-

Kenya's economy faces climate change risks: World Bank

Kenya's economy faces climate change risks: World Bank

-

In Dakar fishing village, surfing entices girls back to school

-

Russian pensioners turn to soup kitchen as war economy stutters

Russian pensioners turn to soup kitchen as war economy stutters

-

As Estonia schools phase out Russian, many families struggle

-

Toyota names new CEO, hikes profit forecasts

Toyota names new CEO, hikes profit forecasts

-

Bangladesh Islamist leader seeks power in post-uprising vote

-

Japan to restart world's biggest nuclear plant

Japan to restart world's biggest nuclear plant

-

UK royal finances in spotlight after Andrew's downfall

-

Undercover probe finds Australian pubs short-pouring beer

Undercover probe finds Australian pubs short-pouring beer

-

New Zealand deputy PM defends claims colonisation good for Maori

-

Amazon shares plunge as AI costs climb

Amazon shares plunge as AI costs climb

-

Deadly storm sparks floods in Spain, raises calls to postpone Portugal vote

-

Carney scraps Canada EV sales mandate, affirms auto sector's future is electric

Carney scraps Canada EV sales mandate, affirms auto sector's future is electric

-

Lower pollution during Covid boosted methane: study

-

Carney scraps Canada EV sales mandate

Carney scraps Canada EV sales mandate

-

Record January window for transfers despite drop in spending

-

Mining giant Rio Tinto abandons Glencore merger bid

Mining giant Rio Tinto abandons Glencore merger bid

-

Davos forum opens probe into CEO Brende's Epstein links

-

ECB warns of stronger euro impact, holds rates

ECB warns of stronger euro impact, holds rates

-

Greece aims to cut queues at ancient sites with new portal

-

ECB holds interest rates as strong euro causes jitters

ECB holds interest rates as strong euro causes jitters

-

What does Iran want from talks with the US?

