-

Kenya's economy faces climate change risks: World Bank

Kenya's economy faces climate change risks: World Bank

-

Social media fuels surge in UK men seeking testosterone jabs

-

Trump nominates former US Fed official as next central bank chief

Trump nominates former US Fed official as next central bank chief

-

Chad, France eye economic cooperation as they reset strained ties

-

Artist chains up thrashing robot dog to expose AI fears

Artist chains up thrashing robot dog to expose AI fears

-

Dutch watchdog launches Roblox probe over 'risks to children'

-

Cuddly Olympics mascot facing life or death struggle in the wild

Cuddly Olympics mascot facing life or death struggle in the wild

-

UK schoolgirl game character Amelia co-opted by far-right

-

Panama court annuls Hong Kong firm's canal port concession

Panama court annuls Hong Kong firm's canal port concession

-

Asian stocks hit by fresh tech fears as gold retreats from peak

-

Apple earnings soar as China iPhone sales surge

Apple earnings soar as China iPhone sales surge

-

With Trump administration watching, Canada oil hub faces separatist bid

-

What are the key challenges awaiting the new US Fed chair?

What are the key challenges awaiting the new US Fed chair?

-

Moscow records heaviest snowfall in over 200 years

-

Polar bears bulk up despite melting Norwegian Arctic: study

Polar bears bulk up despite melting Norwegian Arctic: study

-

Waymo gears up to launch robotaxis in London this year

-

French IT group Capgemini under fire over ICE links

French IT group Capgemini under fire over ICE links

-

Czechs wind up black coal mining in green energy switch

-

EU eyes migration clampdown with push on deportations, visas

EU eyes migration clampdown with push on deportations, visas

-

Northern Mozambique: massive gas potential in an insurgency zone

-

Gold demand hits record high on Trump policy doubts: industry

Gold demand hits record high on Trump policy doubts: industry

-

UK drugs giant AstraZeneca announces $15 bn investment in China

-

Ghana moves to rewrite mining laws for bigger share of gold revenues

Ghana moves to rewrite mining laws for bigger share of gold revenues

-

Russia's sanctioned oil firm Lukoil to sell foreign assets to Carlyle

-

Gold soars towards $5,600 as Trump rattles sabre over Iran

Gold soars towards $5,600 as Trump rattles sabre over Iran

-

Deutsche Bank logs record profits, as new probe casts shadow

-

Vietnam and EU upgrade ties as EU chief visits Hanoi

Vietnam and EU upgrade ties as EU chief visits Hanoi

-

Hongkongers snap up silver as gold becomes 'too expensive'

-

Gold soars past $5,500 as Trump sabre rattles over Iran

Gold soars past $5,500 as Trump sabre rattles over Iran

-

Samsung logs best-ever profit on AI chip demand

-

China's ambassador warns Australia on buyback of key port

China's ambassador warns Australia on buyback of key port

-

As US tensions churn, new generation of protest singers meet the moment

-

Venezuelans eye economic revival with hoped-for oil resurgence

Venezuelans eye economic revival with hoped-for oil resurgence

-

Samsung Electronics posts record profit on AI demand

-

Formerra to Supply Foster Medical Compounds in Europe

Formerra to Supply Foster Medical Compounds in Europe

-

French Senate adopts bill to return colonial-era art

-

Tesla profits tumble on lower EV sales, AI spending surge

Tesla profits tumble on lower EV sales, AI spending surge

-

Meta shares jump on strong earnings report

-

Anti-immigration protesters force climbdown in Sundance documentary

Anti-immigration protesters force climbdown in Sundance documentary

-

Springsteen releases fiery ode to Minneapolis shooting victims

-

SpaceX eyes IPO timed to planet alignment and Musk birthday: report

SpaceX eyes IPO timed to planet alignment and Musk birthday: report

-

Neil Young gifts music to Greenland residents for stress relief

-

Fear in Sicilian town as vast landslide risks widening

Fear in Sicilian town as vast landslide risks widening

-

King Charles III warns world 'going backwards' in climate fight

-

Court orders Dutch to protect Caribbean island from climate change

Court orders Dutch to protect Caribbean island from climate change

-

Rules-based trade with US is 'over': Canada central bank head

-

Holocaust survivor urges German MPs to tackle resurgent antisemitism

Holocaust survivor urges German MPs to tackle resurgent antisemitism

-

'Extraordinary' trove of ancient species found in China quarry

-

Google unveils AI tool probing mysteries of human genome

Google unveils AI tool probing mysteries of human genome

-

UK proposes to let websites refuse Google AI search

Most markets rise as US rate cut bets temper Japan bond unease

Stocks mostly rose Tuesday following the previous day's stutter as more weak data helped solidify US interest rate cut optimism and tempered nervousness over rising Japanese bond yields.

Expectations that the Federal Reserve will lower borrowing costs have provided a boon to markets in the past few weeks and saw them recover early November's losses that had been stoked by fears of a tech bubble.

Bets on the central bank easing monetary policy for a third successive meeting have been rising since a number of decision-makers said protecting jobs was a bigger concern for them than keeping a lid on elevated inflation.

Those comments have been compounded by figures showing the economy -- particularly the labour market -- continues to soften while inflation appears to have stabilised for now.

The latest round of data added to that narrative, with a survey of manufacturers by the Institute for Supply Management indicating that activity in the sector contracted for a ninth straight month.

After a mixed day to start the week, Asia battled to eke out some gains.

Hong Kong, Sydney, Seoul, Singapore, Taipei and Jakarta were all up, though Shanghai, Manila, Mumbai and Bangkok dipped.

