-

Kenya's economy faces climate change risks: World Bank

Kenya's economy faces climate change risks: World Bank

-

Stellantis takes massive hit for 'overestimation' of EV shift

-

'Mona's Eyes': how an obscure French art historian swept the globe

'Mona's Eyes': how an obscure French art historian swept the globe

-

In Dakar fishing village, surfing entices girls back to school

-

Russian pensioners turn to soup kitchen as war economy stutters

Russian pensioners turn to soup kitchen as war economy stutters

-

As Estonia schools phase out Russian, many families struggle

-

Toyota names new CEO, hikes profit forecasts

Toyota names new CEO, hikes profit forecasts

-

Bangladesh Islamist leader seeks power in post-uprising vote

-

Japan to restart world's biggest nuclear plant

Japan to restart world's biggest nuclear plant

-

UK royal finances in spotlight after Andrew's downfall

-

Undercover probe finds Australian pubs short-pouring beer

Undercover probe finds Australian pubs short-pouring beer

-

New Zealand deputy PM defends claims colonisation good for Maori

-

Amazon shares plunge as AI costs climb

Amazon shares plunge as AI costs climb

-

Deadly storm sparks floods in Spain, raises calls to postpone Portugal vote

-

Carney scraps Canada EV sales mandate, affirms auto sector's future is electric

Carney scraps Canada EV sales mandate, affirms auto sector's future is electric

-

Lower pollution during Covid boosted methane: study

-

Carney scraps Canada EV sales mandate

Carney scraps Canada EV sales mandate

-

Record January window for transfers despite drop in spending

-

Mining giant Rio Tinto abandons Glencore merger bid

Mining giant Rio Tinto abandons Glencore merger bid

-

Davos forum opens probe into CEO Brende's Epstein links

-

ECB warns of stronger euro impact, holds rates

ECB warns of stronger euro impact, holds rates

-

Greece aims to cut queues at ancient sites with new portal

-

ECB holds interest rates as strong euro causes jitters

ECB holds interest rates as strong euro causes jitters

-

What does Iran want from talks with the US?

-

Wind turbine maker Vestas sees record revenue in 2025

Wind turbine maker Vestas sees record revenue in 2025

-

Bitcoin under $70,000 for first time since Trump's election

-

Germany claws back 59 mn euros from Amazon over price controls

Germany claws back 59 mn euros from Amazon over price controls

-

Germany claws back 70 mn euros from Amazon over price controls

-

Stock markets drop amid tech concerns before rate calls

Stock markets drop amid tech concerns before rate calls

-

BBVA posts record profit after failed Sabadell takeover

-

UN human rights agency in 'survival mode': chief

UN human rights agency in 'survival mode': chief

-

Greenpeace slams fossel fuel sponsors for Winter Olympics

-

Russia says thwarted smuggling of giant meteorite to UK

Russia says thwarted smuggling of giant meteorite to UK

-

Heathrow still Europe's busiest airport, but Istanbul gaining fast

-

Shell profits climb despite falling oil prices

Shell profits climb despite falling oil prices

-

German factory orders rise at fastest rate in 2 years in December

-

Trump fuels EU push to cut cord with US tech

Trump fuels EU push to cut cord with US tech

-

Top US news anchor pleads with kidnappers for mom's life

-

The coming end of ISS, symbol of an era of global cooperation

The coming end of ISS, symbol of an era of global cooperation

-

New crew set to launch for ISS after medical evacuation

-

Stocks in retreat as traders reconsider tech investment

Stocks in retreat as traders reconsider tech investment

-

Fiji football legend returns home to captain first pro club

-

Barry Manilow cancels Las Vegas shows but 'doing great' post-surgery

Barry Manilow cancels Las Vegas shows but 'doing great' post-surgery

-

Rising euro, falling inflation in focus at ECB meeting

-

AI to track icebergs adrift at sea in boon for science

AI to track icebergs adrift at sea in boon for science

-

Google's annual revenue tops $400 bn for first time, AI investments rise

-

Boxer Khelif reveals 'hormone treatments' before Paris Olympics

Boxer Khelif reveals 'hormone treatments' before Paris Olympics

-

BHP damages trial over Brazil mine disaster to open in 2027

-

Bezos-led Washington Post announces 'painful' job cuts

Bezos-led Washington Post announces 'painful' job cuts

-

UK PM says Mandelson 'lied' about Epstein relations

World Bank's IFC ramps up investment amid global uncertainty

While the world economy faces instability from US President Donald Trump's threats of a global trade war, the International Finance Corporation (IFC) is dramatically ramping up its investment activities.

The Washington-based IFC -- the World Bank's private sector arm -- mobilizes private capital and provides financing to support businesses across emerging economies.

Though not widely known outside development circles, the organization plays a crucial role in creating jobs and supporting growth in less developed regions.

