-

Kenya's economy faces climate change risks: World Bank

Kenya's economy faces climate change risks: World Bank

-

Tokyo-bound United plane returns to Washington after engine fails

-

Deja vu? Trump accused of economic denial and physical decline

Deja vu? Trump accused of economic denial and physical decline

-

China's smaller manufacturers look to catch the automation wave

-

Hungary winemakers fear disease may 'wipe out' industry

Hungary winemakers fear disease may 'wipe out' industry

-

Campaigning starts in Central African Republic quadruple election

-

'Stop the slaughter': French farmers block roads over cow disease cull

'Stop the slaughter': French farmers block roads over cow disease cull

-

First urban cable car unveiled outside Paris

-

Why SpaceX IPO plan is generating so much buzz

Why SpaceX IPO plan is generating so much buzz

-

US unseals warrant for tanker seized off Venezuelan coast

-

World stocks mostly slide, consolidating Fed-fuelled gains

World stocks mostly slide, consolidating Fed-fuelled gains

-

Crypto firm Tether bids for Juventus, is quickly rebuffed

-

UK's king shares 'good news' that cancer treatment will be reduced in 2026

UK's king shares 'good news' that cancer treatment will be reduced in 2026

-

Can Venezuela survive US targeting its oil tankers?

-

Salah admired from afar in his Egypt home village as club tensions swirl

Salah admired from afar in his Egypt home village as club tensions swirl

-

World stocks retrench, consolidating Fed-fuelled gains

-

Iran frees child bride sentenced to death over husband's killing: activists

Iran frees child bride sentenced to death over husband's killing: activists

-

World stocks consolidate Fed-fuelled gains

-

France updates net-zero plan, with fossil fuel phaseout

France updates net-zero plan, with fossil fuel phaseout

-

Stocks rally in wake of Fed rate cut

-

EU agrees recycled plastic targets for cars

EU agrees recycled plastic targets for cars

-

British porn star to be deported from Bali after small fine

-

British porn star fined, faces imminent Bali deportation

British porn star fined, faces imminent Bali deportation

-

Spain opens doors to descendants of Franco-era exiles

-

Indonesia floods were 'extinction level' for rare orangutans

Indonesia floods were 'extinction level' for rare orangutans

-

Thai teacher finds 'peace amidst chaos' painting bunker murals

-

Japan bear victim's watch shows last movements

Japan bear victim's watch shows last movements

-

South Korea exam chief quits over complaints of too-hard tests

-

French indie 'Clair Obscur' dominates Game Awards

French indie 'Clair Obscur' dominates Game Awards

-

South Korea exam chief resigns after tests dubbed too hard

-

Asian markets track Wall St record after Fed cut

Asian markets track Wall St record after Fed cut

-

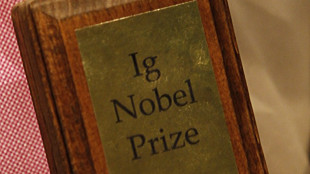

Laughing about science more important than ever: Ig Nobel founder

-

Vaccines do not cause autism: WHO

Vaccines do not cause autism: WHO

-

Crypto mogul Do Kwon sentenced to 15 years for fraud: US media

-

'In her prime': Rare blooming of palm trees in Rio

'In her prime': Rare blooming of palm trees in Rio

-

Make your own Mickey Mouse clip - Disney embraces AI

-

OpenAI beefs up GPT models in AI race with Google

OpenAI beefs up GPT models in AI race with Google

-

Dark, wet, choppy: Machado's secret sea escape from Venezuela

-

Cyclone causes blackout, flight chaos in Brazil's Sao Paulo

Cyclone causes blackout, flight chaos in Brazil's Sao Paulo

-

2024 Eurovision winner Nemo returns trophy over Israel's participation

-

US bringing seized tanker to port, as Venezuela war threats build

US bringing seized tanker to port, as Venezuela war threats build

-

Make your own AI Mickey Mouse - Disney embraces new tech

-

Time magazine names 'Architects of AI' as Person of the Year

Time magazine names 'Architects of AI' as Person of the Year

-

Floodworks on Athens 'oasis' a tough sell among locals

-

OpenAI, Disney to let fans create AI videos in landmark deal

OpenAI, Disney to let fans create AI videos in landmark deal

-

German growth forecasts slashed, Merz under pressure

-

Thyssenkrupp pauses steel production at two sites citing Asian pressure

Thyssenkrupp pauses steel production at two sites citing Asian pressure

