-

Kenya's economy faces climate change risks: World Bank

Kenya's economy faces climate change risks: World Bank

-

Rural India powers global AI models

-

Equities, metals, oil rebound after Asia-wide rout

Equities, metals, oil rebound after Asia-wide rout

-

Italy's spread-out Olympics face transport challenge

-

Paying for a selfie: Rome starts charging for Trevi Fountain

Paying for a selfie: Rome starts charging for Trevi Fountain

-

Musk merges xAI into SpaceX in bid to build space data centers

-

New York records 13 cold-related deaths since late January

New York records 13 cold-related deaths since late January

-

In post-Maduro Venezuela, pro- and anti-government workers march for better pay

-

Late-January US snowstorm wasn't historically exceptional: NOAA

Late-January US snowstorm wasn't historically exceptional: NOAA

-

Punctuality at Germany's crisis-hit railway slumps

-

Europe observatory hails plan to abandon light-polluting Chile project

Europe observatory hails plan to abandon light-polluting Chile project

-

Oil slides, gold loses lustre as Iran threat recedes

-

Russian captain found guilty in fatal North Sea crash

Russian captain found guilty in fatal North Sea crash

-

Disney earnings boosted by theme parks, as CEO handover nears

-

France demands 1.7 bn euros in payroll taxes from Uber: media report

France demands 1.7 bn euros in payroll taxes from Uber: media report

-

Latest Epstein file dump rocks UK royals, politics

-

More baby milk recalls in France after new toxin rules

More baby milk recalls in France after new toxin rules

-

Germany hit by nationwide public transport strike

-

WHO chief says turmoil creates chance for reset

WHO chief says turmoil creates chance for reset

-

European stocks rise as gold, oil prices tumble

-

Trump says US talking deal with 'highest people' in Cuba

Trump says US talking deal with 'highest people' in Cuba

-

Olympic Games in northern Italy have German twist

-

At Grammys, 'ICE out' message loud and clear

At Grammys, 'ICE out' message loud and clear

-

Steven Spielberg earns coveted EGOT status with Grammy win

-

Kendrick Lamar, Bad Bunny, Lady Gaga triumph at Grammys

Kendrick Lamar, Bad Bunny, Lady Gaga triumph at Grammys

-

Japan says rare earth found in sediment retrieved on deep-sea mission

-

Oil tumbles on Iran hopes, precious metals hit by stronger dollar

Oil tumbles on Iran hopes, precious metals hit by stronger dollar

-

Kendrick Lamar, Bad Bunny, Lady Gaga win early at Grammys

-

Surging euro presents new headache for ECB

Surging euro presents new headache for ECB

-

US talking deal with 'highest people' in Cuba: Trump

-

Formerra and Evonik Expand Distribution Partnership for Healthcare Grades

Formerra and Evonik Expand Distribution Partnership for Healthcare Grades

-

Hans Vestberg, Former Verizon Chairman and CEO, Joins Digipower X As Senior Advisor

