-

Kenya's economy faces climate change risks: World Bank

Kenya's economy faces climate change risks: World Bank

-

BP profits slide awaiting new CEO

-

Trump tariffs hurt French wine and spirits exports

Trump tariffs hurt French wine and spirits exports

-

OpenAI starts testing ads in ChatGPT

-

Back to black: Philips posts first annual profit since 2021

Back to black: Philips posts first annual profit since 2021

-

Man arrested in Thailand for smuggling rhino horn inside meat

-

'Family and intimacy under pressure' at Berlin film festival

'Family and intimacy under pressure' at Berlin film festival

-

Asian markets extend gains as Tokyo enjoys another record day

-

Unions rip American Airlines CEO on performance

Unions rip American Airlines CEO on performance

-

Jury told that Meta, Google 'engineered addiction' at landmark US trial

-

Three missing employees of Canadian miner found dead in Mexico

Three missing employees of Canadian miner found dead in Mexico

-

Meta, Google face jury in landmark US addiction trial

-

Epstein accomplice Maxwell seeks Trump clemency before testimony

Epstein accomplice Maxwell seeks Trump clemency before testimony

-

Some striking NY nurses reach deal with employers

-

Emergency measures kick in as Cuban fuel supplies dwindle under US pressure

Emergency measures kick in as Cuban fuel supplies dwindle under US pressure

-

EU chief backs Made-in-Europe push for 'strategic' sectors

-

AI chatbots give bad health advice, research finds

AI chatbots give bad health advice, research finds

-

Iran steps up arrests while remaining positive on US talks

-

Bank of France governor Francois Villeroy de Galhau to step down in June

Bank of France governor Francois Villeroy de Galhau to step down in June

-

EU warns Meta it must open up WhatsApp to rival AI chatbots

-

Japan restarts world's biggest nuclear plant again

Japan restarts world's biggest nuclear plant again

-

Japan's Takaichi may struggle to soothe voters and markets

-

'Want to go home': Indonesian crew abandoned off Africa demand wages

'Want to go home': Indonesian crew abandoned off Africa demand wages

-

Arguments to begin in key US social media addiction trial

-

Trump says China's Xi to visit US 'toward the end of the year'

Trump says China's Xi to visit US 'toward the end of the year'

-

'Send Help' repeats as N.America box office champ

-

US astronaut to take her 3-year-old's cuddly rabbit into space

US astronaut to take her 3-year-old's cuddly rabbit into space

-

UK foreign office to review pay-off to Epstein-linked US envoy

-

Storm-battered Portugal votes in presidential election run-off

Storm-battered Portugal votes in presidential election run-off

-

French police arrest five over crypto-linked magistrate kidnapping

-

De Beers sale drags in diamond doldrums

De Beers sale drags in diamond doldrums

-

What's at stake for Indian agriculture in Trump's trade deal?

