-

Kenya's economy faces climate change risks: World Bank

Kenya's economy faces climate change risks: World Bank

-

Rome to charge visitors for access to Trevi Fountain

-

Stocks advance with focus on central banks, tech

Stocks advance with focus on central banks, tech

-

Norway crown princess likely to undergo lung transplant

-

France's budget hits snag in setback for embattled PM

France's budget hits snag in setback for embattled PM

-

Volatile Oracle shares a proxy for Wall Street's AI jitters

-

Japan hikes interest rates to 30-year-high

Japan hikes interest rates to 30-year-high

-

Brazil's top court strikes down law blocking Indigenous land claims

-

'We are ghosts': Britain's migrant night workers

'We are ghosts': Britain's migrant night workers

-

Asian markets rise as US inflation eases, Micron soothes tech fears

-

Trump signs $900 bn defense policy bill into law

Trump signs $900 bn defense policy bill into law

-

EU-Mercosur deal delayed as farmers stage Brussels show of force

-

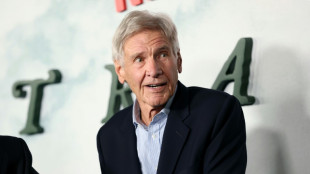

Harrison Ford to get lifetime acting award

Harrison Ford to get lifetime acting award

-

Trump health chief seeks to bar trans youth from gender-affirming care

-

Argentine unions in the street over Milei labor reforms

Argentine unions in the street over Milei labor reforms

-

Brazil open to EU-Mercosur deal delay as farmers protest in Brussels

-

Brussels farmer protest turns ugly as EU-Mercosur deal teeters

Brussels farmer protest turns ugly as EU-Mercosur deal teeters

-

US accuses S. Africa of harassing US officials working with Afrikaners

-

ECB holds rates as Lagarde stresses heightened uncertainty

ECB holds rates as Lagarde stresses heightened uncertainty

-

Trump Media announces merger with fusion power company

-

Stocks rise as US inflation cools, tech stocks bounce

Stocks rise as US inflation cools, tech stocks bounce

-

Zelensky presses EU to tap Russian assets at crunch summit

-

Danish 'ghetto' residents upbeat after EU court ruling

Danish 'ghetto' residents upbeat after EU court ruling

-

ECB holds rates but debate swirls over future

-

Bank of England cuts interest rate after UK inflation slides

Bank of England cuts interest rate after UK inflation slides

-

Have Iran's authorities given up on the mandatory hijab?

