-

Kenya's economy faces climate change risks: World Bank

Kenya's economy faces climate change risks: World Bank

-

French IT giant Capgemini to sell US subsidiary after row over ICE links

-

New Epstein accuser claims sexual encounter with ex-prince Andrew: report

New Epstein accuser claims sexual encounter with ex-prince Andrew: report

-

Snowstorm disrupts travel in southern US as blast of icy weather widens

-

Afghan returnees in Bamiyan struggle despite new homes

Afghan returnees in Bamiyan struggle despite new homes

-

Mired in economic trouble, Bangladesh pins hopes on election boost

-

Chinese cash in jewellery at automated gold recyclers as prices soar

Chinese cash in jewellery at automated gold recyclers as prices soar

-

Nvidia boss insists 'huge' investment in OpenAI on track

-

Snowstorm barrels into southern US as blast of icy weather widens

Snowstorm barrels into southern US as blast of icy weather widens

-

Ex-prince Andrew again caught up in Epstein scandal

-

How Lego got swept up in US-Mexico trade frictions

How Lego got swept up in US-Mexico trade frictions

-

Snow storm barrels into southern US as blast of icy weather widens

-

Ex-prince Andrew dogged again by Epstein scandal

Ex-prince Andrew dogged again by Epstein scandal

-

'Malfunction' cuts power in Ukraine. Here's what we know

-

Women in ties return as feminism faces pushback

Women in ties return as feminism faces pushback

-

Ship ahoy! Prague's homeless find safe haven on river boat

-

Epstein offered ex-prince Andrew meeting with Russian woman: files

Epstein offered ex-prince Andrew meeting with Russian woman: files

-

China factory activity loses steam in January

-

Melania Trump's atypical, divisive doc opens in theatres

Melania Trump's atypical, divisive doc opens in theatres

-

Gold, silver prices tumble as investors soothed by Trump Fed pick

-

US Senate votes on funding deal - but shutdown still imminent

US Senate votes on funding deal - but shutdown still imminent

-

Trump expects Iran to seek deal to avoid US strikes

-

NASA delays Moon mission over frigid weather

NASA delays Moon mission over frigid weather

-

Fela Kuti: first African to get Grammys Lifetime Achievement Award

-

Cubans queue for fuel as Trump issues oil ultimatum

Cubans queue for fuel as Trump issues oil ultimatum

-

France rescues over 6,000 UK-bound Channel migrants in 2025

-

Analysts say Kevin Warsh a safe choice for US Fed chair

Analysts say Kevin Warsh a safe choice for US Fed chair

-

Fela Kuti to be first African to get Grammys Lifetime Achievement Award

-

Gold, silver prices tumble as investors soothed by Trump's Fed pick

Gold, silver prices tumble as investors soothed by Trump's Fed pick

-

Social media fuels surge in UK men seeking testosterone jabs

-

Trump nominates former US Fed official as next central bank chief

Trump nominates former US Fed official as next central bank chief

-

Chad, France eye economic cooperation as they reset strained ties

-

Artist chains up thrashing robot dog to expose AI fears

Artist chains up thrashing robot dog to expose AI fears

-

Dutch watchdog launches Roblox probe over 'risks to children'

-

Cuddly Olympics mascot facing life or death struggle in the wild

Cuddly Olympics mascot facing life or death struggle in the wild

-

UK schoolgirl game character Amelia co-opted by far-right

-

Panama court annuls Hong Kong firm's canal port concession

Panama court annuls Hong Kong firm's canal port concession

-

Asian stocks hit by fresh tech fears as gold retreats from peak

-

Apple earnings soar as China iPhone sales surge

Apple earnings soar as China iPhone sales surge

-

With Trump administration watching, Canada oil hub faces separatist bid

-

What are the key challenges awaiting the new US Fed chair?

What are the key challenges awaiting the new US Fed chair?