-

Wind turbine maker Vestas sees record revenue in 2025

Wind turbine maker Vestas sees record revenue in 2025

-

Bitcoin under $70,000 for first time since Trump's election

-

Germany claws back 59 mn euros from Amazon over price controls

Germany claws back 59 mn euros from Amazon over price controls

-

Germany claws back 70 mn euros from Amazon over price controls

-

Stock markets drop amid tech concerns before rate calls

Stock markets drop amid tech concerns before rate calls

-

BBVA posts record profit after failed Sabadell takeover

-

UN human rights agency in 'survival mode': chief

UN human rights agency in 'survival mode': chief

-

Greenpeace slams fossel fuel sponsors for Winter Olympics

-

Russia says thwarted smuggling of giant meteorite to UK

Russia says thwarted smuggling of giant meteorite to UK

-

Heathrow still Europe's busiest airport, but Istanbul gaining fast

-

Shell profits climb despite falling oil prices

Shell profits climb despite falling oil prices

-

German factory orders rise at fastest rate in 2 years in December

-

Trump fuels EU push to cut cord with US tech

Trump fuels EU push to cut cord with US tech

-

Top US news anchor pleads with kidnappers for mom's life

-

The coming end of ISS, symbol of an era of global cooperation

The coming end of ISS, symbol of an era of global cooperation

-

New crew set to launch for ISS after medical evacuation

-

Stocks in retreat as traders reconsider tech investment

Stocks in retreat as traders reconsider tech investment

-

Fiji football legend returns home to captain first pro club

-

Barry Manilow cancels Las Vegas shows but 'doing great' post-surgery

Barry Manilow cancels Las Vegas shows but 'doing great' post-surgery

-

Rising euro, falling inflation in focus at ECB meeting

-

AI to track icebergs adrift at sea in boon for science

AI to track icebergs adrift at sea in boon for science

-

Google's annual revenue tops $400 bn for first time, AI investments rise

-

Boxer Khelif reveals 'hormone treatments' before Paris Olympics

Boxer Khelif reveals 'hormone treatments' before Paris Olympics

-

BHP damages trial over Brazil mine disaster to open in 2027

-

Bezos-led Washington Post announces 'painful' job cuts

Bezos-led Washington Post announces 'painful' job cuts

-

UK PM says Mandelson 'lied' about Epstein relations

-

Trump suggests 'softer touch' needed on immigration

Trump suggests 'softer touch' needed on immigration

-

Panama hits back after China warns of 'heavy price' in ports row

US stocks retreat from records on Trump tariff deluge

Stock markets were mixed Monday with US indices retreating from records as President Donald Trump's aggressive trade policy came back to the forefront, reviving worries about trade wars and inflation.

"Tariff threats look likely to take center stage yet again this week, following further developments over the weekend," noted Richard Hunter, head of markets at Interactive Investor.

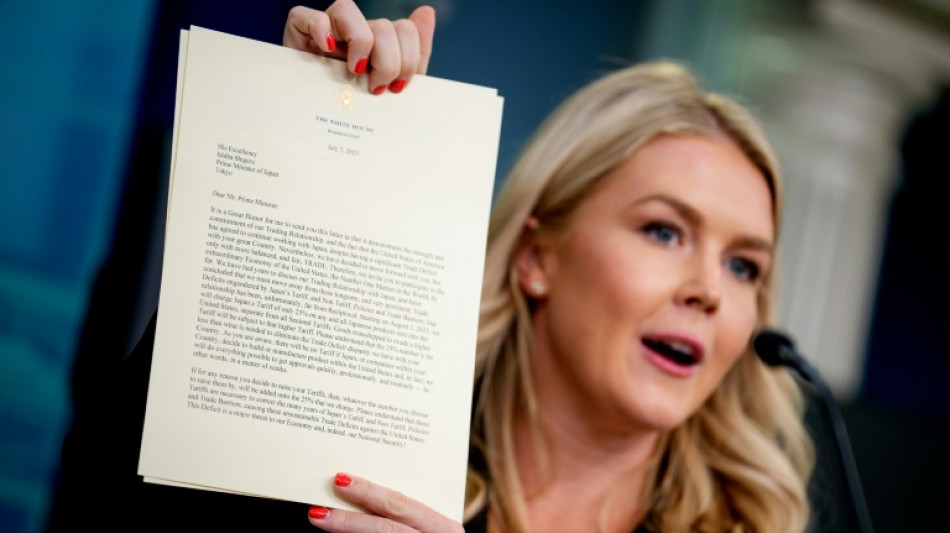

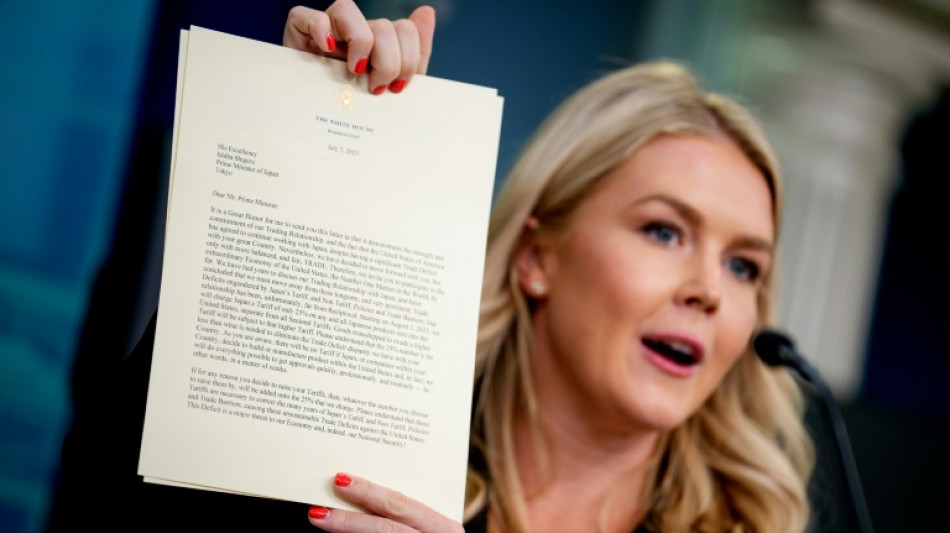

After warning of a tariff hike of 10 percent on countries aligning themselves with the emerging BRICS nations, Trump announced plans for 25 percent tariffs on Japan and South Korea from August 1 if the countries do not reach a deal.

