-

Kenya's economy faces climate change risks: World Bank

Kenya's economy faces climate change risks: World Bank

-

Rome to charge visitors for access to Trevi Fountain

-

Stocks advance with focus on central banks, tech

Stocks advance with focus on central banks, tech

-

Norway crown princess likely to undergo lung transplant

-

France's budget hits snag in setback for embattled PM

France's budget hits snag in setback for embattled PM

-

Volatile Oracle shares a proxy for Wall Street's AI jitters

-

Japan hikes interest rates to 30-year-high

Japan hikes interest rates to 30-year-high

-

Brazil's top court strikes down law blocking Indigenous land claims

-

'We are ghosts': Britain's migrant night workers

'We are ghosts': Britain's migrant night workers

-

Asian markets rise as US inflation eases, Micron soothes tech fears

-

Trump signs $900 bn defense policy bill into law

Trump signs $900 bn defense policy bill into law

-

EU-Mercosur deal delayed as farmers stage Brussels show of force

-

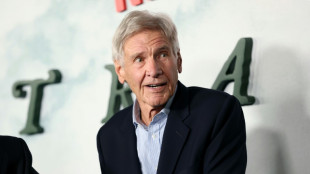

Harrison Ford to get lifetime acting award

Harrison Ford to get lifetime acting award

-

Trump health chief seeks to bar trans youth from gender-affirming care

-

Argentine unions in the street over Milei labor reforms

Argentine unions in the street over Milei labor reforms

-

Brazil open to EU-Mercosur deal delay as farmers protest in Brussels

-

Brussels farmer protest turns ugly as EU-Mercosur deal teeters

Brussels farmer protest turns ugly as EU-Mercosur deal teeters

-

US accuses S. Africa of harassing US officials working with Afrikaners

-

ECB holds rates as Lagarde stresses heightened uncertainty

ECB holds rates as Lagarde stresses heightened uncertainty

-

Trump Media announces merger with fusion power company

-

Stocks rise as US inflation cools, tech stocks bounce

Stocks rise as US inflation cools, tech stocks bounce

-

Zelensky presses EU to tap Russian assets at crunch summit

-

Danish 'ghetto' residents upbeat after EU court ruling

Danish 'ghetto' residents upbeat after EU court ruling

-

ECB holds rates but debate swirls over future

-

Bank of England cuts interest rate after UK inflation slides

Bank of England cuts interest rate after UK inflation slides

-

Have Iran's authorities given up on the mandatory hijab?