-

Nigeria's president pays tribute to Fela Kuti after Grammys Award

Nigeria's president pays tribute to Fela Kuti after Grammys Award

-

Iguanas fall from trees in Florida as icy weather bites southern US

-

French IT giant Capgemini to sell US subsidiary after row over ICE links

French IT giant Capgemini to sell US subsidiary after row over ICE links

-

New Epstein accuser claims sexual encounter with ex-prince Andrew: report

-

Snowstorm disrupts travel in southern US as blast of icy weather widens

Snowstorm disrupts travel in southern US as blast of icy weather widens

-

Afghan returnees in Bamiyan struggle despite new homes

-

Mired in economic trouble, Bangladesh pins hopes on election boost

Mired in economic trouble, Bangladesh pins hopes on election boost

-

Chinese cash in jewellery at automated gold recyclers as prices soar

-

Nvidia boss insists 'huge' investment in OpenAI on track

Nvidia boss insists 'huge' investment in OpenAI on track

-

Snowstorm barrels into southern US as blast of icy weather widens

-

Ex-prince Andrew again caught up in Epstein scandal

Ex-prince Andrew again caught up in Epstein scandal

-

How Lego got swept up in US-Mexico trade frictions

-

Snow storm barrels into southern US as blast of icy weather widens

Snow storm barrels into southern US as blast of icy weather widens

-

Ex-prince Andrew dogged again by Epstein scandal

-

'Malfunction' cuts power in Ukraine. Here's what we know

'Malfunction' cuts power in Ukraine. Here's what we know

-

Women in ties return as feminism faces pushback

-

Ship ahoy! Prague's homeless find safe haven on river boat

Ship ahoy! Prague's homeless find safe haven on river boat

-

Epstein offered ex-prince Andrew meeting with Russian woman: files

Stock markets brush aside higher US tariffs

Most stock markets gained Thursday even as President Donald Trump's new tariffs on dozens of countries took effect, with investors eyeing exemptions from his threatened 100-percent levy on semiconductors.

Sentiment was also lifted by hopes of easing geopolitical tensions after the Kremlin said Trump and Russia's leader Vladimir Putin were set to meet for talks in the coming days.

Paris and Frankfurt each piled on around one percent in midday deals.

London was a rare faller ahead of an expected interest-rate cut by the Bank of England.

"Trump's global web of tariffs is now in place, but the stock market appears largely unfazed," said Jochen Stanzl, chief market analyst at CMC Markets.

He added that buying was driven by "the potential for an interest rate cut by the Federal Reserve in just over a month and a possible meeting between Trump, (Ukraine leader Volodymyr) Zelensky, and Putin as early as next week".

The dollar struggled as the United States began charging higher tariffs on goods from dozens of trading partners, including the European Union and India, as part of Trump's drive to reshape global trade in America's favour.

Switzerland's stock market gained around one percent even after top officials failed to convince Washington not to impose a 39-percent tariff on Swiss goods.

Shortly before the new levies kicked in, Washington separately announced it would double Indian tariffs to 50 percent.