-

Pakistan's capital picks concrete over trees, angering residents

Pakistan's capital picks concrete over trees, angering residents

-

Neglected killer: kala-azar disease surges in Kenya

-

Chile's climate summit chief to lead plastic pollution treaty talks

Chile's climate summit chief to lead plastic pollution treaty talks

-

Spain, Portugal face fresh storms, torrential rain

-

Opinions of Zuckerberg hang over social media addiction trial jury selection

Opinions of Zuckerberg hang over social media addiction trial jury selection

-

Crypto firm accidentally sends $40 bn in bitcoin to users

-

Dow surges above 50,000 for first time as US stocks regain mojo

Dow surges above 50,000 for first time as US stocks regain mojo

-

Danone expands recall of infant formula batches in Europe

-

EU nations back chemical recycling for plastic bottles

EU nations back chemical recycling for plastic bottles

-

Why bitcoin is losing its luster after stratospheric rise

-

Stocks rebound though tech stocks still suffer

Stocks rebound though tech stocks still suffer

-

Digital euro delay could leave Europe vulnerable, ECB warns

-

German exports to US plunge as tariffs exact heavy cost

German exports to US plunge as tariffs exact heavy cost

-

Stellantis takes massive hit for 'overestimation' of EV shift

-

'Mona's Eyes': how an obscure French art historian swept the globe

'Mona's Eyes': how an obscure French art historian swept the globe

-

In Dakar fishing village, surfing entices girls back to school

-

Russian pensioners turn to soup kitchen as war economy stutters

Russian pensioners turn to soup kitchen as war economy stutters

-

As Estonia schools phase out Russian, many families struggle

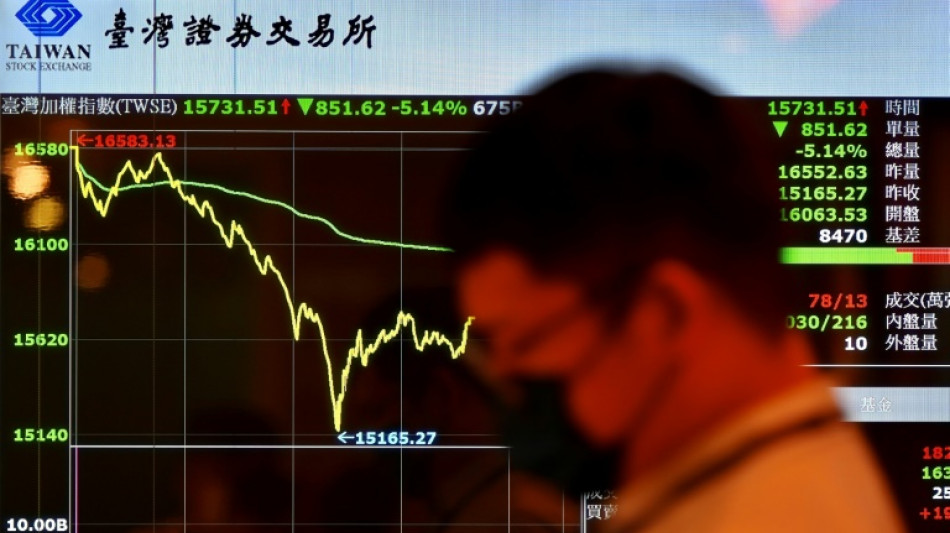

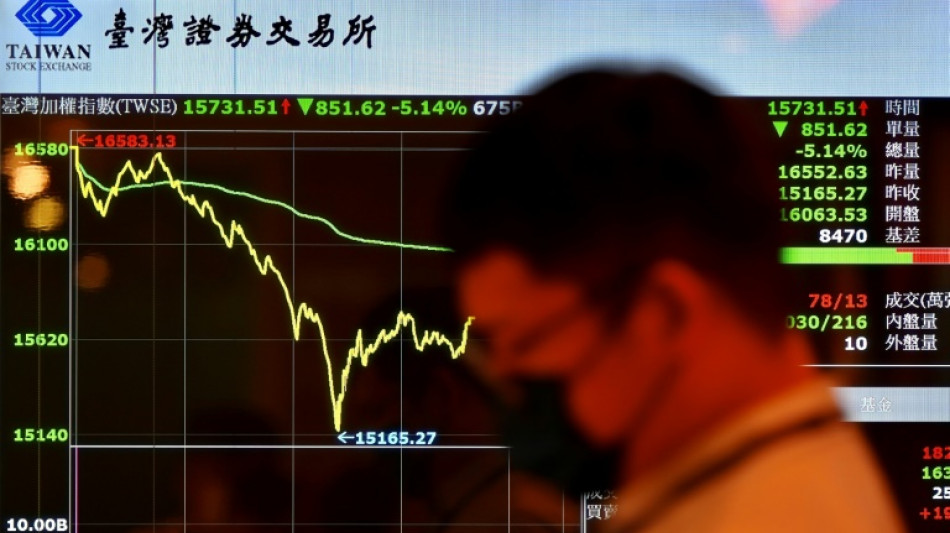

Stocks savaged as China retaliation to Trump tariffs fans trade war

Asian equities collapsed on a black Monday for markets after China hammered the United States with its own hefty tariffs, ramping up a trade war many fear could spark a recession.

Trading floors were overcome by a wave of selling as investors fled to the hills, with Hong Kong's loss of 12 percent its worst in more than 16 years, while Taipei tanked more than nine percent and Tokyo more than seven percent.

Futures for Wall Street's markets were also taking another drubbing, while concerns about the impact on demand also saw commodities slump.

President Donald Trump sparked a market meltdown last week when he unveiled sweeping tariffs against US trading partners for what he said was years of being ripped off and claimed that governments were lining up to cut deals with Washington.

