-

Kenya's economy faces climate change risks: World Bank

Kenya's economy faces climate change risks: World Bank

-

Norway crown princess likely to undergo lung transplant

-

France's budget hits snag in setback for embattled PM

France's budget hits snag in setback for embattled PM

-

Volatile Oracle shares a proxy for Wall Street's AI jitters

-

Japan hikes interest rates to 30-year-high

Japan hikes interest rates to 30-year-high

-

Brazil's top court strikes down law blocking Indigenous land claims

-

'We are ghosts': Britain's migrant night workers

'We are ghosts': Britain's migrant night workers

-

Asian markets rise as US inflation eases, Micron soothes tech fears

-

Trump signs $900 bn defense policy bill into law

Trump signs $900 bn defense policy bill into law

-

EU-Mercosur deal delayed as farmers stage Brussels show of force

-

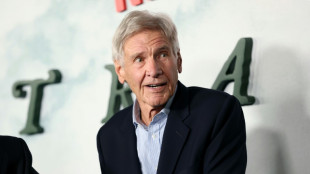

Harrison Ford to get lifetime acting award

Harrison Ford to get lifetime acting award

-

Trump health chief seeks to bar trans youth from gender-affirming care

-

Argentine unions in the street over Milei labor reforms

Argentine unions in the street over Milei labor reforms

-

Brazil open to EU-Mercosur deal delay as farmers protest in Brussels

-

Brussels farmer protest turns ugly as EU-Mercosur deal teeters

Brussels farmer protest turns ugly as EU-Mercosur deal teeters

-

US accuses S. Africa of harassing US officials working with Afrikaners

-

ECB holds rates as Lagarde stresses heightened uncertainty

ECB holds rates as Lagarde stresses heightened uncertainty

-

Trump Media announces merger with fusion power company

-

Stocks rise as US inflation cools, tech stocks bounce

Stocks rise as US inflation cools, tech stocks bounce

-

Zelensky presses EU to tap Russian assets at crunch summit

-

Danish 'ghetto' residents upbeat after EU court ruling

Danish 'ghetto' residents upbeat after EU court ruling

-

ECB holds rates but debate swirls over future

-

Bank of England cuts interest rate after UK inflation slides

Bank of England cuts interest rate after UK inflation slides

-

Have Iran's authorities given up on the mandatory hijab?

-

British energy giant BP extends shakeup with new CEO pick

British energy giant BP extends shakeup with new CEO pick

-

EU kicks off crunch summit on Russian asset plan for Ukraine

-

Sri Lanka plans $1.6 bn in cyclone recovery spending in 2026

Sri Lanka plans $1.6 bn in cyclone recovery spending in 2026

-

Most Asian markets track Wall St lower as AI fears mount

-

Danish 'ghetto' tenants hope for EU discrimination win

Danish 'ghetto' tenants hope for EU discrimination win

-

What to know about the EU-Mercosur deal

-

Trump vows economic boom, blames Biden in address to nation

Trump vows economic boom, blames Biden in address to nation

-

ECB set to hold rates but debate swirls over future

-

EU holds crunch summit on Russian asset plan for Ukraine

EU holds crunch summit on Russian asset plan for Ukraine

-

Nasdaq tumbles on renewed angst over AI building boom

-

Billionaire Trump nominee confirmed to lead NASA amid Moon race

Billionaire Trump nominee confirmed to lead NASA amid Moon race

-

CNN's future unclear as Trump applies pressure

-

German MPs approve 50 bn euros in military purchases

German MPs approve 50 bn euros in military purchases

-

EU's Mercosur trade deal hits French, Italian roadblock

-

Warner Bros rejects Paramount bid, sticks with Netflix

Warner Bros rejects Paramount bid, sticks with Netflix

-

Crude prices surge after Trump orders Venezuela oil blockade

-

Warner Bros. Discovery rejects Paramount bid

Warner Bros. Discovery rejects Paramount bid

-

Doctors in England go on strike for 14th time

-

Ghana's Highlife finds its rhythm on UNESCO world stage

Ghana's Highlife finds its rhythm on UNESCO world stage

-

Stocks gain as traders bet on interest rate moves

-

France probes 'foreign interference' after malware found on ferry

France probes 'foreign interference' after malware found on ferry

-

Europe's Ariane 6 rocket puts EU navigation satellites in orbit

-

Bleak end to the year as German business morale drops

Bleak end to the year as German business morale drops

-

Hundreds queue at Louvre museum as strike vote delays opening

-

Markets rise even as US jobs data fail to boost rate cut bets

Markets rise even as US jobs data fail to boost rate cut bets

-

Asian markets mixed as US jobs data fails to boost rate cut hopes

Stocks consolidate after bumper week buoyed by resilient US economy

US and European stock markets stalled or trimmed gains on Friday after a bullish week buoyed by US data and upbeat company earnings.