- Chip levies -

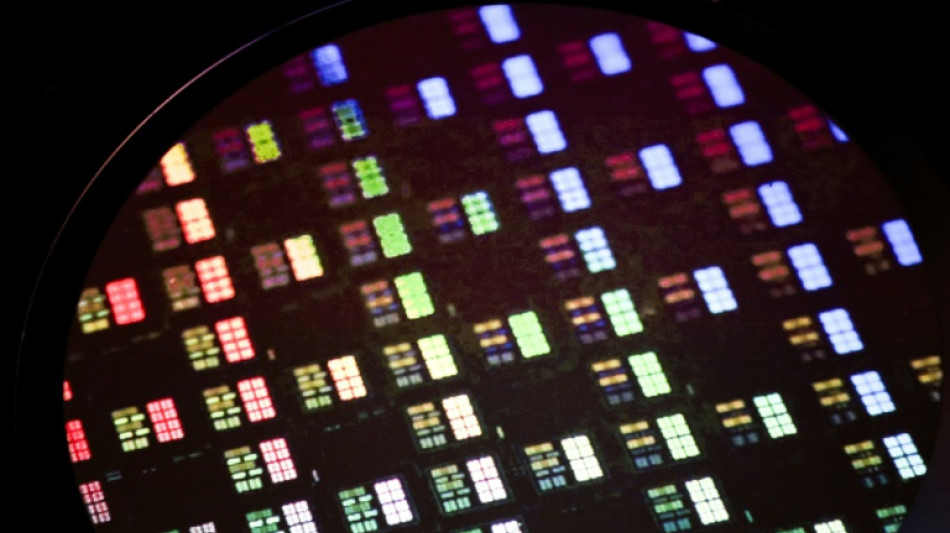

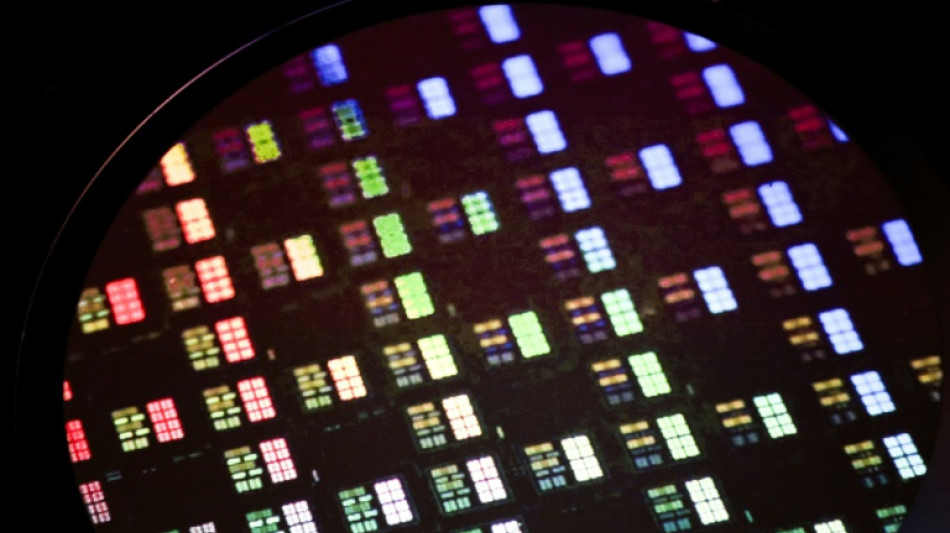

Asian markets extended gains following a strong day on Wall Street, with tech stocks lifted by chip-tariff exemptions for companies investing heavily in the United States or committed to do so.

Apple-linked stocks rose after the US tech giant pledged to invest an additional $100 billion in the United States.

Tokyo and Hong Kong closed in the green Thursday, with Taipei leading the way thanks to the surge in Taiwanese chip-making giant TSMC.

TSMC climbed five percent as Taipei said it would be exempt from Trump's threatened levies on the sector.

Seoul-listed Samsung, which is also pumping billions into the world's number one economy, rose more than two percent while South Korean rival SK hynix was up more than one percent.

However, some other Asian manufacturers took a beating, including Japan's Tokyo Electron and chipmaker Renesas.

Analysts said that while the chip threat was steep, there was optimism the final level would be lower.

Shanghai closed higher after data showed stronger-than-expected Chinese exports, with a surge in shipments to the EU and Southeast Asian nations offsetting a plunge in those to the United States.

Markets were already buoyed this week by bets on a Federal Reserve rate cute following weak US jobs data that signalled the economy was weakening.

Oil prices rose after Trump threatened penalties on other countries that "directly or indirectly" import Russian oil, after imposing his extra toll on India.

In other company news, shares in Sony jumped more than four percent after the PlayStation-maker raised its annual profit forecasts, citing strong performance in its key gaming business and a smaller-than-expected negative impact of US tariffs.

- Key figures at around 1030 GMT -

London - FTSE 100: DOWN 0.5 percent at 9,121.10 points

Paris - CAC 40: UP 1.1 percent at 7,719.07

Frankfurt - DAX: UP 1.4 percent at 24,266.65

Tokyo - Nikkei 225: UP 0.7 percent at 41,059.15 (close)

Hong Kong - Hang Seng Index: UP 0.7 percent at 25,081.63 (close)

Shanghai - Composite: UP 0.2 percent at 3,639.67 (close)

New York - Dow: UP 0.2 percent at 44,193.12 (close)

Euro/dollar: UP at $1.1667 from $1.1659 on Wednesday

Pound/dollar: UP at $1.3366 from $1.3358

Dollar/yen: DOWN at 147.36 yen from 147.38 yen

Euro/pound: UP at 87.28 pence from 87.23 pence

Brent North Sea Crude: UP 0.6 percent at $67.29 per barrel

West Texas Intermediate: UP 0.6 percent at $64.74 per barrel

M.García--CPN