-

Kenya's economy faces climate change risks: World Bank

Kenya's economy faces climate change risks: World Bank

-

Bangladesh Islamist leader seeks power in post-uprising vote

-

Japan to restart world's biggest nuclear plant

Japan to restart world's biggest nuclear plant

-

UK royal finances in spotlight after Andrew's downfall

-

Undercover probe finds Australian pubs short-pouring beer

Undercover probe finds Australian pubs short-pouring beer

-

New Zealand deputy PM defends claims colonisation good for Maori

-

Amazon shares plunge as AI costs climb

Amazon shares plunge as AI costs climb

-

Deadly storm sparks floods in Spain, raises calls to postpone Portugal vote

-

Carney scraps Canada EV sales mandate, affirms auto sector's future is electric

Carney scraps Canada EV sales mandate, affirms auto sector's future is electric

-

Lower pollution during Covid boosted methane: study

-

Carney scraps Canada EV sales mandate

Carney scraps Canada EV sales mandate

-

Record January window for transfers despite drop in spending

-

Mining giant Rio Tinto abandons Glencore merger bid

Mining giant Rio Tinto abandons Glencore merger bid

-

Davos forum opens probe into CEO Brende's Epstein links

-

ECB warns of stronger euro impact, holds rates

ECB warns of stronger euro impact, holds rates

-

Greece aims to cut queues at ancient sites with new portal

-

ECB holds interest rates as strong euro causes jitters

ECB holds interest rates as strong euro causes jitters

-

What does Iran want from talks with the US?

