-

Kenya's economy faces climate change risks: World Bank

Kenya's economy faces climate change risks: World Bank

-

BP profits slide awaiting new CEO

-

Trump tariffs hurt French wine and spirits exports

Trump tariffs hurt French wine and spirits exports

-

OpenAI starts testing ads in ChatGPT

-

Back to black: Philips posts first annual profit since 2021

Back to black: Philips posts first annual profit since 2021

-

Man arrested in Thailand for smuggling rhino horn inside meat

-

'Family and intimacy under pressure' at Berlin film festival

'Family and intimacy under pressure' at Berlin film festival

-

Asian markets extend gains as Tokyo enjoys another record day

-

Unions rip American Airlines CEO on performance

Unions rip American Airlines CEO on performance

-

Jury told that Meta, Google 'engineered addiction' at landmark US trial

-

Three missing employees of Canadian miner found dead in Mexico

Three missing employees of Canadian miner found dead in Mexico

-

Meta, Google face jury in landmark US addiction trial

-

Epstein accomplice Maxwell seeks Trump clemency before testimony

Epstein accomplice Maxwell seeks Trump clemency before testimony

-

Some striking NY nurses reach deal with employers

-

Emergency measures kick in as Cuban fuel supplies dwindle under US pressure

Emergency measures kick in as Cuban fuel supplies dwindle under US pressure

-

EU chief backs Made-in-Europe push for 'strategic' sectors

-

AI chatbots give bad health advice, research finds

AI chatbots give bad health advice, research finds

-

Iran steps up arrests while remaining positive on US talks

-

Bank of France governor Francois Villeroy de Galhau to step down in June

Bank of France governor Francois Villeroy de Galhau to step down in June

-

EU warns Meta it must open up WhatsApp to rival AI chatbots

-

Japan restarts world's biggest nuclear plant again

Japan restarts world's biggest nuclear plant again

-

Japan's Takaichi may struggle to soothe voters and markets

-

'Want to go home': Indonesian crew abandoned off Africa demand wages

'Want to go home': Indonesian crew abandoned off Africa demand wages

-

Arguments to begin in key US social media addiction trial

-

Trump says China's Xi to visit US 'toward the end of the year'

Trump says China's Xi to visit US 'toward the end of the year'

-

'Send Help' repeats as N.America box office champ

-

US astronaut to take her 3-year-old's cuddly rabbit into space

US astronaut to take her 3-year-old's cuddly rabbit into space

-

UK foreign office to review pay-off to Epstein-linked US envoy

-

Storm-battered Portugal votes in presidential election run-off

Storm-battered Portugal votes in presidential election run-off

-

French police arrest five over crypto-linked magistrate kidnapping

-

De Beers sale drags in diamond doldrums

De Beers sale drags in diamond doldrums

-

What's at stake for Indian agriculture in Trump's trade deal?

