-

Kenya's economy faces climate change risks: World Bank

Kenya's economy faces climate change risks: World Bank

-

As US battles China on AI, some companies choose Chinese

-

AI resurrections of dead celebrities amuse and rankle

AI resurrections of dead celebrities amuse and rankle

-

Third 'Avatar' film soars to top in N. American box office debut

-

China's rare earths El Dorado gives strategic edge

China's rare earths El Dorado gives strategic edge

-

Wheelchair user flies into space, a first

-

French culture boss accused of mass drinks spiking to humiliate women

French culture boss accused of mass drinks spiking to humiliate women

-

US Afghans in limbo after Washington soldier attack

-

Nasdaq rallies again while yen falls despite BOJ rate hike

Nasdaq rallies again while yen falls despite BOJ rate hike

-

US university killer's mystery motive sought after suicide

-

IMF approves $206 mn aid to Sri Lanka after Cyclone Ditwah

IMF approves $206 mn aid to Sri Lanka after Cyclone Ditwah

-

Rome to charge visitors for access to Trevi Fountain

-

Stocks advance with focus on central banks, tech

Stocks advance with focus on central banks, tech

-

Norway crown princess likely to undergo lung transplant

-

France's budget hits snag in setback for embattled PM

France's budget hits snag in setback for embattled PM

-

Volatile Oracle shares a proxy for Wall Street's AI jitters

-

Japan hikes interest rates to 30-year-high

Japan hikes interest rates to 30-year-high

-

Brazil's top court strikes down law blocking Indigenous land claims

-

'We are ghosts': Britain's migrant night workers

'We are ghosts': Britain's migrant night workers

-

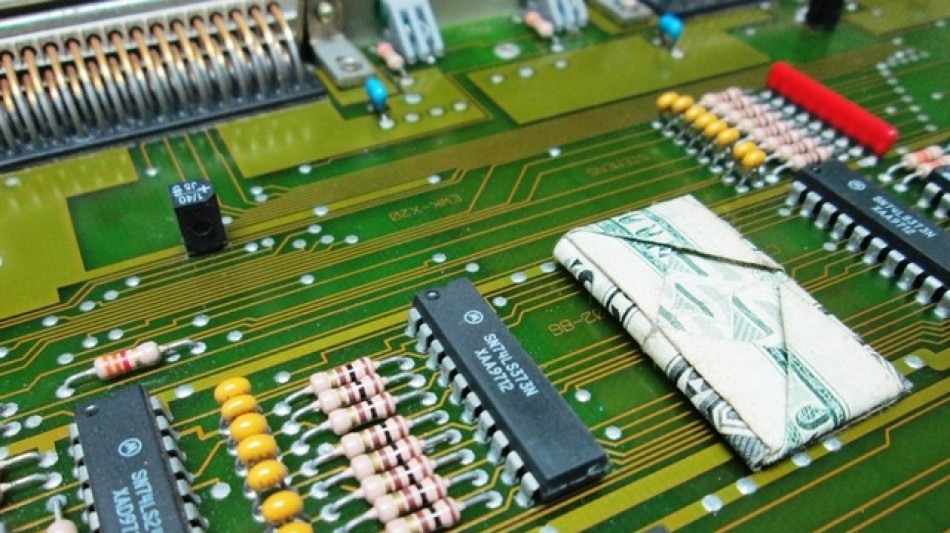

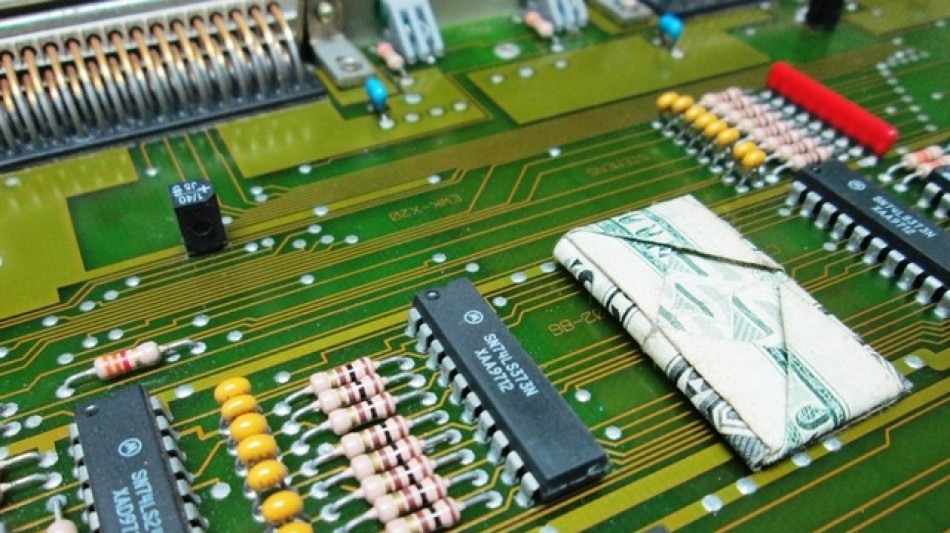

Asian markets rise as US inflation eases, Micron soothes tech fears

-

Trump signs $900 bn defense policy bill into law

Trump signs $900 bn defense policy bill into law

-

EU-Mercosur deal delayed as farmers stage Brussels show of force

-

Harrison Ford to get lifetime acting award

Harrison Ford to get lifetime acting award

-

Trump health chief seeks to bar trans youth from gender-affirming care

-

Argentine unions in the street over Milei labor reforms

Argentine unions in the street over Milei labor reforms

-

Brazil open to EU-Mercosur deal delay as farmers protest in Brussels

-

Brussels farmer protest turns ugly as EU-Mercosur deal teeters

Brussels farmer protest turns ugly as EU-Mercosur deal teeters

-

US accuses S. Africa of harassing US officials working with Afrikaners

-

ECB holds rates as Lagarde stresses heightened uncertainty

ECB holds rates as Lagarde stresses heightened uncertainty