-

Wind turbine maker Vestas sees record revenue in 2025

Wind turbine maker Vestas sees record revenue in 2025

-

Bitcoin under $70,000 for first time since Trump's election

-

Germany claws back 59 mn euros from Amazon over price controls

Germany claws back 59 mn euros from Amazon over price controls

-

Germany claws back 70 mn euros from Amazon over price controls

-

Stock markets drop amid tech concerns before rate calls

Stock markets drop amid tech concerns before rate calls

-

BBVA posts record profit after failed Sabadell takeover

-

UN human rights agency in 'survival mode': chief

UN human rights agency in 'survival mode': chief

-

Greenpeace slams fossel fuel sponsors for Winter Olympics

-

Russia says thwarted smuggling of giant meteorite to UK

Russia says thwarted smuggling of giant meteorite to UK

-

Heathrow still Europe's busiest airport, but Istanbul gaining fast

-

Shell profits climb despite falling oil prices

Shell profits climb despite falling oil prices

-

German factory orders rise at fastest rate in 2 years in December

-

Trump fuels EU push to cut cord with US tech

Trump fuels EU push to cut cord with US tech

-

Top US news anchor pleads with kidnappers for mom's life

-

The coming end of ISS, symbol of an era of global cooperation

The coming end of ISS, symbol of an era of global cooperation

-

New crew set to launch for ISS after medical evacuation

-

Stocks in retreat as traders reconsider tech investment

Stocks in retreat as traders reconsider tech investment

-

Fiji football legend returns home to captain first pro club

-

Barry Manilow cancels Las Vegas shows but 'doing great' post-surgery

Barry Manilow cancels Las Vegas shows but 'doing great' post-surgery

-

Rising euro, falling inflation in focus at ECB meeting

-

AI to track icebergs adrift at sea in boon for science

AI to track icebergs adrift at sea in boon for science

-

Google's annual revenue tops $400 bn for first time, AI investments rise

-

Boxer Khelif reveals 'hormone treatments' before Paris Olympics

Boxer Khelif reveals 'hormone treatments' before Paris Olympics

-

BHP damages trial over Brazil mine disaster to open in 2027

-

Bezos-led Washington Post announces 'painful' job cuts

Bezos-led Washington Post announces 'painful' job cuts

-

UK PM says Mandelson 'lied' about Epstein relations

-

Trump suggests 'softer touch' needed on immigration

Trump suggests 'softer touch' needed on immigration

-

Panama hits back after China warns of 'heavy price' in ports row

-

US seeks minerals trade zone in rare Trump move with allies

US seeks minerals trade zone in rare Trump move with allies

-

US removing 700 immigration officers from Minnesota

-

Son of Norway's crown princess admits excesses but denies rape

Son of Norway's crown princess admits excesses but denies rape

-

Netflix film probes conviction of UK baby killer nurse

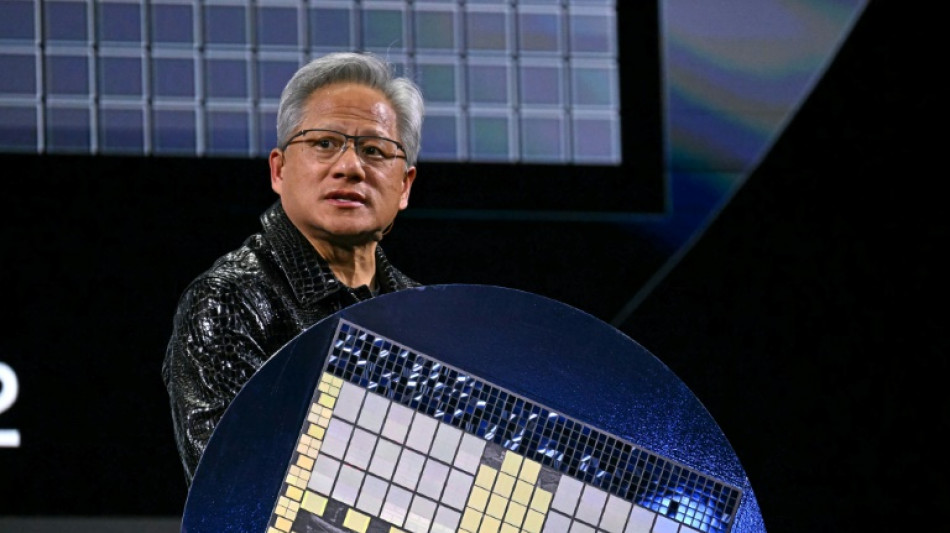

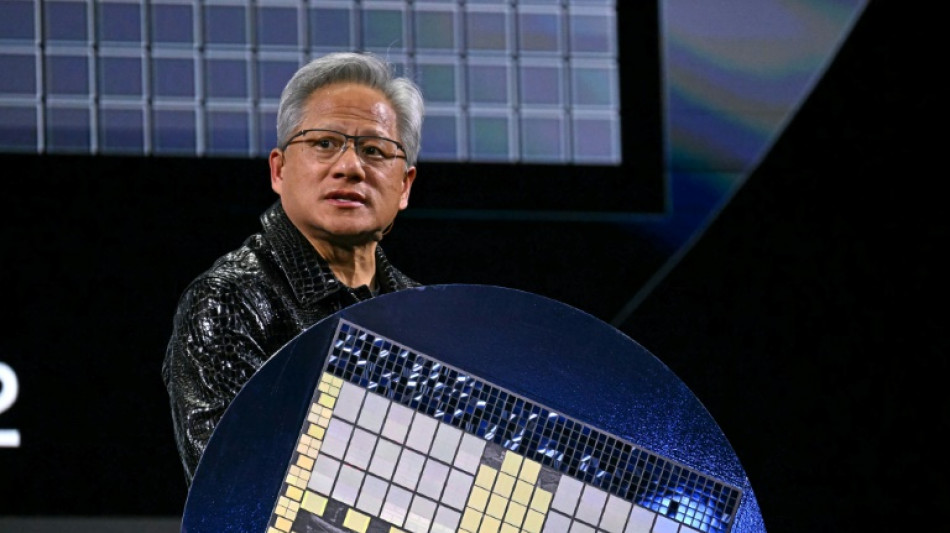

AI giant Nvidia becomes first company to reach $4 tn in value

Nvidia became the first company to touch $4 trillion in market value on Wednesday, a new milestone in Wall Street's bet that artificial intelligence will transform the economy.

Shortly after the stock market opened, Nvidia vaulted as high as $164.42, giving it a valuation above $4 trillion. The stock subsequently edged lower, ending just under the record threshold.

"The market has an incredible certainty that AI is the future," said Steve Sosnick of Interactive Brokers. "Nvidia is certainly the company most positioned to benefit from that gold rush."

Nvidia, led by electrical engineer Jensen Huang, now has a market value greater than the GDP of France, Britain or India, a testament to investor confidence that AI will spur a new era of robotics and automation.

The California chip company's latest surge is helping drive a recovery in the broader stock market, as Nvidia itself outperforms major indices.

Part of this is due to relief that President Donald Trump has walked back his most draconian tariffs, which pummeled global markets in early April.

Even as Trump announced new tariff actions in recent days, US stocks have stayed at lofty levels, with the tech-centered Nasdaq ending at a fresh record on Wednesday.

"You've seen the markets walk us back from a worst-case scenario in terms of tariffs," said Angelo Zino, technology analyst at CFRA Research.

While Nvidia still faces US export controls to China as well as broader tariff uncertainty, the company's deal to build AI infrastructure in Saudi Arabia during a Trump state visit in May showed a potential upside in the US president's trade policy.

"We've seen the administration using Nvidia chips as a bargaining chip," Zino said.

- New advances -

Nvidia's surge to $4 trillion marks a new benchmark in a fairly consistent rise over the last two years as AI enthusiasm has built.

In 2025 so far, the company's shares have risen more than 21 percent, whereas the Nasdaq has gained 6.7 percent.

Taiwan-born Huang has wowed investors with a series of advances, including its core product: graphics processing units (GPUs), key to many of the generative AI programs behind autonomous driving, robotics and other cutting-edge domains.

The company has also unveiled its Blackwell next-generation technology allowing more super processing capacity. One of its advances is "real-time digital twins," significantly speeding production development time in manufacturing, aerospace and myriad other sectors.

However, Nvidia's winning streak was challenged early in 2025 when China-based DeepSeek shook up the world of generative AI with a low-cost, high-performance model that challenged the hegemony of OpenAI and other big-spending behemoths.

Nvidia's lost some $600 billion in market valuation in a single session during this period.

Huang has welcomed DeepSeek's presence, while arguing against US export constraints.

- AI race -

In the most recent quarter, Nvidia reported earnings of nearly $19 billion despite a $4.5 billion hit from US export controls limiting sales of cutting-edge technology to China.

The first-quarter earnings period also revealed that momentum for AI remained strong. Many of the biggest tech companies -- Microsoft, Google, Amazon and Meta -- are jostling to come out on top in the multi-billion-dollar AI race.

A recent UBS survey of technology executives showed Nvidia widening its lead over rivals.

Zino said Nvidia's latest surge reflected a fuller understanding of DeepSeek, which has ultimately stimulated investment in complex reasoning models but not threatened Nvidia's business.

Nvidia is at the forefront of "AI agents," the current focus in generative AI in which machines are able to reason and infer more than in the past, he said.

"Overall the demand landscape has improved for 2026 for these more complex reasoning models," Zino said.

But the speedy growth of AI will also be a source of disruption.

Executives at Ford, JPMorgan Chase and Amazon are among those who have begun to say the "quiet part out loud," according to a Wall Street Journal report recounting recent public acknowledgment of white-collar job loss due to AI.

Shares of Nvidia closed the day at $162.88, up 1.8 percent, finishing at just under $4 trillion in market value.

P.Gonzales--CPN