-

Pakistan's capital picks concrete over trees, angering residents

Pakistan's capital picks concrete over trees, angering residents

-

Neglected killer: kala-azar disease surges in Kenya

-

Chile's climate summit chief to lead plastic pollution treaty talks

Chile's climate summit chief to lead plastic pollution treaty talks

-

Spain, Portugal face fresh storms, torrential rain

-

Opinions of Zuckerberg hang over social media addiction trial jury selection

Opinions of Zuckerberg hang over social media addiction trial jury selection

-

Crypto firm accidentally sends $40 bn in bitcoin to users

-

Dow surges above 50,000 for first time as US stocks regain mojo

Dow surges above 50,000 for first time as US stocks regain mojo

-

Danone expands recall of infant formula batches in Europe

-

EU nations back chemical recycling for plastic bottles

EU nations back chemical recycling for plastic bottles

-

Why bitcoin is losing its luster after stratospheric rise

-

Stocks rebound though tech stocks still suffer

Stocks rebound though tech stocks still suffer

-

Digital euro delay could leave Europe vulnerable, ECB warns

-

German exports to US plunge as tariffs exact heavy cost

German exports to US plunge as tariffs exact heavy cost

-

Stellantis takes massive hit for 'overestimation' of EV shift

-

'Mona's Eyes': how an obscure French art historian swept the globe

'Mona's Eyes': how an obscure French art historian swept the globe

-

In Dakar fishing village, surfing entices girls back to school

-

Russian pensioners turn to soup kitchen as war economy stutters

Russian pensioners turn to soup kitchen as war economy stutters

-

As Estonia schools phase out Russian, many families struggle

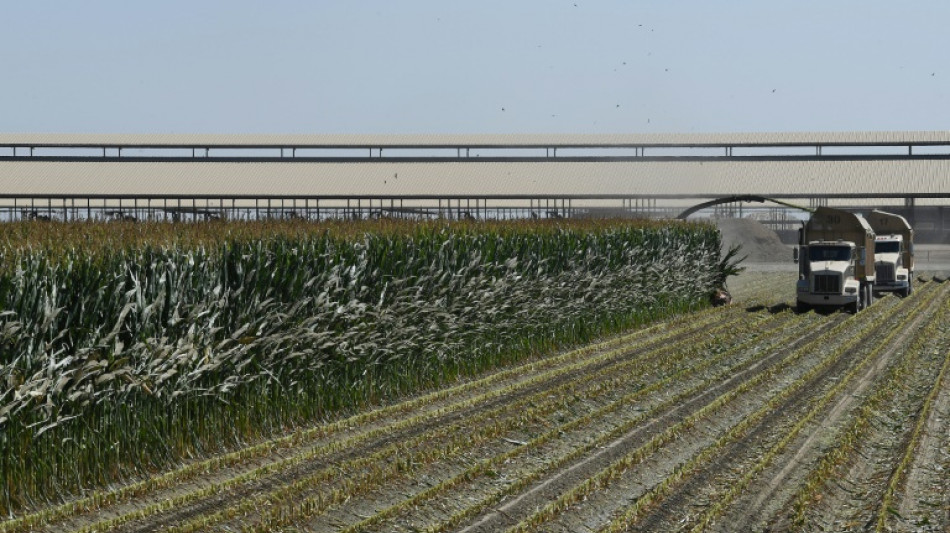

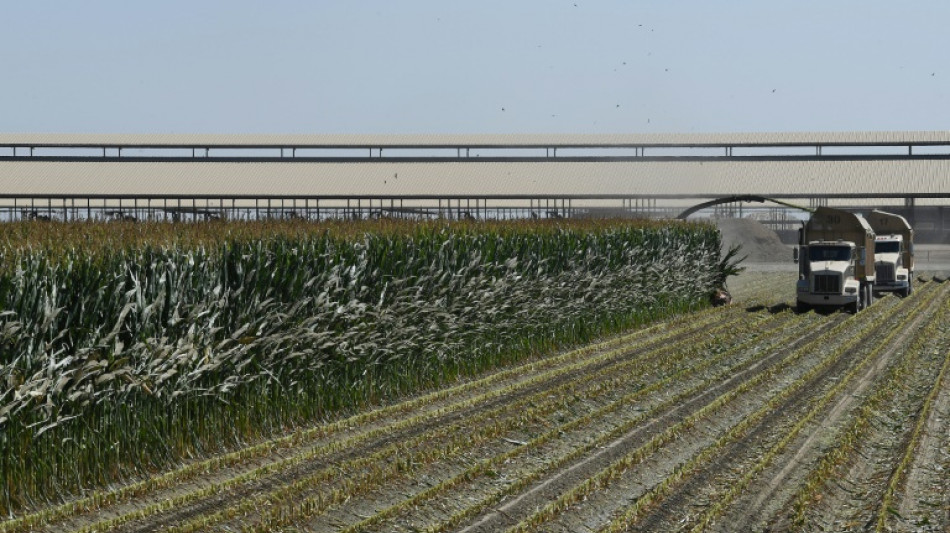

'Anxious': US farmers see tariffs threaten earnings

As President Donald Trump's sweeping global tariffs took effect this weekend, US farmers hoping for a profit this year instead found themselves facing lower crop prices -- and the prospect of ceding more ground in foreign markets.

"We're already getting below break-even at the current time," said Jim Martin, a fifth-generation Illinois farmer who grows soybeans and corn.

"We knew it was coming," he told AFP of Trump's tariffs. "I guess we're anxious to see how things are going to eventually be resolved."

The president's 10-percent "baseline" rate on goods from most US trading partners except Mexico and Canada took effect Saturday.

And dozens of economies, including the European Union, China and India, are set to face even higher levels -- tailored to each party -- starting Wednesday.

With talk of retaliation, farmers, a key support base in Trump's 2024 re-election campaign, are again in the crossfire and bracing for losses.

Prices for many US agricultural products fell alongside the stock market on Friday, following Trump's tariff announcement and China's pushback.

China, the third-biggest importer of American farm goods behind Canada and Mexico, is set to be hard hit, with a 34-percent US duty on its products piling on an earlier 20-percent levy.

In response, Beijing said it would place its own 34-percent tariff on American goods, stacking on previous rates of up to 15 percent on US agricultural products.

The tariffs mean businesses pay more to import US products, hurting American farmers' competitiveness.

- Market loss -

"There is less incentive for them to purchase US soybeans. It is cheaper to get them out of Brazil by far," said Michael Slattery, who grows corn, soybeans and wheat in the Midwest state of Wisconsin.

At least half of US soybean exports and even more of its sorghum go to China, which spent $24.7 billion on US agriculture last year, including on chicken, beef and other crops.

But the US Department of Agriculture (USDA) said China's purchases last year dropped 15 percent from 2023 "as soybean and corn sales fell amid rising competition from South America."

Slattery expects Chinese buyers will dial back further.

"The loss of this market is a very big deal, because it's expensive to find other buyers," said Christopher Barrett, a Cornell University professor whose expertise includes agricultural economics.

During Trump's escalating tariff war in his first presidency, China was the "only target, and therefore the only country retaliating," Barrett said.

With all trading partners now targeted, farmers will likely have a harder time finding new markets, he said.

- 'Band-aid' -

"More than 20 percent of farm income comes from exports, and farmers rely on imports for crucial supplies like fertilizer and specialized tools," the American Farm Bureau Federation warned this week.

"Tariffs will drive up the cost of critical supplies, and retaliatory tariffs will make American-grown products more expensive globally," it added.

The International Dairy Foods Association cautioned Wednesday that "broad and prolonged tariffs" on top trading partners and growing markets risk undermining billions in investments to meet global demand.

Retaliatory tariffs on the United States triggered over $27 billion in agricultural export losses from mid-2018 to late-2019, the USDA found.

While the department provided $23 billion to help farmers hit by trade disputes in 2018 and 2019, Martin in Illinois likened the bailouts to "a band-aid, a temporary fix on a long-term problem."

"The president says it's going to be better in the long-term so we need to decide how patient we need to be, I guess," he added.

Martin, like other producers, hopes for more trade deals with countries beyond China.

Slattery called Trump's policies "a major restructuring of the international order."

He is bracing for losses this year and next.

"I've attempted to sell as much as I can of the soybeans and corn in advance, before Trump began to indicate the amount of tariffs he was going to charge," he said.

M.P.Jacobs--CPN