-

Kenya's economy faces climate change risks: World Bank

Kenya's economy faces climate change risks: World Bank

-

Tokyo-bound United plane returns to Washington after engine fails

-

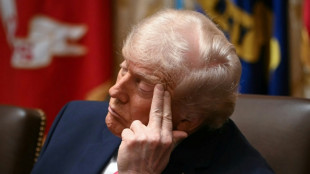

Deja vu? Trump accused of economic denial and physical decline

Deja vu? Trump accused of economic denial and physical decline

-

China's smaller manufacturers look to catch the automation wave

-

Hungary winemakers fear disease may 'wipe out' industry

Hungary winemakers fear disease may 'wipe out' industry

-

Campaigning starts in Central African Republic quadruple election

-

'Stop the slaughter': French farmers block roads over cow disease cull

'Stop the slaughter': French farmers block roads over cow disease cull

-

First urban cable car unveiled outside Paris

-

Why SpaceX IPO plan is generating so much buzz

Why SpaceX IPO plan is generating so much buzz

-

US unseals warrant for tanker seized off Venezuelan coast

-

World stocks mostly slide, consolidating Fed-fuelled gains

World stocks mostly slide, consolidating Fed-fuelled gains

-

Crypto firm Tether bids for Juventus, is quickly rebuffed

-

UK's king shares 'good news' that cancer treatment will be reduced in 2026

UK's king shares 'good news' that cancer treatment will be reduced in 2026

-

Can Venezuela survive US targeting its oil tankers?