-

Moscow records heaviest snowfall in over 200 years

-

Polar bears bulk up despite melting Norwegian Arctic: study

Polar bears bulk up despite melting Norwegian Arctic: study

-

Waymo gears up to launch robotaxis in London this year

-

French IT group Capgemini under fire over ICE links

French IT group Capgemini under fire over ICE links

-

Czechs wind up black coal mining in green energy switch

-

EU eyes migration clampdown with push on deportations, visas

EU eyes migration clampdown with push on deportations, visas

-

Northern Mozambique: massive gas potential in an insurgency zone

-

Gold demand hits record high on Trump policy doubts: industry

Gold demand hits record high on Trump policy doubts: industry

-

UK drugs giant AstraZeneca announces $15 bn investment in China

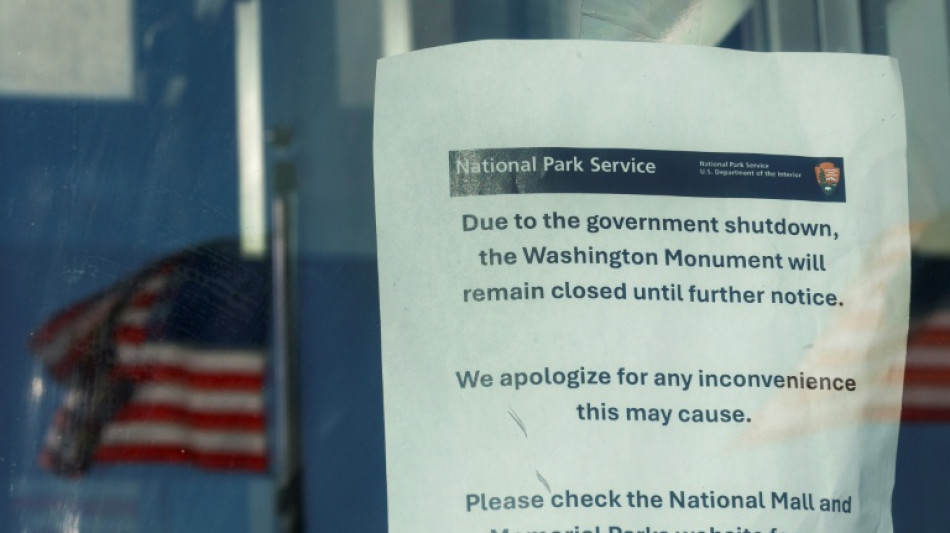

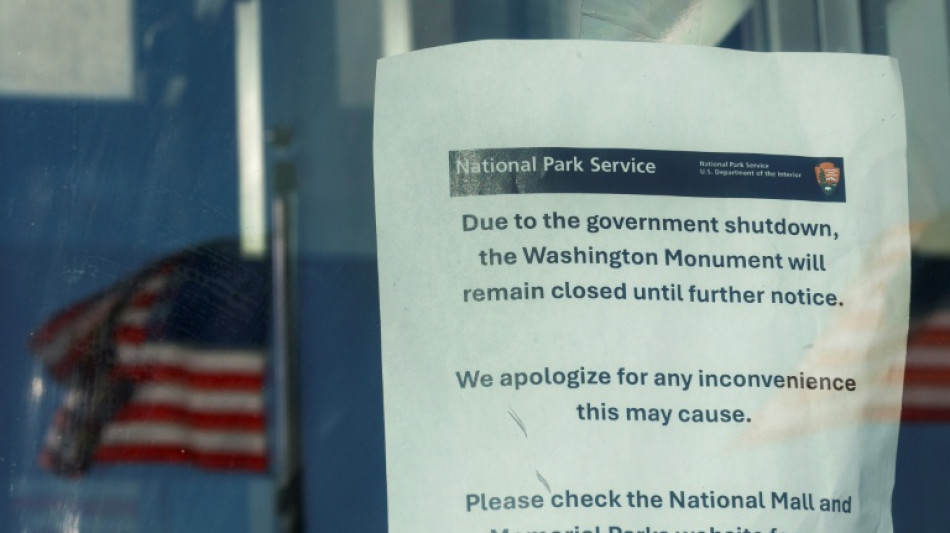

Dow, S&P 500 end at records despite US government shutdown

Wall Street stocks rose again Wednesday, shrugging off the partial US government shutdown as major indices finished at records amid hopes for more Federal Reserve interest rate cuts.

Both the Dow and S&P 500 closed at fresh records as investors focused on poor US employment data, which boosted expectations that the Fed could cut interest rates later this month.

US government operations began grinding to a halt at 12:01 am (0401 GMT) Wednesday after Republicans and Democrats failed to break a budget impasse in Congress.

The closure will see non-essential operations halted, leaving hundreds of thousands of civil servants temporarily unpaid, and many social safety net benefit payments potentially disrupted.

But analysts note that shutdowns have not significantly weighed on markets due in part to the view that the negative impacts from closures can be reversed once the government reopens.

"History reminds us that government shutdowns have typically been more headline-making than bottom-line impacting," said CFRA Research's Sam Stovall.

Investors took note of a report from payroll firm ADP that showed the US private sector shed 32,000 jobs last month.

"The market's getting a little bit excited that this is something where the Fed can continue cutting interest rates," said Tim Urbanowicz, chief investment strategist at Innovator Capital Management. "There's this kind of middle ground where the data is not showing a lot of strength, but it's not weak enough where people start getting concerned about recession."

Analysts said the weaker job market cements expectations that the Fed will cut interest rates twice more this year, after lowering borrowing costs last month for the first time since December.

But investors are concerned the US government shutdown could prevent the release Friday of the key non-farm payrolls report -- a crucial data point for the Fed on rate decisions.

European markets were lifted by pharmaceutical shares after Pfizer was granted reprieve from Trump's tariffs by agreeing to lower drug prices in the United States.

Shares in British pharma giant AstraZeneca rose more than eight percent and GSK was up over six percent in London.

Several US pharma names also rose, including Merck and Bristol-Myers Squibb, while Lithium Americas Corp. surged 23.3 percent after announcing it would grant the US government an equity stake as part of the restructuring of a loan from the Department of Energy.

In Asia, Tokyo's stock market sank, while Hong Kong and Shanghai were closed for holidays.

- Key figures at around 2030 GMT -

New York - Dow: UP 0.1 percent at 46,441.10 (close)

New York - S&P 500: UP 0.3 percent at 6,711.20 (close)

New York - Nasdaq Composite: UP 0.4 percent at 22,755.16 (close)

London - FTSE 100: UP 1.0 percent at 9,446.43 (close)

Paris - CAC 40: UP 0.9 percent at 7,966.95 (close)

Frankfurt - DAX: UP 1.0 percent at 24,113.62 (close)

Tokyo - Nikkei 225: DOWN 0.9 percent at 44,550.85 (close)

Hong Kong - Hang Seng Index: Closed for a holiday

Shanghai - Composite: Closed for a holiday

Euro/dollar: DOWN at $1.1728 from $1.1734 on Tuesday

Pound/dollar: UP at $1.3476 from $1.3446

Dollar/yen: DOWN at 147.14 yen from 147.90 yen

Euro/pound: DOWN at 87.04 pence from 87.27 pence

West Texas Intermediate: DOWN 0.9 percent at $61.78 per barrel

Brent North Sea Crude: DOWN 1.0 percent at $65.35 per barrel

burs-jmb/ksb

Y.Jeong--CPN