-

British energy giant BP extends shakeup with new CEO pick

British energy giant BP extends shakeup with new CEO pick

-

EU kicks off crunch summit on Russian asset plan for Ukraine

-

Sri Lanka plans $1.6 bn in cyclone recovery spending in 2026

Sri Lanka plans $1.6 bn in cyclone recovery spending in 2026

-

Most Asian markets track Wall St lower as AI fears mount

-

Danish 'ghetto' tenants hope for EU discrimination win

Danish 'ghetto' tenants hope for EU discrimination win

-

What to know about the EU-Mercosur deal

-

Trump vows economic boom, blames Biden in address to nation

Trump vows economic boom, blames Biden in address to nation

-

ECB set to hold rates but debate swirls over future

-

EU holds crunch summit on Russian asset plan for Ukraine

EU holds crunch summit on Russian asset plan for Ukraine

-

Nasdaq tumbles on renewed angst over AI building boom

-

Billionaire Trump nominee confirmed to lead NASA amid Moon race

Billionaire Trump nominee confirmed to lead NASA amid Moon race

-

CNN's future unclear as Trump applies pressure

-

German MPs approve 50 bn euros in military purchases

German MPs approve 50 bn euros in military purchases

-

EU's Mercosur trade deal hits French, Italian roadblock

-

Warner Bros rejects Paramount bid, sticks with Netflix

Warner Bros rejects Paramount bid, sticks with Netflix

-

Crude prices surge after Trump orders Venezuela oil blockade

-

Warner Bros. Discovery rejects Paramount bid

Warner Bros. Discovery rejects Paramount bid

-

Doctors in England go on strike for 14th time

-

Ghana's Highlife finds its rhythm on UNESCO world stage

Ghana's Highlife finds its rhythm on UNESCO world stage

-

Stocks gain as traders bet on interest rate moves

-

France probes 'foreign interference' after malware found on ferry

France probes 'foreign interference' after malware found on ferry

-

Europe's Ariane 6 rocket puts EU navigation satellites in orbit

-

Bleak end to the year as German business morale drops

Bleak end to the year as German business morale drops

-

Hundreds queue at Louvre museum as strike vote delays opening

| RYCEF | -0.98% | 15.25 | $ | |

| RBGPF | 0% | 80.22 | $ | |

| CMSC | 0.28% | 23.355 | $ | |

| SCS | 0.12% | 16.14 | $ | |

| BCC | -4.13% | 74.62 | $ | |

| VOD | 0.74% | 12.895 | $ | |

| NGG | 0.65% | 76.89 | $ | |

| RIO | 0.97% | 78.39 | $ | |

| JRI | -0.11% | 13.415 | $ | |

| CMSD | -0.06% | 23.265 | $ | |

| GSK | 0.94% | 48.746 | $ | |

| RELX | 0.57% | 40.885 | $ | |

| BCE | 0.54% | 22.975 | $ | |

| BP | 2.16% | 34.045 | $ | |

| AZN | 1.02% | 91.54 | $ | |

| BTI | -0.41% | 56.805 | $ |

UK govt launches flagship green energy plan

Britain's new Labour government launched its flagship green energy infrastructure plan on Tuesday, announcing a multi-billion-pound partnership with the business arm of the royal family to develop offshore wind farms.

Prime Minister Keir Starmer is establishing a publicly owned body called Great British Energy to spearhead funding in domestic renewable energy projects as the UK weans itself off fossil fuels.

"There is a massive prize within our reach, and make no mistake the race is on to get there," Starmer said of his pledge to ensure Britain's energy "independence".

His government has allocated £8.3 billion ($10 billion) of public money over the next five years as Labour aims to meet Britain's climate change targets.

It also wants to bring down the price of energy by reducing reliance on foreign imports of oil and gas.

GB Energy will also seek to attract private investment, and the government announced a first tie-up with the monarchy's land and property holdings company that aims to leverage private investment of £60 billion.

The Crown Estate is an independently run business whose profits go to the government, which passes on a small portion to the monarchy to support official duties of the royal family.

It is one of Europe's biggest property empires, owning vast swathes of Britain's seabed with a huge commercial potential in developing offshore wind power generation.

The Crown Estate estimates that its GB Energy partnership will lease enough offshore land to produce up to 30 gigawatts of new energy, enough to power almost 20 million homes, by 2030.

The UK currently produces only 14 gigawatts of energy through offshore wind, according to government data.

- 'Clean energy superpower' -

The government was introducing its legislation to establish GB Energy into parliament on Thursday.

The company is the bedrock of Labour's pledge made before its landslide general election victory against the Conservatives on July 4 to make Britain a "clean energy superpower".

Labour, in power for the first time since 2010, is committed to meeting the UK's legal obligation of reaching net zero carbon emissions by 2050.

It also wants to decarbonise Britain's electricity grid by 2030, although experts have said the ambitious target will be difficult to meet.

Starmer's government has already ended a ban on new onshore wind farms in England that the Conservatives imposed in 2015.

The government is introducing a separate bill to widen the investment powers of the Crown Estate, giving it more scope to borrow for investments including offshore wind projects.

It has also proposed boosting investment in sustainable aviation fuel plants across the country.

Profit from the Crown Estate more than doubled last year to a record £1.1 billion, driven by a short-term boost from offshore wind farms, according to annual accounts published on Wednesday.

The government says GB Energy will have five key functions, including leading projects and building supply chains. It will not produce its own power.

New technologies it will invest in include carbon capture and storage, hydrogen, wave and tidal energy.

The public financing of the body will be funded through windfall taxes levied on oil and gas companies.

British customers' energy bills have soared since key producer Russia launched a full-scaled invasion of neighbouring Ukraine in February 2022.

Labour maintains the party's net-zero energy plans will save households £300 a year on their bills.

But the Conservatives' energy spokeswoman Claire Coutinho called GB Energy "nothing but a gimmick that will end up costing families, not cutting bills".

J.Bondarev--CPN