-

Kenya's economy faces climate change risks: World Bank

Kenya's economy faces climate change risks: World Bank

-

French IT giant Capgemini to sell US subsidiary after row over ICE links

-

New Epstein accuser claims sexual encounter with ex-prince Andrew: report

New Epstein accuser claims sexual encounter with ex-prince Andrew: report

-

Snowstorm disrupts travel in southern US as blast of icy weather widens

-

Afghan returnees in Bamiyan struggle despite new homes

Afghan returnees in Bamiyan struggle despite new homes

-

Mired in economic trouble, Bangladesh pins hopes on election boost

-

Chinese cash in jewellery at automated gold recyclers as prices soar

Chinese cash in jewellery at automated gold recyclers as prices soar

-

Nvidia boss insists 'huge' investment in OpenAI on track

-

Snowstorm barrels into southern US as blast of icy weather widens

Snowstorm barrels into southern US as blast of icy weather widens

-

Ex-prince Andrew again caught up in Epstein scandal

-

How Lego got swept up in US-Mexico trade frictions

How Lego got swept up in US-Mexico trade frictions

-

Snow storm barrels into southern US as blast of icy weather widens

-

Ex-prince Andrew dogged again by Epstein scandal

Ex-prince Andrew dogged again by Epstein scandal

-

'Malfunction' cuts power in Ukraine. Here's what we know

-

Women in ties return as feminism faces pushback

Women in ties return as feminism faces pushback

-

Ship ahoy! Prague's homeless find safe haven on river boat

-

Epstein offered ex-prince Andrew meeting with Russian woman: files

Epstein offered ex-prince Andrew meeting with Russian woman: files

-

China factory activity loses steam in January

-

Melania Trump's atypical, divisive doc opens in theatres

Melania Trump's atypical, divisive doc opens in theatres

-

Gold, silver prices tumble as investors soothed by Trump Fed pick

-

US Senate votes on funding deal - but shutdown still imminent

US Senate votes on funding deal - but shutdown still imminent

-

Trump expects Iran to seek deal to avoid US strikes

-

NASA delays Moon mission over frigid weather

NASA delays Moon mission over frigid weather

-

Fela Kuti: first African to get Grammys Lifetime Achievement Award

-

Cubans queue for fuel as Trump issues oil ultimatum

Cubans queue for fuel as Trump issues oil ultimatum

-

France rescues over 6,000 UK-bound Channel migrants in 2025

-

Analysts say Kevin Warsh a safe choice for US Fed chair

Analysts say Kevin Warsh a safe choice for US Fed chair

-

Fela Kuti to be first African to get Grammys Lifetime Achievement Award

-

Gold, silver prices tumble as investors soothed by Trump's Fed pick

Gold, silver prices tumble as investors soothed by Trump's Fed pick

-

Social media fuels surge in UK men seeking testosterone jabs

-

Trump nominates former US Fed official as next central bank chief

Trump nominates former US Fed official as next central bank chief

-

Chad, France eye economic cooperation as they reset strained ties

-

Artist chains up thrashing robot dog to expose AI fears

Artist chains up thrashing robot dog to expose AI fears

-

Dutch watchdog launches Roblox probe over 'risks to children'

-

Cuddly Olympics mascot facing life or death struggle in the wild

Cuddly Olympics mascot facing life or death struggle in the wild

-

UK schoolgirl game character Amelia co-opted by far-right

-

Panama court annuls Hong Kong firm's canal port concession

Panama court annuls Hong Kong firm's canal port concession

-

Asian stocks hit by fresh tech fears as gold retreats from peak

-

Apple earnings soar as China iPhone sales surge

Apple earnings soar as China iPhone sales surge

-

With Trump administration watching, Canada oil hub faces separatist bid

-

What are the key challenges awaiting the new US Fed chair?

What are the key challenges awaiting the new US Fed chair?

