instagram CEO to testify at social media addiction trial

-

Cyclone kills 20 in Madagascar as 2nd-largest city '75% destroyed'

Cyclone kills 20 in Madagascar as 2nd-largest city '75% destroyed'

-

xAI sees key staff exits, Musk promises moon factories

-

US hiring soars past expectations as unemployment edges down

US hiring soars past expectations as unemployment edges down

-

France lawmakers urge changes to counter dwindling births

European stocks rise tracking earnings, US jobs

European stock markets rose Thursday as traders digested a string of company earnings and a stronger-than-expected US jobs report, which boosted optimism about the health of the world's largest economy.

Asian markets were subdued after a weak close Wednesday on Wall Street, as investors pared back bets on Federal Reserve interest rate cuts and the share prices of tech firms again underperformed.

"The strength seen in Europe... comes from improved earnings data from some of the big hitters," said Joshua Mahony, chief market analyst at Scope Markets.

Shares in German industrial giant Siemens jumped seven percent as it raised its outlook for the year after a strong first quarter boosted by spending on artificial intelligence.

In Paris, RayBan maker EssilorLuxottica shares rose around four percent as its fourth-quarter earnings beat market expectations.

London edged up to a fresh record high, even as data showed the UK economy grew less than expected in the final three months of 2025.

British asset manager Schroders was the biggest riser in the FTSE 100 index after agreeing a takeover by the US firm Nuveen, sending its shares up 28 percent to reflect the premium paid for the company.

Investors were also reacting to a bumper US jobs report on Wednesday that eased concerns about the state of the world's top economy, even though it reduced expectations for Federal Reserve interest rate cuts to spur growth.

Around 130,000 US jobs were created last month, more than double what was forecast, while unemployment unexpectedly dipped.

The reading soothed concerns about the economy that had been stoked by a report earlier this week showing weak US consumer activity.

"This was a solid report across headline job creation, unemployment, and wage growth, easing concerns over the health of the US labour market," wrote Fiona Cincotta, senior market analyst at City Index.

However, "The markets have pushed back on expectations for the next rate cut by the Federal Reserve to July, compared to June previously," she added.

The winners in Asia on Thursday were again led by Seoul's Kospi index, the world's best performer this year thanks to a surge in chipmakers Samsung and SK hynix as traders turn to the region's AI plays.

The region's recent rally comes amid a turn from Wall Street titans caused by concerns about extended valuations of firms such as Microsoft and Meta amid massive investments in AI deployment.

Shanghai closed higher, while Hong Kong retreated and Tokyo was flat.

The dollar weakened against the yen despite waning expectations for an early US rate cut and the prospect of big Japanese spending after Prime Minister Sanae Takaichi's landslide election win.

Analysts said the yen's advance has been helped by the sense of stability in Tokyo caused by the governing party's big win.

The dollar was also down against the pound and euro.

- Key figures at around 1120 GMT -

London - FTSE 100: UP 0.2 percent at 10,495.18 points

Paris - CAC 40: UP 0.7 percent at 8,372.71

Frankfurt - DAX: UP 1.4 percent at 25,206.64

Tokyo - Nikkei 225: FLAT at 57,639.84 (close)

Hong Kong - Hang Seng Index: DOWN 0.9 percent at 27,032.54 (close)

Shanghai - Composite: UP 0.1 percent at 4,134.02 (close)

New York - Dow: DOWN 0.1 percent at 50,121.40 (close)

Euro/dollar: UP at $1.1882 from $1.1874 on Wednesday

Pound/dollar: UP at $1.3645 from $1.3628

Dollar/yen: DOWN at 153.09 yen from 153.14 yen

Euro/pound: DOWN at 87.10 pence from 87.13 pence

Brent North Sea Crude: DOWN 0.6 percent at $69.02 per barrel

West Texas Intermediate: DOWN 0.5 percent at $64.32 per barrel

O.Hansen--CPN