-

British energy giant BP extends shakeup with new CEO pick

British energy giant BP extends shakeup with new CEO pick

-

EU kicks off crunch summit on Russian asset plan for Ukraine

-

Sri Lanka plans $1.6 bn in cyclone recovery spending in 2026

Sri Lanka plans $1.6 bn in cyclone recovery spending in 2026

-

Most Asian markets track Wall St lower as AI fears mount

-

Danish 'ghetto' tenants hope for EU discrimination win

Danish 'ghetto' tenants hope for EU discrimination win

-

What to know about the EU-Mercosur deal

-

Trump vows economic boom, blames Biden in address to nation

Trump vows economic boom, blames Biden in address to nation

-

ECB set to hold rates but debate swirls over future

-

EU holds crunch summit on Russian asset plan for Ukraine

EU holds crunch summit on Russian asset plan for Ukraine

-

Nasdaq tumbles on renewed angst over AI building boom

-

Billionaire Trump nominee confirmed to lead NASA amid Moon race

Billionaire Trump nominee confirmed to lead NASA amid Moon race

-

CNN's future unclear as Trump applies pressure

-

German MPs approve 50 bn euros in military purchases

German MPs approve 50 bn euros in military purchases

-

EU's Mercosur trade deal hits French, Italian roadblock

-

Warner Bros rejects Paramount bid, sticks with Netflix

Warner Bros rejects Paramount bid, sticks with Netflix

-

Crude prices surge after Trump orders Venezuela oil blockade

-

Warner Bros. Discovery rejects Paramount bid

Warner Bros. Discovery rejects Paramount bid

-

Doctors in England go on strike for 14th time

-

Ghana's Highlife finds its rhythm on UNESCO world stage

Ghana's Highlife finds its rhythm on UNESCO world stage

-

Stocks gain as traders bet on interest rate moves

-

France probes 'foreign interference' after malware found on ferry

France probes 'foreign interference' after malware found on ferry

-

Europe's Ariane 6 rocket puts EU navigation satellites in orbit

-

Bleak end to the year as German business morale drops

Bleak end to the year as German business morale drops

-

Hundreds queue at Louvre museum as strike vote delays opening

| RBGPF | 0% | 80.22 | $ | |

| GSK | 0.55% | 48.556 | $ | |

| RIO | 0.58% | 78.08 | $ | |

| RYCEF | -0.98% | 15.25 | $ | |

| SCS | 0.12% | 16.14 | $ | |

| CMSC | 0.02% | 23.294 | $ | |

| BCC | -2.57% | 75.755 | $ | |

| NGG | -0.09% | 76.32 | $ | |

| CMSD | -0.06% | 23.265 | $ | |

| RELX | 0.12% | 40.7 | $ | |

| AZN | 0.91% | 91.44 | $ | |

| VOD | 0.86% | 12.911 | $ | |

| BTI | -0.39% | 56.82 | $ | |

| BCE | 0.47% | 22.958 | $ | |

| JRI | 0.01% | 13.431 | $ | |

| BP | 1.62% | 33.86 | $ |

US stocks end at fresh records as markets shrug off tariff worries

A jump in US retail sales boosted world markets Thursday even as investors mulled the US rates outlook, US President Donald Trump's tariffs and the future of Federal Reserve boss Jerome Powell.

Both the S&P 500 and Nasdaq finished at fresh records as investors focused on solid US economic data and earnings and shrugged off lingering worries about tariffs and Powell.

"Right now, as long as the markets don't have a reason to sell off, they're going to go up," said Steve Sosnick of Interactive Brokers. "The news on the economy this week has been good enough."

Investors were wary heading into second-quarter earnings season, but "the data so far and the earnings are coming in better than expected," said Jack Ablin of Cresset Capital Management.

Earlier, European markets also finished strongly in the green.

Frankfurt and Paris closed almost 1.5 percent ahead although London could only manage a 0.5 percent rise amid a higher official UK jobless count and slowing wages growth.

Overall, US retail sales were up 0.6 percent in June to $720.1 billion, reversing a May 0.9 percent decline. The figures topped analyst expectations.

Besides retail sales, another week of modest weekly US jobless claims provided reassurance on the economy, said Art Hogan of B. Riley Wealth Management.

"We've been worried about earnings and trade wars, but the economic data (...) remains resilient," Hogan said.

Thursday's strong session on Wall Street followed a volatile round the day before. Stocks had briefly nose-dived on Wednesday following reports that Trump was planning to fire Powell, lambasting him for not cutting interest rates.

But the US president swiftly denied the story, sending markets higher again.

Powell's apparent security in the role also helped lift the dollar again Thursday, its latest rise in July after an historic retreat in the first six months of 2025.

Trump's unrelenting criticism of Powell has prompted foreign exchange traders to anticipate that "we are moving to a world where the US wants to have a more accommodative monetary policy," said Kit Juckes, chief FX strategist at Societe Generale.

But the dollar's resilience in the wake of the latest Powell-Trump dustup suggests markets still believe "monetary policy in the US is still credible," Juckes said.

Among individual companies, United Airlines climbed 3.1 percent as it offered an upbeat outlook on travel demand in the second half of 2025 despite reporting a drop in second-quarter profits.

Tokyo-listed shares in the Japanese owner of convenience store giant 7-Eleven plunged after a Canadian rival, Alimentation Couche-Tard, pulled out of a $47 billion takeover bid.

- Key figures at around 2050 GMT -

New York - Dow: UP 0.5 percent at 44,484.49 (close)

New York - S&P 500: UP 0.5 percent at 6,297.36 (close)

New York - Nasdaq Composite: UP 0.7 percent at 20,885.65 (close)

London - FTSE 100: UP 0.5 percent at 8,972.64 points (close)

Paris - CAC 40: UP 1.3 percent at 7,822.00 (close)

Frankfurt - DAX: UP 1.5 percent at 24,370.93 (close)

Tokyo - Nikkei 225: UP 0.6 percent at 39,901.19 (close)

Hong Kong - Hang Seng Index: DOWN 0.1 percent at 24,498.95 (close)

Shanghai - Composite: UP 0.4 percent at 3,516.83 (close)

Euro/dollar: DOWN at $1.1600 from $1.1641 on Wednesday

Pound/dollar: DOWN at $1.3415 from $1.3422

Dollar/yen: UP at 148.60 yen from 147.88 yen

Euro/pound: DOWN at 86.43 pence from 86.71 pence

Brent North Sea Crude: UP 1.5 percent at $69.52 per barrel

West Texas Intermediate: UP 1.8 percent at $67.54 per barrel

M.P.Jacobs--CPN