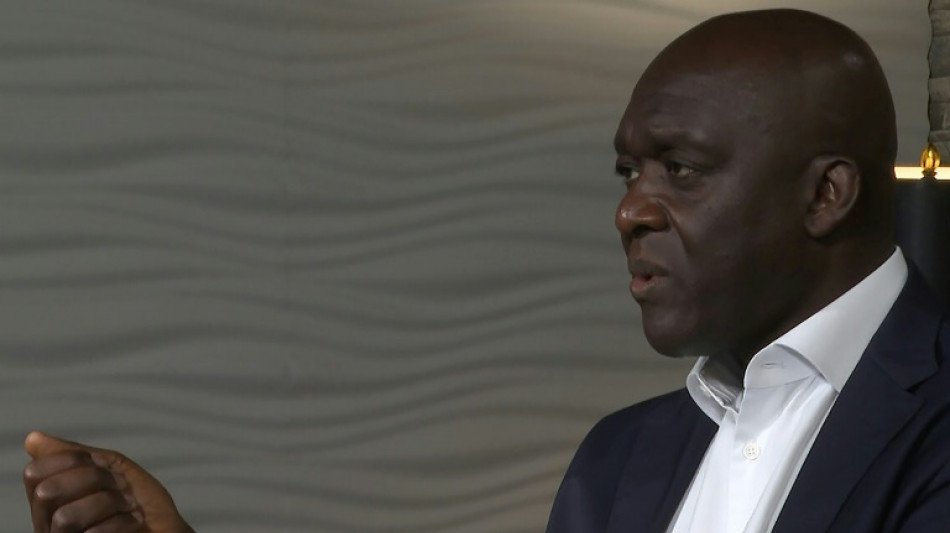

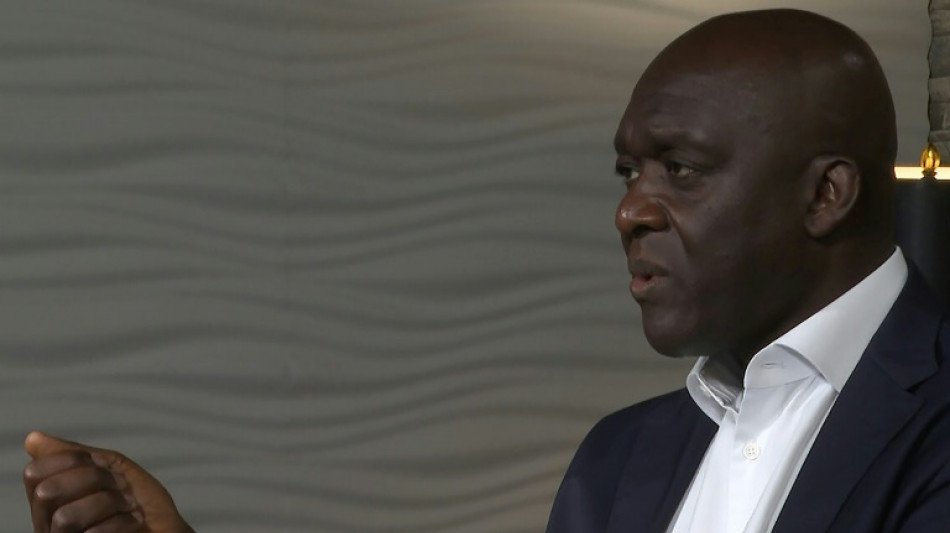

"The world economy has been going through a bit of a turbulent time, but what I must say is that even though there is turbulence... we are seeing a lot of interest in investing in emerging countries," Makhtar Diop, the IFC's managing director, told AFP.

This optimism is backed by concrete numbers. In the fiscal year ending June 30, preliminary data shows that the IFC committed over $71 billion -- nearly double its commitment from just three years ago and a significant jump from last year's record of $56 billion.

The investment spans the globe, with more than $20 billion flowing to Latin America, $17 billion to Asia, and $15.4 billion to Africa.

The dramatic increase stems from a deliberate strategic shift.

Diop, an economist and former Senegalese finance minister, explained that the IFC has focused on becoming "simpler, more agile, and delegating decision-making to our teams that are in the field."

This approach abandons the over-centralized structure that previously "was slowing down our ability to respond and seize new opportunities."

The timing is significant. As Western economies pull back from direct aid to developing countries -- constrained by mounting debts, rising defense budgets, and increasingly inward-looking politics -- the IFC has accelerated.

"It's totally understandable that they have fewer resources to make available in the form of grants to developing countries," Diop acknowledges.

However, he emphasized that World Bank funding for the world's poorest countries remains fully replenished, calling it "the most efficient and best way to support countries."

The IFC's expanding role within the World Bank Group is evident. Today, its funding nearly matches the support the bank provides directly to governments, making it an equal partner in development efforts.

- Dubai to Africa -

The organization is also attracting new types of investors.

Many co-financing partners now come from regions that traditionally haven't invested outside their home areas. The IFC's largest renewable energy investment in Africa, for example, was completed with a Dubai-based company.

These investors trust the IFC not only for its market knowledge but also for the risk-mitigation tools it offers, Diop said.

In Africa particularly, the IFC pursues a strategy of identifying and supporting "national champions" -- successful local companies that need help to become more competitive and globally integrated.

A significant portion of the IFC's mandate involves sustainability projects, an area where Diop decries debates with false choices between economic development and the environment, especially in electricity projects that form an important part of the agency's portfolio.

"It happens that today, you don't have to make that trade-off because the sustainable solutions are often the cheaper ones, and that's the beauty of what we are seeing," he said.

While fossil fuel generation remains part of the energy mix to ensure grid stability, the economics increasingly favor clean alternatives.

Behind all these investments lies an urgent demographic reality: 1.2 billion young people will reach working age in developing countries over the next decade.

For the World Bank, creating employment for this massive cohort is paramount.

"The first question of any leader you meet from the developing world is how can you help to create jobs for young people?" Diop observed.

Beyond infrastructure development that stimulates broader economic activity, Diop identifies tourism, pharmaceuticals, and agriculture as the most promising sectors for job creation.

These industries can offer the scale and growth potential needed to absorb the coming wave of young workers entering the global economy.

D.Avraham--CPN