-

Kenya's economy faces climate change risks: World Bank

Kenya's economy faces climate change risks: World Bank

-

China factory activity loses steam in January

-

Melania Trump's atypical, divisive doc opens in theatres

Melania Trump's atypical, divisive doc opens in theatres

-

Gold, silver prices tumble as investors soothed by Trump Fed pick

-

US Senate votes on funding deal - but shutdown still imminent

US Senate votes on funding deal - but shutdown still imminent

-

Trump expects Iran to seek deal to avoid US strikes

-

NASA delays Moon mission over frigid weather

NASA delays Moon mission over frigid weather

-

Fela Kuti: first African to get Grammys Lifetime Achievement Award

-

Cubans queue for fuel as Trump issues oil ultimatum

Cubans queue for fuel as Trump issues oil ultimatum

-

France rescues over 6,000 UK-bound Channel migrants in 2025

-

Analysts say Kevin Warsh a safe choice for US Fed chair

Analysts say Kevin Warsh a safe choice for US Fed chair

-

Fela Kuti to be first African to get Grammys Lifetime Achievement Award

-

Gold, silver prices tumble as investors soothed by Trump's Fed pick

Gold, silver prices tumble as investors soothed by Trump's Fed pick

-

Social media fuels surge in UK men seeking testosterone jabs

-

Trump nominates former US Fed official as next central bank chief

Trump nominates former US Fed official as next central bank chief

-

Chad, France eye economic cooperation as they reset strained ties

-

Artist chains up thrashing robot dog to expose AI fears

Artist chains up thrashing robot dog to expose AI fears

-

Dutch watchdog launches Roblox probe over 'risks to children'

-

Cuddly Olympics mascot facing life or death struggle in the wild

Cuddly Olympics mascot facing life or death struggle in the wild

-

UK schoolgirl game character Amelia co-opted by far-right

-

Panama court annuls Hong Kong firm's canal port concession

Panama court annuls Hong Kong firm's canal port concession

-

Asian stocks hit by fresh tech fears as gold retreats from peak

-

Apple earnings soar as China iPhone sales surge

Apple earnings soar as China iPhone sales surge

-

With Trump administration watching, Canada oil hub faces separatist bid

-

What are the key challenges awaiting the new US Fed chair?

What are the key challenges awaiting the new US Fed chair?

-

Moscow records heaviest snowfall in over 200 years

-

Polar bears bulk up despite melting Norwegian Arctic: study

Polar bears bulk up despite melting Norwegian Arctic: study

-

Waymo gears up to launch robotaxis in London this year

-

French IT group Capgemini under fire over ICE links

French IT group Capgemini under fire over ICE links

-

Czechs wind up black coal mining in green energy switch

-

EU eyes migration clampdown with push on deportations, visas

EU eyes migration clampdown with push on deportations, visas

-

Northern Mozambique: massive gas potential in an insurgency zone

-

Gold demand hits record high on Trump policy doubts: industry

Gold demand hits record high on Trump policy doubts: industry

-

UK drugs giant AstraZeneca announces $15 bn investment in China

-

Ghana moves to rewrite mining laws for bigger share of gold revenues

Ghana moves to rewrite mining laws for bigger share of gold revenues

-

Russia's sanctioned oil firm Lukoil to sell foreign assets to Carlyle

-

Gold soars towards $5,600 as Trump rattles sabre over Iran

Gold soars towards $5,600 as Trump rattles sabre over Iran

-

Deutsche Bank logs record profits, as new probe casts shadow

-

Vietnam and EU upgrade ties as EU chief visits Hanoi

Vietnam and EU upgrade ties as EU chief visits Hanoi

-

Hongkongers snap up silver as gold becomes 'too expensive'

-

Gold soars past $5,500 as Trump sabre rattles over Iran

Gold soars past $5,500 as Trump sabre rattles over Iran

-

Samsung logs best-ever profit on AI chip demand

-

China's ambassador warns Australia on buyback of key port

China's ambassador warns Australia on buyback of key port

-

As US tensions churn, new generation of protest singers meet the moment

-

Venezuelans eye economic revival with hoped-for oil resurgence

Venezuelans eye economic revival with hoped-for oil resurgence

-

Samsung Electronics posts record profit on AI demand

-

Formerra to Supply Foster Medical Compounds in Europe

Formerra to Supply Foster Medical Compounds in Europe

-

French Senate adopts bill to return colonial-era art

-

Tesla profits tumble on lower EV sales, AI spending surge

Tesla profits tumble on lower EV sales, AI spending surge

-

Meta shares jump on strong earnings report

US stocks end mostly higher despite drop in Nvidia

Wall Street stocks mostly rose Tuesday as optimism over a likely end to the US government shutdown offset weakness in some leading technology equities.

After Monday's rally, US stocks opened mostly lower on lingering unease about the stratospheric valuation growth of major players in artificial intelligence.

Those worries ebbed a bit as the session progressed, with some large tech equities finishing in positive territory. But the tech-heavy Nasdaq Composite was down 0.3 percent, the only one of the three main US indices to retreat.

"There's definitely concern over valuations but that valuations don't mean the market's going to sell off," said Tim Urbanowicz of Innovator Capital Management, adding "it just leaves a lot less room for bad news."