-

Trump Media announces merger with fusion power company

-

Stocks rise as US inflation cools, tech stocks bounce

Stocks rise as US inflation cools, tech stocks bounce

-

Zelensky presses EU to tap Russian assets at crunch summit

-

Danish 'ghetto' residents upbeat after EU court ruling

Danish 'ghetto' residents upbeat after EU court ruling

-

ECB holds rates but debate swirls over future

-

Bank of England cuts interest rate after UK inflation slides

Bank of England cuts interest rate after UK inflation slides

-

Have Iran's authorities given up on the mandatory hijab?

-

British energy giant BP extends shakeup with new CEO pick

British energy giant BP extends shakeup with new CEO pick

-

EU kicks off crunch summit on Russian asset plan for Ukraine

-

Sri Lanka plans $1.6 bn in cyclone recovery spending in 2026

Sri Lanka plans $1.6 bn in cyclone recovery spending in 2026

-

Most Asian markets track Wall St lower as AI fears mount

-

Danish 'ghetto' tenants hope for EU discrimination win

Danish 'ghetto' tenants hope for EU discrimination win

-

What to know about the EU-Mercosur deal

-

Trump vows economic boom, blames Biden in address to nation

Trump vows economic boom, blames Biden in address to nation

-

ECB set to hold rates but debate swirls over future

-

EU holds crunch summit on Russian asset plan for Ukraine

EU holds crunch summit on Russian asset plan for Ukraine

-

Nasdaq tumbles on renewed angst over AI building boom

-

Billionaire Trump nominee confirmed to lead NASA amid Moon race

Billionaire Trump nominee confirmed to lead NASA amid Moon race

-

CNN's future unclear as Trump applies pressure

-

German MPs approve 50 bn euros in military purchases

German MPs approve 50 bn euros in military purchases

-

EU's Mercosur trade deal hits French, Italian roadblock

Middle East-Based Sigma Capital Unveils $100M Fund to Accelerate Web3 Innovations

The fund will focus on DeFi, tokenization, and blockchain infrastructure by managing a portfolio of venture investments and liquid tokens.

Launch highlights UAE's growing role as a global hub for Web3 investments.

$100M fund will focus on early-stage Web3 Startups, liquid tokens, and fund-of-fund allocations.

Led by Web3 pioneer Vineet Budki, the fund will leverage global partnerships and deep market access to support portfolio success.

Sigma Capital, a leading Web3 early-stage venture firm, today announced the launch of a $100 million fund dedicated to accelerating the next wave of Web3 innovation in the Middle East and globally. The fund launch spotlights the UAE's growing role as a global hub for the Web3 & Blockchain sector.