But after Asian markets closed on Friday, China said it would impose retaliatory levies of 34 percent on all US goods from April 10.

Beijing also imposed export controls on seven rare earth elements, including gadolinium -- commonly used in MRIs -- and yttrium, utilised in consumer electronics.

On Sunday, vice commerce minister Ling Ji told representatives of US firms its tariffs "firmly protect the legitimate rights and interests of enterprises, including American companies".

Hopes that the US president would rethink his policy in light of the turmoil were dashed Sunday when he said he would not make a deal with other countries unless trade deficits were solved.

Trump denied that he was intentionally engineering a selloff and insisted he could not foresee market reactions.

"Sometimes you have to take medicine to fix something," he said of the ructions that have wiped trillions of dollars off company valuations.

- No sector spared -

The savage selling in Asia was across the board, with no sector unharmed -- tech firms, car makers, banks, casinos and energy firms all felt the pain as investors abandoned riskier assets.

Among the biggest losers, Chinese ecommerce titans Alibaba tanked more than 17 percent and rival JD.com shed 14 percent, while Japanese tech investment giant SoftBank dived more than 11 percent and Sony gave up nine percent.

Hong Kong's 12 percent loss marked its worst day since October 2008 during the global financial crisis.

Shanghai shed more than seven percent and Singapore eight percent, while Seoul gave up more than five percent triggering a so-called sidecar mechanism -- for the first time in eight months -- that briefly halted some trading.

Sydney, Wellington, Manila and Mumbai were also deep in the red.

"We could see a recession happen very quickly in the US, and it could last through the year or so, it could be rather lengthy," said Steve Cochrane, chief Asia-Pacific economist at Moody's Analytics.

"If there's a recession in the US, of course, China will feel it as well because demand for its goods will be hit even harder. Harder than they would have been hit just because of the tariffs," he added.

Concerns about demand saw oil prices sink more than three percent at one point Monday, having dropped around seven percent Friday. Both main contracts are now sitting at their lowest levels since 2021.

Copper -- a vital component for energy storage, electric vehicles, solar panels and wind turbines -- also extended losses.

- Carnage on Wall Street -

The losses followed another day of carnage on Wall Street on Friday, where all three main indexes fell almost six percent.

That came after Federal Reserve boss Jerome Powell said US tariffs will likely cause inflation to rise and growth to slow and warned of an "elevated" risk of higher unemployment.

The measures by Trump are likely to give US central bankers a headache as they try to balance the need for interest rate cuts to support the economy with the need to keep a lid on prices.

His comments came after Trump had insisted "my policies will never change" and urged the Fed to cut rates.

"Powell's hands are tied," said Stephen Innes at SPI Asset Management. "He's acknowledged the obvious -- that tariffs are inflationary and recessionary -- but he's not signalling a rescue.

"And that's the problem. This time, the Fed's inflation mandate is forcing it to keep the safety net rolled up while asset prices get torched."

While Powell has so far refused to announce any rate cuts, markets are betting he will do soon.

"A first-rate cut is fully priced for June, with markets betting that the Fed will be forced to look through a tariff-induced boost to inflation to prevent the US economy from slipping into a rather needless recession," said IG's Tony Sycamore.

Tim Waterer, chief market analyst at KCM Trade, said traders fear that both Washington and Beijing "could receive knockout blows from a prolonged economic fight".

- Key figures around 0600 GMT -

Tokyo - Nikkei 225: DOWN 7.8 percent at 31,136.58 (close)

Hong Kong - Hang Seng Index: DOWN 12.2 percent at 20,068.62

Shanghai - Composite: DOWN 7.4 percent at 3,093.84

West Texas Intermediate: DOWN 2.8 percent at $60.24 per barrel

Brent North Sea Crude: DOWN 2.7 percent at $63.76 per barrel

Dollar/yen: DOWN at 145.72 yen from 146.98 yen on Friday

Euro/dollar: UP at $1.1015 from $1.0962

Pound/dollar: UP at $1.2925 from $1.2893

Euro/pound: UP at 85.23 pence from 85.01 pence

New York - Dow: DOWN 5.5 percent at 38,314.86 (close)

London - FTSE 100: DOWN 5.0 percent at 8,054.98 (close)

P.Schmidt--CPN