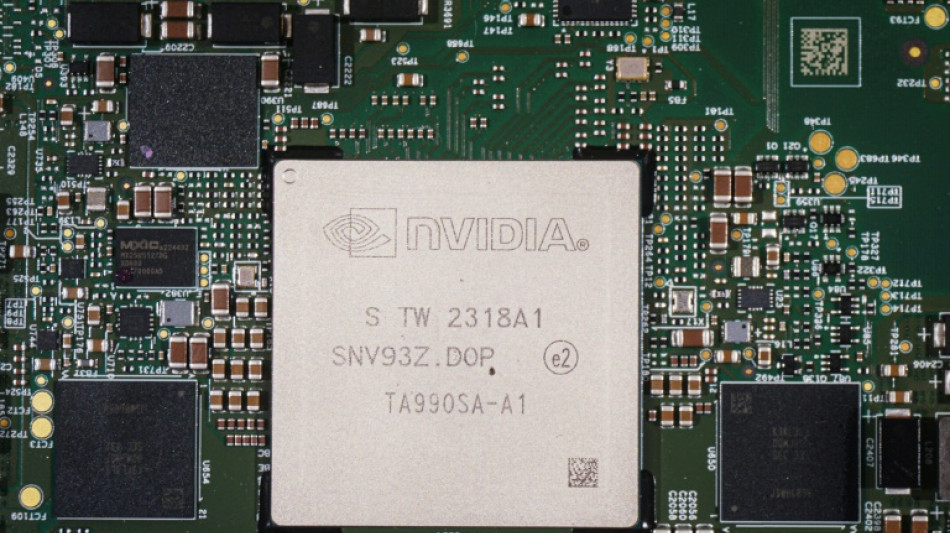

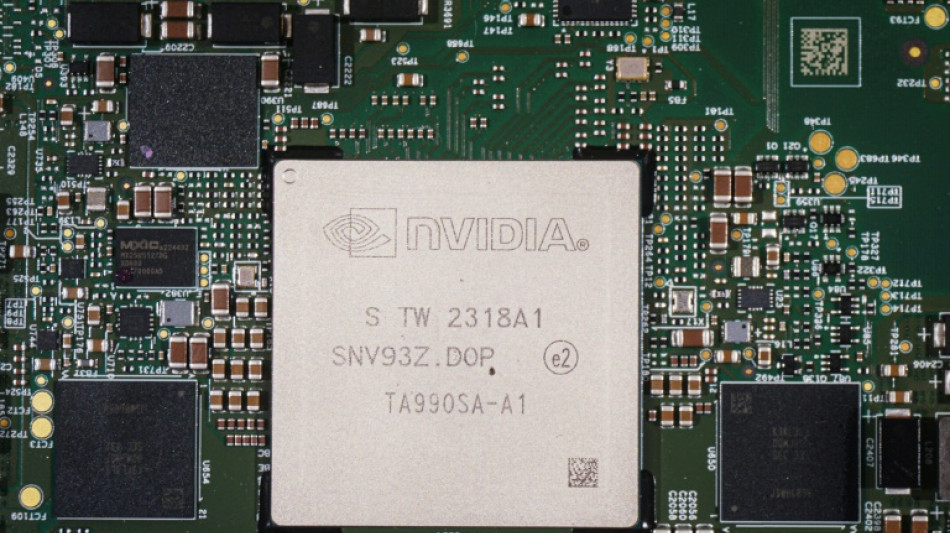

Japan's SoftBank announced it sold $5.8 billion worth of shares in US chip giant Nvidia last month. SoftBank did not give a reason for the Nvidia stock sale in its earnings statement.

Shares in Nvidia, whose processors are prized by companies training and operating AI models, fell 3.0 percent.

"For the wider investment community, when big investors cash out of their AI positions, they will take notice, and this is why the stock is declining today," said Kathleen Brooks, research director at XTB trading group.

More broadly, Brooks said tech stocks were no longer providing market momentum.

"Without momentum helping US indices move higher, volatility could take hold, so we are not expecting stocks to move in a straight line for now, and the market correction may not be over," she said in a note to clients.

Some market watchers viewed Tuesday's strong rise in the Dow as evidence of a rotation to industrial names from tech.

Investors have been cheered by the progress on legislation on Capitol Hill to reopen the government.

On Monday night several Democratic senators broke ranks to join Republicans in a 60-40 vote passing legislation to reopen the government, which would trigger a release of US economic reports on labor, consumer prices and other key benchmarks in the coming weeks.

Tuesday's session was held on Veteran's Day, a US holiday, resulting in lower volumes than normal.

Europe's main stock markets climbed Tuesday.

London's top-tier FTSE 100 index reached a fresh record high as a weakening pound boosted multi-nationals earning in dollars, while Paris won solid gains in a day that is also a public holiday in France.

- Key figures at 2110 GMT -

New York - Dow: UP 1.2 percent at 47,927.96 (close)

New York - S&P 500: UP 0.2 percent at 6,846.61 (close)

New York - Nasdaq Composite: DOWN 0.3 percent at 23,468.30 (close)

London - FTSE 100: UP 1.2 percent at 9,899.60 (close)

Paris - CAC 40: UP 1.3 percent at 8,156.23 (close)

Frankfurt - DAX: UP 0.5 percent at 24,088.06 (close)

Tokyo - Nikkei 225: DOWN 0.1 percent at 50,842.93 (close)

Hong Kong - Hang Seng Index: UP 0.2 percent at 26,696.41 (close)

Shanghai - Composite: DOWN 0.4 percent at 4,002.76 (close)

Euro/dollar: UP at $1.1588 from $1.1557 on Monday

Pound/dollar: DOWN at $1.3168 from $1.3175

Dollar/yen: DOWN at 154.10 yen from 154.15 yen

Euro/pound: UP at 87.99 pence from 87.72 pence

Brent North Sea Crude: UP 1.7 percent at $65.16 per barrel

West Texas Intermediate: UP 1.5 percent at $61.04 per barrel

burs-jmb/jgc

D.Avraham--CPN