-

ECB proposes simplifying rules for banks

-

Stocks mixed as US rate cut offset by Fed outlook, Oracle earnings

Stocks mixed as US rate cut offset by Fed outlook, Oracle earnings

-

Desert dunes beckon for Afghanistan's 4x4 fans

Markets track Wall St gains as tech inspires Hong Kong

Asian and European equity markets rallied on Tuesday following another positive day on Wall Street stoked by US data that eased recession fears, while Chinese tech firms helped propel another surge in Hong Kong.

Traders have kicked off the week on a positive note after Beijing at the weekend unveiled a range of measures aimed at reigniting activity in China's army of consumers.

That was followed Monday by figures showing US retail sales grew less than expected last month but a separate reading -- used to calculate economic growth -- topped forecasts, tempering possible concerns about a possible downturn.

However, while there have been no new announcements in recent days, investors continue to fret over the impact of Donald Trump's trade war on global growth.

Hong Kong, which has piled on more than a fifth since the turn of the year, rose 2.5 percent to lead the gains Tuesday thanks to further buying of Chinese tech firms including Alibaba, Tencent and JD.com.

Electric vehicle maker BYD was also a big winner, adding more than four percent -- having jumped more than six percent to a record at one point -- after unveiling battery technology it says can charge in five minutes.

Shanghai also rose, along with Tokyo, Sydney, Seoul, Singapore, Taipei, Mumbai and Bangkok.

However, trading in Jakarta was halted as the market tanked more than seven percent -- its biggest intraday drop since 2011 -- on worries about the Indonesian economy and weakening consumer spending heading into the Eid holiday period. It later resumed and pared its losses to four percent.

The bourse has plunged more than 10 percent so far this year as the economy struggles, and eyes are now on the country's central bank ahead of a policy decision due on Wednesday.

London rose at the open XXXX

The rally came after a second successive day of gains on Wall Street, which has been hammered this month by a sell-off sparked by Trump's tariffs campaign that many fear could ramp up US inflation and hammer the economy.

But SPI Asset Management's Stephen Innes warned investors that investors weer not out of the woods yet.

"Don't get too comfortable -- nervous eyes remain locked on Washington's tariff tumult," he wrote in a commentary.

"The storm is far from over, and with the next escalation looming, the market is still walking a fine line between optimism and another sharp reality check."

Uncertainty about the impact of the tariffs and renewed concerns about the Middle East after Israel struck targets in Gaza helped safe-haven gold hit a fresh record just short of $3,020.

This week is due to see policy decisions by the Federal Reserve, Bank of Japan and Bank of England, with all three forecast to stand pat on interest rates.

The US central bank's announcement will also come with updates to its outlook for the economy and interest rates this year, in light of Trump's trade measures as well as plans to slash taxes, immigration and federal jobs.

"We do not expect major changes in forward guidance on policy rates in the updated (policy board) statement," said Ryan Wang, US economist for HSBC.

"The statement could repeat that risks to (its) employment and inflation goals 'are roughly in balance' and that the 'economic outlook is uncertain'."

However, he did say that while he saw no major changes to the bank's median economic outlook, "the changes that we do expect are in a pessimistic direction".

- Key figures around 0815 GMT -

Tokyo - Nikkei 225: UP 1.2 percent at 37,845.42 (close)

Hong Kong - Hang Seng Index: UP 2.5 percent at 24,740.57 (close)

Shanghai - Composite: UP 0.1 percent at 3,429.76 (close)

London - FTSE 100: UP 0.4 percent at 8,711.68

Euro/dollar: UP at $1.0929 from $1.0925 on Monday

Pound/dollar: DOWN at $1.2987 from $1.2990

Dollar/yen: UP at 149.85 yen from 149.12 yen

Euro/pound: UP at 84.16 pence from 84.07 pence

West Texas Intermediate: UP 0.8 percent at $68.12 per barrel

Brent North Sea Crude: UP 0.8 percent at $71.62 per barrel

New York - Dow: UP 0.9 percent at 41,841.63 (close)

U.Ndiaye--CPN