-

Kenya's economy faces climate change risks: World Bank

Kenya's economy faces climate change risks: World Bank

-

US Afghans in limbo after Washington soldier attack

-

Nasdaq rallies again while yen falls despite BOJ rate hike

Nasdaq rallies again while yen falls despite BOJ rate hike

-

US university killer's mystery motive sought after suicide

-

IMF approves $206 mn aid to Sri Lanka after Cyclone Ditwah

IMF approves $206 mn aid to Sri Lanka after Cyclone Ditwah

-

Rome to charge visitors for access to Trevi Fountain

-

Stocks advance with focus on central banks, tech

Stocks advance with focus on central banks, tech

-

Norway crown princess likely to undergo lung transplant

-

France's budget hits snag in setback for embattled PM

France's budget hits snag in setback for embattled PM

-

Volatile Oracle shares a proxy for Wall Street's AI jitters

-

Japan hikes interest rates to 30-year-high

Japan hikes interest rates to 30-year-high

-

Brazil's top court strikes down law blocking Indigenous land claims

-

'We are ghosts': Britain's migrant night workers

'We are ghosts': Britain's migrant night workers

-

Asian markets rise as US inflation eases, Micron soothes tech fears

-

Trump signs $900 bn defense policy bill into law

Trump signs $900 bn defense policy bill into law

-

EU-Mercosur deal delayed as farmers stage Brussels show of force

-

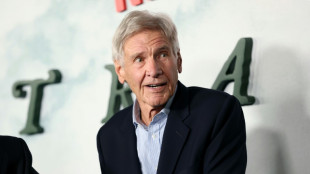

Harrison Ford to get lifetime acting award

Harrison Ford to get lifetime acting award

-

Trump health chief seeks to bar trans youth from gender-affirming care

-

Argentine unions in the street over Milei labor reforms

Argentine unions in the street over Milei labor reforms

-

Brazil open to EU-Mercosur deal delay as farmers protest in Brussels

-

Brussels farmer protest turns ugly as EU-Mercosur deal teeters

Brussels farmer protest turns ugly as EU-Mercosur deal teeters

-

US accuses S. Africa of harassing US officials working with Afrikaners

-

ECB holds rates as Lagarde stresses heightened uncertainty

ECB holds rates as Lagarde stresses heightened uncertainty

-

Trump Media announces merger with fusion power company

-

Stocks rise as US inflation cools, tech stocks bounce

Stocks rise as US inflation cools, tech stocks bounce

-

Zelensky presses EU to tap Russian assets at crunch summit

-

Danish 'ghetto' residents upbeat after EU court ruling

Danish 'ghetto' residents upbeat after EU court ruling

-

ECB holds rates but debate swirls over future

-

Bank of England cuts interest rate after UK inflation slides

Bank of England cuts interest rate after UK inflation slides

-

Have Iran's authorities given up on the mandatory hijab?