Tokyo was marginally higher, giving up early gains, following Monday's losses that came on the back of comments from Bank of Japan boss Kazuo Ueda hinting at a possible interest rate hike this month.

The remarks boosted the yen and provided a jolt to equities as the yield of Japanese two-year government bonds rose past one percent to their highest since 2008 during the global financial crisis. The Japanese unit eased slightly Tuesday as an auction of 10-year bonds received healthy interest.

Ueda's hint also helped pin back Wall Street after last week's Thanksgiving run-up and dented overall risk sentiment, pulling bitcoin back down.

The comments "could mark a de-anchoring of the carry trade, in which traders borrow yen at low cost to invest in riskier assets", wrote City Index senior market analyst Fiona Cincotta.

"A higher rate in Japan could suck liquidity out of the markets. Tech stocks and crypto are particularly sensitive to even the smallest shifts in liquidity."

Still, National Australia Bank's Rodrigo Catril said Ueda also mentioned the need "to confirm the momentum of initial moves toward next year's annual spring labour-management wage negotiations".

He said that "implies that the December meeting may be too soon to have a good understanding of the wage momentum for next year".

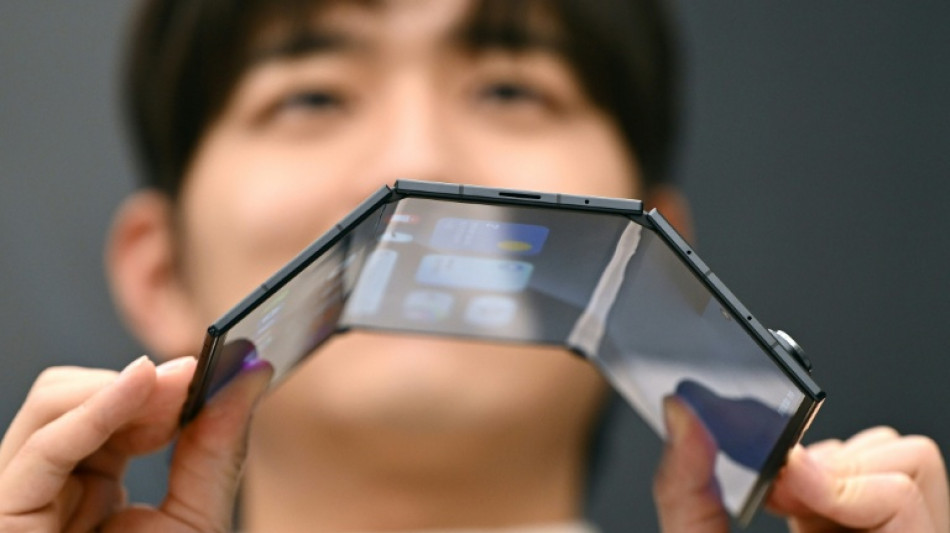

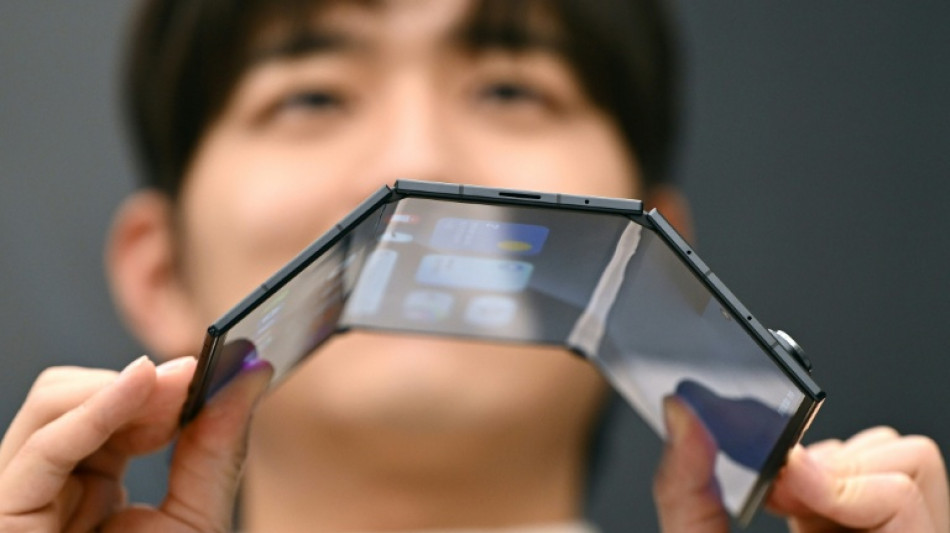

South Korean tech titan Samsung Electronics surged more than two percent in Seoul as it launched its first triple-folding phone, even as the device's more than $2,400 price tag places it out of reach for the average customer.

- Key figures at around 0700 GMT -

Tokyo - Nikkei 225: FLAT at 49,303.45 (close)

Hong Kong - Hang Seng Index: UP 0.2 percent at 26,074.74

Shanghai - Composite: DOWN 0.4 percent at 3,897.71 (close)

Dollar/yen: UP at 155.80 yen from 155.50 yen on Monday

Euro/dollar: UP at $1.1610 from $1.1608

Pound/dollar: UP at $1.3212 from $1.3211

Euro/pound: DOWN at 87.86 pence from 87.87 pence

West Texas Intermediate: UP 0.2 percent at $59.46 per barrel

Brent North Sea Crude: UP 0.1 percent at $63.26 per barrel

New York - Dow: DOWN 0.9 percent at 47,289.33 (close)

London - FTSE 100: DOWN 0.2 percent at 9,702.53 (close)

Ch.Lefebvre--CPN