-

Kenya's economy faces climate change risks: World Bank

Kenya's economy faces climate change risks: World Bank

-

Volatile Oracle shares a proxy for Wall Street's AI jitters

-

Japan hikes interest rates to 30-year-high

Japan hikes interest rates to 30-year-high

-

Brazil's top court strikes down law blocking Indigenous land claims

-

'We are ghosts': Britain's migrant night workers

'We are ghosts': Britain's migrant night workers

-

Asian markets rise as US inflation eases, Micron soothes tech fears

-

Trump signs $900 bn defense policy bill into law

Trump signs $900 bn defense policy bill into law

-

EU-Mercosur deal delayed as farmers stage Brussels show of force

-

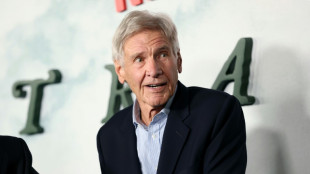

Harrison Ford to get lifetime acting award

Harrison Ford to get lifetime acting award

-

Trump health chief seeks to bar trans youth from gender-affirming care

-

Argentine unions in the street over Milei labor reforms

Argentine unions in the street over Milei labor reforms

-

Brazil open to EU-Mercosur deal delay as farmers protest in Brussels

-

Brussels farmer protest turns ugly as EU-Mercosur deal teeters

Brussels farmer protest turns ugly as EU-Mercosur deal teeters

-

US accuses S. Africa of harassing US officials working with Afrikaners

-

ECB holds rates as Lagarde stresses heightened uncertainty

ECB holds rates as Lagarde stresses heightened uncertainty

-

Trump Media announces merger with fusion power company

-

Stocks rise as US inflation cools, tech stocks bounce

Stocks rise as US inflation cools, tech stocks bounce

-

Zelensky presses EU to tap Russian assets at crunch summit

-

Danish 'ghetto' residents upbeat after EU court ruling

Danish 'ghetto' residents upbeat after EU court ruling

-

ECB holds rates but debate swirls over future

-

Bank of England cuts interest rate after UK inflation slides

Bank of England cuts interest rate after UK inflation slides

-

Have Iran's authorities given up on the mandatory hijab?

-

British energy giant BP extends shakeup with new CEO pick

British energy giant BP extends shakeup with new CEO pick

-

EU kicks off crunch summit on Russian asset plan for Ukraine

-

Sri Lanka plans $1.6 bn in cyclone recovery spending in 2026

Sri Lanka plans $1.6 bn in cyclone recovery spending in 2026

-

Most Asian markets track Wall St lower as AI fears mount

-

Danish 'ghetto' tenants hope for EU discrimination win

Danish 'ghetto' tenants hope for EU discrimination win

-

What to know about the EU-Mercosur deal

-

Trump vows economic boom, blames Biden in address to nation

Trump vows economic boom, blames Biden in address to nation

-

ECB set to hold rates but debate swirls over future

-

EU holds crunch summit on Russian asset plan for Ukraine

EU holds crunch summit on Russian asset plan for Ukraine

-

Nasdaq tumbles on renewed angst over AI building boom

-

Billionaire Trump nominee confirmed to lead NASA amid Moon race

Billionaire Trump nominee confirmed to lead NASA amid Moon race

-

CNN's future unclear as Trump applies pressure

-

German MPs approve 50 bn euros in military purchases

German MPs approve 50 bn euros in military purchases

-

EU's Mercosur trade deal hits French, Italian roadblock

-

Warner Bros rejects Paramount bid, sticks with Netflix

Warner Bros rejects Paramount bid, sticks with Netflix

-

Crude prices surge after Trump orders Venezuela oil blockade

-

Warner Bros. Discovery rejects Paramount bid

Warner Bros. Discovery rejects Paramount bid

-

Doctors in England go on strike for 14th time

-

Ghana's Highlife finds its rhythm on UNESCO world stage

Ghana's Highlife finds its rhythm on UNESCO world stage

-

Stocks gain as traders bet on interest rate moves

-

France probes 'foreign interference' after malware found on ferry

France probes 'foreign interference' after malware found on ferry

-

Europe's Ariane 6 rocket puts EU navigation satellites in orbit

-

Bleak end to the year as German business morale drops

Bleak end to the year as German business morale drops

-

Hundreds queue at Louvre museum as strike vote delays opening

-

Markets rise even as US jobs data fail to boost rate cut bets

Markets rise even as US jobs data fail to boost rate cut bets

-

Asian markets mixed as US jobs data fails to boost rate cut hopes

-

Bondi shooting shocks, angers Australia Jewish community

Bondi shooting shocks, angers Australia Jewish community

-

UK experiences sunniest year on record

'Positive signs' for chip world as ASML profits soar

Dutch tech giant ASML, which supplies chipmaking machines to the semiconductor industry, reported Wednesday a rise in annual net profit despite a high-tech trade spat between China and the West.

Net profits came in at 7.8 billion euros ($8.5 billion) for 2023, the firm said in its annual results, compared to 5.6 billion euros the previous year.

"The semiconductor industry continues to work through the bottom of the cycle," CEO Peter Wennink said in a statement.

"Although our customers are still not certain about the shape of the semiconductor market recovery this year, there are some positive signs," he added.

ASML is one of the world's leading manufacturers of equipment to make state-of-the-art semiconductor chips, which power everything from mobile phones to cars.

But the semiconductor industry has become a geopolitical battleground, as the West seeks to restrict China's access over fears the chips could be used for advanced weaponry.

ASML announced earlier this month that it had been blocked from exporting "a small number" of its advanced machines to China, amid reports of US pressure on the Dutch government.

At the time, Beijing lashed out at what it called "bullying behaviour" by Washington, adding that it "seriously violates international trade rules".

China has described the restrictions placed on exports as "technological terrorism".

Amid the trade tensions with China, there are also concerns Beijing may introduce its own export controls on gallium and germanium -- two rare earth metals critical for the manufacture of semiconductors.

ASML has shrugged off the financial impact of the geopolitical headwinds, with top officials saying the firm is well placed to weather the storm.

- 'Significant growth' for 2025 -

The company has said it expects flat sales this year, which it has called a "transition year", before registering "significant growth" in 2025.

Overall net sales for 2023 came in at 27.6 billion euros, up from 21.1 billion euros in 2022.

The numbers for the fourth quarter were also slightly better than the firm had expected, with profits of 2.0 billion euros on sales of 7.2 billion euros.

ASML said its pipeline was also robust, with net bookings nearly tripling to 9.2 billion euros in the fourth quarter compared to 2.6 billion euros in the third.

"Our strong order intake in the fourth quarter clearly supports future demand," Wennink said.

However, net bookings were down for the year as a whole, at 20.0 billion euros compared to 30.6 billion euros in 2022.

The firm said sales in the first quarter of this year were expected to slow compared to the pace set in the fourth quarter of last year, with a forecast of 5.0 to 5.5 billion euros.

"In spite of the positive signs as described above, we maintain our conservative view for the total year and expect 2024 revenue to be similar to 2023," Wennink said.

"We also expect 2024 to be an important year to prepare for significant growth that we expect for 2025."

P.Kolisnyk--CPN