-

Kenya's economy faces climate change risks: World Bank

Kenya's economy faces climate change risks: World Bank

-

Trump orders Pentagon to buy coal-fired electricity

-

US pushes for 'dramatic increase' in Venezuela oil output

US pushes for 'dramatic increase' in Venezuela oil output

-

Milei labor law reforms spark clashes in Buenos Aires

-

US stocks move sideways after January job growth tops estimates

US stocks move sideways after January job growth tops estimates

-

James Van Der Beek, star of 'Dawson's Creek,' dies at 48

-

US top official in Venezuela for oil talks after leader's ouster

US top official in Venezuela for oil talks after leader's ouster

-

TotalEnergies can do without Russian gas: CEO

-

Instagram CEO denies addiction claims in landmark US trial

Instagram CEO denies addiction claims in landmark US trial

-

EU leaders push rival fixes to reverse bloc's 'decline'

-

BMW recalls hundreds of thousands of cars over fire risk

BMW recalls hundreds of thousands of cars over fire risk

-

Norway's ex-diplomat seen as key cog in Epstein affair

-

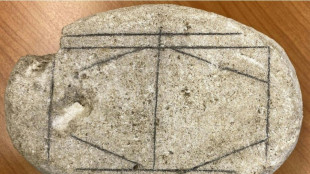

AI cracks Roman-era board game

AI cracks Roman-era board game

-

Cyclone batters Madagascar's second city, killing 31

-

Instagram CEO to testify at social media addiction trial

Instagram CEO to testify at social media addiction trial

-

Cyclone kills 20 in Madagascar as 2nd-largest city '75% destroyed'