-

Moscow records heaviest snowfall in over 200 years

-

Polar bears bulk up despite melting Norwegian Arctic: study

Polar bears bulk up despite melting Norwegian Arctic: study

-

Waymo gears up to launch robotaxis in London this year

-

French IT group Capgemini under fire over ICE links

French IT group Capgemini under fire over ICE links

-

Czechs wind up black coal mining in green energy switch

-

EU eyes migration clampdown with push on deportations, visas

EU eyes migration clampdown with push on deportations, visas

-

Northern Mozambique: massive gas potential in an insurgency zone

-

Gold demand hits record high on Trump policy doubts: industry

Gold demand hits record high on Trump policy doubts: industry

-

UK drugs giant AstraZeneca announces $15 bn investment in China

Tech stocks fuel Asian and European gains, Wall Street wobbles

A surge in tech stocks helped fuel gains in Asia and Europe, but Wall Street wobbled as a partial US government shutdown entered a second day.

While both the S&P 500 and Nasdaq Composite pushed higher from record closes at the opening bell, those gains faded and Wall Street was mostly lower in late morning trading.

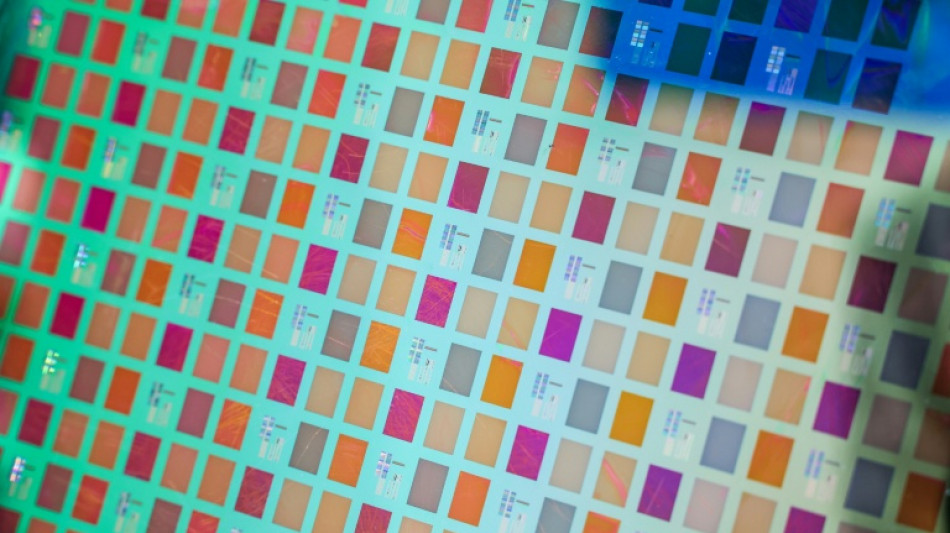

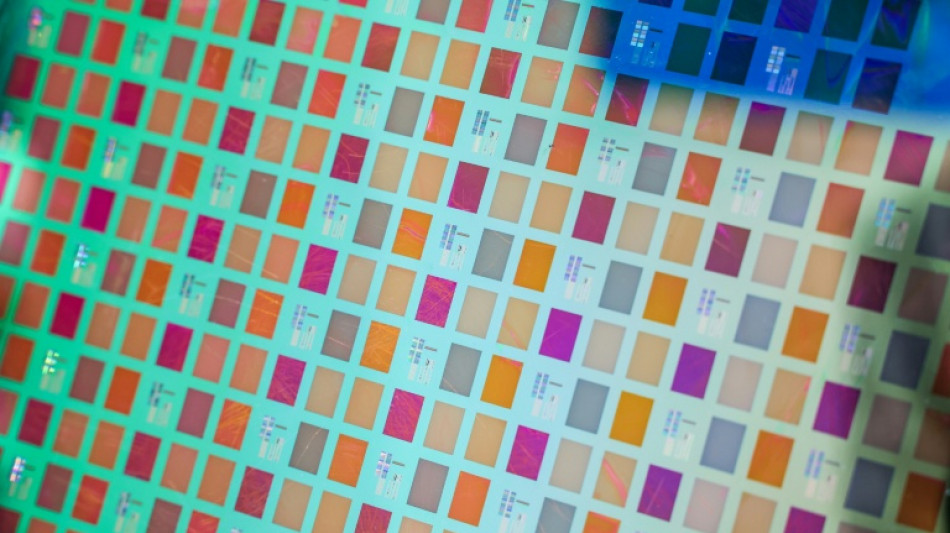

The trading day started off positively in Asia, with tech stocks surging as South Korea's biggest chip firms agreed to supply chips and other equipment to OpenAI's Stargate project for AI infrastructure.

South Korea's Kospi index climbed 2.7 percent to a record high, thanks to Samsung and SK hynix shares soaring to one-year highs after the firms signed a preliminary deal with the ChatGPT developer OpenAI.

Tokyo rose, as did Hong Kong's tech-heavy Hang Seng index. Shanghai was closed for a week-long holiday.

Taipei's stock index jumped 1.5 percent as chip titan and market heavyweight TSMC piled on three percent.

The positive trend continued into European trading, with Europe's tech companies also rising. Shares in ASML gained 4.5 percent, and STMicroelectronics and Schneider Electric adding more than two percent.

But shares in US tech firms didn't fare as well, with leading AI chipmaker Nvidia up 1.1 percent.

Tech companies have been at the forefront of a surge across markets this year as investors pile into all things linked to artificial intelligence, with hundreds of billions being pumped into the sector.