New York -- whose S&P 500 and Nasdaq Composite struck record highs on Thursday -- mainly held on to gains but made little further headway. The Dow fell.

In Europe, London's blue-chip FTSE was up though just under its all-time record reached on Tuesday. Paris was flat and Frankfurt slipped a little on profit-taking.

Asian markets had closed higher -- except for Tokyo, which was dragged down ahead of weekend upper-house elections that could spell trouble for Prime Minister Shigeru Ishiba.

The week's strong performance in equities showed that worries -- for now -- were largely being set aside over US President Donald Trump's threats of piling on further tariffs from August 1 if governments did not agree on trade deals.

"With the president toning down his rhetoric, markets are quick to forget tariff risks and concentrate on the positives including a resilient US economy," Kathleen Brooks, research director at trading firm XTB, said.

The overall optimism was fuelled by data suggesting the US economy was still well, with no persuasive indication that the tariffs were pushing up inflation.

A June consumer price index report released this week "does not reveal tariff-induced price increases, but a closer look shows clear signs" they could be building, said Holger Schmieding, chief economist at Berenberg bank.

"We expect (US) annual core inflation to approach 3.5 percent by year-end and the Fed to hold the policy rate at the 4.25-4.50 percent target range," he said.

The dollar retreated on Friday as traders bet on the Federal Reserve cutting US interest rates.

One Federal Reserve governor, Christopher Waller, on Thursday argued for a July rate cut, saying he saw limited upside inflation risks.

Trump this week denied he was planning to sack Fed boss Jerome Powell, whom he had been urging to reduce US borrowing costs to further boost the world's top economy.

A meeting in South Africa of G20 finance ministers on Friday pointedly stressed that "central bank independence is crucial" around the world.

In corporate news, American Express followed big US banks in reporting better-than-expected second-quarter results.

Results from streaming giant Netflix also outperformed -- though its share price slipped on Friday as investors weighed whether it had been overvalued.

In London, British luxury brand Burberry said sales had not fallen as much as analysts expected, "which is a sign that the company's new strategic direction could be working", said XTB's Brooks. Its shares rose nearly six percent.

On the downside, shares in GlaxoSmithKline slid more than four percent after the British pharmaceutical giant reported a US regulatory setback for its blood cancer drug Blenrep.

Oil prices initially rose after fresh EU sanctions aimed at crimping Russia's crude exports, to pressure Moscow over its war on Ukraine. But then they fell back.

- Key figures at around 1545 GMT -

New York - Dow: DOWN 0.3 percent at 44,346.88 points

New York - S&P 500: FLAT at 6,299.17

New York - Nasdaq Composite: FLAT at 20,893.97

London - FTSE 100: UP 0.2 percent at 8,992.12 (close)

Paris - CAC 40: FLAT at 7,822.67 (close)

Frankfurt - DAX: DOWN 0.3 percent at 24,289.51 (close)

Tokyo - Nikkei 225: DOWN 0.2 percent at 39,819.11 (close)

Hong Kong - Hang Seng Index: UP 1.3 percent at 24,825.66 (close)

Shanghai - Composite: UP 0.5 percent at 3,534.48 (close)

Euro/dollar: UP at $1.1652 from $1.1600 on Thursday

Pound/dollar: UP at $1.3439 from $1.3415

Dollar/yen: DOWN at 148.49 yen from 148.60 yen

Euro/pound: UP at 86.71 pence from 86.43 pence

Brent North Sea Crude: DOWN 0.1 percent at $69.44 per barrel

West Texas Intermediate: FLAT at $66.24 per barrel

burs/rmb/djt

Ch.Lefebvre--CPN