The fund will focus on early-stage venture investments in transformative areas such as DeFi, blockchain infrastructure, real-world asset tokenization, gaming, and the metaverse. Sigma Capital will actively manage a portfolio of liquid tokens, seizing market opportunities to generate consistent returns. The fund will also leverage high-yield DeFi strategies to optimize portfolio performance and invest in high-growth crypto venture funds that broaden exposure to emerging innovations.

Vineet Budki, a recognized leader in the Web3 space, will lead the fund. As the former CEO and Managing Partner at Cypher Capital, another leading Web3-native VC based in the UAE, Vineet spearheaded over 300+ investments in high-profile projects, including Mysten Labs, Sei Network, Casper Labs, Web3Auth, Casper labs, Manta network, Mocaverse, Peak network and MyPetHooligan.

The Sigma Capital Team has years of experience in the Blockchain investing space and has invested in or partnered with multiple reputed players in the space, including Polygon Technology, Morningstar Ventures, Blockchain Founders Fund, Woodstock Fund, and many others.

Vineet Budki, CEO and Managing Partner of Sigma Capital, said: "We envision a digital economy that is more open, inclusive, and innovative. The UAE's dynamic economy and forward-thinking regulatory environment provide the perfect backdrop for Web3 innovation. This fund empowers startups with capital, equips them with access to our extensive network and expertise, and enables them to thrive in a rapidly evolving landscape."

Sandeep Naliwal, Founder of Polygon Technology, said: "Having had the pleasure of investing alongside Vineet, I can confidently say that he is deeply entrenched in Web3 ecosystem. His ability to identify and support changing trends in crypto is a testament to his deep crypto nativeness. Looking forward to Sigma Capital to be a great support for builders building in Web3."

Sigma Capital plans to deploy investments across 100 early-stage projects, 25 liquid tokens, and 10 fund-of-fund allocations over the next three years. The firm's strategic edge lies in its proven expertise and global reach, leveraging its network to provide access to key exchanges, market makers, exchanges, launchpads, and opinion leaders.

Sigma Capital collaborates with Web3 hubs across 10 global cities, providing portfolio companies with deep market insights and comprehensive support to enable success in a competitive market. By combining a diversified approach with deep market access, Sigma Capital aims to drive sustainable growth in both the Global and GCC Web3 ecosystem.

The firm's dual presence in Dubai and Singapore, coupled with regulatory oversight from the Cayman Islands, ensures access to global opportunities while maintaining a strong compliance framework.

Sigma Capital's $100 million fund launch underscores the UAE's growing importance as a global epicenter for Web3 & Blockchain innovation and capital movement. The firm's commitment to empowering startups aligns with the UAE's strategic vision to lead the decentralized economy, paving the way for the region to become a hub for transformative technologies and financial innovation.

About Sigma Capital

Sigma Capital is a global Crypto investment firm dedicated to identifying and supporting the most innovative blockchain and cryptocurrency projects. With a focus on empowering startups and delivering superior returns, Sigma Capital is at the forefront of advancing the Web3 ecosystem while fostering long-term growth and sustainability.

Contact:

Ross Williamson | [email protected] | +971 525 96 4630

Vickaash Agarwal | [email protected]

Other Key Partner Quotes:

Danilo S. Carlucci, Founder & CEO at Morningstar Ventures, said: "Since our establishment in Dubai in 2020, Morningstar Ventures has been committed to supporting transformative projects and bold founders that push the boundaries of blockchain innovation. Sigma Capital's $100 million fund is a testament to the region's growing influence in blockchain and financial technology. It will support the growth of Web3 startups and further solidify the region's position as a leader in financial innovation."

Shreyansh Singh, Partner at P2 Ventures (Formerly Polygon ventures), said: "Vineet's track record as a visionary leader in Web3 speaks for itself. His deep understanding of market dynamics and foresight in nurturing high-impact projects have been pivotal in advancing the ecosystem. The launch of Sigma Capital's $100 million fund is a testament to his expertise and the UAE's emergence as a global hub for blockchain innovation. I have no doubt this fund will catalyze the next wave of groundbreaking startups and solidify the region's role in the decentralized economy."

SOURCE: Sigma Capital

Ch.Lefebvre--CPN