-

xAI sees key staff exits, Musk promises moon factories

xAI sees key staff exits, Musk promises moon factories

-

US hiring soars past expectations as unemployment edges down

-

France lawmakers urge changes to counter dwindling births

France lawmakers urge changes to counter dwindling births

-

Actor behind Albania's AI 'minister' wants her face back

-

Eat less meat, France urges, for sake of health, climate

Eat less meat, France urges, for sake of health, climate

-

French AI firm Mistral to build data centres in Sweden

-

Siemens Energy trebles profit as AI boosts power demand

Siemens Energy trebles profit as AI boosts power demand

-

EU eyes tighter registration, no-fly zones to tackle drone threats

-

Spanish PM vows justice, defends rail safety after deadly accidents

Spanish PM vows justice, defends rail safety after deadly accidents

-

Struggling brewer Heineken to cut up to 6,000 jobs

-

UK's crumbling canals threatened with collapse

UK's crumbling canals threatened with collapse

-

Moderna says US refusing to review mRNA-based flu shot

-

More American women holding multiple jobs as high costs sting

More American women holding multiple jobs as high costs sting

-

Britney Spears sells rights to her music catalog: US media

-

'Outrage' as LGBTQ Pride flag removed from Stonewall monument

'Outrage' as LGBTQ Pride flag removed from Stonewall monument

-

Google turns to century-long debt to build AI

-

Till death do us bark: Brazilian state lets pets be buried with owners

Till death do us bark: Brazilian state lets pets be buried with owners

-

Latam-GPT: a Latin American AI to combat US-centric bias

-

Europe's Ariane 6 to launch Amazon constellation satellites into orbit

Europe's Ariane 6 to launch Amazon constellation satellites into orbit

-

Spain's Telefonica sells Chile unit in Latin America pullout

-

Stocks rise but lacklustre US retail sales spur caution

Stocks rise but lacklustre US retail sales spur caution

-

US retail sales flat in December as consumers pull back

-

Bumper potato harvests spell crisis for European farmers

Bumper potato harvests spell crisis for European farmers

-

US vice president Vance on peace bid in Azerbaijan after Armenia visit

-

ArcelorMittal confirms long-stalled French steel plant revamp

ArcelorMittal confirms long-stalled French steel plant revamp

-

Spotify says active users up 11 percent in fourth quarter to 751 mn

-

AstraZeneca profit jumps as cancer drug sales grow

AstraZeneca profit jumps as cancer drug sales grow

-

BP profits slide awaiting new CEO

-

Trump tariffs hurt French wine and spirits exports

Trump tariffs hurt French wine and spirits exports

-

OpenAI starts testing ads in ChatGPT

-

Back to black: Philips posts first annual profit since 2021

Back to black: Philips posts first annual profit since 2021

-

Man arrested in Thailand for smuggling rhino horn inside meat

-

'Family and intimacy under pressure' at Berlin film festival

'Family and intimacy under pressure' at Berlin film festival

-

Asian markets extend gains as Tokyo enjoys another record day

US stocks move sideways after January job growth tops estimates

Wall Street stocks moved sideways Wednesday following solid US jobs data that boosted sentiment about the economy but dented prospects for imminent Federal Reserve interest rate cuts.

The US economy added 130,000 jobs last month, the Department of Labor said, more than double the amount expected by analysts. Meanwhile, the jobless rate inched lower to 4.3 percent.

The report comes on the heels of recent data that has raised questions about US economic health.

"There were some investors concerned after yesterday's retail sales that this report would potentially add to some growth worries," said Angelo Kourkafas of Edward Jones. "But I think the solid numbers really alleviated some of these fears."

But the report also means "there is less urgency from the Fed to cut interest rates," Kourkafas said. "This could support the rotation that is happening with the old economy stocks benefiting while we still see some of the lingering disruption worries on the technology space."

The S&P 500 finished flat while both the Dow and Nasdaq ended marginally lower after choppy sessions.

In Europe, London's FTSE 100 gained more than one percent and set a new record high thanks to buoyant commodity prices.

Paris and Frankfurt both ended lower.

Asia's main stock markets closed higher before the US jobs report.

XTB research director Kathleen Brooks noted that the jobs data still raised concerns thanks to an annual revision that was also given Wednesday -- which showed a benchmark reduction of 862,000 positions.

"The revisions suggest there was virtually no jobs growth in the US last year," she said.

In Europe on Wednesday, shares in Heineken climbed 4.2 percent after the Dutch brewer said it would axe 6,000 jobs amid falling beer shipments.

TotalEnergies rose 3.1 percent as the French energy giant announced fresh share buybacks, helping offset news of a 17 percent drop in annual net profit.

Siemens Energy shares jumped 8.4 percent on ballooning profits as AI boosts demand for electricity.

On the downside, Dassault Systemes tumbled 20 percent after the French software group posted lower sales than expected.

Among US companies, Mattel plunged 25 percent after reporting disappointing results.

CEO Ynon Kreiz pointed to disappointing demand in December and said the toymaker's 2026 investments would crimp profits this year but "accelerate growth in top and bottom lines in 2027 and beyond."

- Key figures at around 2115 GMT -

New York - Dow: DOWN 0.1 percent at 50,121.40 (close)

New York - S&P 500: FLAT at 6,941.47 (close)

New York - Nasdaq Composite: DOWN 0.2 percent at 23,066.47 (close)

London - FTSE 100: UP 1.1 percent at 10,472.11 (close)

Paris - CAC 40: DOWN 0.2 percent at 8,313.24 (close)

Frankfurt - DAX: DOWN 0.5 percent at 24,856.15 (close)

Hong Kong - Hang Seng Index: UP 0.3 percent at 27,266.38 (close)

Shanghai - Composite: UP 0.1 percent at 4,131.98 (close)

Tokyo - Nikkei 225: Closed for a holiday

Euro/dollar: DOWN at $1.1874 from $1.1895 on Tuesday

Pound/dollar: DOWN at $1.3628 from $1.3643

Dollar/yen: DOWN at 153.14 yen from 154.39 yen

Euro/pound: DOWN at 87.13 pence from 87.19 pence

Brent North Sea Crude: UP 0.9 percent at $69.40 per barrel

West Texas Intermediate: UP 1.1 percent at $64.63 per barrel

burs-jmb/sla

Y.Ibrahim--CPN