-

British energy giant BP extends shakeup with new CEO pick

British energy giant BP extends shakeup with new CEO pick

-

EU kicks off crunch summit on Russian asset plan for Ukraine

-

Sri Lanka plans $1.6 bn in cyclone recovery spending in 2026

Sri Lanka plans $1.6 bn in cyclone recovery spending in 2026

-

Most Asian markets track Wall St lower as AI fears mount

-

Danish 'ghetto' tenants hope for EU discrimination win

Danish 'ghetto' tenants hope for EU discrimination win

-

What to know about the EU-Mercosur deal

-

Trump vows economic boom, blames Biden in address to nation

Trump vows economic boom, blames Biden in address to nation

-

ECB set to hold rates but debate swirls over future

-

EU holds crunch summit on Russian asset plan for Ukraine

EU holds crunch summit on Russian asset plan for Ukraine

-

Nasdaq tumbles on renewed angst over AI building boom

-

Billionaire Trump nominee confirmed to lead NASA amid Moon race

Billionaire Trump nominee confirmed to lead NASA amid Moon race

-

CNN's future unclear as Trump applies pressure

-

German MPs approve 50 bn euros in military purchases

German MPs approve 50 bn euros in military purchases

-

EU's Mercosur trade deal hits French, Italian roadblock

-

Warner Bros rejects Paramount bid, sticks with Netflix

Warner Bros rejects Paramount bid, sticks with Netflix

-

Crude prices surge after Trump orders Venezuela oil blockade

-

Warner Bros. Discovery rejects Paramount bid

Warner Bros. Discovery rejects Paramount bid

-

Doctors in England go on strike for 14th time

-

Ghana's Highlife finds its rhythm on UNESCO world stage

Ghana's Highlife finds its rhythm on UNESCO world stage

-

Stocks gain as traders bet on interest rate moves

France quietly catches rivals in battle for data centre supremacy

At the end of a narrow suburban street north of Paris, a giant structure shrouded in a skin of mesh and steel looks like a football stadium, but is in fact a vast data centre.

Paris Digital Park, which towers over four-storey apartment blocks and is owned by US firm Digital Realty, is one of more than 70 centres that ring the French capital -- more than a third of the country's total.

The government is pushing hard to expand an industry seen as the backbone of the digital economy, playing catch-up with established hubs like London and Frankfurt, and is so far avoiding the backlash that has slowed development elsewhere.

"The Paris region is the fourth largest hub in the world for content exchanges," Fabrice Coquio, President of Digital Realty France, told AFP on a recent tour of his firm's campus.

The capital region's data centre industry is already worth 1.2 billion euros ($1.3 billion), according to specialist consultancy Structure Research.

And Coquio, like everyone else in the industry, believes artificial intelligence is about to supercharge it.

He said the massive computing needs of AI would power a "second wave" of expansion for data centres, after the shift to cloud computing fuelled the first wave.

Jerome Totel of French firm Data4 said there were virtually no AI-ready data centres in France right now. But by 2030 data capacity would double in France, with between 30 and 40 percent of it dedicated to the technology, according to a recent report by trade group Datacenter.

That expansion will suck up power and land on a dramatic scale -- Coquio sees electricity usage at data centres doubling in the next four years.

But unlike in other parts of the world, there are few dissenting voices in France.

- 'Isolated' protests -

Concerns over energy and land use pushed Amsterdam and Dublin to restrict licences for new data centres -- helping Paris overtake the Dutch capital in the race for market share.

Frankfurt has clamped down on data centre sprawl with new zoning and energy rules.

And public protests have been seen recently from the Netherlands to the heart of the global industry in the US state of Virginia.

Yet in France, one of the few concerted efforts to block a centre was back in 2015 when Coquio's firm -- then known as Interxion -- had to overcome local protests and legal challenges to an earlier building.

Amazon's data centre arm, AWS, also backed off from a planned centre in 2021 after facing pushback in Bretigny-sur-Orge, in the south of Paris.

"Protests have existed and still exist, but they are very ad hoc and isolated," said Clement Marquet, a researcher at Paris-based engineering school Mines.

He said the objections had not gone beyond NIMBY, or "not in my backyard".

Those who had tried to widen the issue to the broader climate costs of digital developments "failed to bring people together over time and eventually gave up", said Marquet.

- Faster planning -

France already has some advantages that explain why data centre developments are not as divisive as in other countries.

It is much bigger than the Netherlands or Ireland, with much more free land and a less strained power grid.

Added to this, national laws largely restrict data centre companies to building on land already in industrial use.

Coquio stresses that his new Paris campus is built on a former Airbus helicopter plant.

Keeping developments mostly out of the public eye, tucked away next to motorways, in former factories, and on wasteland, has helped keep the public neutral about the centres.

However, this balance could be about to shift.

Before President Emmanuel Macron called snap elections in June that his centrist party lost, resulting in a hung parliament, his government had been trying to push through a law that would allow large data centres to be classified as projects of major national interest.

The idea would be to speed up planning processes and connection to the power grid.

Marquet said France should be moving in the opposite direction and putting more thought into planning.

"In the long term, we all need to think hard about the ecological consequences of digital growth in general," he said, labelling the current habit of ignoring climate concerns as "absurd".

But with the ramped-up computing needs of AI combining with looser regulation, the transformation of France's post-industrial suburbs looks set to continue apace.

D.Goldberg--CPN