-

Salah admired from afar in his Egypt home village as club tensions swirl

Salah admired from afar in his Egypt home village as club tensions swirl

-

World stocks retrench, consolidating Fed-fuelled gains

-

Iran frees child bride sentenced to death over husband's killing: activists

Iran frees child bride sentenced to death over husband's killing: activists

-

World stocks consolidate Fed-fuelled gains

-

France updates net-zero plan, with fossil fuel phaseout

France updates net-zero plan, with fossil fuel phaseout

-

Stocks rally in wake of Fed rate cut

-

EU agrees recycled plastic targets for cars

EU agrees recycled plastic targets for cars

-

British porn star to be deported from Bali after small fine

-

British porn star fined, faces imminent Bali deportation

British porn star fined, faces imminent Bali deportation

-

Spain opens doors to descendants of Franco-era exiles

-

Indonesia floods were 'extinction level' for rare orangutans

Indonesia floods were 'extinction level' for rare orangutans

-

Thai teacher finds 'peace amidst chaos' painting bunker murals

-

Japan bear victim's watch shows last movements

Japan bear victim's watch shows last movements

-

South Korea exam chief quits over complaints of too-hard tests

-

French indie 'Clair Obscur' dominates Game Awards

French indie 'Clair Obscur' dominates Game Awards

-

South Korea exam chief resigns after tests dubbed too hard

-

Asian markets track Wall St record after Fed cut

Asian markets track Wall St record after Fed cut

-

Laughing about science more important than ever: Ig Nobel founder

-

Vaccines do not cause autism: WHO

Vaccines do not cause autism: WHO

-

Crypto mogul Do Kwon sentenced to 15 years for fraud: US media

-

'In her prime': Rare blooming of palm trees in Rio

'In her prime': Rare blooming of palm trees in Rio

-

Make your own Mickey Mouse clip - Disney embraces AI

-

OpenAI beefs up GPT models in AI race with Google

OpenAI beefs up GPT models in AI race with Google

-

Dark, wet, choppy: Machado's secret sea escape from Venezuela

-

Cyclone causes blackout, flight chaos in Brazil's Sao Paulo

Cyclone causes blackout, flight chaos in Brazil's Sao Paulo

-

2024 Eurovision winner Nemo returns trophy over Israel's participation

-

US bringing seized tanker to port, as Venezuela war threats build

US bringing seized tanker to port, as Venezuela war threats build

-

Make your own AI Mickey Mouse - Disney embraces new tech

-

Time magazine names 'Architects of AI' as Person of the Year

Time magazine names 'Architects of AI' as Person of the Year

-

Floodworks on Athens 'oasis' a tough sell among locals

-

OpenAI, Disney to let fans create AI videos in landmark deal

OpenAI, Disney to let fans create AI videos in landmark deal

-

German growth forecasts slashed, Merz under pressure

-

Thyssenkrupp pauses steel production at two sites citing Asian pressure

Thyssenkrupp pauses steel production at two sites citing Asian pressure

-

ECB proposes simplifying rules for banks

-

Stocks mixed as US rate cut offset by Fed outlook, Oracle earnings

Stocks mixed as US rate cut offset by Fed outlook, Oracle earnings

-

Desert dunes beckon for Afghanistan's 4x4 fans

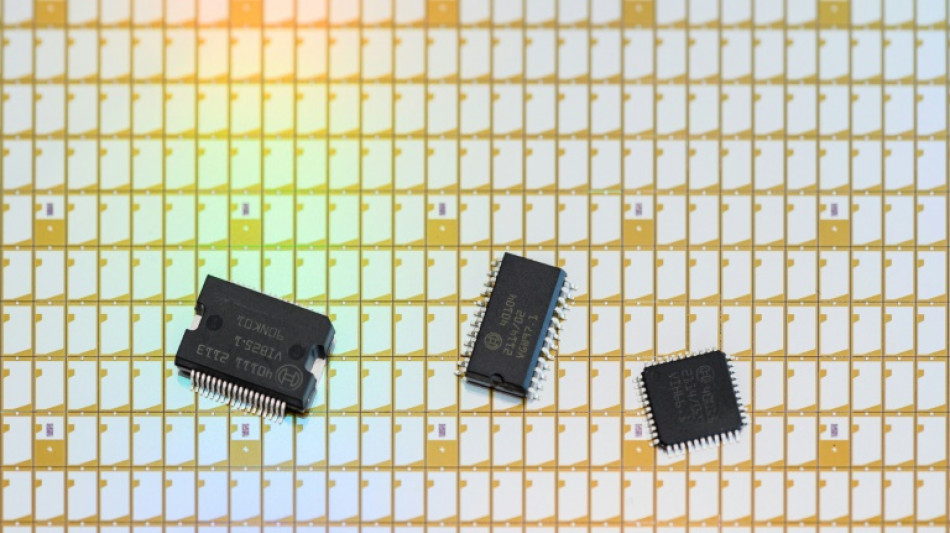

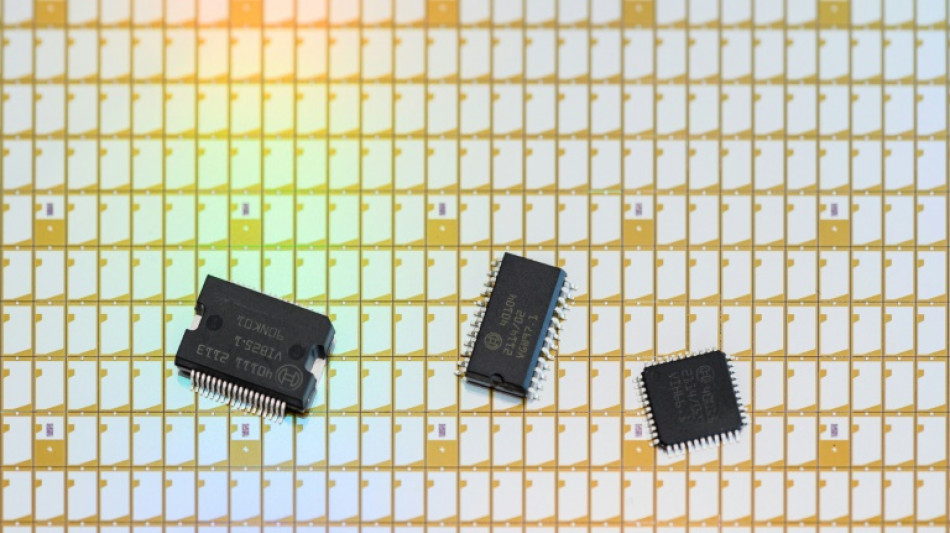

Taiwan chip firm's bid to buy German rival collapses

A Taiwanese semiconductor technology company's $4.5 billion deal to acquire a German rival collapsed on Tuesday after a deadline for Berlin to approve the bid passed without a decision.

The demise of GlobalWafers' attempt to buy Siltronic was welcomed by German politicians, who said the country had to protect its security interests.

The Taiwanese firm makes wafers, one-millimetre-thick sheets of silicon necessary for the manufacturing of semiconductors that are the backbone of the global technology sector.

GlobalWafers had signed an agreement with Siltronic in December 2020 to acquire all of the German company's outstanding shares at a 10 percent premium worth roughly $4.5 billion (4.0 billion euros).

But the deal needed regulatory approval from Berlin, which was not obtained by the January 31 deadline.

"Therefore, the takeover offer by GlobalWafers and the agreements which came into existence as a result of the offer will not be completed and will lapse," GlobalWafers said.

CEO Doris Hsu called it "disappointing" and said the Taiwanese company will work to "analyse the non-decision" by Berlin.

A spokeswoman for the German ministry for the economy and climate said in a statement that "not all the necessary investment review steps could be completed before the end of the period".

Siltronic said GlobalWafers will pay the German company a termination fee of 50 million euros ($56.1 million).

German politicians voiced support for the government's decision to drop the deal, according to local business newspaper Handelsblatt.

"We do not gain technological sovereignty by selling off our silverware," said Hannes Walter, vice chairman of the Economics Committee.

Julia Kloeckner, an economic policy spokeswoman for centre-right CDU/CSU parliamentary group, said the move was right to "keep our security interests in mind".

Governments are increasingly scrutinising huge takeovers in the global technology industry, rattled by growing national security concerns and supply chain crunches due to the pandemic.

US regulators filed a December lawsuit to block a $40 billion merger of graphics chip star Nvidia with mobile chip tech powerhouse Arm Ltd.

The Federal Trade Commission said it was fearful it could provide one of the largest semiconductor companies with control over computing technology and designs "that rival firms rely on to develop their own competing chips".

A.Zimmermann--CPN