Trump issued similar letters to South Africa, Malaysia, Myanmar, Laos and Kazakhstan, saying he would slap duties on their products ranging from 25 percent to 40 percent.

Later Monday, he announced additional levies on Indonesia, Cambodia and other countries.

The broadsides revived attention on trade after the issue had receded for a few weeks while Congress debated Trump's sweeping fiscal package and worries about the Iran-Israel conflict took certain stage.

Major US indices fell, with the S&P falling 0.8 percent, retreating from a record.

The likelihood that Trump's statements are a bargaining tactic is one reason losses weren't "even worse," said Steve Sosnick of Interactive Brokers.

"No one really wants to overreact negatively right now, which is why we're seeing a bit of a sell-off, but not a major sell-off," he said.

The White House has said several deals were in the pipeline but only two have been finalized so far, with Britain and Vietnam.

The administration had previously set a July 9 deadline to reach agreements. The White House now says it will hike tariffs on August 1 on trading partners that don't strike a deal.

Despite the tariff uncertainty, official data Monday showed German industrial production rose strongly in May, boosting hopes that Europe's top economy has turned a corner.

The news lifted German equities which gained 1.2 percent for the day.

Paris added 0.4 percent, while London dipped 0.2 percent.

Asia's main stock markets mostly steadied.

- OPEC+ hike -

The oil market was also in focus after Saudi Arabia, Russia and six other key members of the OPEC+ alliance said they would increase oil output in August by 548,000 barrels per day, more than expected.

The group said in a statement that "a steady global economic outlook and current healthy market fundamentals, as reflected in the low oil inventories," led to the decision.

IG analyst Chris Beauchamp said that crude prices would ordinarily be expected to drop when additional supply is being brought to market.

"Crude’s strength today suggests that buying momentum is clearly picking up," he said.

"The bearish theme that has dominated for so long seems to have run its course, even if more increases are expected in September," he added.

Among individual companies, Tesla tumbled 6.8 percent after Trump blasted CEO Elon Musk's plan to launch a new political party in opposition to the president's hallmark legislation, the so-called "Big Beautiful Bill."

The back-and-forth escalated a conflict between the president and the world's richest man at a time when investors had hoped Musk would refocus on Tesla and his other ventures and shift attention from politics.

- Key figures at around 2030 GMT -

New York - Dow: DOWN 0.9 percent at 44,406.36 (close)

New York - S&P 500: DOWN 0.8 percent at 6,229.98 (close)

New York - Nasdaq Composite: DOWN 0.9 percent at 20,412.52 (close)

London - FTSE 100: DOWN 0.2 percent at 8,806.53 (close)

Paris - CAC 40: UP 0.4 percent at 7,723.47 (close)

Frankfurt - DAX: UP 0.1.2 percent at 24,073.67 (close)

Tokyo - Nikkei 225: DOWN 0.6 percent at 39,587.68 (close)

Hong Kong - Hang Seng Index: DOWN 0.1 percent at 23,887.83 (close)

Shanghai - Composite: FLAT at 3,473.13 (close)

Euro/dollar: DOWN at $1.1710 from $1.1778 on Friday

Pound/dollar: DOWN at $1.3602 from $1.3650

Dollar/yen: UP at 146.13 yen from 144.47 yen

Euro/pound: DOWN at 86.09 pence from 86.30 pence

Brent North Sea Crude: UP 1.9 percent at $69.58 per barrel

West Texas Intermediate: UP 1.4 percent at $67.93 per barrel

burs-jmb/ksb

T.Morelli--CPN