OpenAI is now worth $500 billion, based on a recent private sale of shares, making it the world's most valuable startup, according to financial media reports Thursday.

Both Paris and Frankfurt stock markets finished the day up more than one percent, with automakers also rallying. London dipped.

The start of the closure of some US departments owing to a funding standoff between lawmakers in Washington did not phase investors, who were more focused on the outlook for more Federal Reserve rate cuts. Figures from payrolls firm ADP on Wednesday showed the US private sector shed jobs in September, despite expectations of employment growth.

"The data emboldens calls for the Fed to ease (rates) in the months ahead," said Joshua Mahony, chief market analyst at Scope Markets.

The data was the latest in a string of below-par reports indicating the labour market in the world's top economy continues to slow.

Observers said the reading had a little more significance owing to expectations that crucial non-farm payrolls statistics will not be released as usual on Friday owing to the shutdown.

The lack of data could also affect the Fed's deliberations, warned Trade Nation analyst David Morrison.

"It could also mean that the central bank holds off from cutting this month if FOMC members feel they have a lack of clarity, given the missing data releases," he said.

Data shows investors currently believe there is nearly a 99 percent chance that the Fed will cut rates at its meeting later this month, and a nearly 87 percent chance at the following meeting in December.

- Key figures at around 1530 GMT -

New York - Dow: DOWN 0.2 percent at 46,338.64 points

New York - S&P 500: DOWN 0.2 percent at 6,699.71

New York - Nasdaq Composite: UP less than 0.1 percent at 22,774.99

London - FTSE 100: DOWN 0.2 percent at 9,427.73 (close)

Paris - CAC 40: UP 1.1 percent at 8,056.63 (close)

Frankfurt - DAX: UP 1.3 percent at 24,422.56 (close)

Tokyo - Nikkei 225: UP 0.9 percent at 44,936.73 (close)

Hong Kong - Hang Seng Index: UP 1.6 percent at 27,287.12 (close)

Shanghai - Composite: Closed for a holiday

Euro/dollar: DOWN at $1.1699 from $1.1728 on Wednesday

Pound/dollar: DOWN at $1.3415 from $1.3476

Dollar/yen: UP at 147.38 yen from 147.14 yen

Euro/pound: UP at 87.20 pence from 87.04 pence

West Texas Intermediate: DOWN 1.2 percent at $61.06 per barrel

Brent North Sea Crude: DOWN 1.3 percent at $64.56 per barrel

burs-rl/

D.Goldberg--CPN